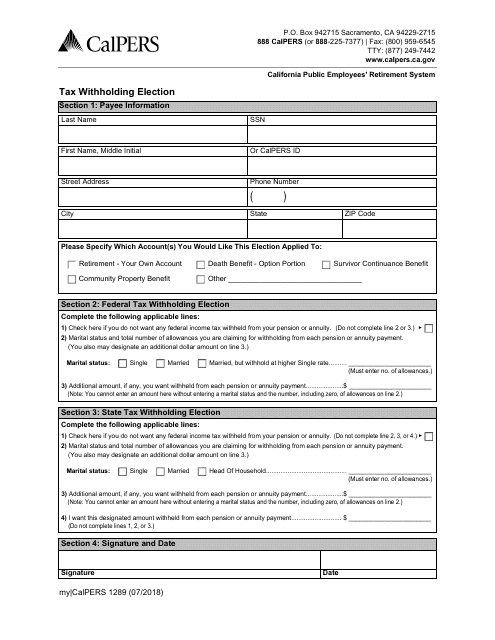

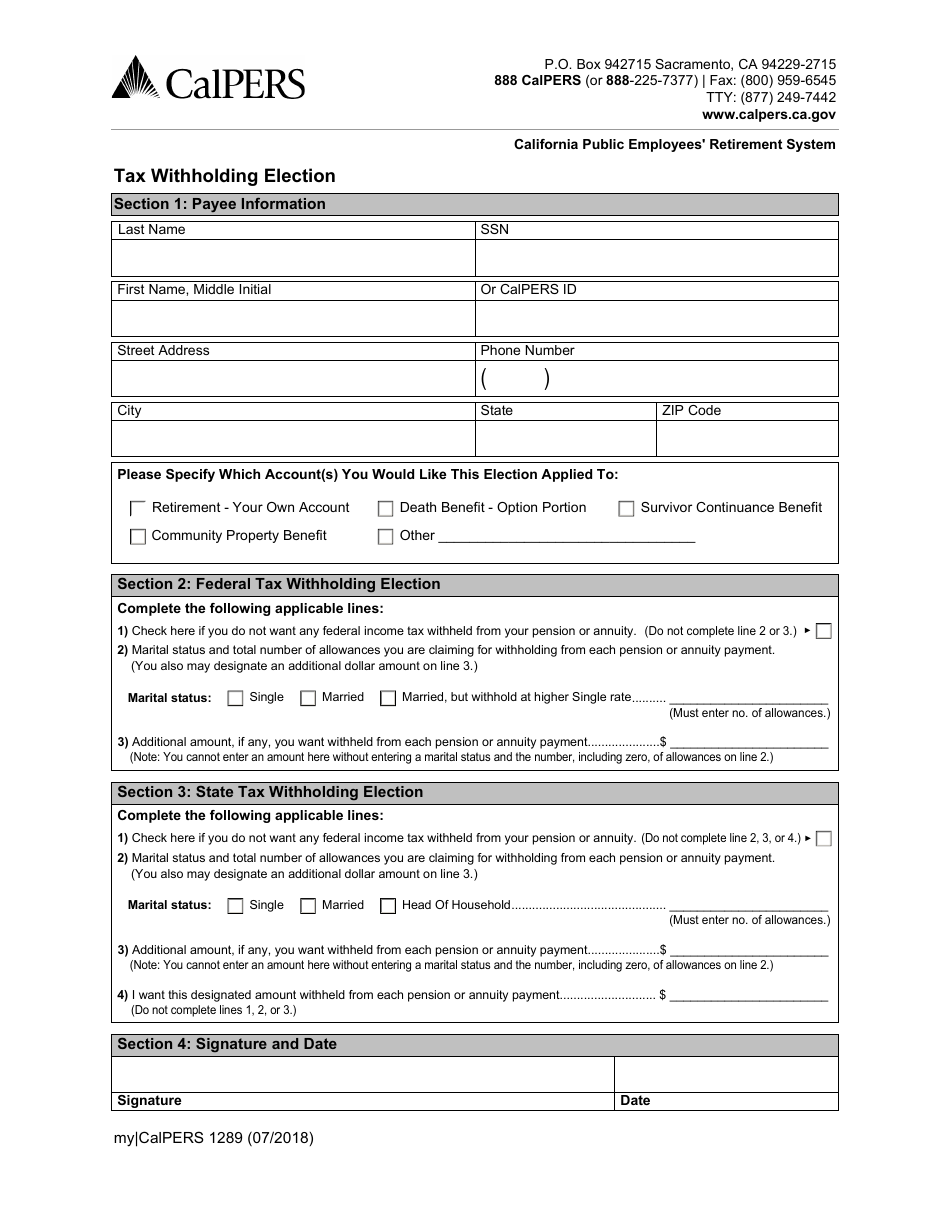

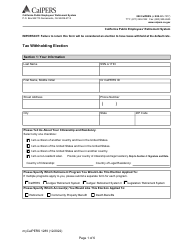

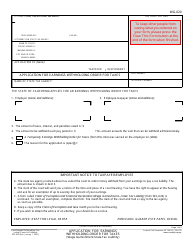

Form 1289 Tax Withholding Election - California

What Is Form 1289?

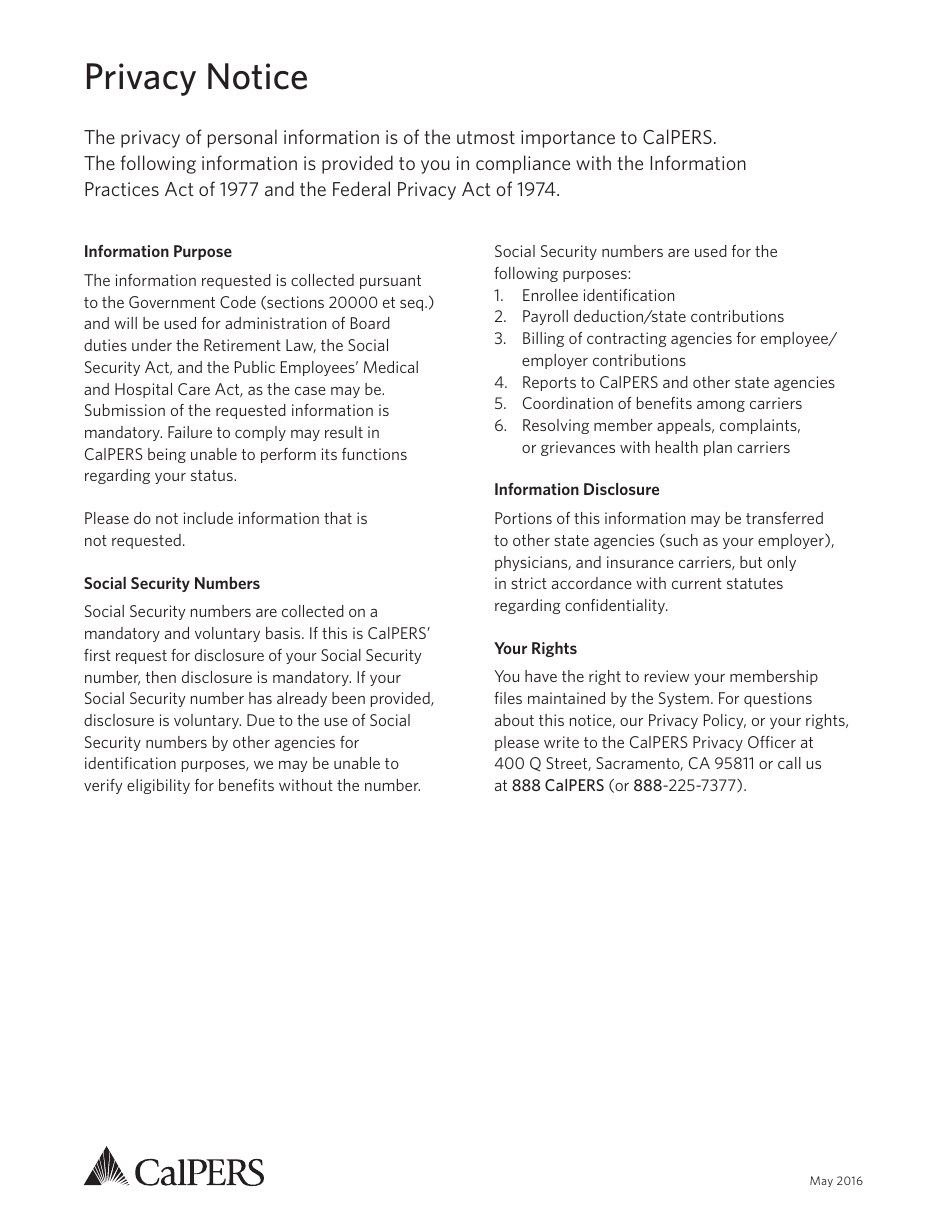

This is a legal form that was released by the California Public Employees' Retirement System - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1289?

A: Form 1289 is a Tax Withholding Election form for California.

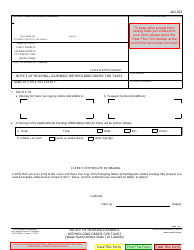

Q: Who needs to fill out Form 1289?

A: Form 1289 must be filled out by employees who want to make changes to their tax withholding in California.

Q: What is the purpose of Form 1289?

A: The purpose of Form 1289 is to allow employees to specify their tax withholding preferences.

Q: When should Form 1289 be filled out?

A: Form 1289 should be filled out whenever an employee wants to make changes to their tax withholding.

Q: How do I fill out Form 1289?

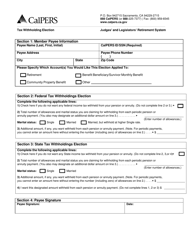

A: You should follow the instructions provided on the form carefully and provide the requested information.

Q: Can I make changes to Form 1289 after submitting it?

A: Yes, you can make changes to Form 1289 at any time by submitting a new form to your employer.

Q: Are there any deadlines for submitting Form 1289?

A: There are no specific deadlines for submitting Form 1289, but it is recommended to submit it as soon as possible to ensure accurate tax withholding.

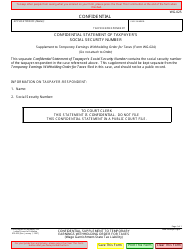

Q: What should I do if I have more questions about Form 1289?

A: If you have more questions about Form 1289, you should contact the California Franchise Tax Board or consult with a tax professional.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the California Public Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1289 by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.