This version of the form is not currently in use and is provided for reference only. Download this version of

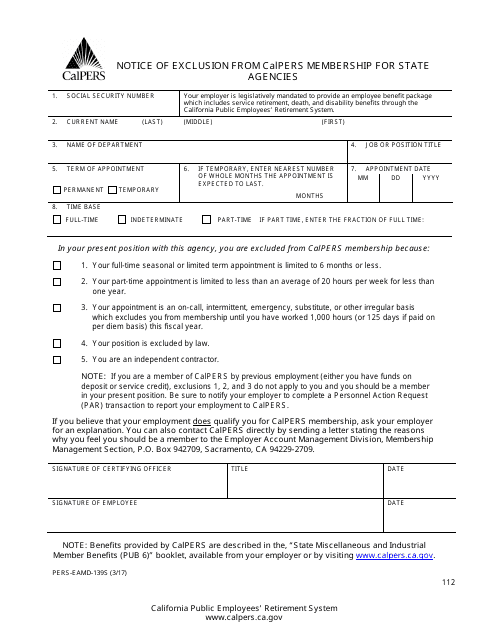

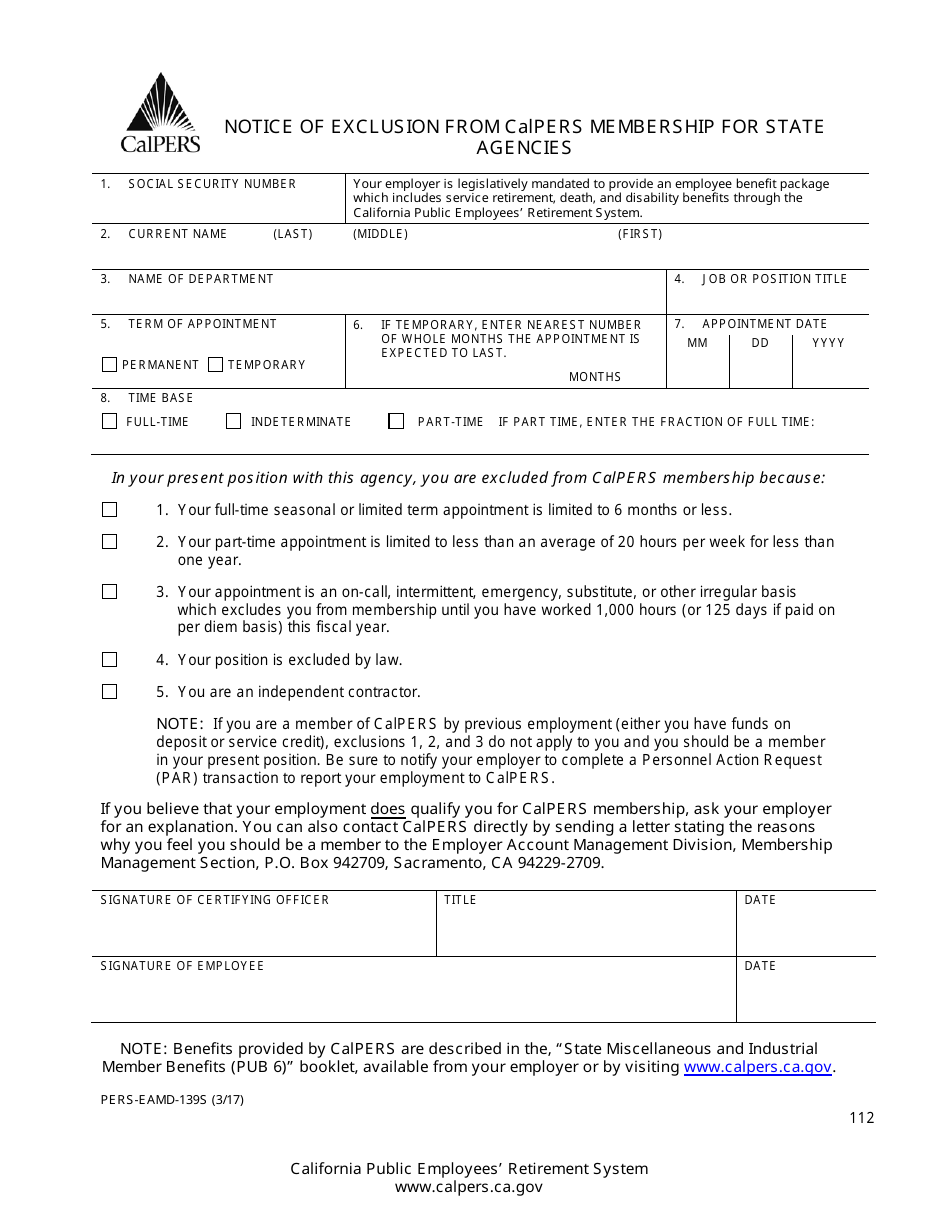

Form PERS-EAMD-139S

for the current year.

Form PERS-EAMD-139S Notice of Exclusion From CalPERS Membership for State Agencies - California

What Is Form PERS-EAMD-139S?

This is a legal form that was released by the California Public Employees' Retirement System - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PERS-EAMD-139S?

A: Form PERS-EAMD-139S is a Notice of Exclusion From CalPERS Membership for State Agencies in California.

Q: Who should use Form PERS-EAMD-139S?

A: State agencies in California should use Form PERS-EAMD-139S to notify CalPERS about excluding their employees from CalPERS membership.

Q: What is the purpose of Form PERS-EAMD-139S?

A: The purpose of Form PERS-EAMD-139S is to inform CalPERS about the exclusion of certain employees from CalPERS membership.

Q: Are all state agency employees automatically enrolled in CalPERS?

A: No, certain state agency employees may be excluded from CalPERS membership.

Q: Do state agencies need to notify CalPERS when excluding employees from membership?

A: Yes, state agencies are required to notify CalPERS by submitting Form PERS-EAMD-139S.

Q: Can state agencies exclude all their employees from CalPERS membership?

A: No, state agencies must follow specific guidelines and criteria to exclude employees from CalPERS membership.

Q: Is there a deadline for submitting Form PERS-EAMD-139S?

A: Yes, state agencies should submit Form PERS-EAMD-139S within 30 days of the effective date of the exclusion.

Q: What happens after submitting Form PERS-EAMD-139S?

A: CalPERS will review the form and determine the eligibility of the employees to be excluded from CalPERS membership.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the California Public Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PERS-EAMD-139S by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.