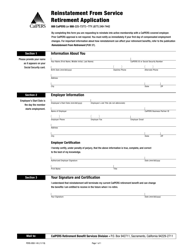

This version of the form is not currently in use and is provided for reference only. Download this version of

Form PERS-BSD-194

for the current year.

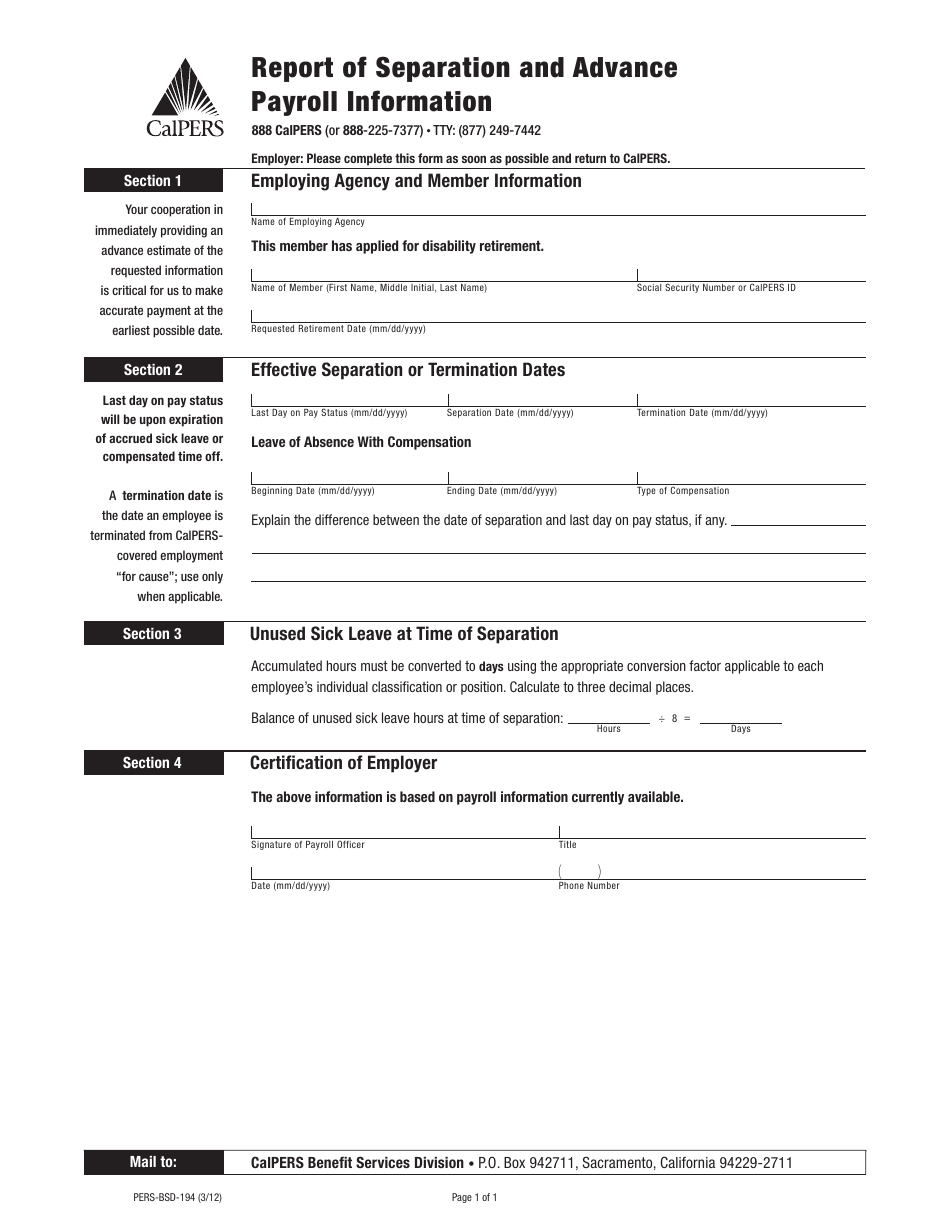

Form PERS-BSD-194 Report of Separation and Advance Payroll Information - California

What Is Form PERS-BSD-194?

This is a legal form that was released by the California Public Employees' Retirement System - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PERS-BSD-194?

A: Form PERS-BSD-194 is the Report of Separation and Advance Payroll Information form for California.

Q: What is the purpose of Form PERS-BSD-194?

A: The purpose of Form PERS-BSD-194 is to report separation and provide advance payroll information.

Q: Who should fill out Form PERS-BSD-194?

A: Form PERS-BSD-194 should be filled out by employees separating from service in California.

Q: What information is required on Form PERS-BSD-194?

A: Form PERS-BSD-194 requires personal information, separation details, and information about advance payroll.

Q: Is there a deadline for submitting Form PERS-BSD-194?

A: Yes, there is a deadline for submitting Form PERS-BSD-194. The deadline is typically specified in the form's instructions.

Q: Are there any fees associated with Form PERS-BSD-194?

A: No, there are no fees associated with Form PERS-BSD-194.

Form Details:

- Released on March 1, 2012;

- The latest edition provided by the California Public Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PERS-BSD-194 by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.