This version of the form is not currently in use and is provided for reference only. Download this version of

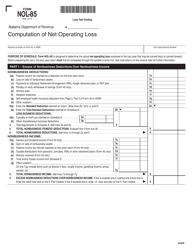

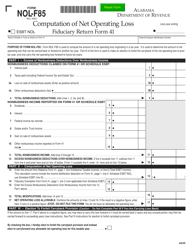

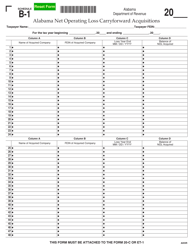

Form NOL-85A

for the current year.

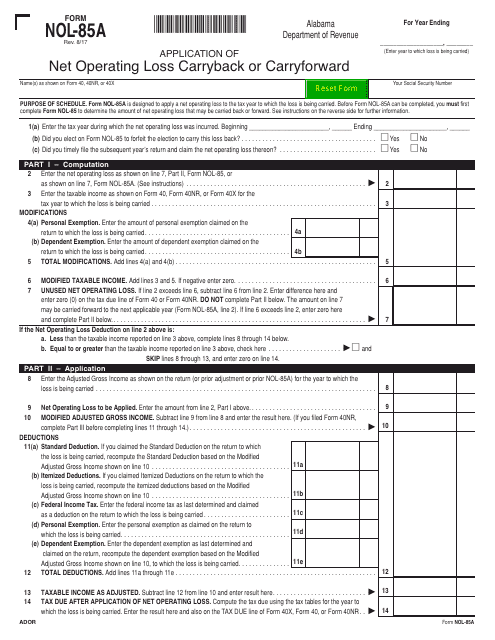

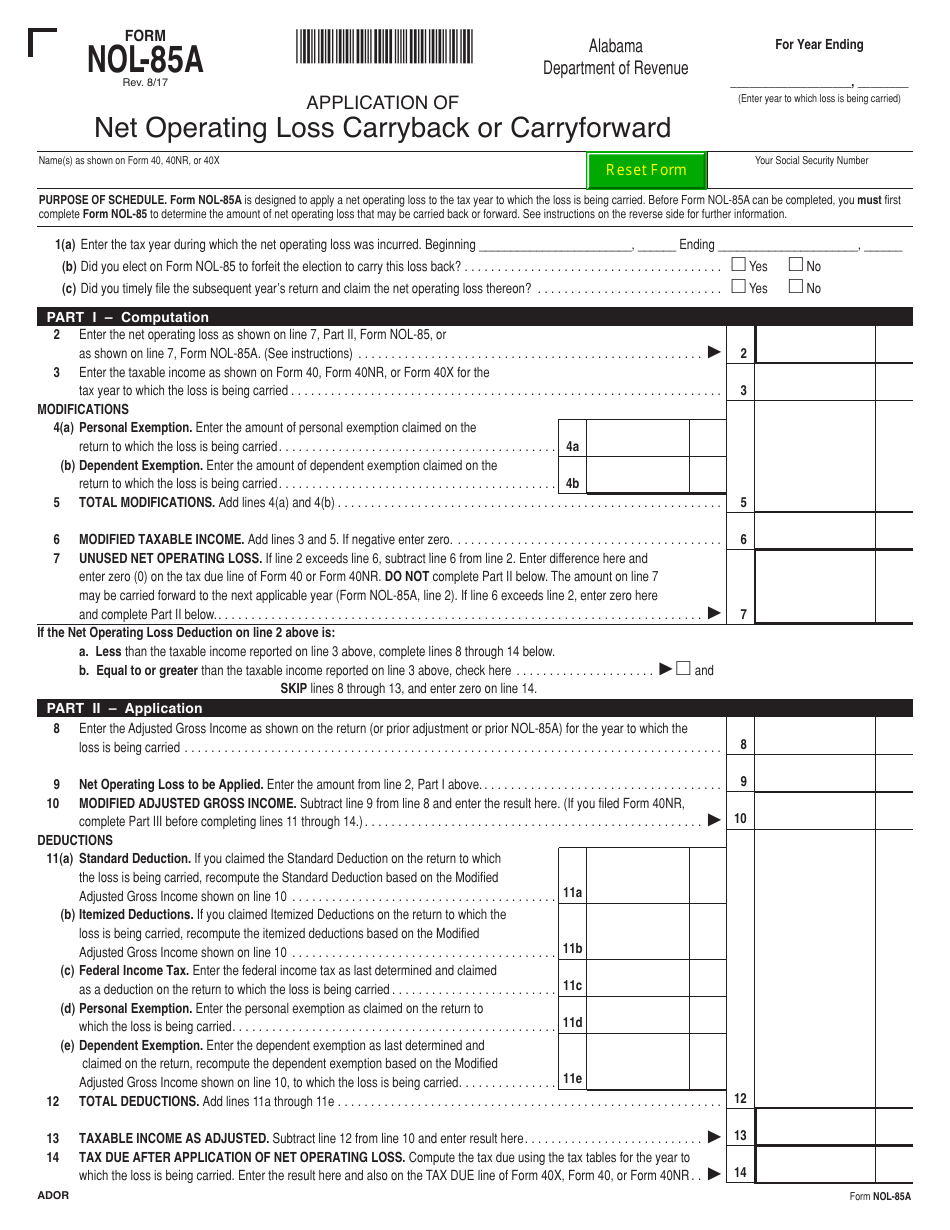

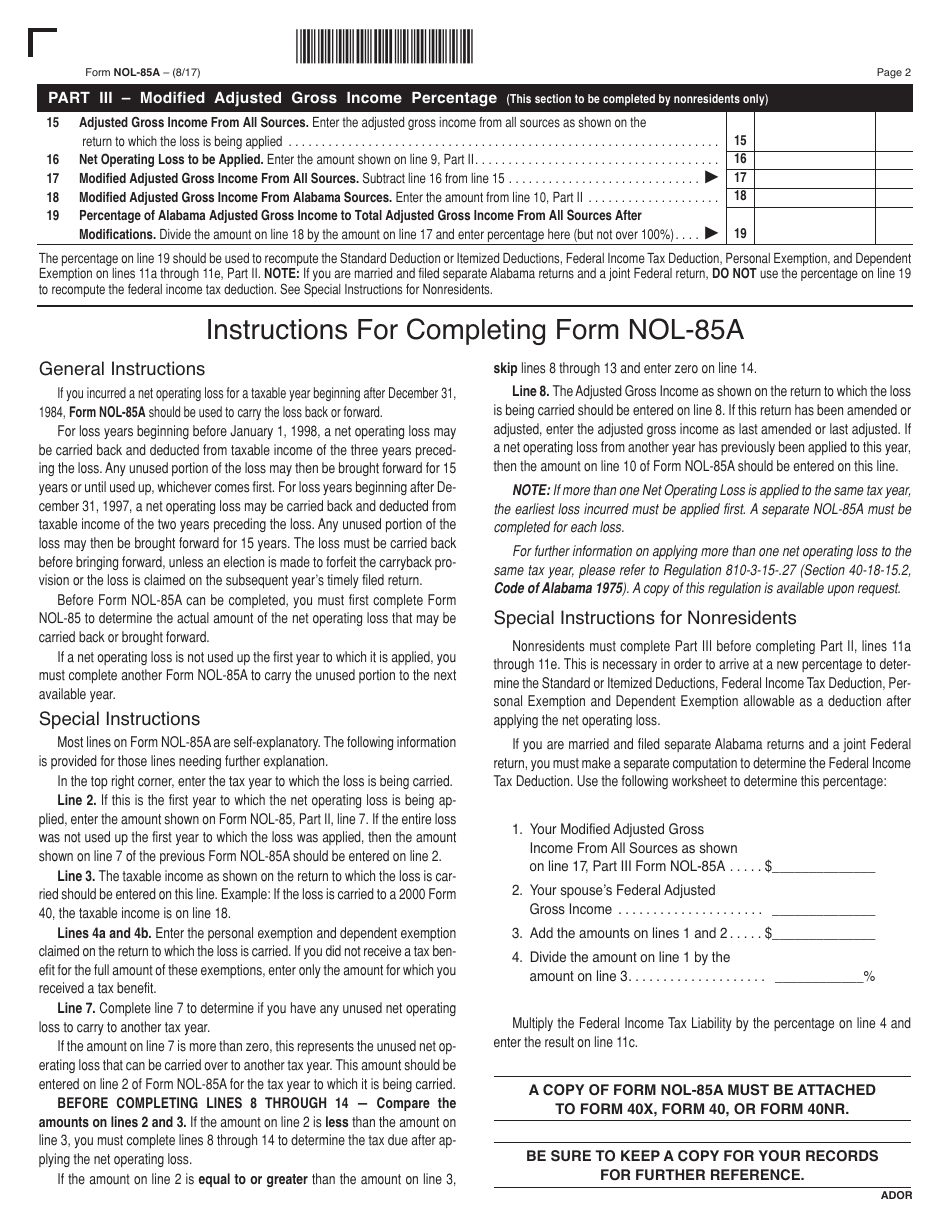

Form NOL-85A Application of Net Operating Loss Carryback or Carryforward - Alabama

What Is Form NOL-85A?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NOL-85A?

A: Form NOL-85A is an application for Net Operating Loss (NOL) Carryback or Carryforward in Alabama.

Q: What is a Net Operating Loss (NOL)?

A: A Net Operating Loss (NOL) occurs when a taxpayer's allowable deductions exceed their taxable income.

Q: What is a NOL carryback?

A: A NOL carryback allows a taxpayer to use their NOL to offset taxable income from previous years.

Q: What is a NOL carryforward?

A: A NOL carryforward allows a taxpayer to use their NOL to offset taxable income in future years.

Q: Who can use Form NOL-85A?

A: Form NOL-85A is used by Alabama taxpayers who have a Net Operating Loss (NOL) and want to carry it back or forward.

Q: What information is required on Form NOL-85A?

A: Form NOL-85A requires the taxpayer's personal information, details of the NOL, and information on the years to which the NOL is being carried.

Q: Are there any filing fees for Form NOL-85A?

A: There are no filing fees for submitting Form NOL-85A.

Q: Is there a deadline for submitting Form NOL-85A?

A: Yes, Form NOL-85A must be submitted within 3 years from the due date of the original return or within 1 year from the date of an overpayment.

Q: Can Form NOL-85A be e-filed?

A: As of now, Form NOL-85A cannot be e-filed and must be submitted by mail.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NOL-85A by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.