Form for Certification of Opeb Funding Policy & Gasb Opeb Standards Reporting Compliance - California

Form for Certification of Opeb Funding Policy & Gasb Opeb Standards Reporting Compliance is a legal document that was released by the California Public Employees' Retirement System - a government authority operating within California.

FAQ

Q: What is the Form for Certification of OPEB Funding Policy?

A: The Form for Certification of OPEB Funding Policy is a document used in California.

Q: What is GASB OPEB Standards Reporting Compliance?

A: GASB OPEB Standards Reporting Compliance refers to the compliance of the reporting standards set by the Governmental Accounting Standards Board (GASB) for Other Postemployment Benefits (OPEB).

Q: What is OPEB?

A: OPEB stands for Other Postemployment Benefits, which refers to benefits other than pensions that are provided to retired employees.

Q: Who uses the Form for Certification of OPEB Funding Policy?

A: The Form for Certification of OPEB Funding Policy is used by entities in California that provide OPEB benefits.

Q: What is the purpose of the Form for Certification of OPEB Funding Policy?

A: The purpose of the Form for Certification of OPEB Funding Policy is to ensure compliance with OPEB funding requirements and to report on GASB OPEB Standards compliance.

Q: What is the Governmental Accounting Standards Board (GASB)?

A: The Governmental Accounting Standards Board (GASB) is an independent organization that establishes and improves accounting and financial reporting standards for state and local governments in the United States.

Q: What are the GASB OPEB Standards?

A: The GASB OPEB Standards are the reporting standards established by the Governmental Accounting Standards Board (GASB) for Other Postemployment Benefits (OPEB) provided by state and local governments.

Q: Why is GASB OPEB Standards Reporting Compliance important?

A: GASB OPEB Standards Reporting Compliance is important to ensure transparency and consistency in the reporting of OPEB benefits provided by state and local governments.

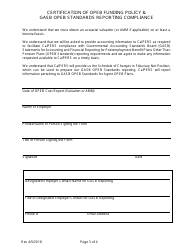

Q: Who is responsible for completing the Form for Certification of OPEB Funding Policy?

A: The responsible entity or organization providing OPEB benefits in California is responsible for completing the Form for Certification of OPEB Funding Policy.

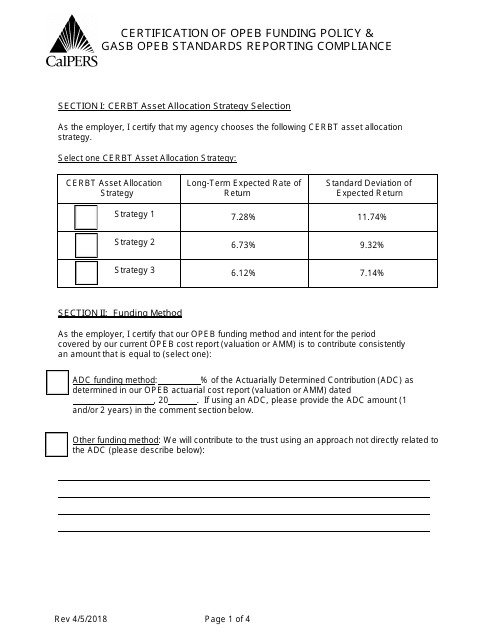

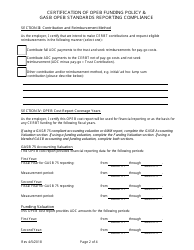

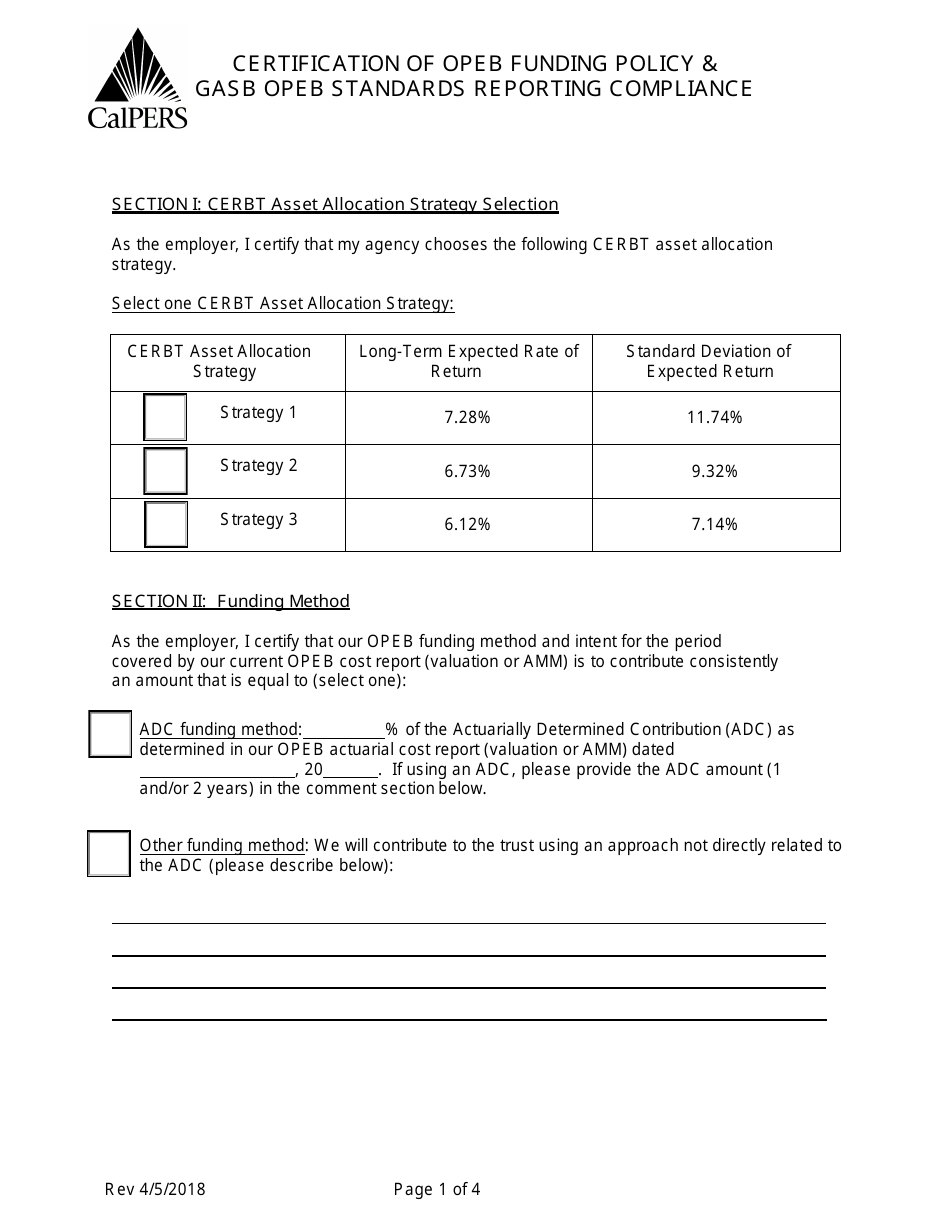

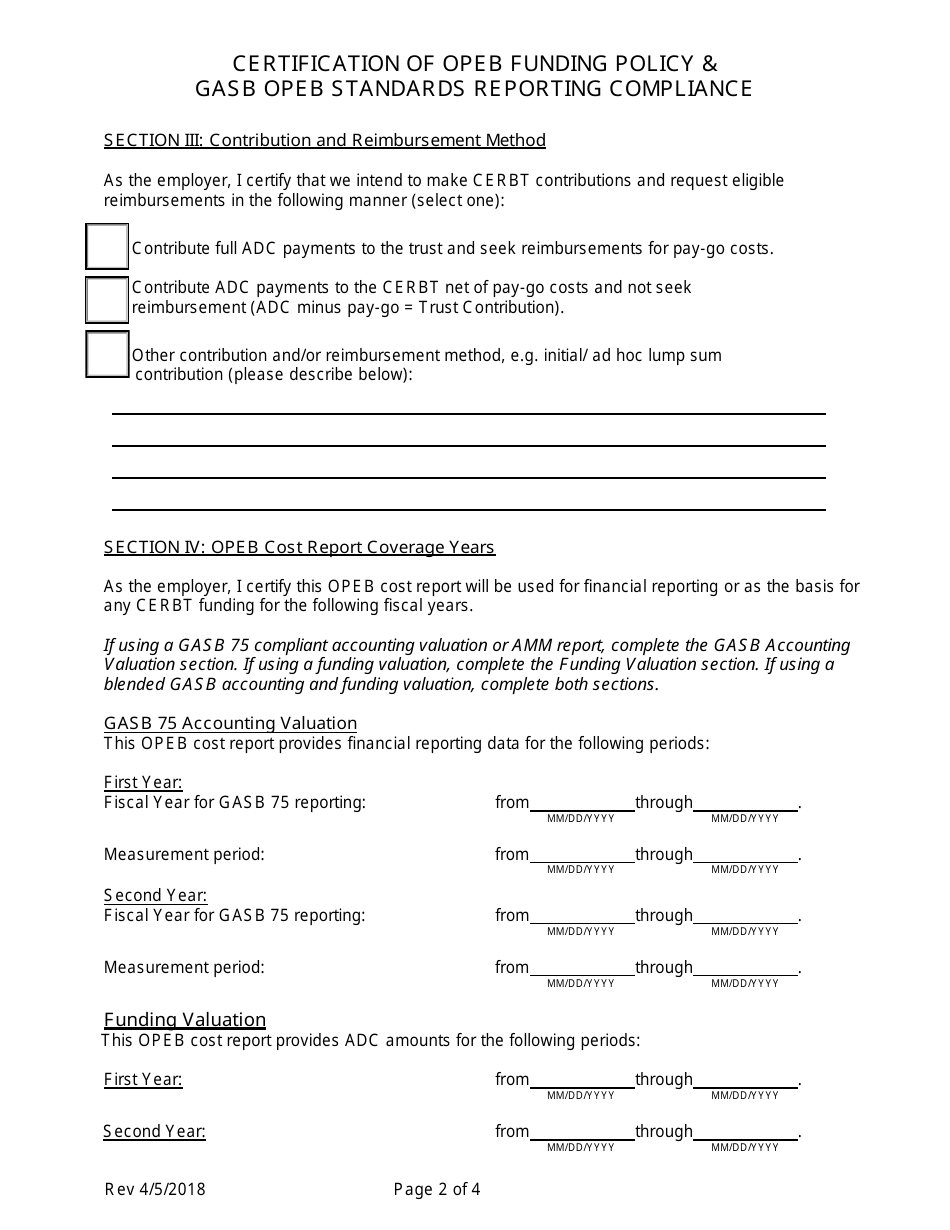

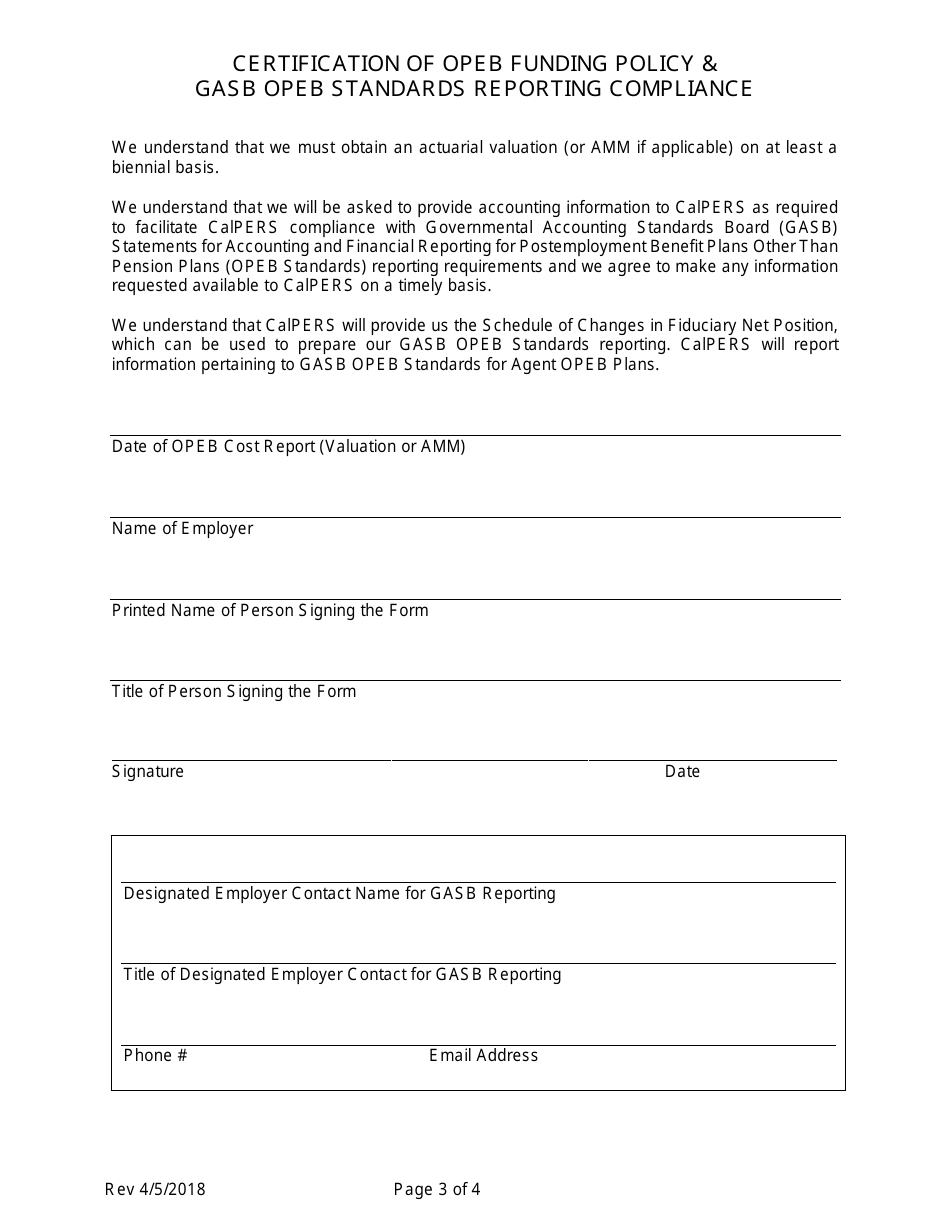

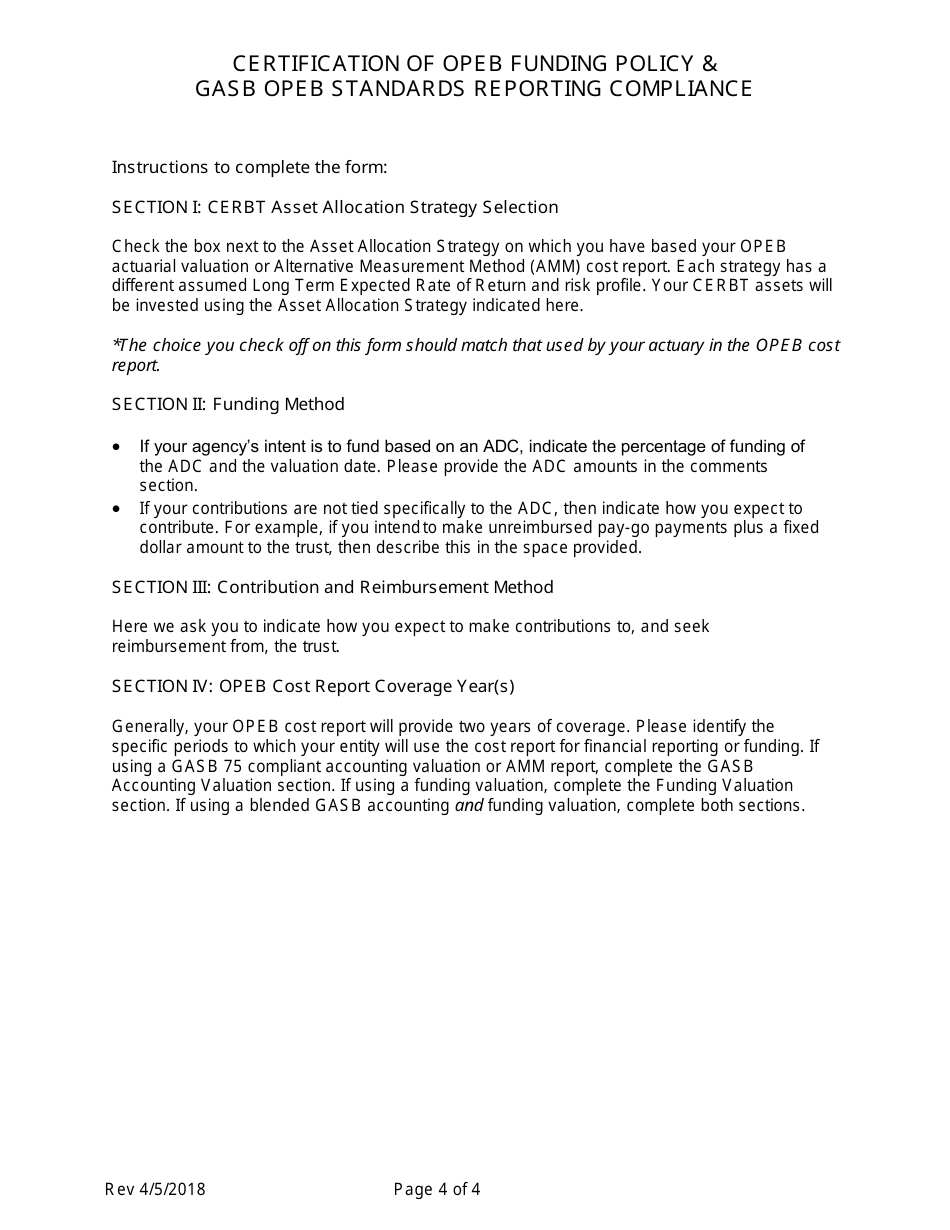

Q: What information is required in the Form for Certification of OPEB Funding Policy?

A: The Form for Certification of OPEB Funding Policy requires information regarding the funding policies and compliance with GASB OPEB Standards.

Q: Is the Form for Certification of OPEB Funding Policy mandatory?

A: Yes, the Form for Certification of OPEB Funding Policy is mandatory for entities in California that provide OPEB benefits.

Q: What are the consequences of non-compliance with GASB OPEB Standards?

A: Non-compliance with GASB OPEB Standards may result in penalties, legal implications, and a lack of transparency in reporting OPEB benefits.

Q: Can the Form for Certification of OPEB Funding Policy be submitted electronically?

A: The submission methods for the Form for Certification of OPEB Funding Policy may vary depending on the relevant authorities or organizations in California.

Q: What is the deadline for submitting the Form for Certification of OPEB Funding Policy?

A: The deadline for submitting the Form for Certification of OPEB Funding Policy may vary depending on the relevant authorities or organizations in California.

Q: Who should I contact for further information or assistance with the Form for Certification of OPEB Funding Policy?

A: For further information or assistance with the Form for Certification of OPEB Funding Policy, you should contact the relevant authorities or organizations in California.

Form Details:

- Released on April 5, 2018;

- The latest edition currently provided by the California Public Employees' Retirement System;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.