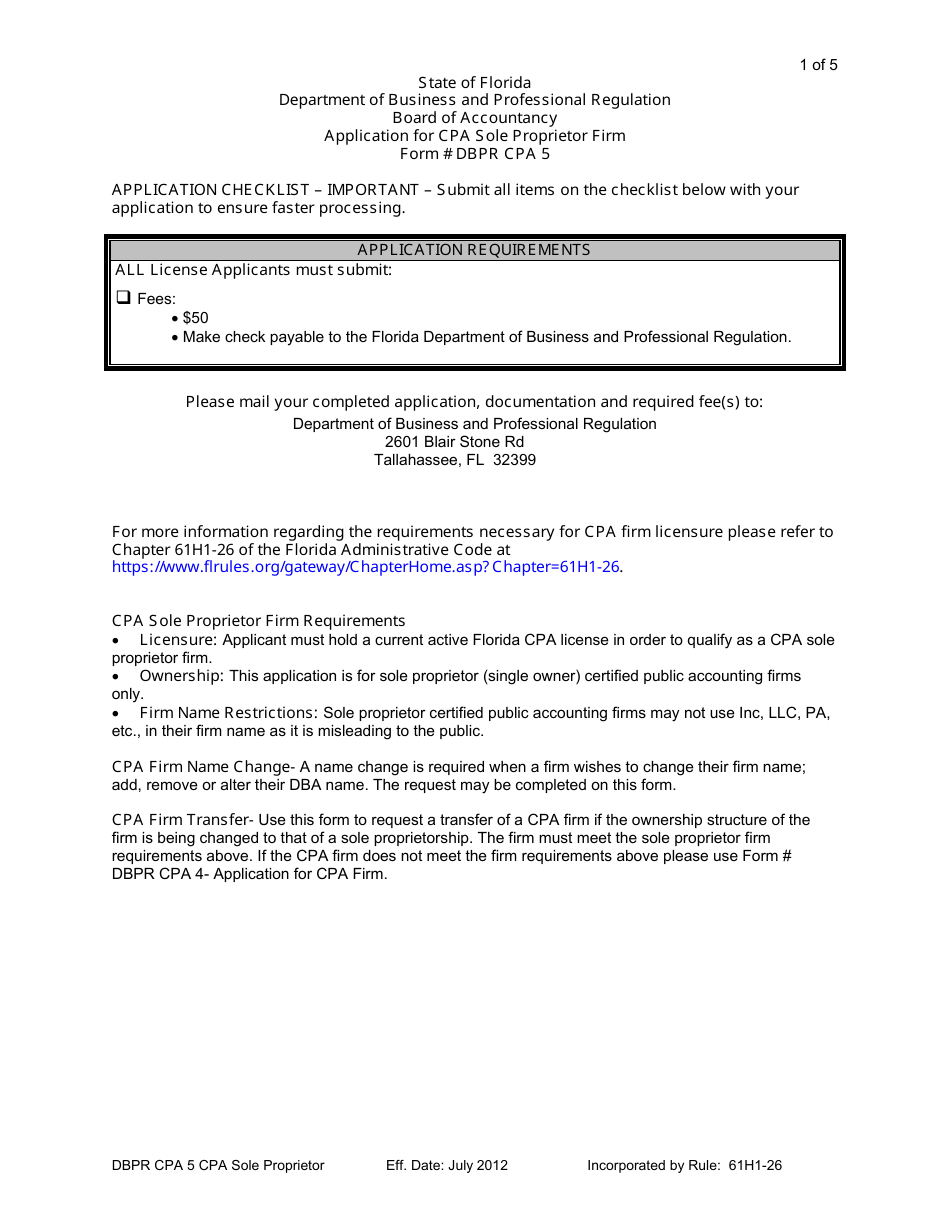

This version of the form is not currently in use and is provided for reference only. Download this version of

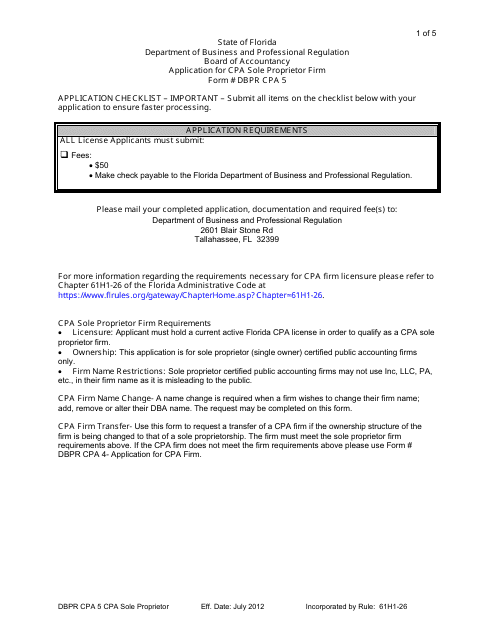

Form DBPR CPA5

for the current year.

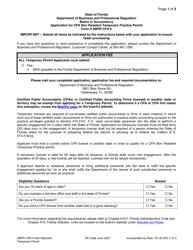

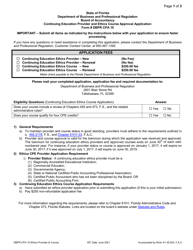

Form DBPR CPA5 Application for CPA Sole Proprietor Firm - Florida

What Is Form DBPR CPA5?

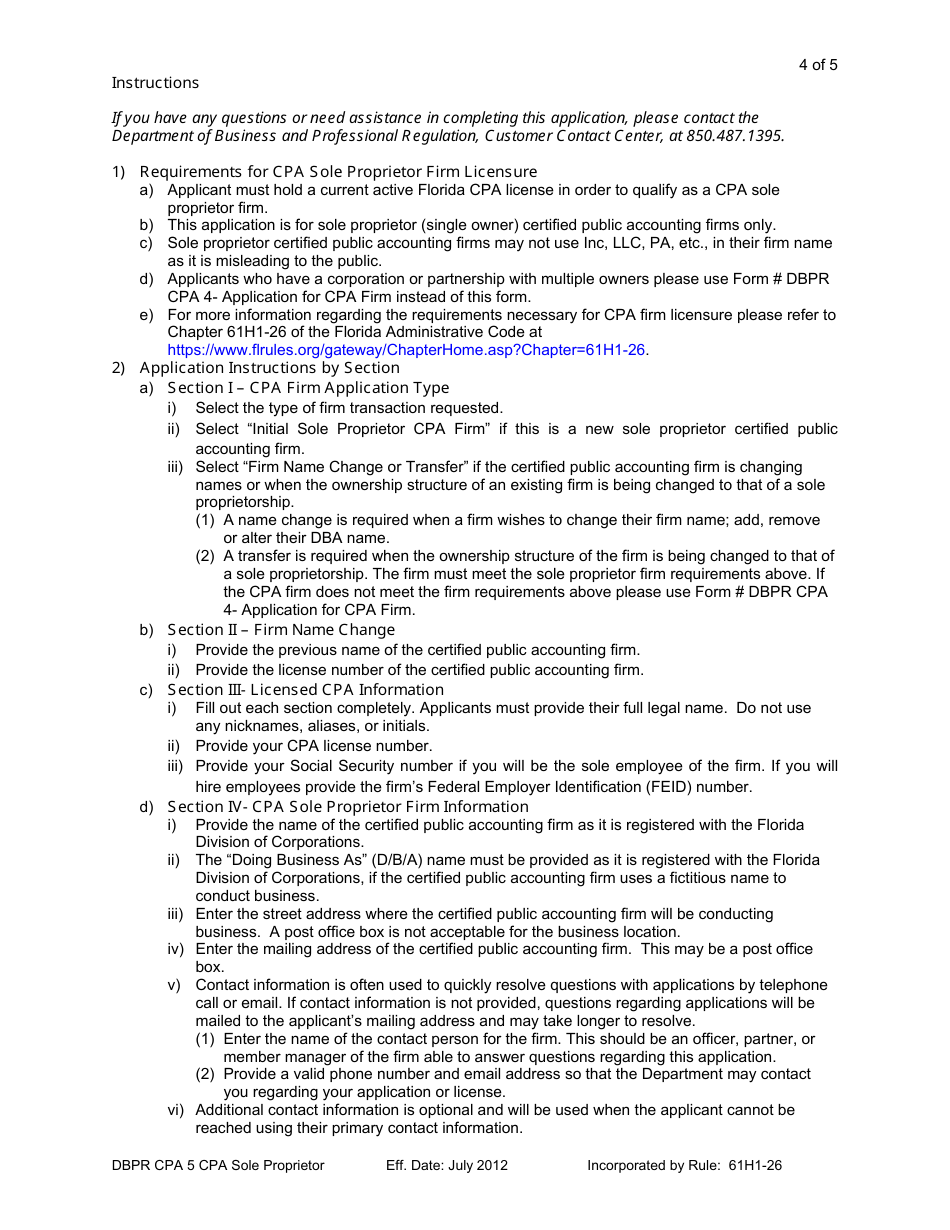

This is a legal form that was released by the Florida Department of Business & Professional Regulation - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

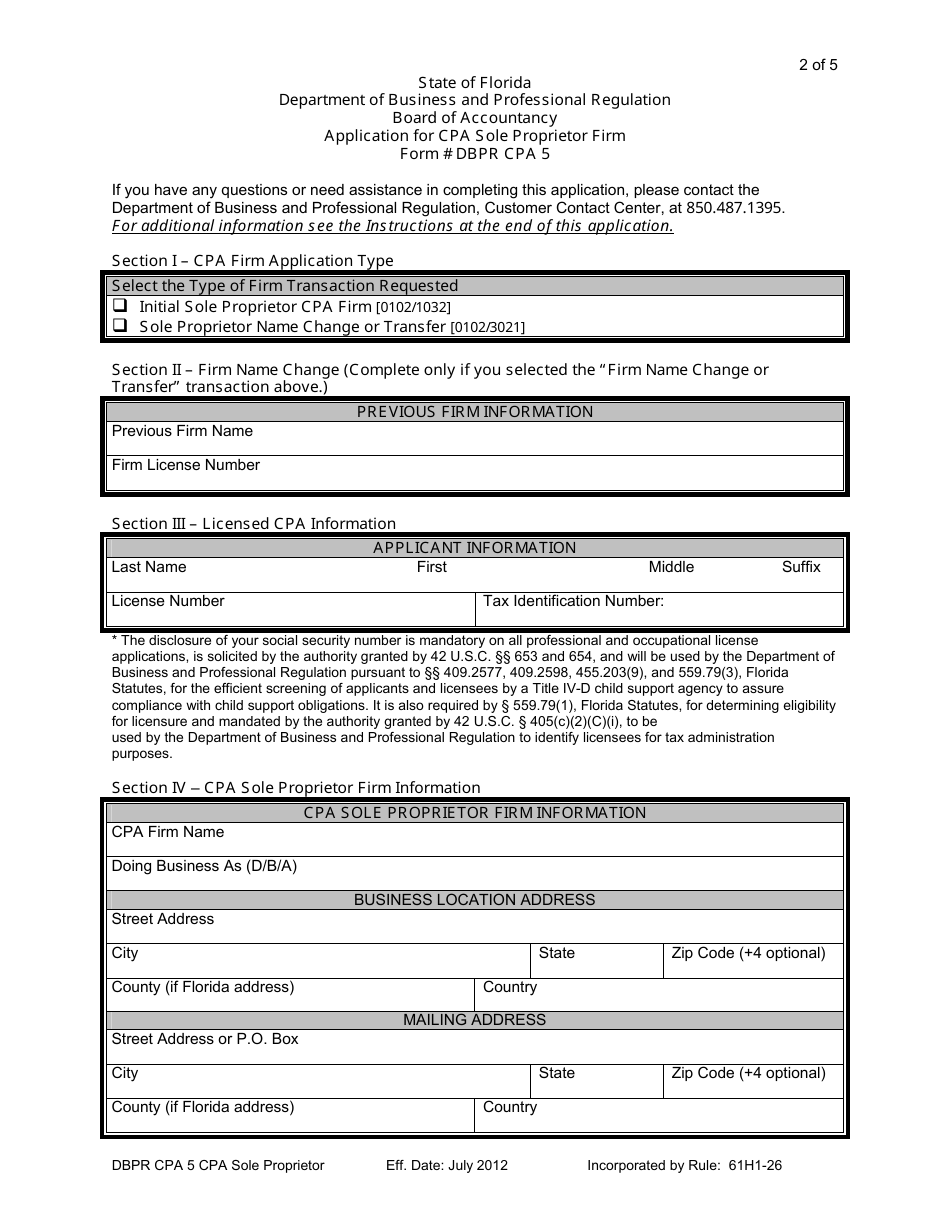

Q: What is a CPA Sole Proprietor Firm?

A: A CPA Sole Proprietor Firm is a business owned and operated by a Certified Public Accountant (CPA) as an individual.

Q: What is DBPR?

A: DBPR stands for Department of Business and Professional Regulation. It is the regulatory agency responsible for licensing and regulating businesses and professionals in Florida.

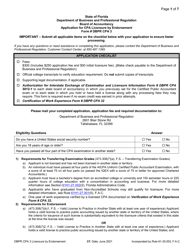

Q: What is the CPA5 Application for?

A: The CPA5 Application is used to apply for a license for a CPA Sole Proprietor Firm in Florida.

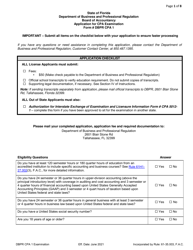

Q: Who needs to fill out the CPA5 Application?

A: Any CPA who wants to operate their accounting practice as a sole proprietorship in Florida needs to fill out the CPA5 Application.

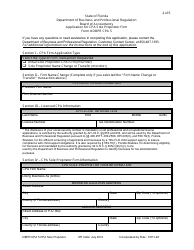

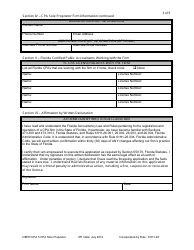

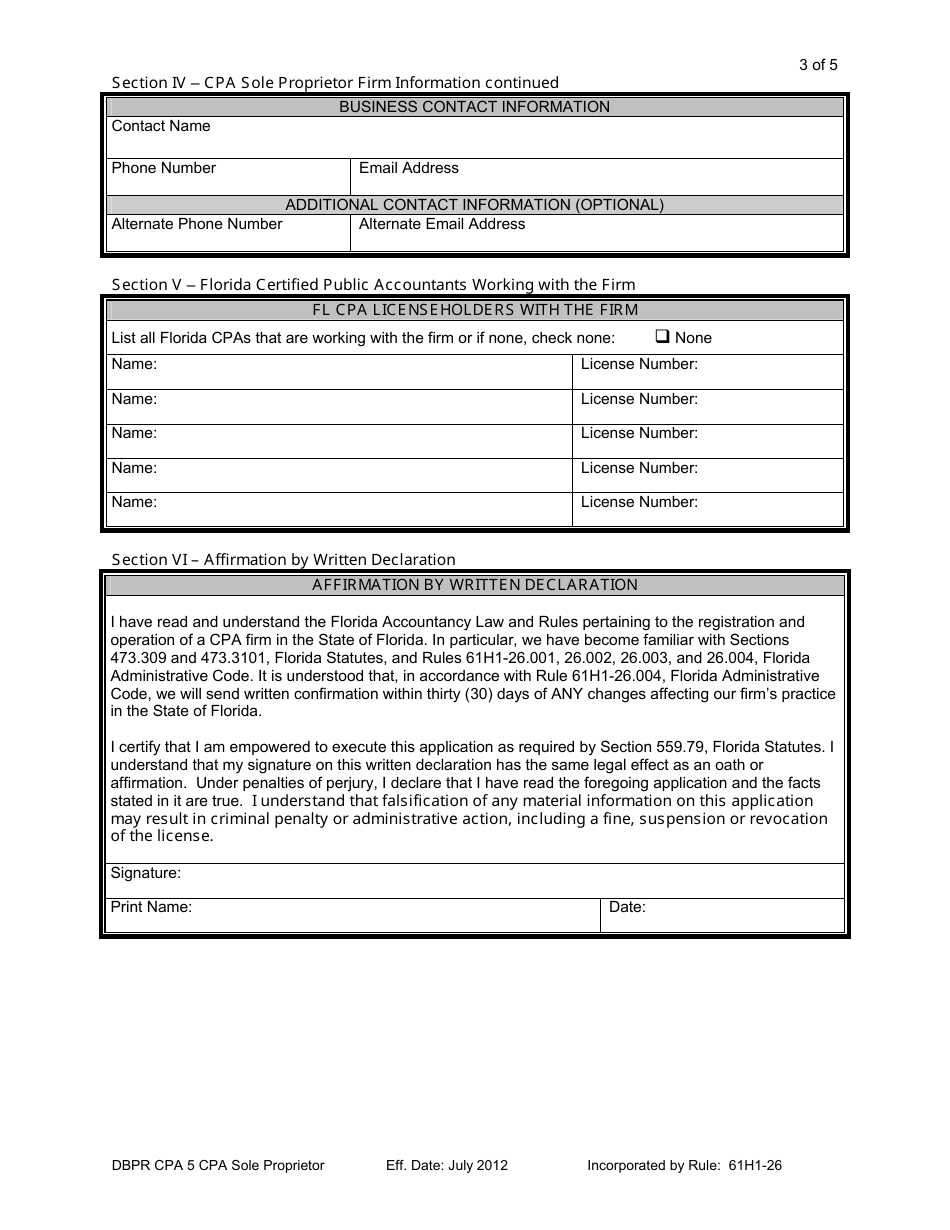

Q: What documents are required for the CPA5 Application?

A: The CPA5 Application requires documentation such as proof of CPA licensure, proof of education, experience verification, and a fingerprint card.

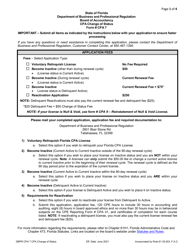

Q: What happens after the CPA5 Application is approved?

A: Once the CPA5 Application is approved, the CPA Sole Proprietor Firm will receive a license to operate their accounting practice in Florida.

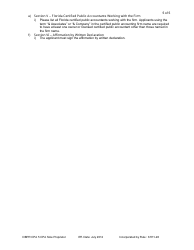

Q: What if my CPA5 Application is denied?

A: If the CPA5 Application is denied, you may have the opportunity to appeal the decision or provide additional documentation to address any deficiencies.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the Florida Department of Business & Professional Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DBPR CPA5 by clicking the link below or browse more documents and templates provided by the Florida Department of Business & Professional Regulation.