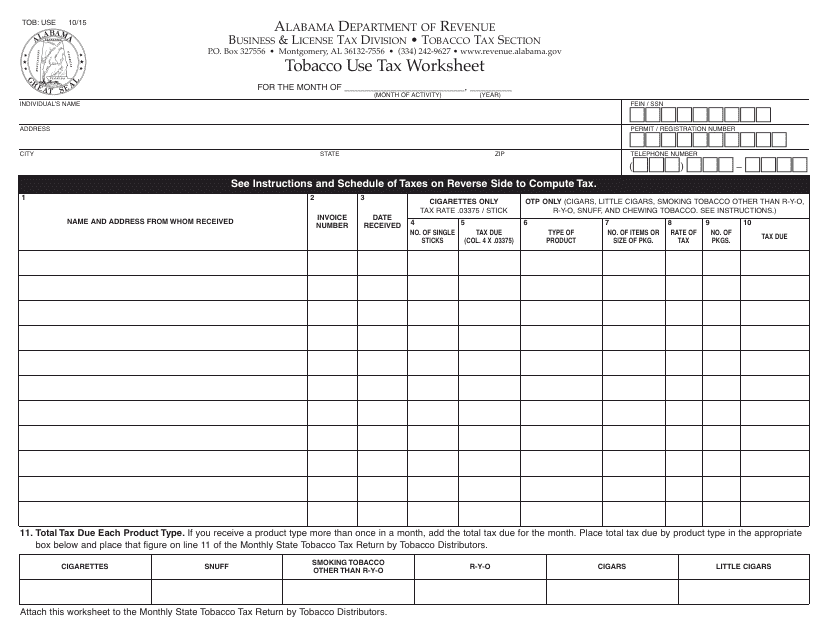

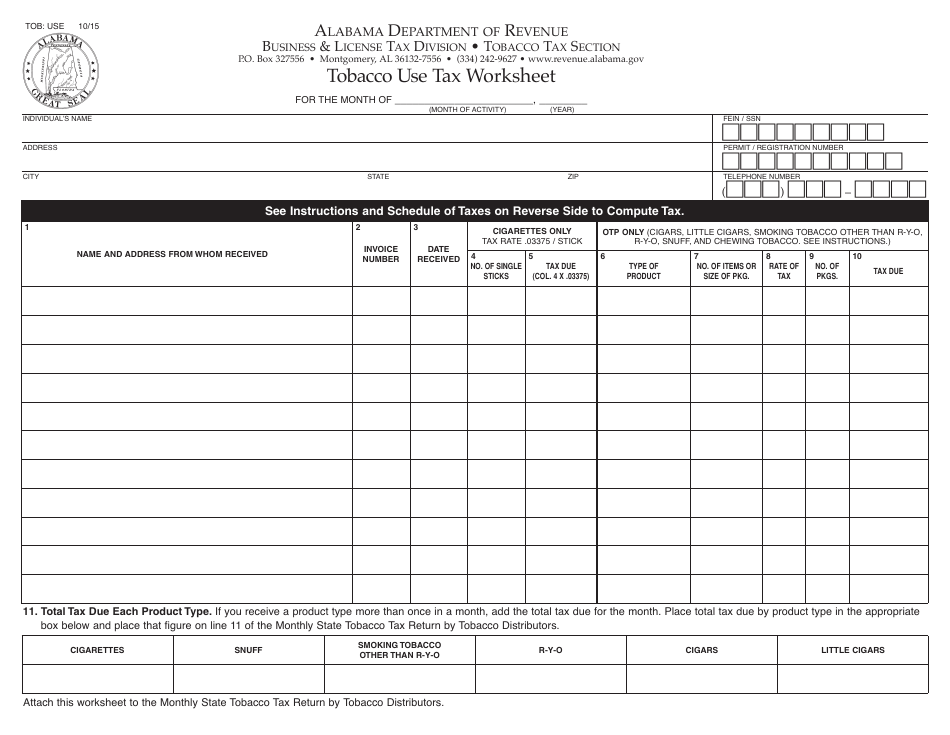

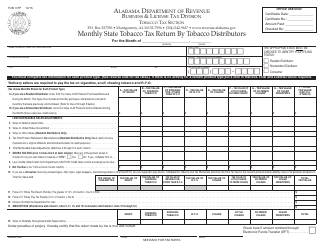

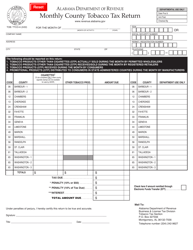

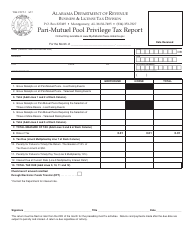

Form TOB: USE Tobacco Use Tax Worksheet - Alabama

What Is Form TOB: USE?

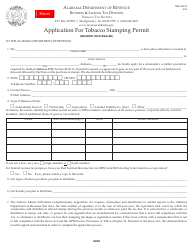

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TOB form?

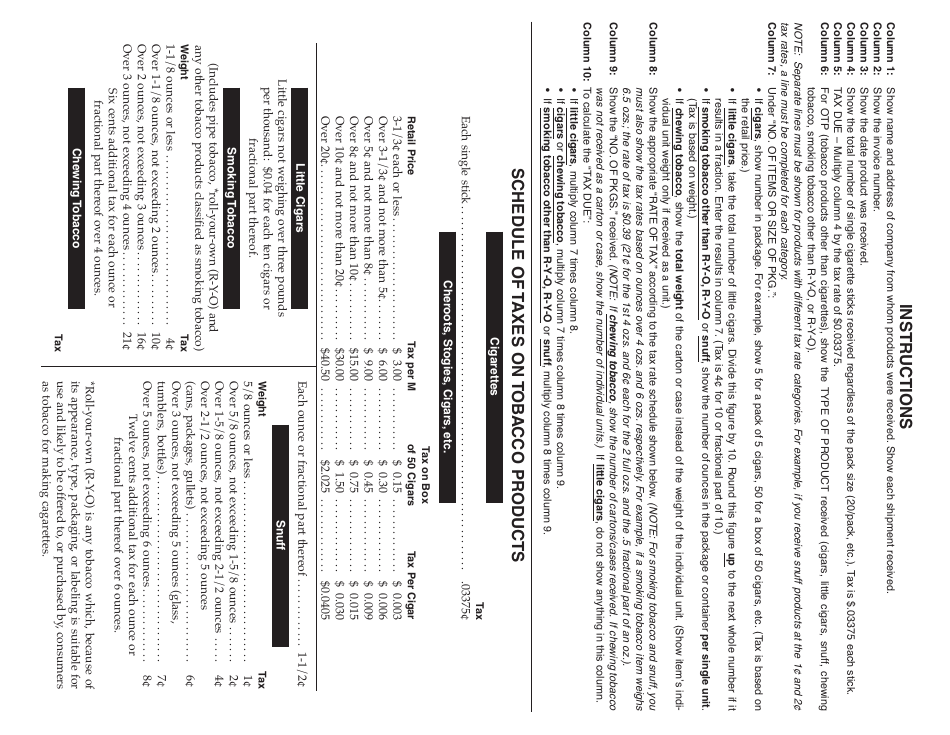

A: The TOB form is the Tobacco Use Tax Worksheet.

Q: What is the purpose of the TOB form?

A: The TOB form is used to calculate and report tobacco use tax in Alabama.

Q: Who needs to file the TOB form?

A: Anyone who sells tobacco products in Alabama needs to file the TOB form.

Q: How often do I need to file the TOB form?

A: The TOB form needs to be filed on a monthly basis.

Q: How do I fill out the TOB form?

A: You need to provide information about the amount of tobacco products sold and calculate the corresponding tax owed.

Q: Is there a deadline to file the TOB form?

A: Yes, the TOB form needs to be filed by the 20th day of the following month.

Q: What happens if I don't file the TOB form?

A: Failure to file the TOB form can result in penalties and interest charges.

Q: Are there any exemptions to the tobacco use tax?

A: Yes, certain tobacco products may be exempt from the tax. Consult the TOB form instructions for more details.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TOB: USE by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.