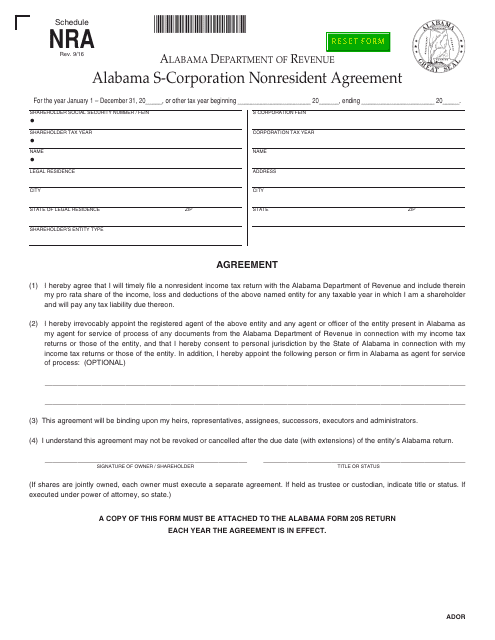

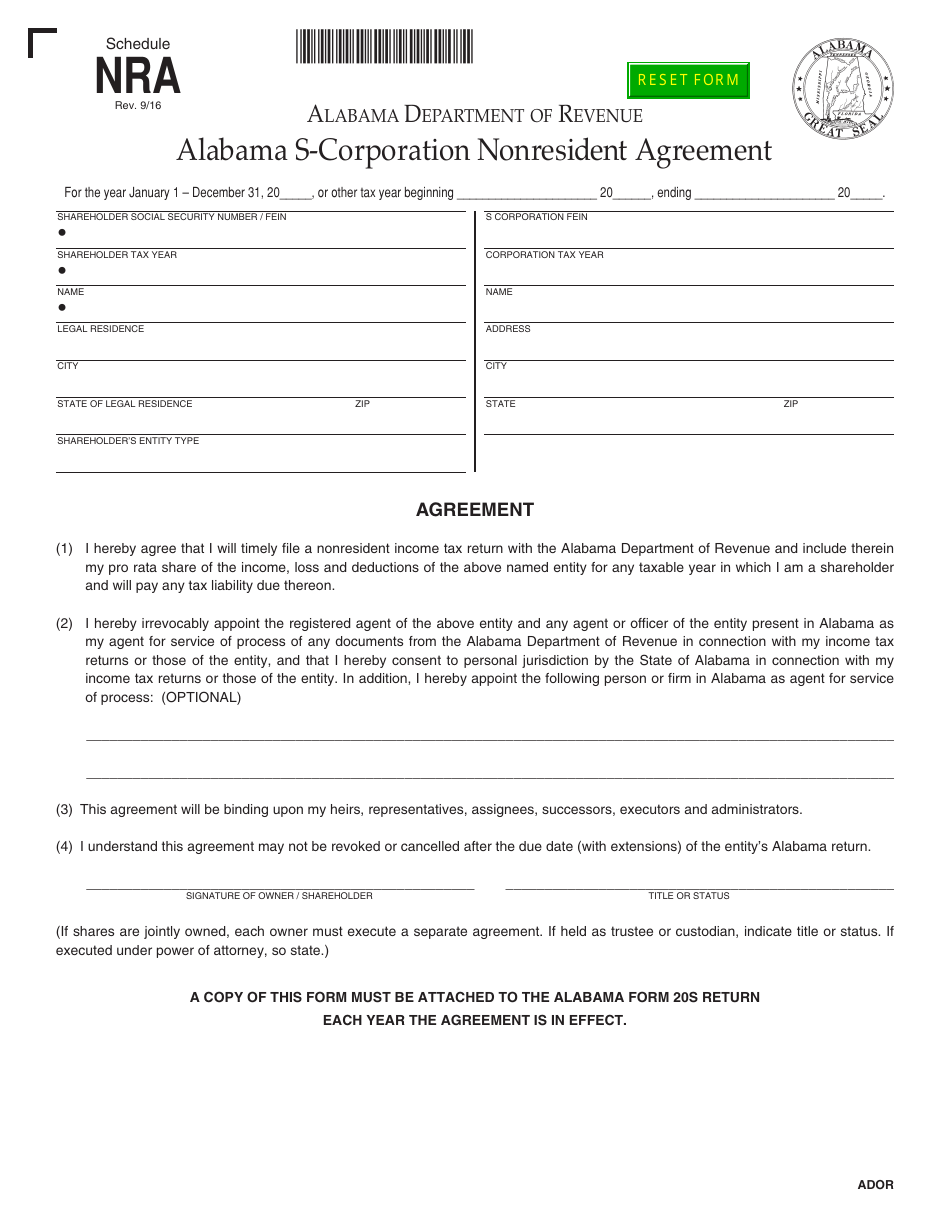

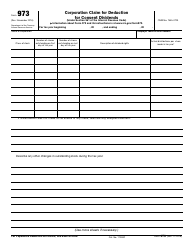

Schedule NRA Alabama S-Corporation Nonresident Agreement - Alabama

What Is Schedule NRA?

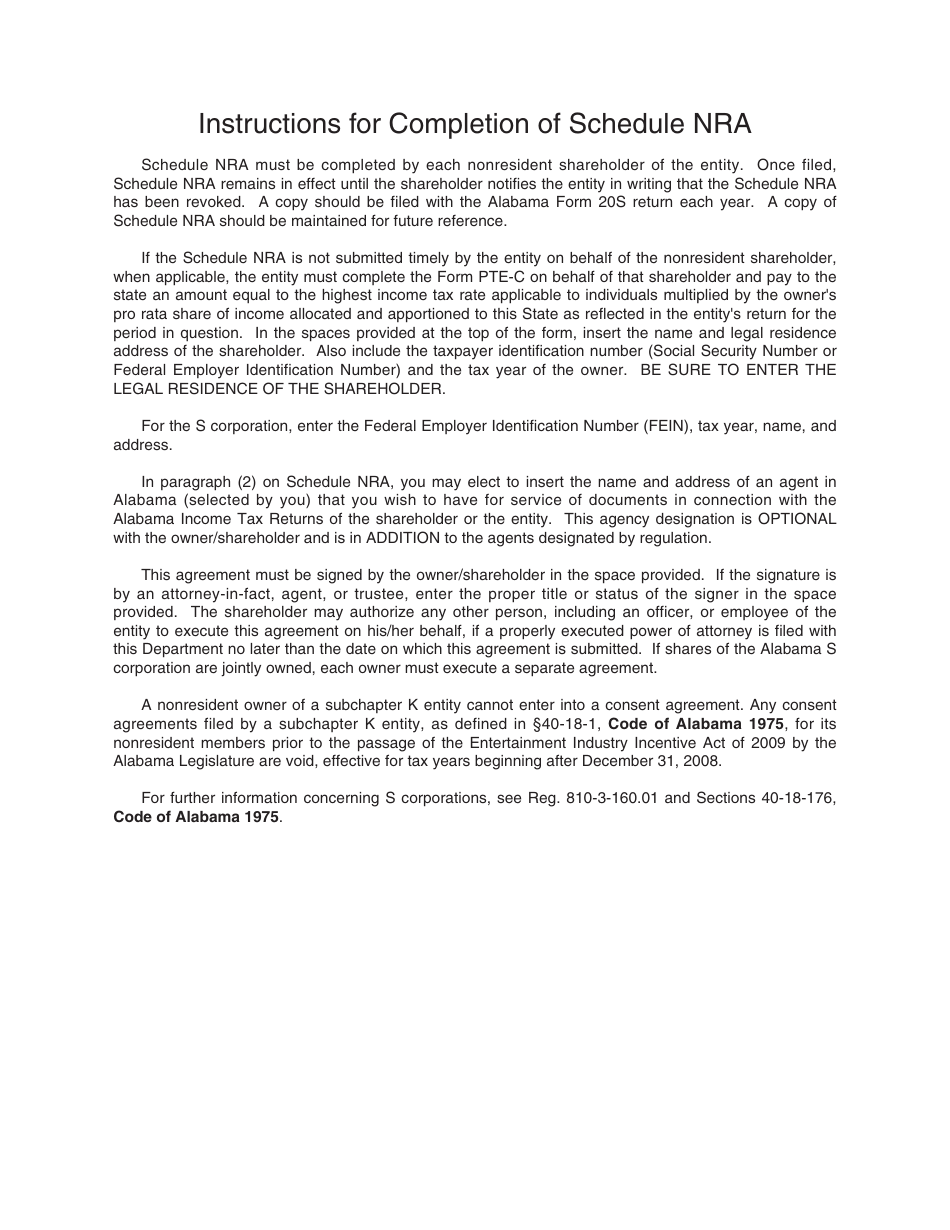

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NRA Alabama S-Corporation Nonresident Agreement?

A: The NRA Alabama S-Corporation Nonresident Agreement is a schedule that outlines the specific details and requirements for nonresident shareholders of an S-Corporation in Alabama.

Q: Who needs to file the NRA Alabama S-Corporation Nonresident Agreement?

A: Nonresident shareholders of an S-Corporation in Alabama need to file the NRA Alabama S-Corporation Nonresident Agreement.

Q: What information is included in the NRA Alabama S-Corporation Nonresident Agreement?

A: The NRA Alabama S-Corporation Nonresident Agreement includes details such as the names and addresses of the nonresident shareholders, their ownership percentages, and any conditions or restrictions on their ownership.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule NRA by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.