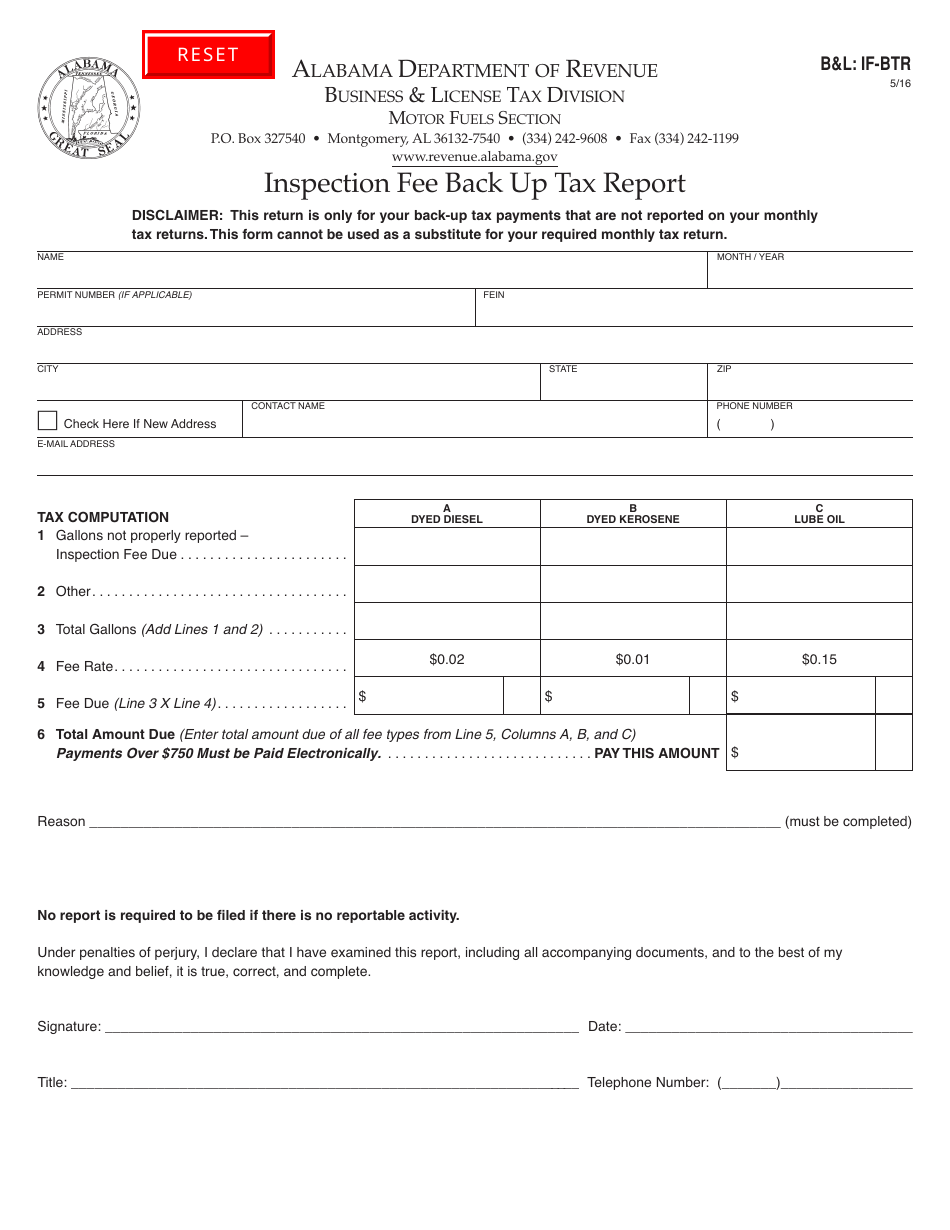

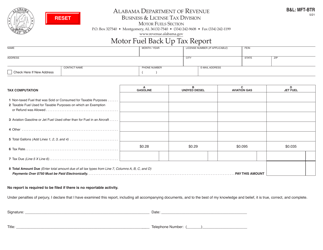

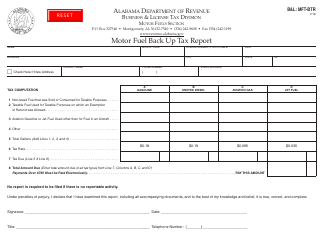

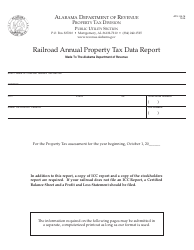

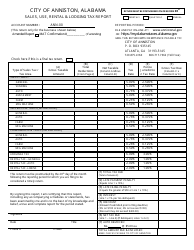

Form B&L:IF-BTR Inspection Fee Back up Tax Report - Alabama

What Is Form B&L:IF-BTR?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

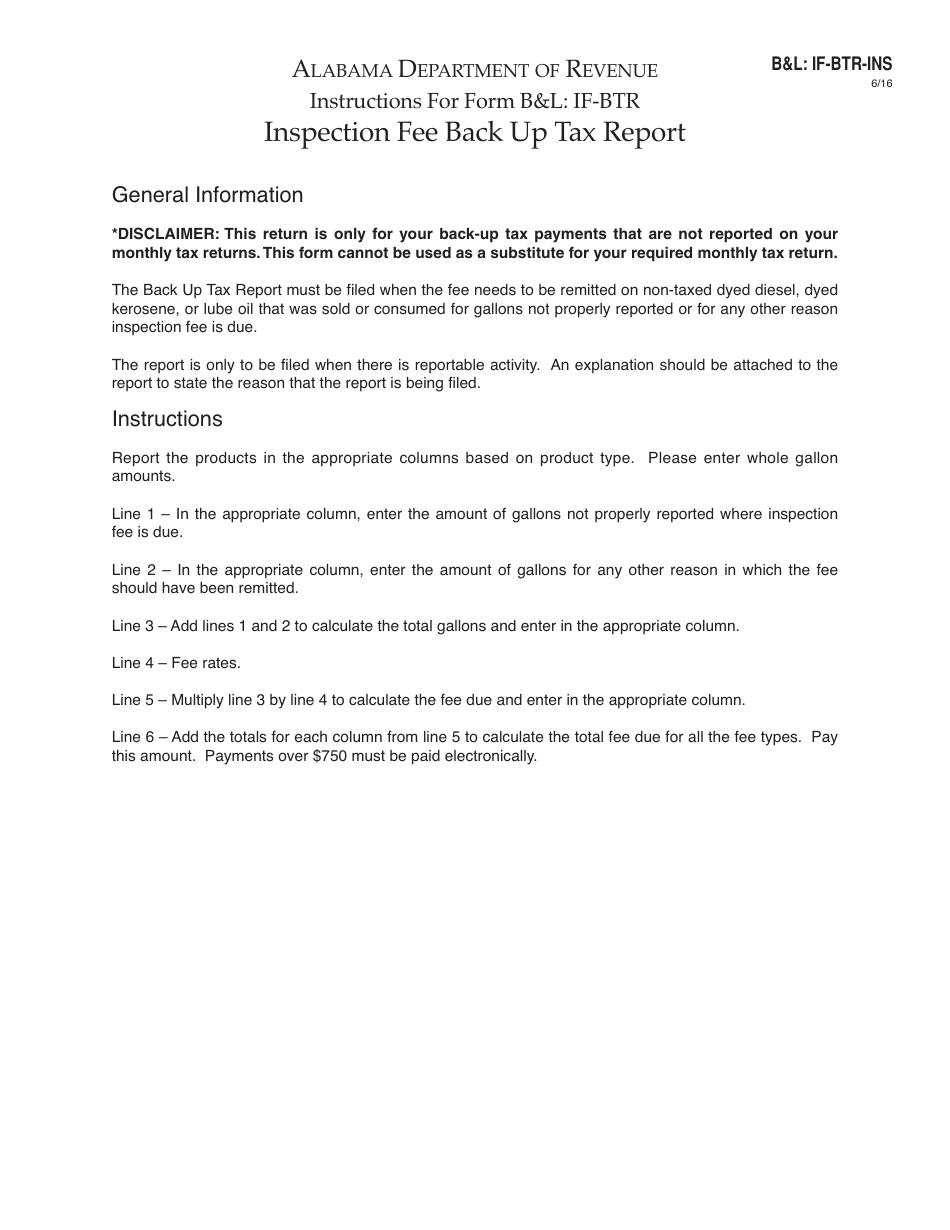

Q: What is the Form B&L:IF-BTR Inspection Fee Back up Tax Report?

A: The Form B&L:IF-BTR Inspection Fee Back up Tax Report is a form used in Alabama to report inspection fees for business and tangible personal property.

Q: Who needs to file the Form B&L:IF-BTR Inspection Fee Back up Tax Report?

A: Businesses and individuals who are required to pay inspection fees for business and tangible personal property in Alabama need to file this form.

Q: What is the purpose of the Form B&L:IF-BTR Inspection Fee Back up Tax Report?

A: The purpose of this form is to report and calculate the inspection fees owed for business and tangible personal property in Alabama.

Q: When is the due date for the Form B&L:IF-BTR Inspection Fee Back up Tax Report?

A: The due date for this form varies each year but is generally on or before April 15th.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L:IF-BTR by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.