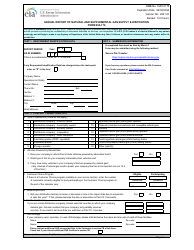

This version of the form is not currently in use and is provided for reference only. Download this version of

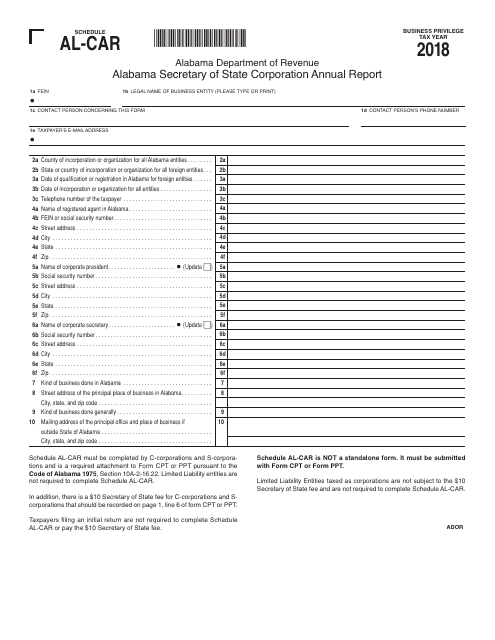

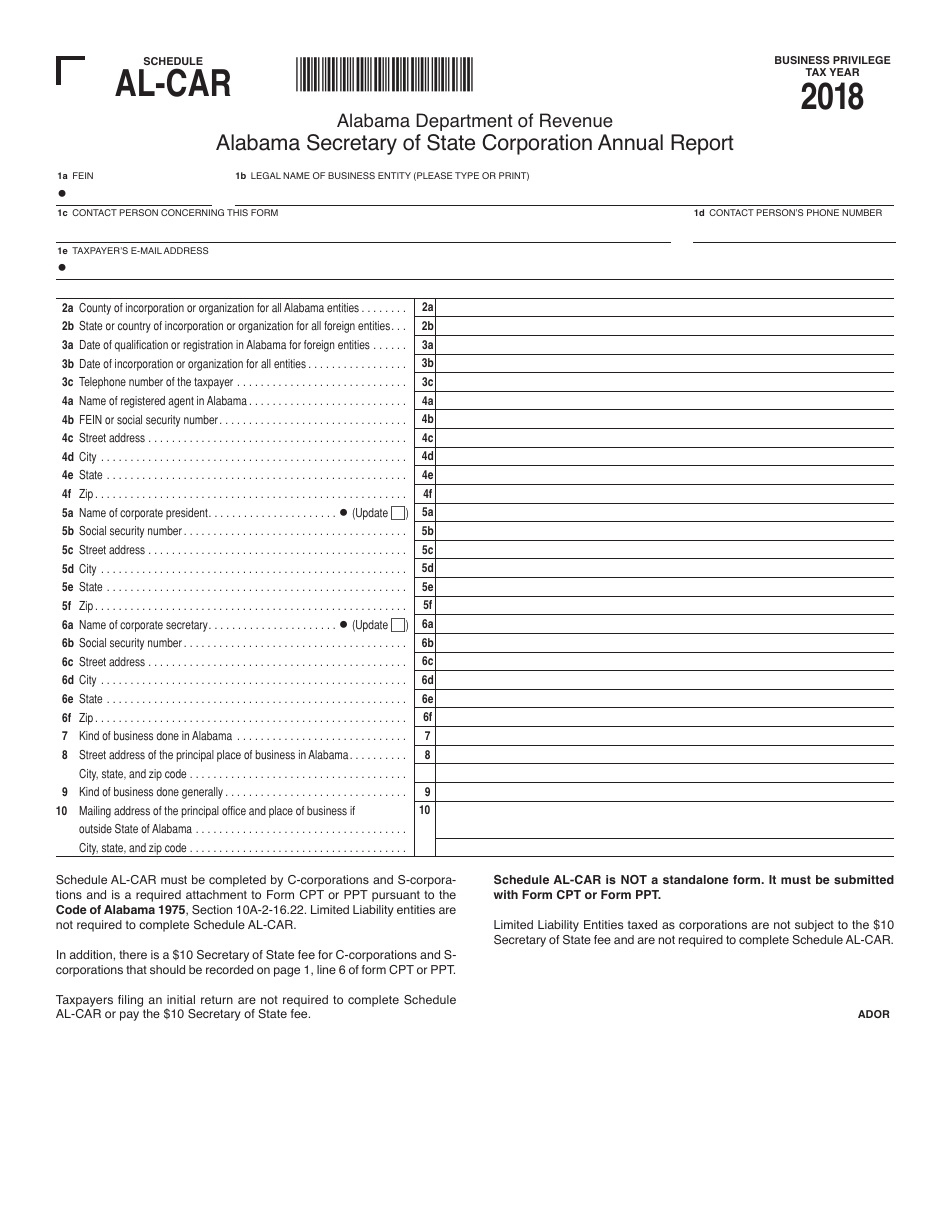

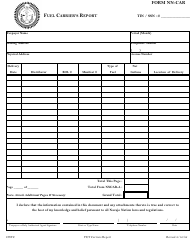

Schedule AL-CAR

for the current year.

Schedule AL-CAR Alabama Secretary of State Corporation Annual Report - Alabama

What Is Schedule AL-CAR?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule AL-CAR?

A: Schedule AL-CAR is the Alabama Secretary of State Corporation Annual Report.

Q: What is the purpose of Schedule AL-CAR?

A: The purpose of Schedule AL-CAR is to report information on an annual basis about a corporation in Alabama.

Q: Who is required to file Schedule AL-CAR?

A: All corporations registered in Alabama are required to file Schedule AL-CAR.

Q: When is Schedule AL-CAR due?

A: Schedule AL-CAR is due by the 15th day of the 3rd month following the end of the corporation's fiscal year.

Q: What information is required to be included in Schedule AL-CAR?

A: Schedule AL-CAR requires information such as the corporation's name, principal office address, registered agent information, and details about the corporation's officers and directors.

Q: Is there a fee for filing Schedule AL-CAR?

A: Yes, there is a fee for filing Schedule AL-CAR. The fee varies depending on the corporation's authorized shares.

Q: What happens if Schedule AL-CAR is not filed on time?

A: If Schedule AL-CAR is not filed on time, the corporation may face penalties and may lose its good standing status with the Alabama Secretary of State.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule AL-CAR by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.