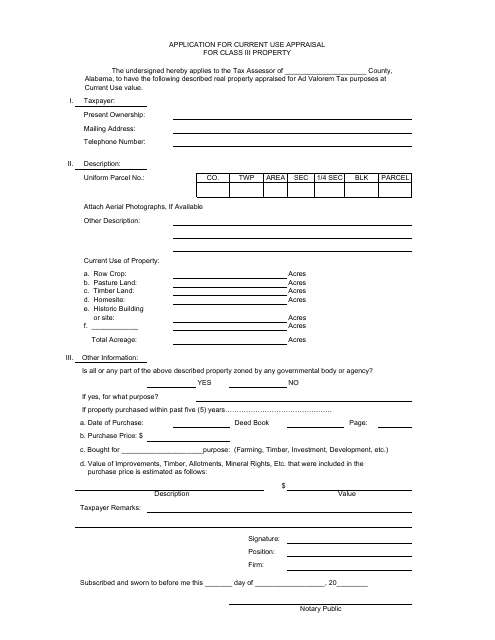

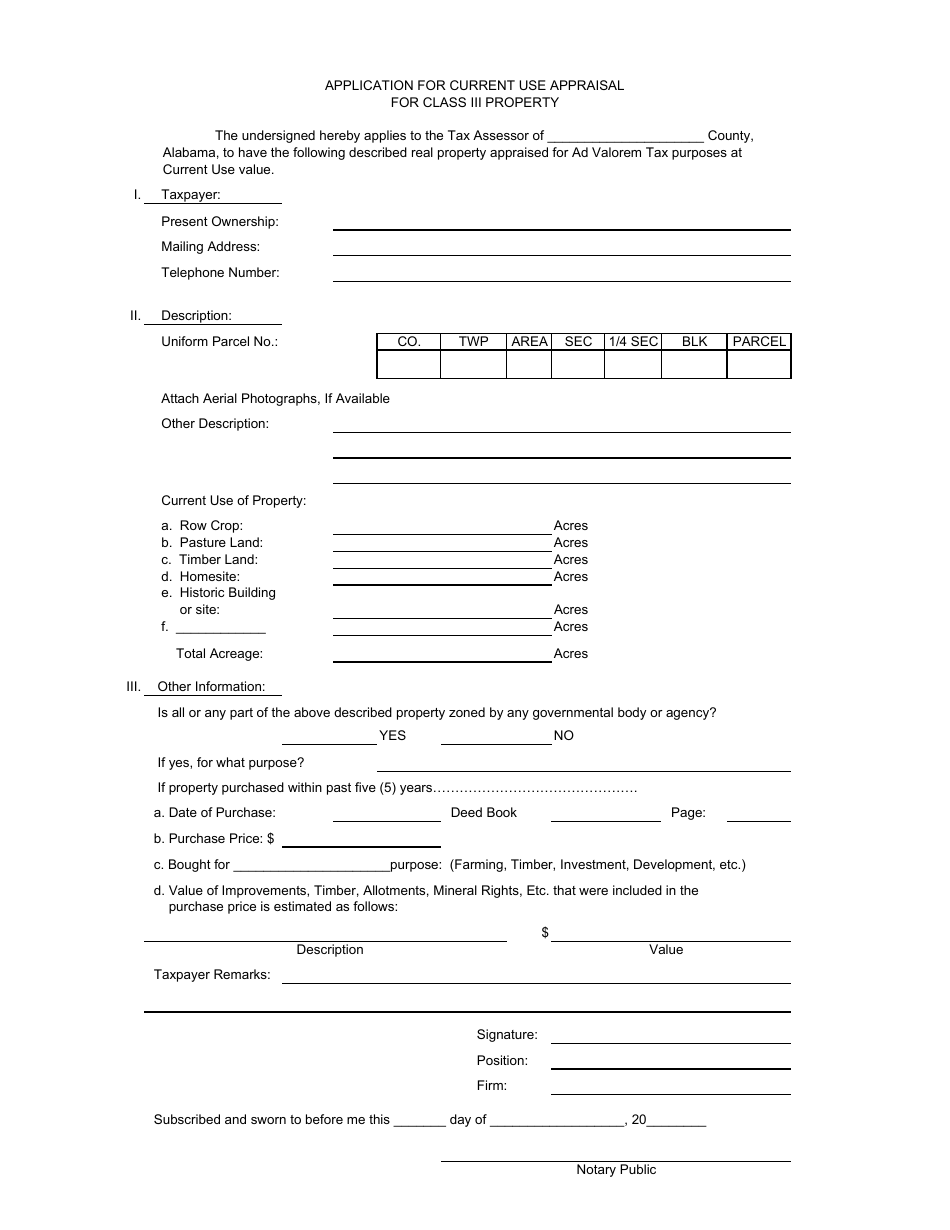

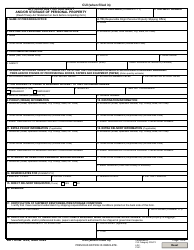

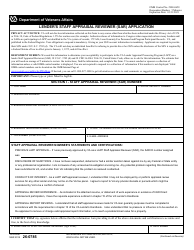

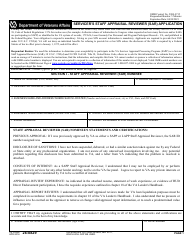

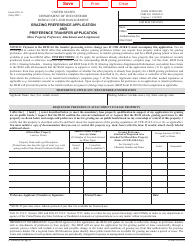

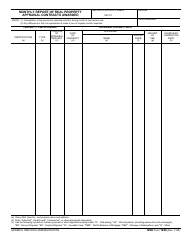

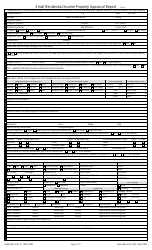

Application for Current Use Appraisal for Class Iii Property - Alabama

Application for Current Use Appraisal for Class Iii Property is a legal document that was released by the Alabama Department of Revenue - a government authority operating within Alabama.

FAQ

Q: What is Current Use Appraisal?

A: Current Use Appraisal is a program that provides property tax reductions for certain types of property in Alabama.

Q: What is Class III property in Alabama?

A: Class III property in Alabama includes agricultural, forest, and other similar land uses.

Q: How can I apply for Current Use Appraisal for Class III property?

A: You can apply for Current Use Appraisal for Class III property by submitting an application to your county tax assessor's office.

Q: What are the benefits of Current Use Appraisal?

A: The benefits of Current Use Appraisal include reduced property taxes for qualifying Class III properties.

Q: Are there any requirements for qualifying for Current Use Appraisal?

A: Yes, there are certain requirements that must be met in order to qualify for Current Use Appraisal, such as maintaining the property for the approved land use.

Q: Is Current Use Appraisal available in all counties of Alabama?

A: Yes, Current Use Appraisal is available in all counties of Alabama.

Form Details:

- The latest edition currently provided by the Alabama Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.