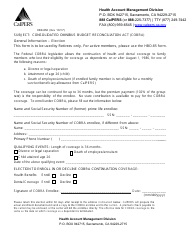

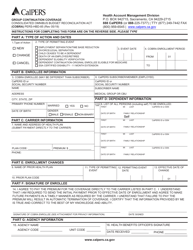

Form HBD-85R Cobra Election Form (Retirees) - California

What Is Form HBD-85R?

This is a legal form that was released by the California Public Employees' Retirement System - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

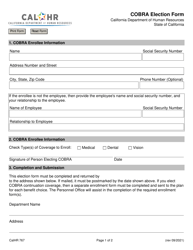

Q: What is Form HBD-85R?

A: Form HBD-85R is the Cobra election form for retirees in California.

Q: Who is eligible to use Form HBD-85R?

A: Retirees in California who are eligible for Cobra coverage can use Form HBD-85R.

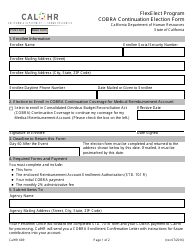

Q: What is Cobra coverage?

A: Cobra coverage is a continuation of health insurance coverage for qualified individuals after their employment ends.

Q: Why do retirees need to fill out Form HBD-85R?

A: Retirees need to fill out Form HBD-85R to elect or decline Cobra coverage.

Q: Are there any deadlines for submitting Form HBD-85R?

A: Yes, retirees must submit Form HBD-85R within 60 days of their coverage termination date to elect Cobra coverage.

Q: Can retirees change their election after submitting Form HBD-85R?

A: No, retirees cannot change their election after submitting Form HBD-85R.

Q: What happens if retirees do not elect Cobra coverage using Form HBD-85R?

A: If retirees do not elect Cobra coverage using Form HBD-85R, they may lose their health insurance benefits.

Q: Is there a cost associated with Cobra coverage?

A: Yes, there is a cost associated with Cobra coverage. Retirees are responsible for paying the full premium.

Q: Can retirees include their dependents in Cobra coverage?

A: Yes, retirees can include their dependents in Cobra coverage, but there may be additional costs.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Public Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HBD-85R by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.