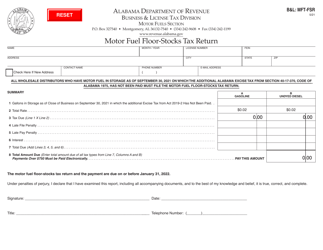

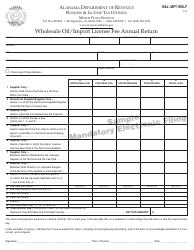

Form B&L:MFT-FSRIF Inspection Fee Floor-Stocks Return - Alabama

What Is Form B&L:MFT-FSRIF?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

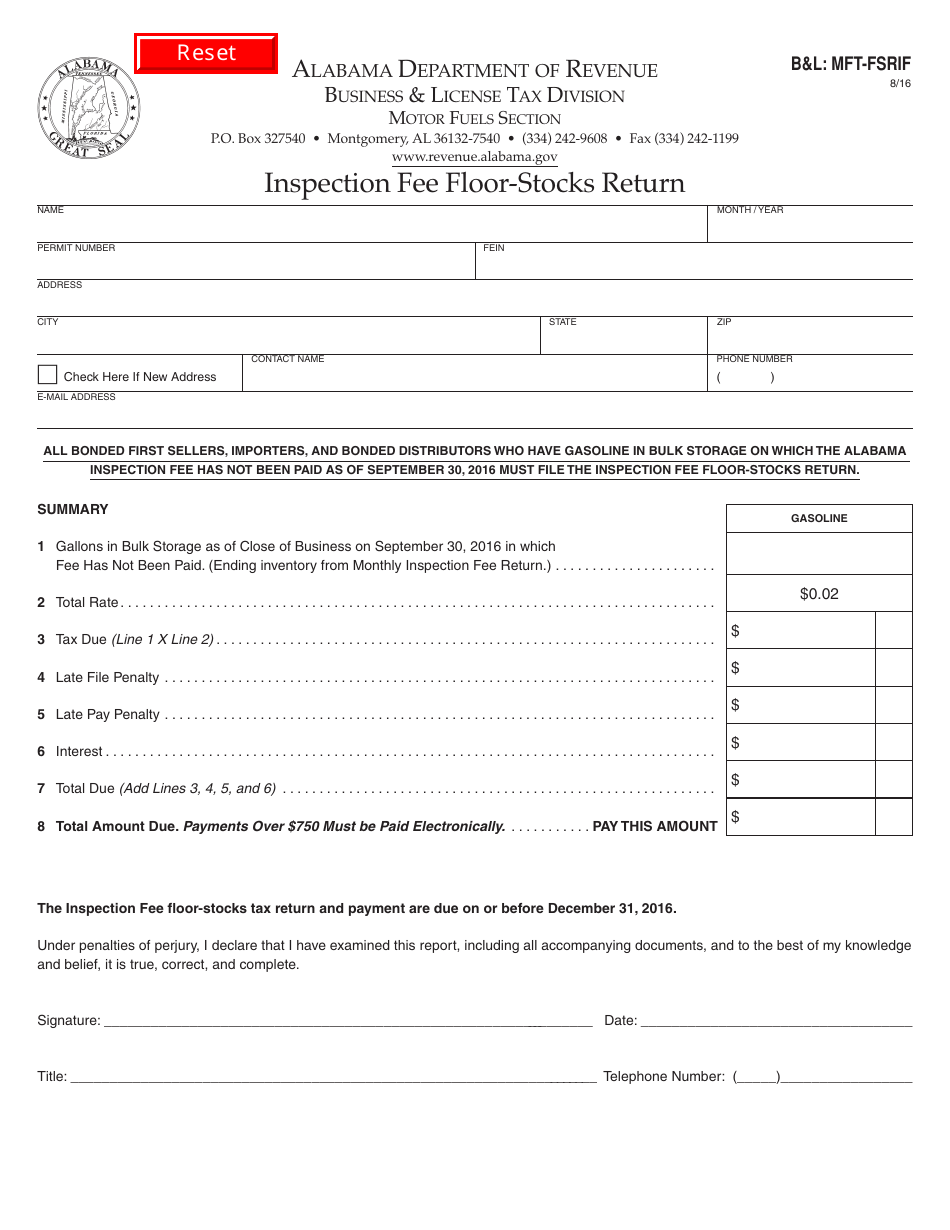

Q: What is the B&L:MFT-FSRIF Inspection Fee Floor-Stocks Return?

A: The B&L:MFT-FSRIF Inspection Fee Floor-Stocks Return is a form used in Alabama for reporting and paying inspection fees on floor-stocks of beer and malt beverages.

Q: Who needs to file the B&L:MFT-FSRIF Inspection Fee Floor-Stocks Return?

A: Any business that holds floor-stocks of beer and malt beverages in Alabama is required to file this return and pay the inspection fees.

Q: When is the deadline for filing the B&L:MFT-FSRIF Inspection Fee Floor-Stocks Return?

A: The deadline for filing this return is typically the 20th day of the month following the end of the tax period.

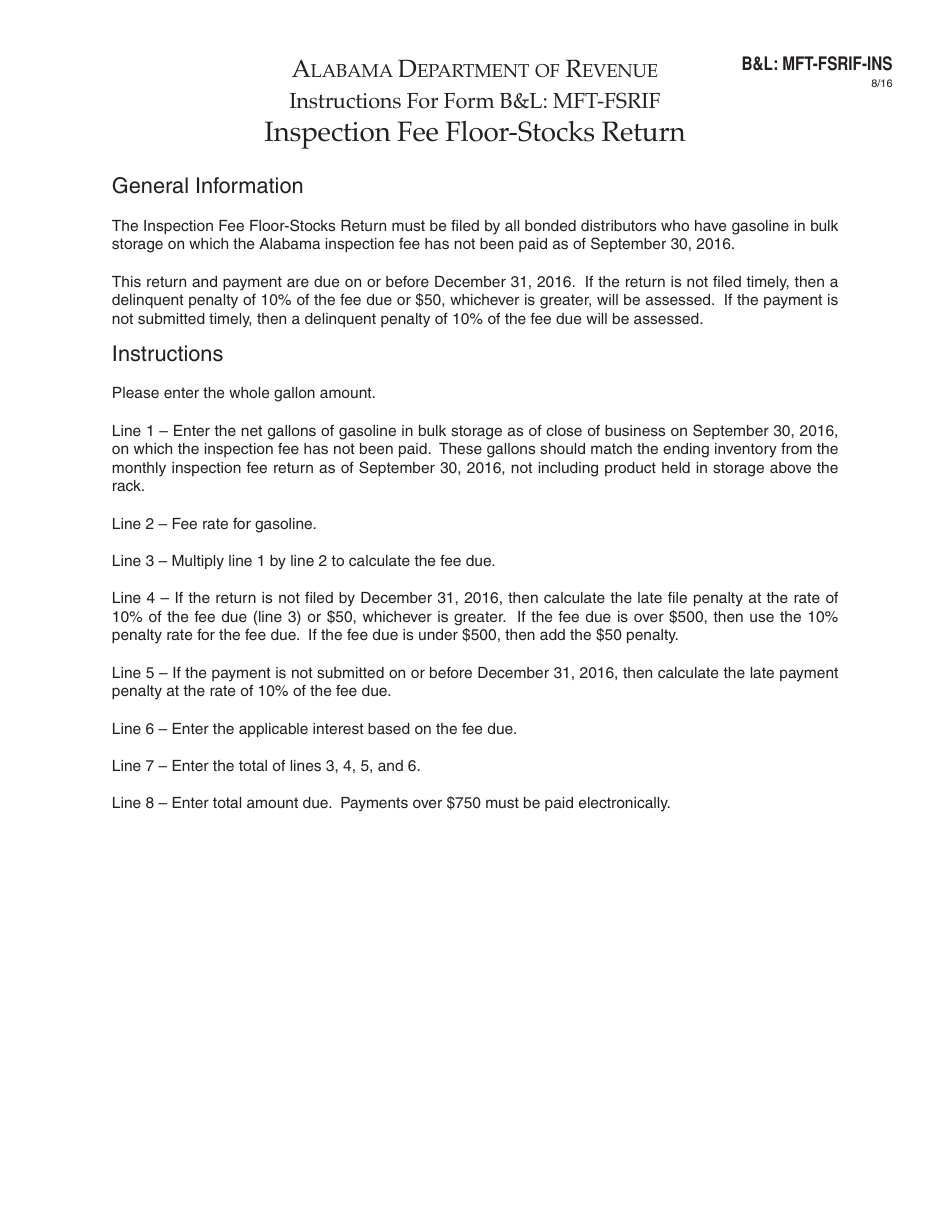

Q: How do I calculate the inspection fees for floor-stocks?

A: The inspection fees are calculated based on the number of gallons of beer and malt beverages held as floor-stocks, multiplied by the inspection fee rate set by the Alabama Alcoholic Beverage Control (ABC) Board.

Q: Are there any penalties for not filing the B&L:MFT-FSRIF Inspection Fee Floor-Stocks Return?

A: Yes, failure to file the return and pay the inspection fees on time may result in penalties imposed by the Alabama Alcoholic Beverage Control (ABC) Board.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L:MFT-FSRIF by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.