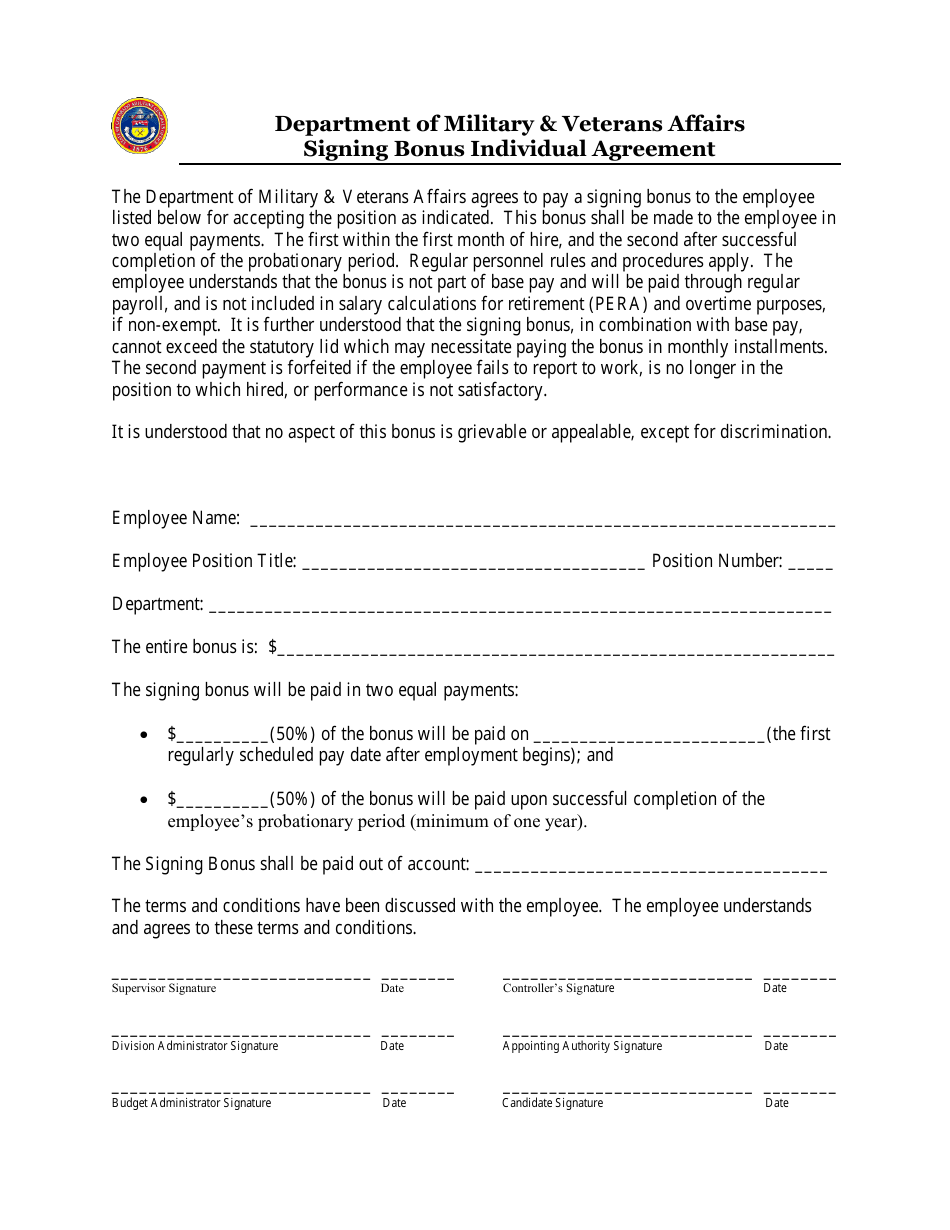

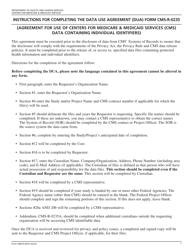

Signing Bonus Individual Agreement Form - Colorado

Signing Bonus Individual Agreement Form is a legal document that was released by the Colorado Department of Military and Veterans Affairs - a government authority operating within Colorado.

FAQ

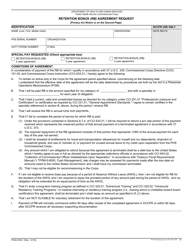

Q: What is a signing bonus?

A: A signing bonus is an amount of money that an employer offers to a new employee as an incentive to join the company.

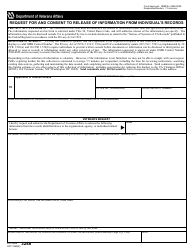

Q: Is a signing bonus taxable?

A: Yes, a signing bonus is considered taxable income and must be reported on your tax return.

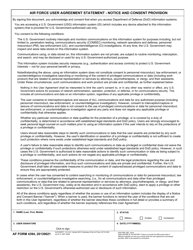

Q: What is an Individual Agreement Form?

A: An Individual Agreement Form is a legal document that outlines the terms and conditions of employment for an individual employee.

Q: Why is an Individual Agreement Form required?

A: An Individual Agreement Form is required to ensure that both the employer and the employee are aware of and agree to the terms of employment.

Q: Is an Individual Agreement Form legally binding?

A: Yes, an Individual Agreement Form is a legally binding document that outlines the rights and responsibilities of both the employer and the employee.

Q: Is a signing bonus mentioned in the Individual Agreement Form?

A: Yes, the signing bonus is typically mentioned in the Individual Agreement Form as part of the employee's total compensation package.

Form Details:

- The latest edition currently provided by the Colorado Department of Military and Veterans Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Department of Military and Veterans Affairs.