This version of the form is not currently in use and is provided for reference only. Download this version of

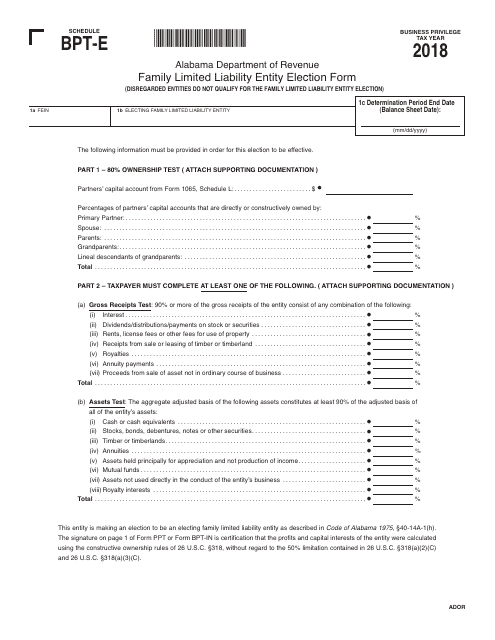

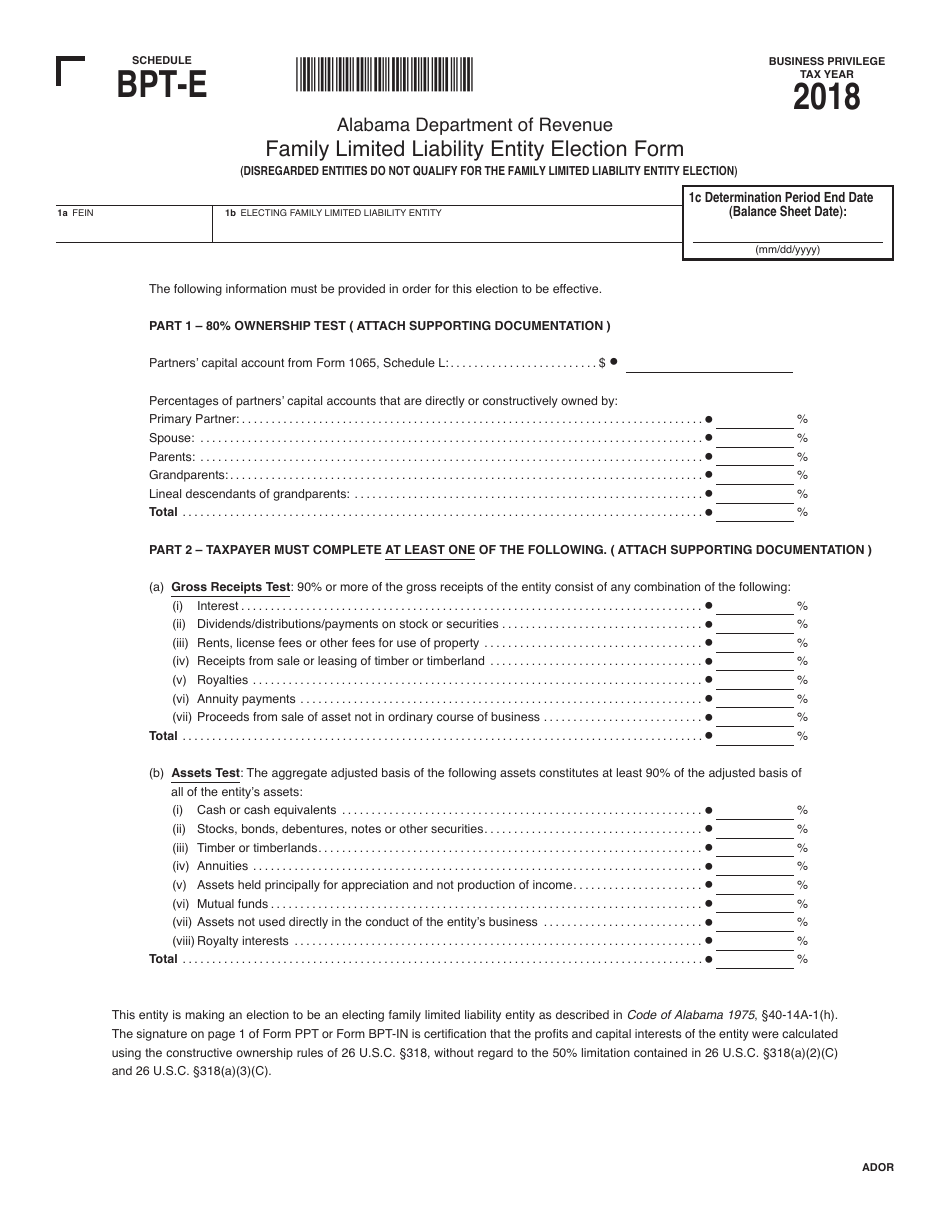

Schedule BPT-E

for the current year.

Schedule BPT-E Family Limited Liability Entity Election Form - Alabama

What Is Schedule BPT-E?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Schedule BPT-E Family Limited Liability Entity Election Form?

A: The Schedule BPT-E Family Limited Liability Entity Election Form is a form used in Alabama to elect to be taxed as a family limited liability entity for Business Privilege Tax purposes.

Q: Who can use the Schedule BPT-E Family Limited Liability Entity Election Form?

A: Any eligible limited liability entity in Alabama can use the Schedule BPT-E form to elect family limited liability entity status.

Q: What is a family limited liability entity?

A: A family limited liability entity is a type of legal structure that combines the benefits of a limited liability entity with certain tax advantages for family-owned businesses.

Q: What is the purpose of the Schedule BPT-E form?

A: The purpose of the Schedule BPT-E form is to allow eligible limited liability entities to elect to be taxed as a family limited liability entity for Business Privilege Tax purposes in Alabama.

Q: What information is required on the Schedule BPT-E form?

A: The Schedule BPT-E form requires information about the limited liability entity, its members, and the election to be taxed as a family limited liability entity.

Q: When is the deadline to file the Schedule BPT-E form?

A: The Schedule BPT-E form must be filed with the Alabama Department of Revenue by the due date for the Business Privilege Tax return, which is generally April 15th.

Q: Are there any fees associated with filing the Schedule BPT-E form?

A: There are no specific fees associated with filing the Schedule BPT-E form, but the Business Privilege Tax itself may have applicable fees based on the entity's taxable net worth.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule BPT-E by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.