This version of the form is not currently in use and is provided for reference only. Download this version of

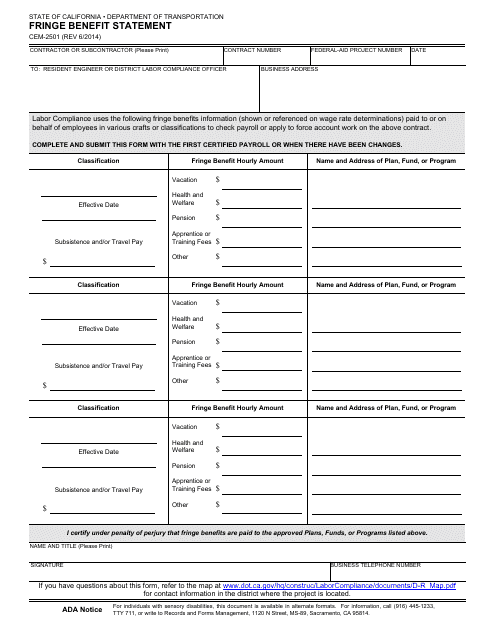

Form CEM-2501

for the current year.

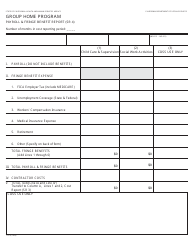

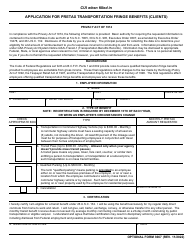

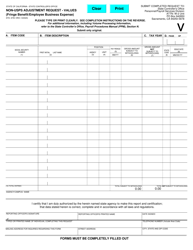

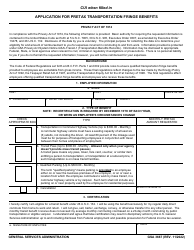

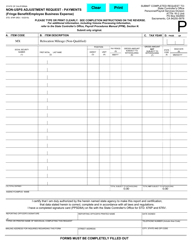

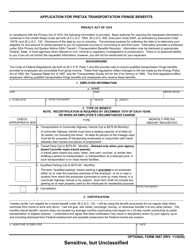

Form CEM-2501 Fringe Benefit Statement - California

What Is Form CEM-2501?

This is a legal form that was released by the California Department of Transportation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CEM-2501?

A: Form CEM-2501 is the Fringe Benefit Statement for California.

Q: Who needs to use Form CEM-2501?

A: Contractors in California who provide fringe benefits to their employees need to use Form CEM-2501.

Q: What are fringe benefits?

A: Fringe benefits are non-wage compensations provided to employees, such as health insurance or retirement plans.

Q: Why is Form CEM-2501 important?

A: Form CEM-2501 is important because it helps contractors in California track and report the fringe benefits they provide to their employees.

Q: How often do contractors need to file Form CEM-2501?

A: Contractors in California need to file Form CEM-2501 annually.

Q: What information is required on Form CEM-2501?

A: Form CEM-2501 requires contractors to provide detailed information about the fringe benefits they provided, including the types of benefits and the number of employees receiving each benefit.

Q: Are there any penalties for not filing Form CEM-2501?

A: Yes, contractors who fail to file Form CEM-2501 or provide false information may be subject to penalties and fines.

Q: Is Form CEM-2501 only for contractors in California?

A: Yes, Form CEM-2501 is specifically for contractors in California who provide fringe benefits to their employees.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the California Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CEM-2501 by clicking the link below or browse more documents and templates provided by the California Department of Transportation.