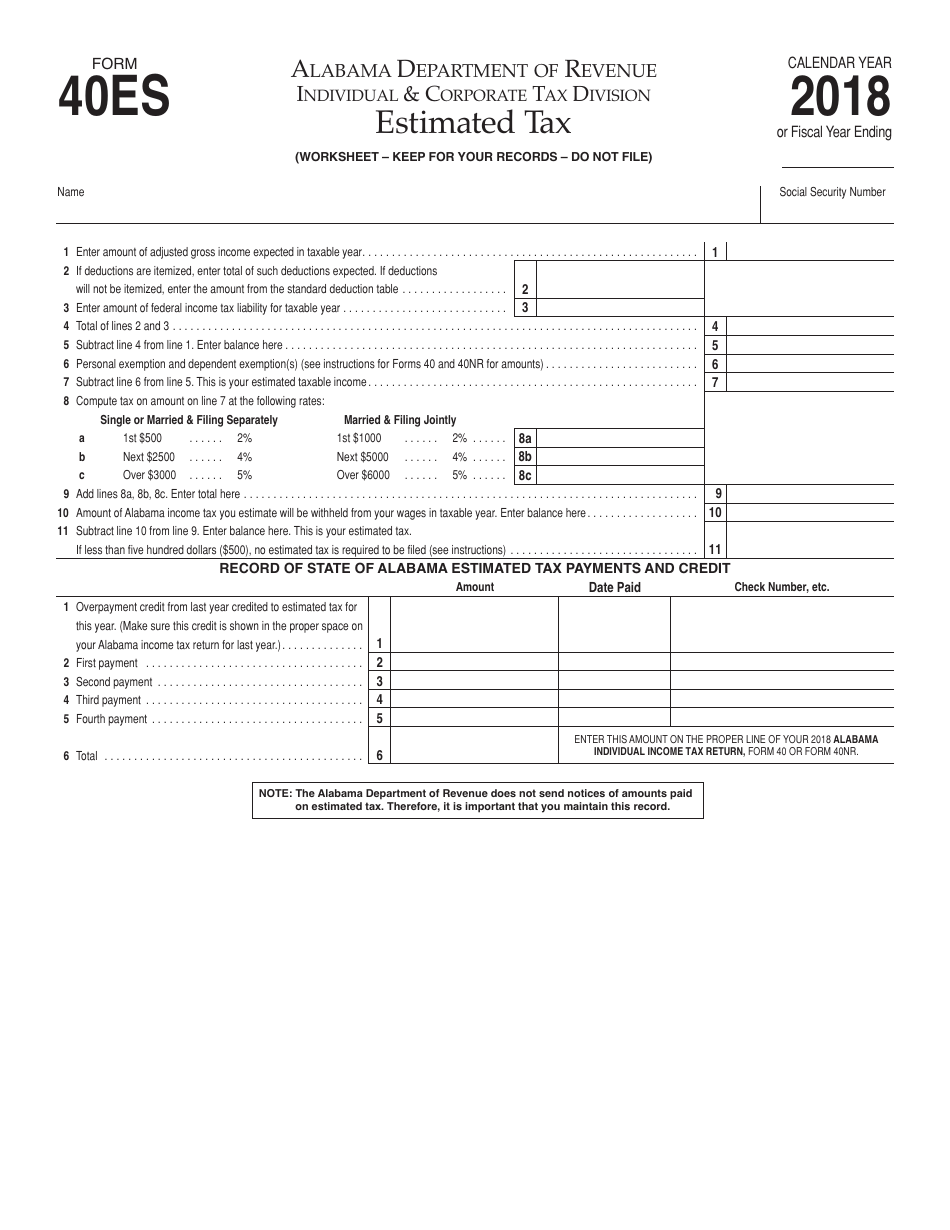

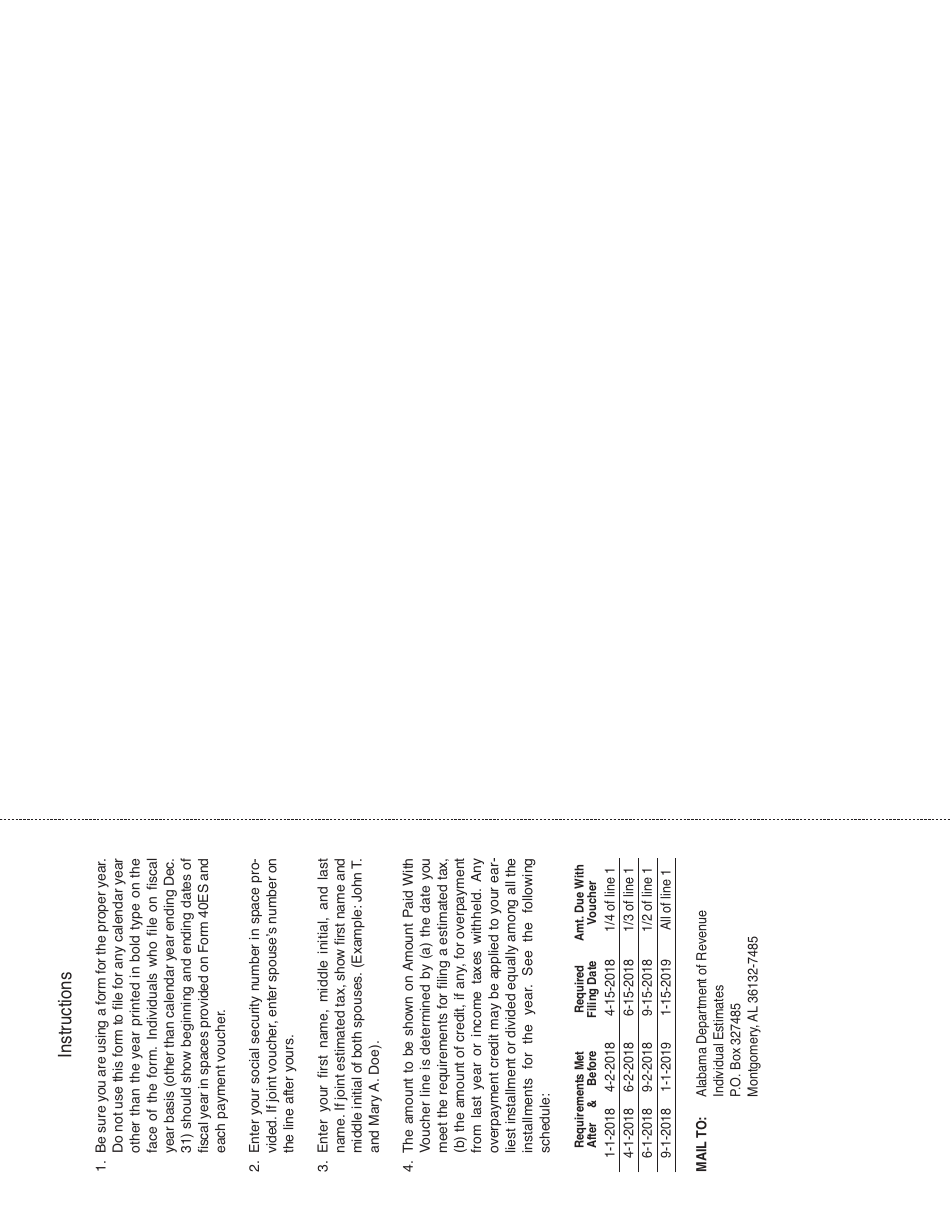

Form 40ES Individual Estimated Tax Form - Alabama

What Is Form 40ES?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40ES?

A: Form 40ES is the Individual Estimated Tax Form used in Alabama.

Q: Who needs to file Form 40ES?

A: Individuals who expect to owe more than $500 in taxes for the year need to file Form 40ES.

Q: What is the purpose of Form 40ES?

A: Form 40ES is used to make estimated tax payments throughout the year to avoid underpayment penalty.

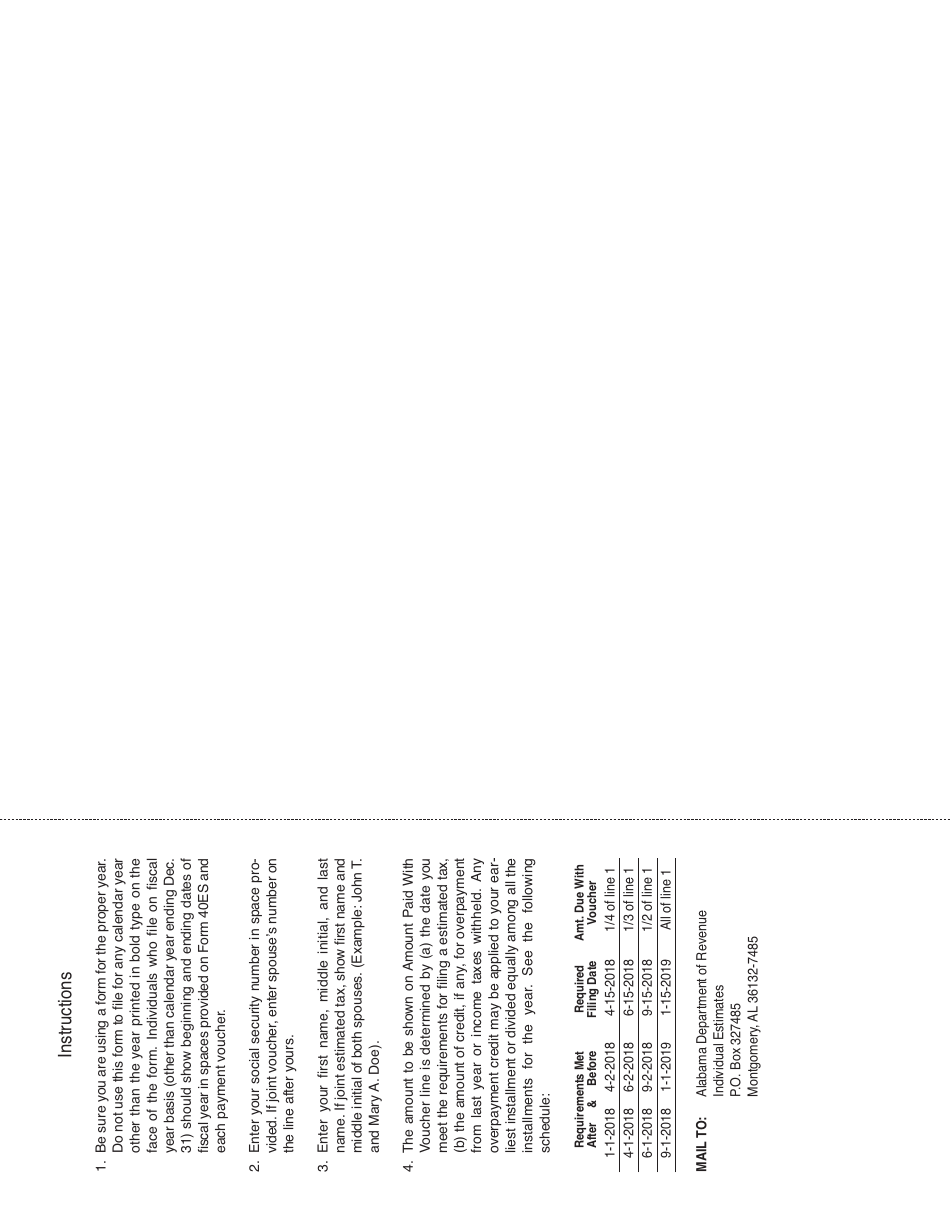

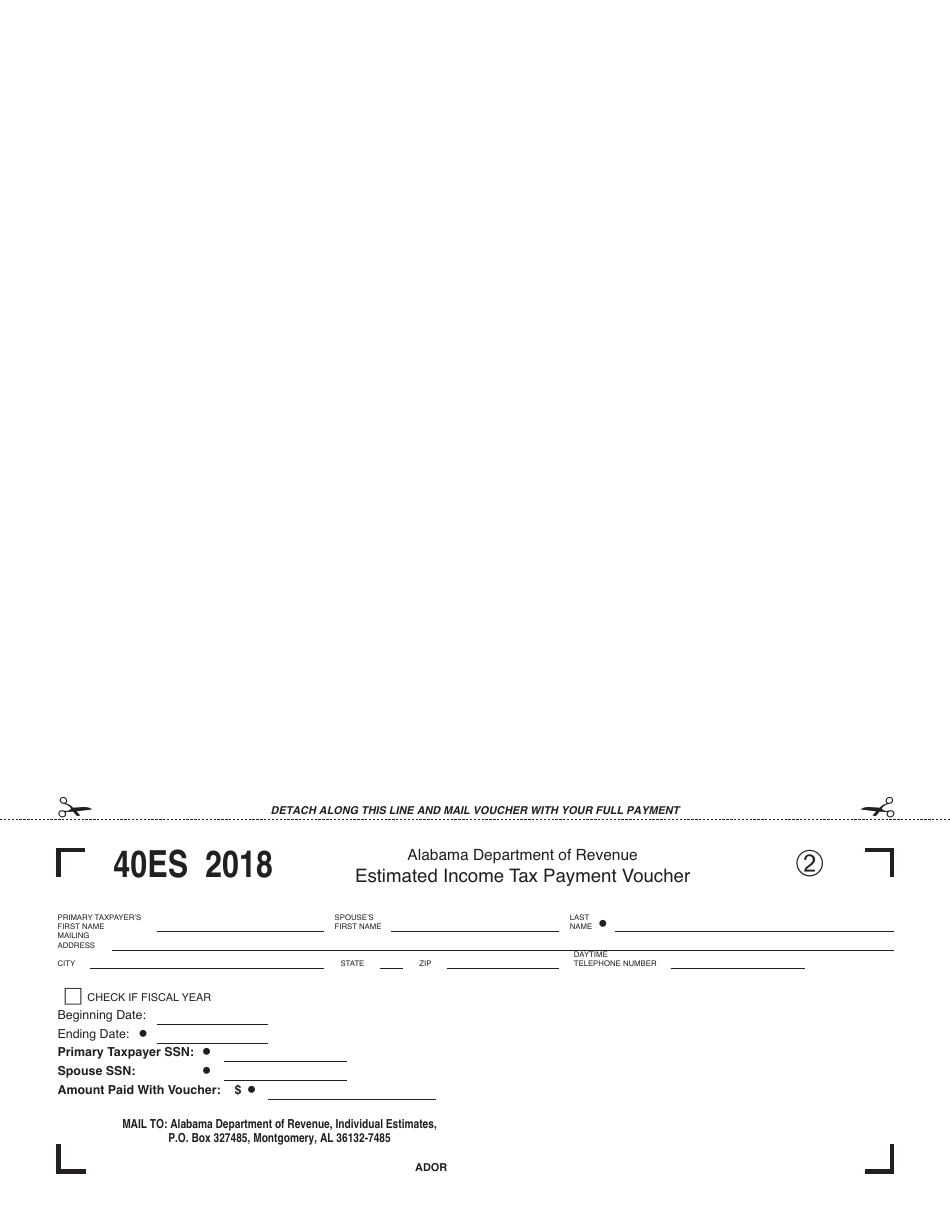

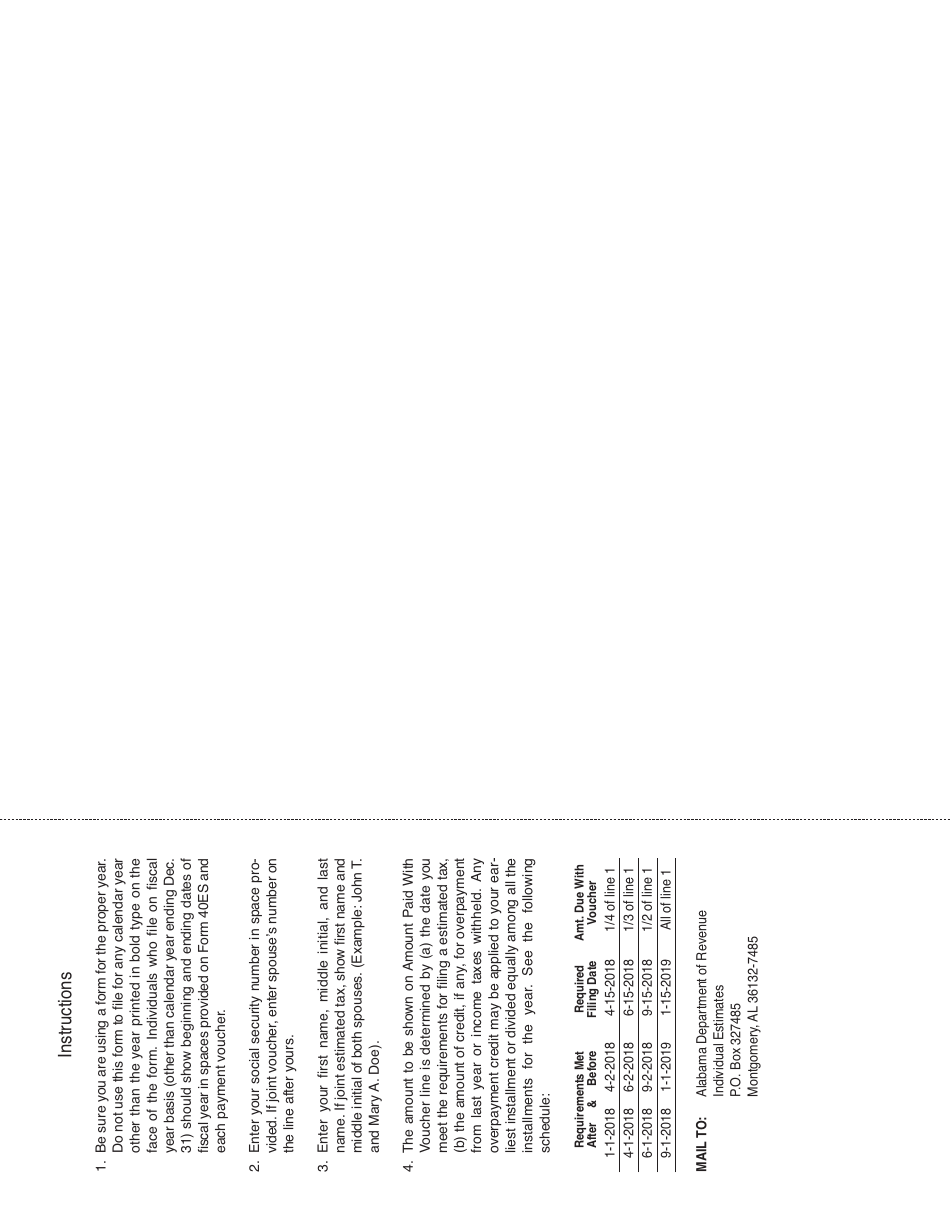

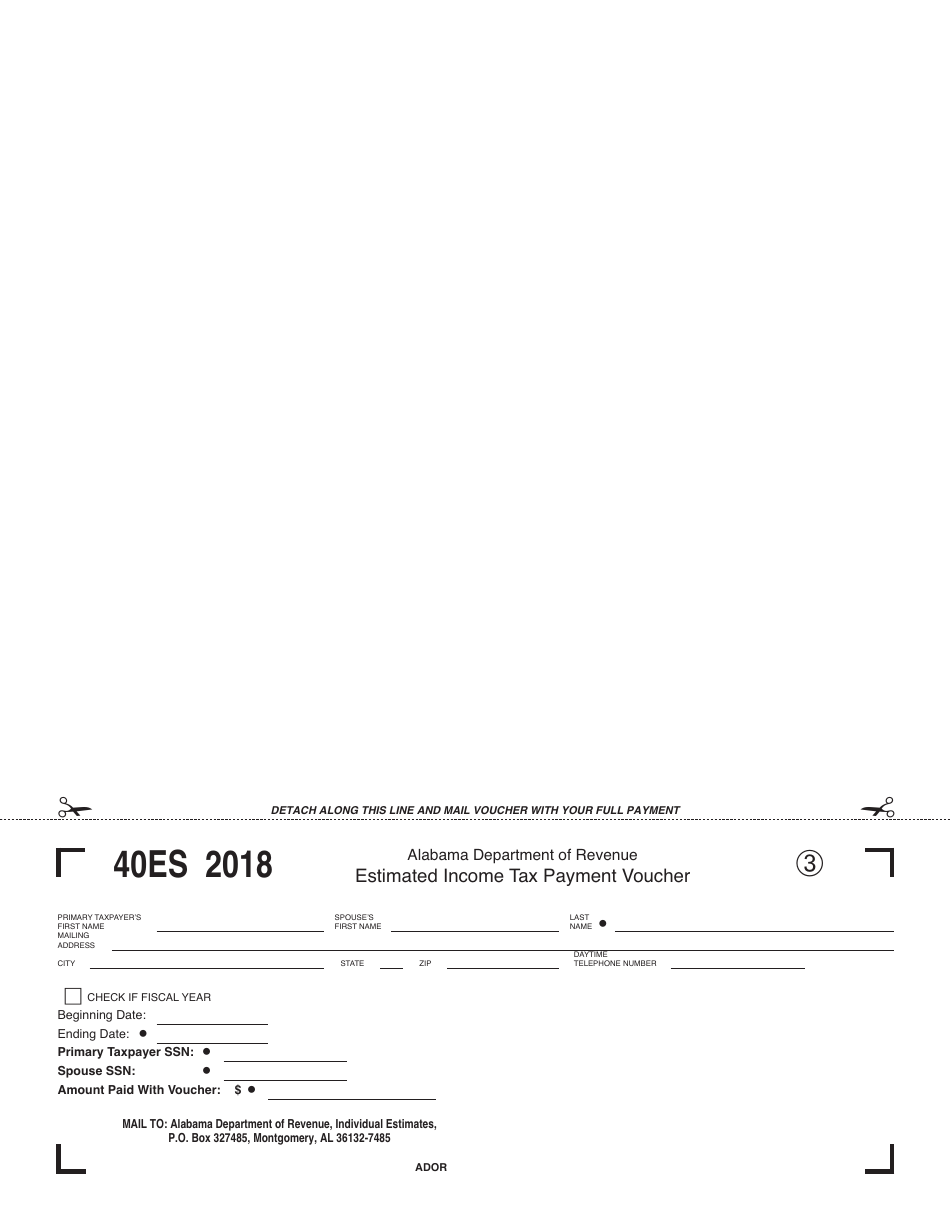

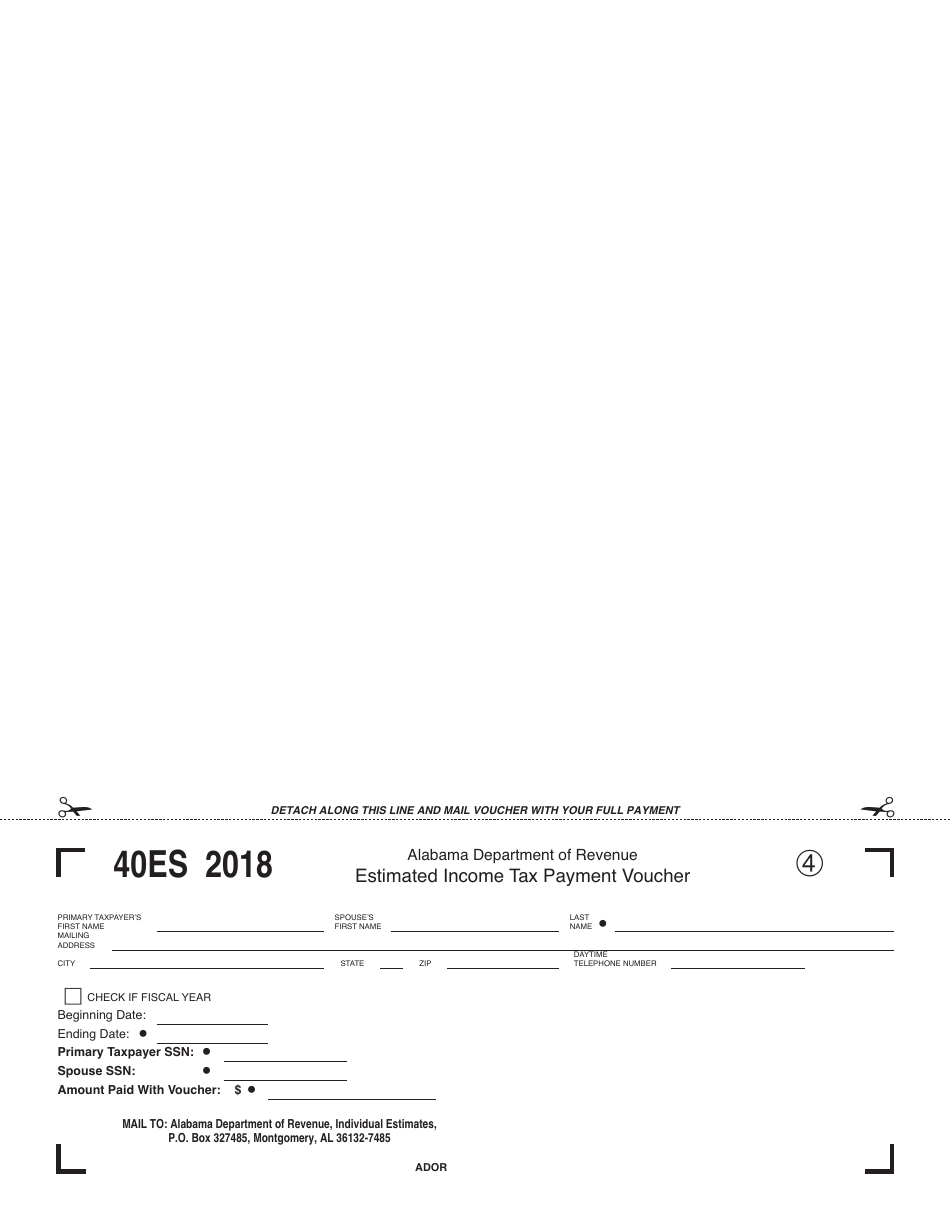

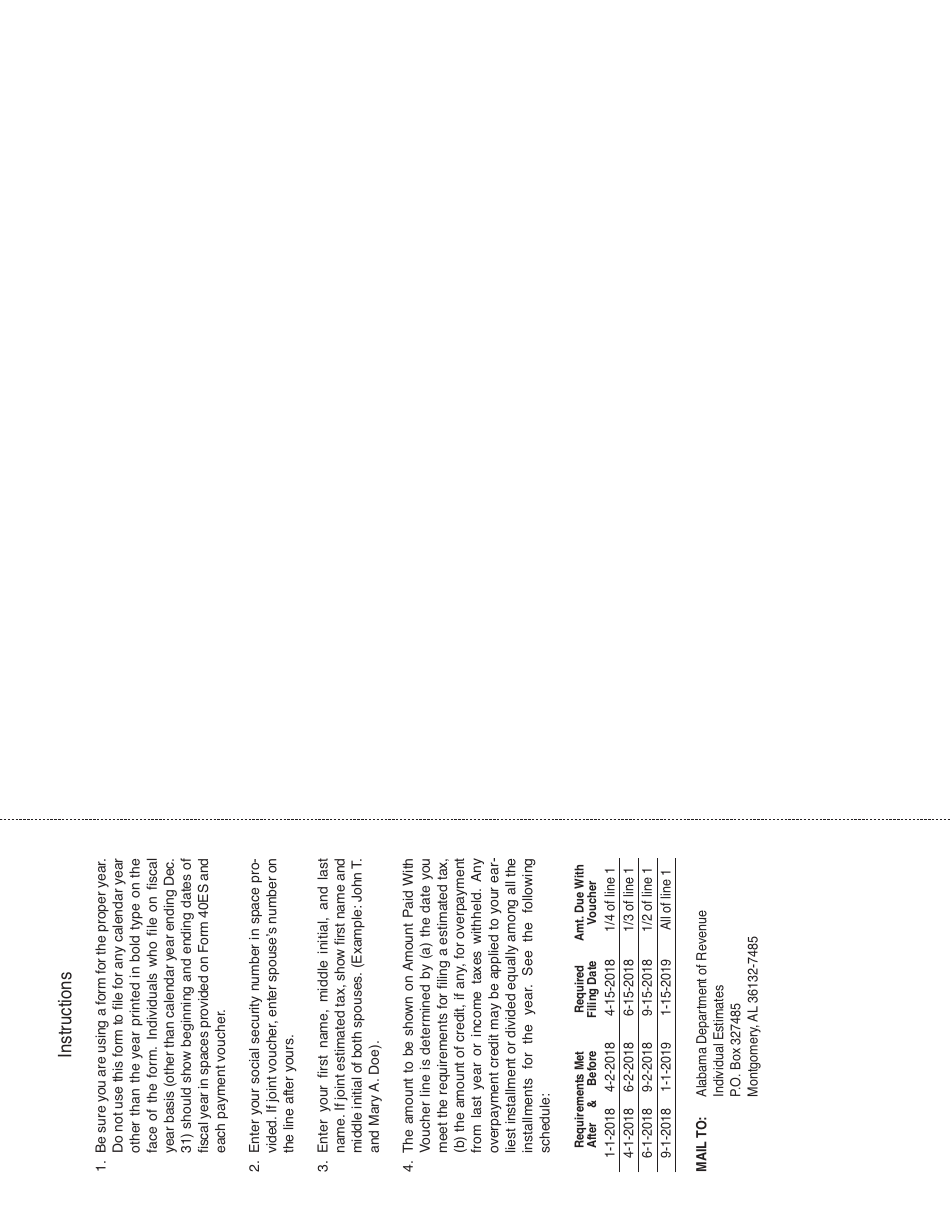

Q: What information is required on Form 40ES?

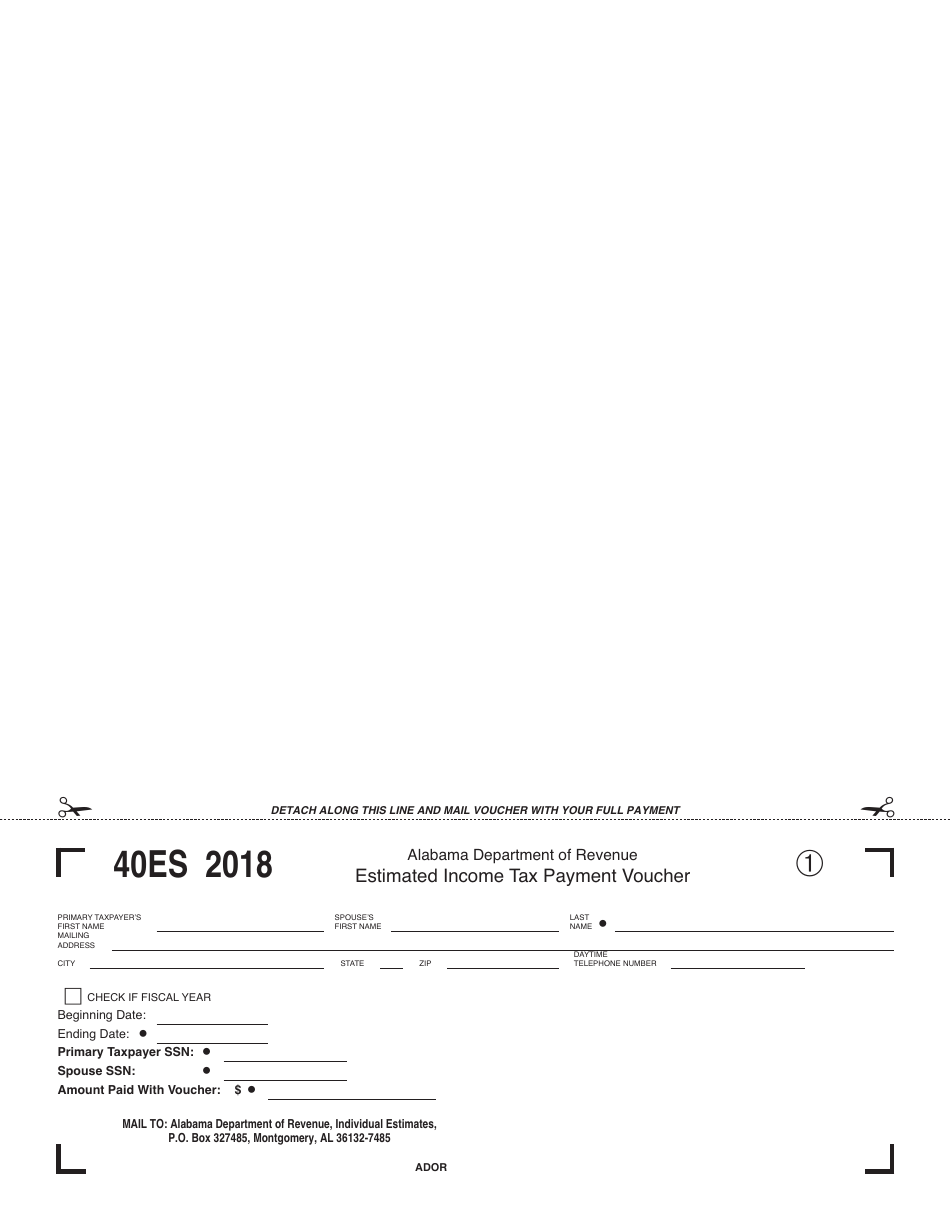

A: Form 40ES requires basic information such as name, address, social security number, and estimated tax liability.

Q: When is Form 40ES due?

A: Form 40ES payments are due quarterly on April 15, June 15, September 15, and January 15 of the following year.

Q: What happens if I don't file Form 40ES?

A: Failing to file Form 40ES or underpaying estimated taxes may result in penalties and interest.

Q: Can I change my estimated tax payments?

A: Yes, you can adjust your estimated tax payments by filing a new Form 40ES with updated information.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 40ES by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.