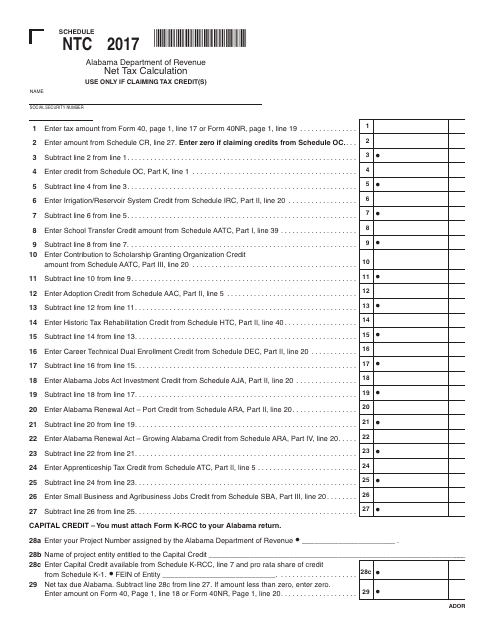

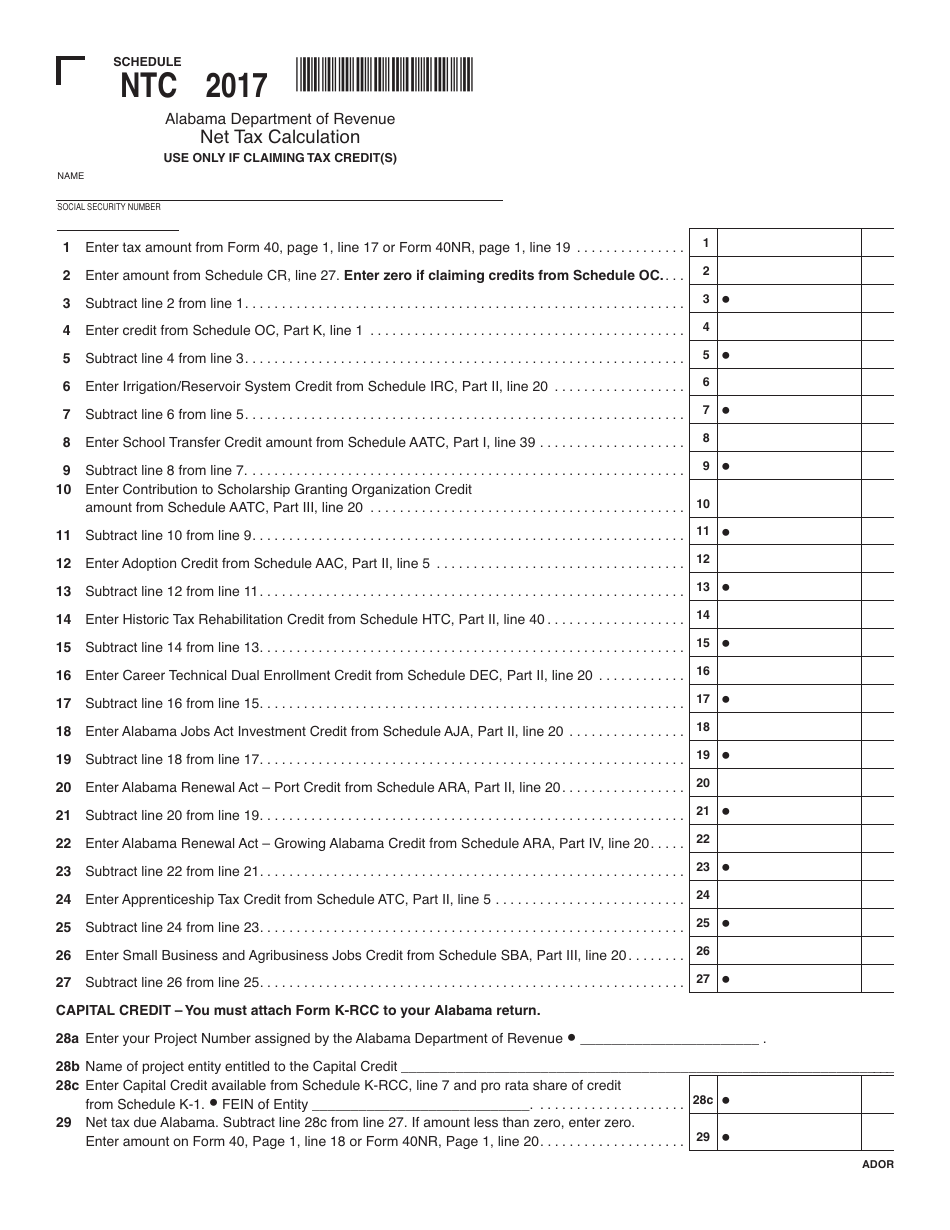

Schedule NTC Net Tax Calculation - Alabama

What Is Schedule NTC?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule NTC Net Tax Calculation in Alabama?

A: Schedule NTC Net Tax Calculation in Alabama is a form used to calculate the net tax liability of a taxpayer.

Q: Who needs to complete Schedule NTC in Alabama?

A: Individuals or businesses that are required to file an Alabama tax return may need to complete Schedule NTC.

Q: How do I complete Schedule NTC in Alabama?

A: You will need to follow the instructions provided on the form and enter the relevant information to calculate your net tax liability.

Q: Are there any tips or guidelines for completing Schedule NTC?

A: It is recommended to carefully review the instructions provided with the form and seek professional assistance if needed to ensure accurate completion of Schedule NTC.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule NTC by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.