This version of the form is not currently in use and is provided for reference only. Download this version of

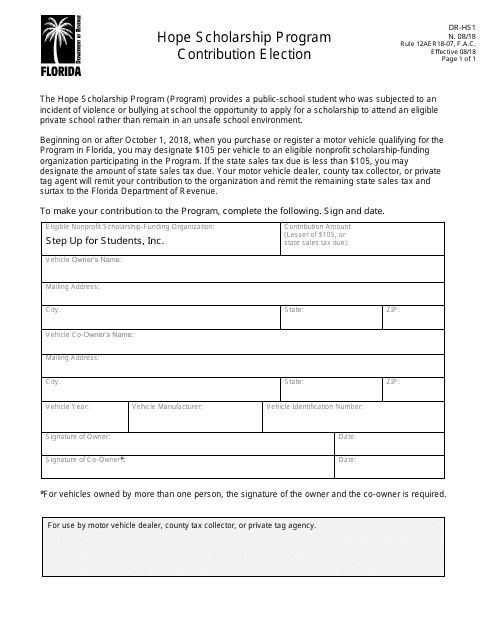

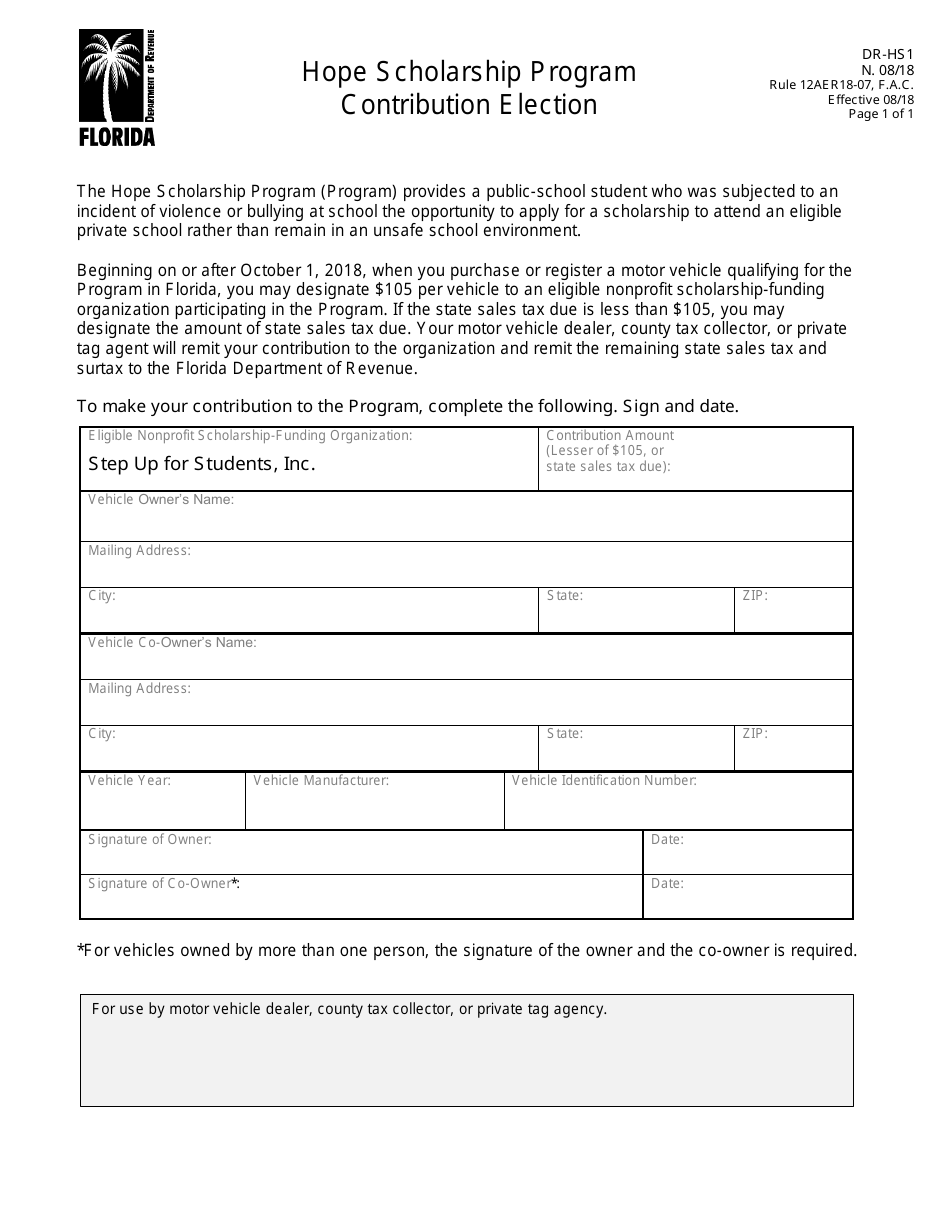

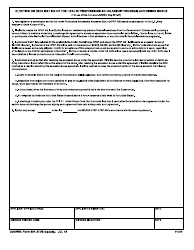

Form DR-HS1

for the current year.

Form DR-HS1 Hope Scholarship Program Contribution Election - Florida

What Is Form DR-HS1?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DR-HS1?

A: Form DR-HS1 is the Hope Scholarship Program Contribution Election form used in Florida.

Q: What is the Hope Scholarship Program?

A: The Hope Scholarship Program is a program in Florida that provides scholarships to students who have been victims of bullying or other specified incidents.

Q: Who is eligible for the Hope Scholarship Program?

A: Students who have experienced bullying or other specified incidents in a public school in Florida may be eligible for the Hope Scholarship Program.

Q: What is the purpose of Form DR-HS1?

A: Form DR-HS1 is used to declare the intent to contribute to the Hope Scholarship Program.

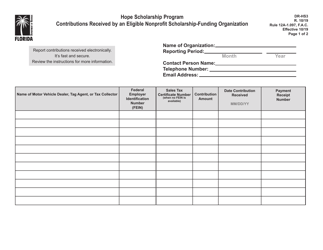

Q: How can I contribute to the Hope Scholarship Program?

A: You can contribute to the Hope Scholarship Program by completing and submitting Form DR-HS1 and indicating the amount you wish to contribute.

Q: Is the contribution to the Hope Scholarship Program tax deductible?

A: Yes, the contribution to the Hope Scholarship Program is eligible for a tax credit or a tax deduction in Florida.

Q: When is the deadline to submit Form DR-HS1?

A: The deadline to submit Form DR-HS1 is typically April 15th of the year following the tax year in which the contribution is made.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-HS1 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.