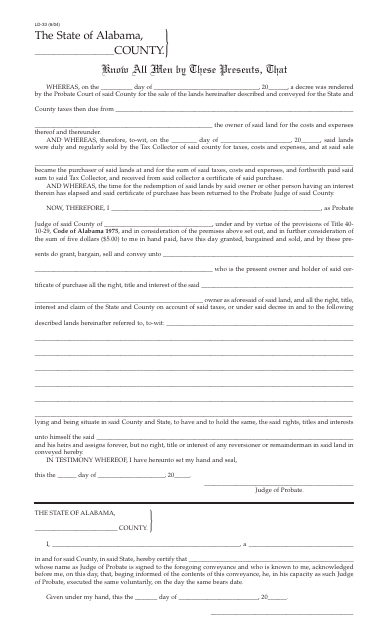

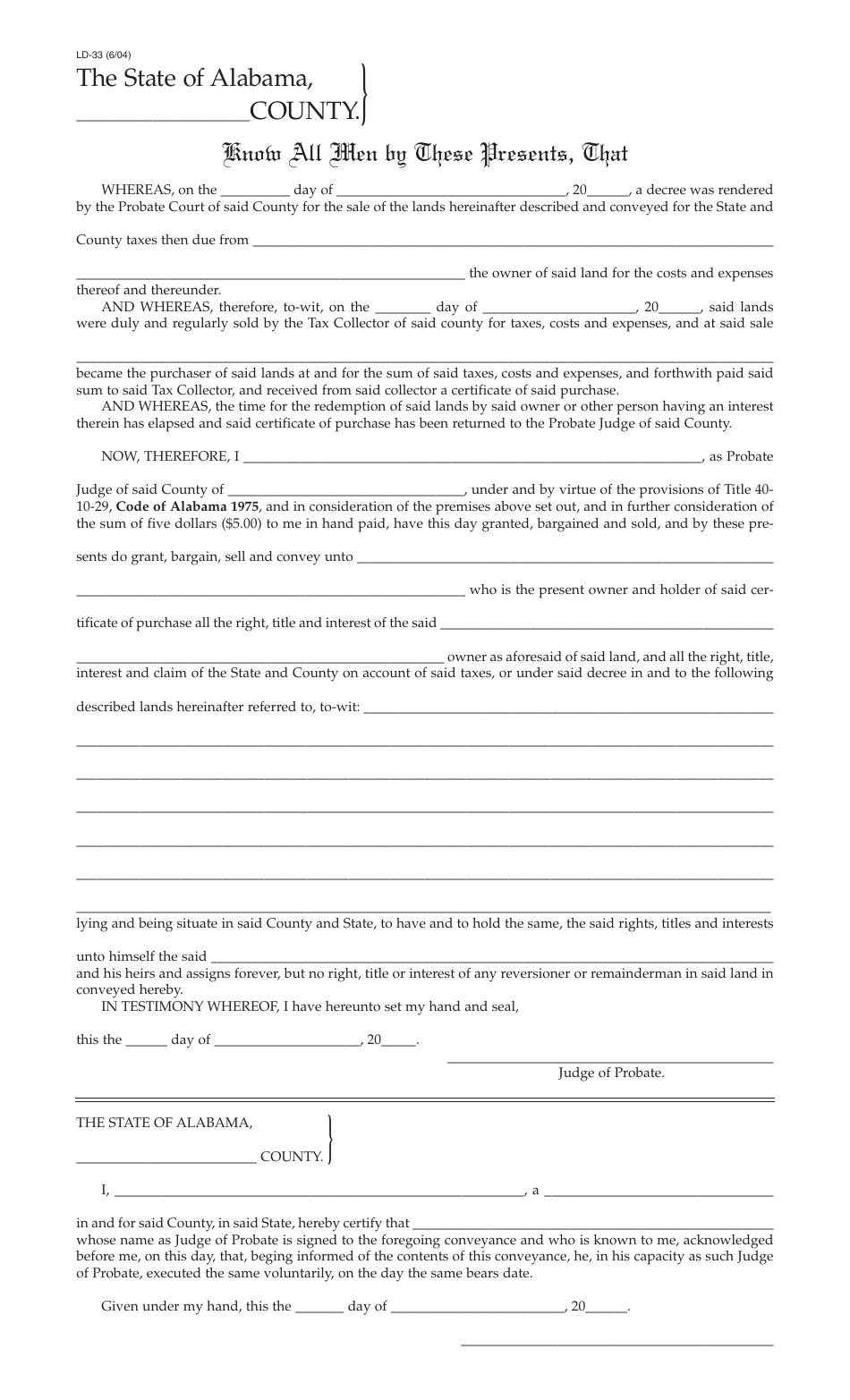

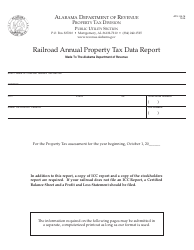

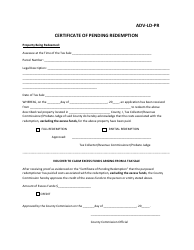

Form ADV: LD-33 Tax Deed Issued by County, for County Use Only - Alabama

What Is Form ADV: LD-33?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

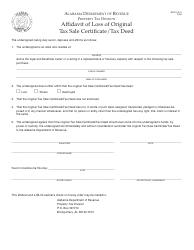

Q: What is a Tax Deed?

A: A Tax Deed is a legal document issued by the county for the sale of property due to unpaid taxes.

Q: What is the purpose of Form ADV: LD-33?

A: Form ADV: LD-33 is used by the county for recording and tracking tax deeds issued.

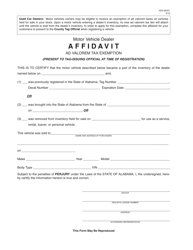

Q: Who can use Form ADV: LD-33?

A: Form ADV: LD-33 is for county use only in Alabama.

Q: What information is included in Form ADV: LD-33?

A: Form ADV: LD-33 includes details about the tax deed, such as the property information, the date of issuance, and the amount of unpaid taxes.

Q: What happens after a tax deed is issued?

A: After a tax deed is issued, the county may sell the property at auction to recoup the unpaid taxes.

Q: How can I obtain a tax deed?

A: To obtain a tax deed, you would need to contact the county office responsible for tax deeds and follow their specific procedures.

Q: Are there any restrictions or limitations on tax deeds?

A: Yes, there may be restrictions or limitations on tax deeds, such as redemption periods or other legal requirements. It is best to consult with the county office for more information.

Q: Can I purchase property through a tax deed?

A: Yes, it is possible to purchase property through a tax deed, but it is important to understand the process and any associated risks before proceeding.

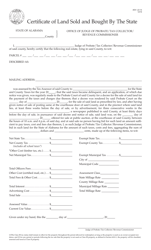

Q: Are tax deeds issued in all counties in Alabama?

A: Yes, tax deeds may be issued in all counties in Alabama when property taxes remain unpaid for a certain period of time.

Q: Is Form ADV: LD-33 required for all tax deeds in Alabama?

A: Yes, Form ADV: LD-33 is required for recording and tracking tax deeds in Alabama.

Form Details:

- Released on June 1, 2004;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADV: LD-33 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.