This version of the form is not currently in use and is provided for reference only. Download this version of

Form ET-1 Schedule EC

for the current year.

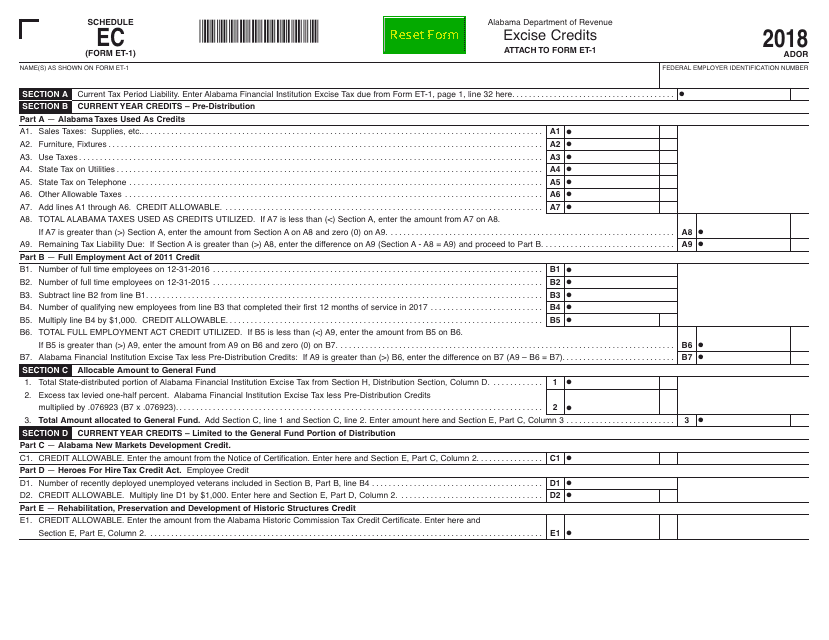

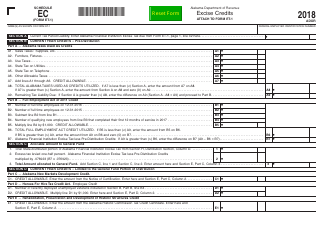

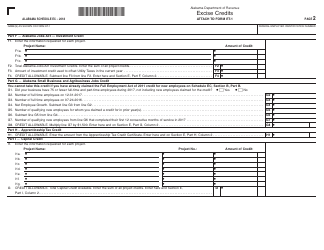

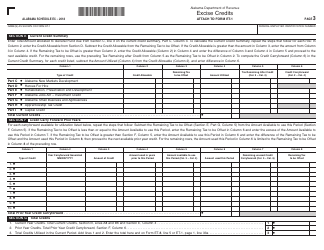

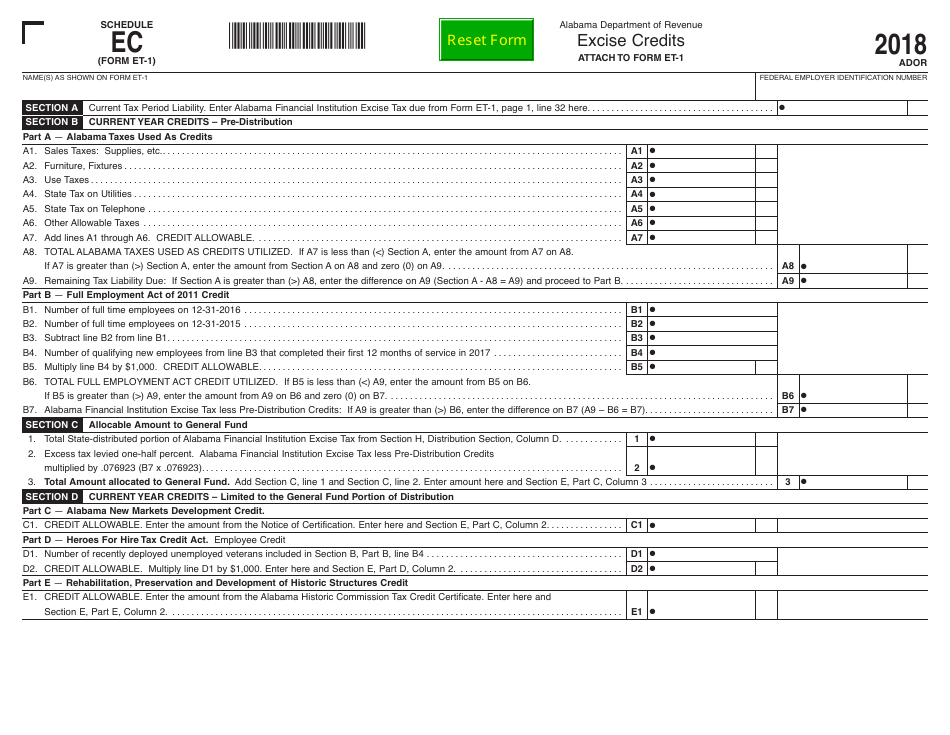

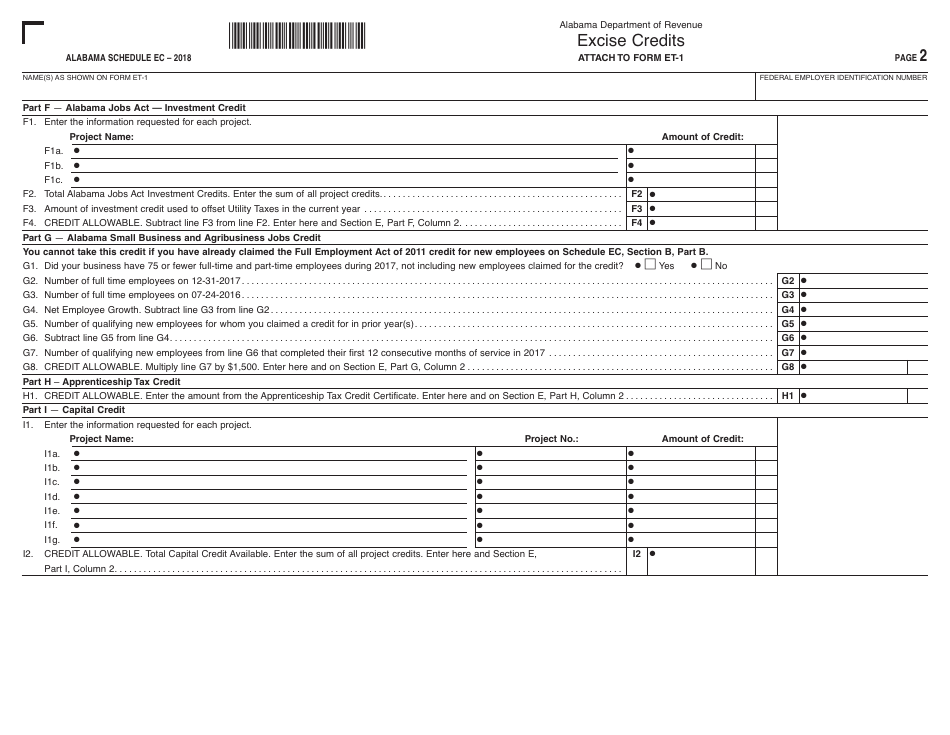

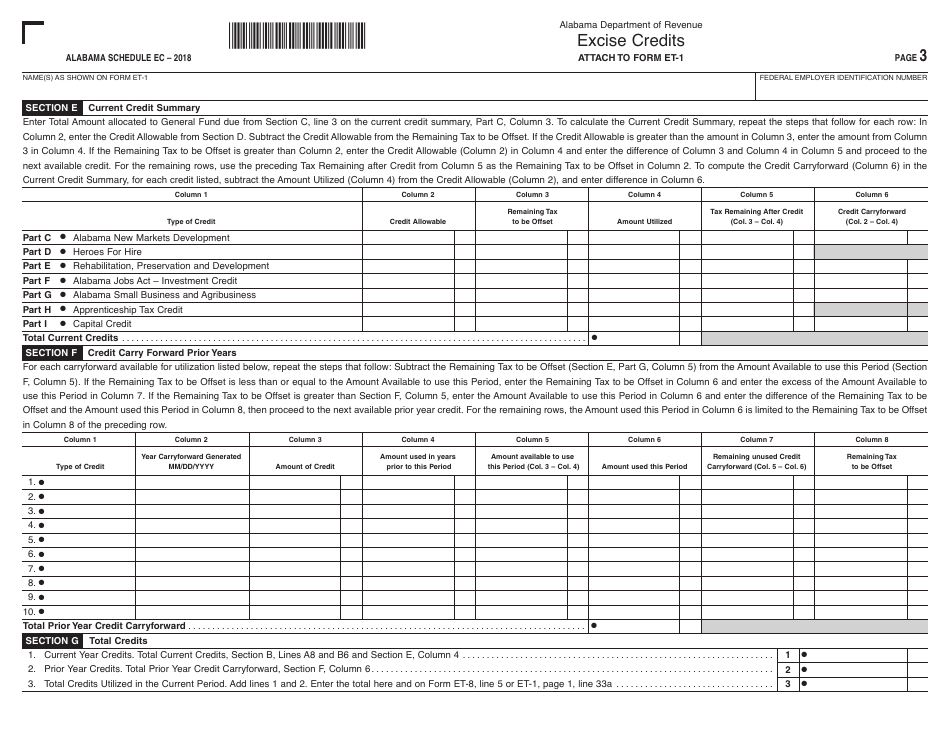

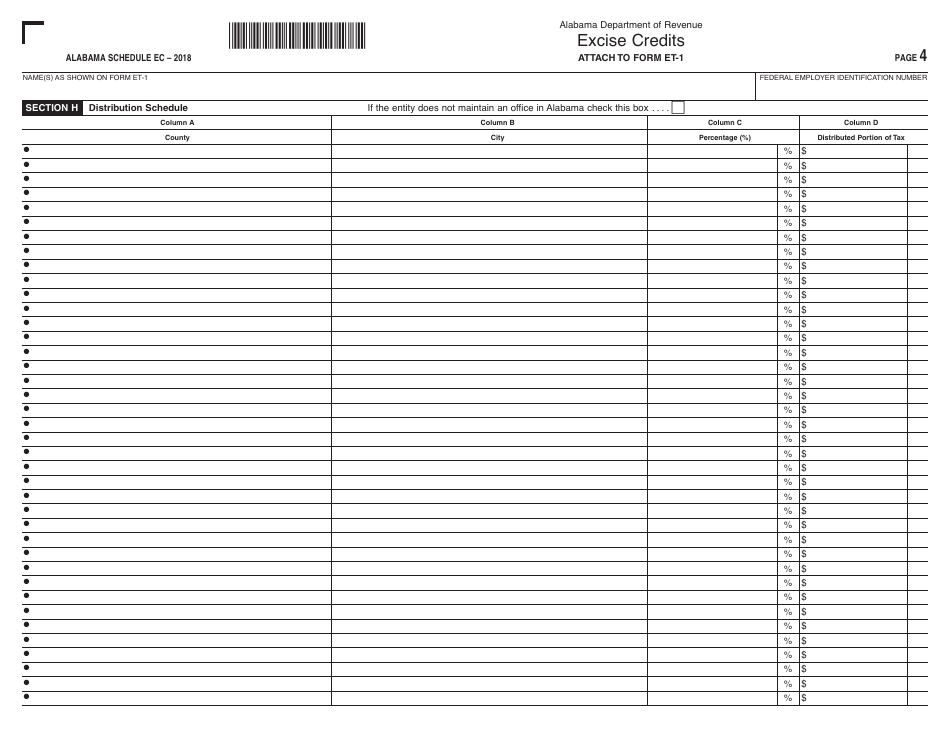

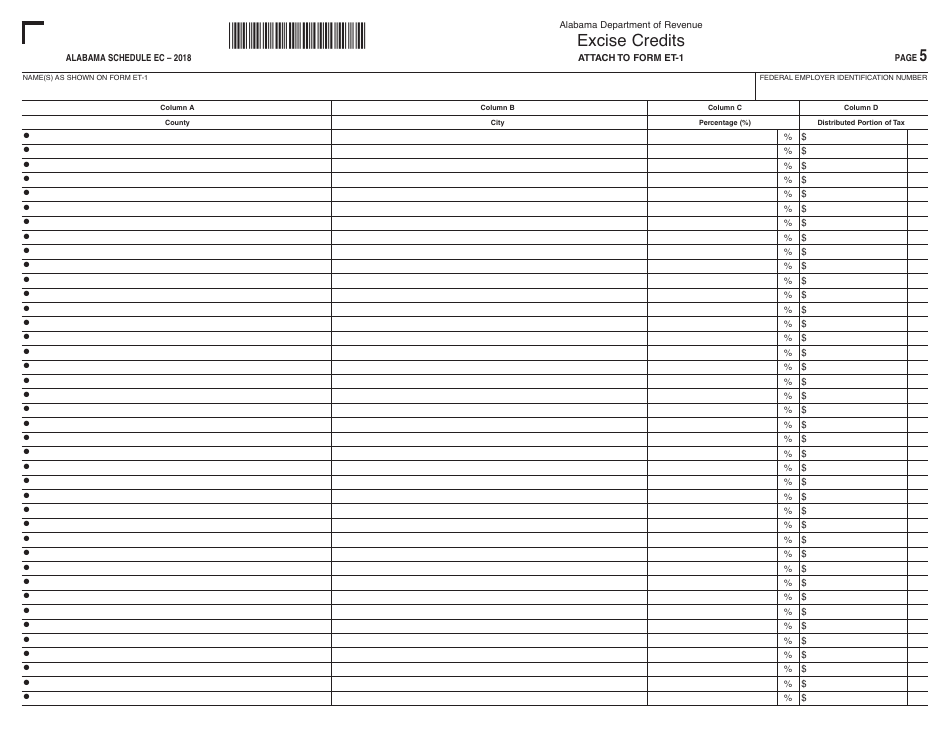

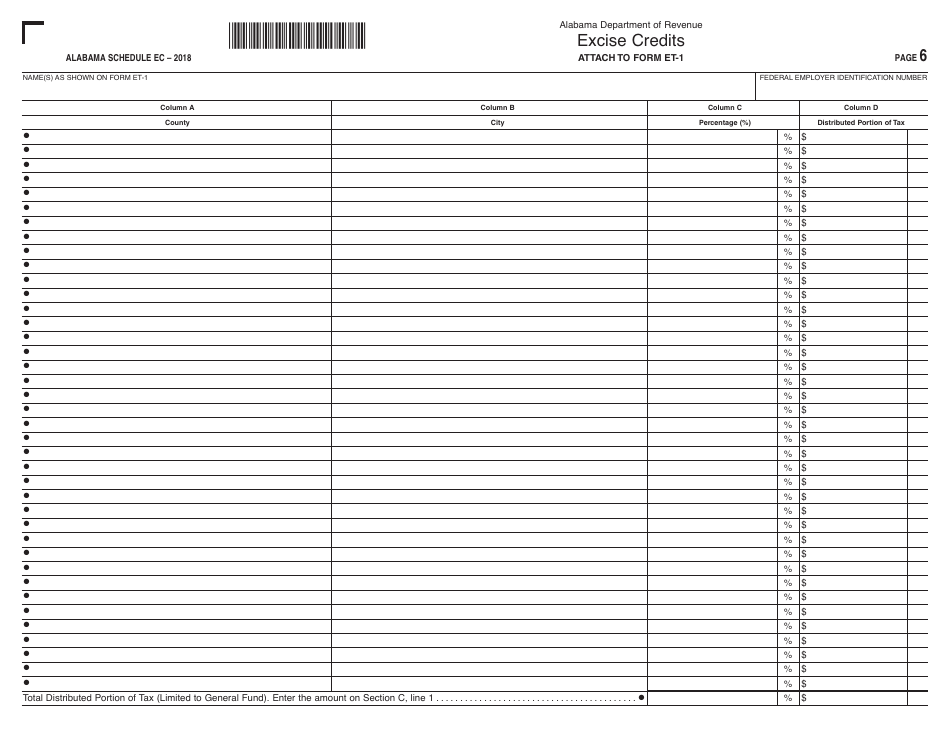

Form ET-1 Schedule EC Excise Credits - Alabama

What Is Form ET-1 Schedule EC?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama.The document is a supplement to Form ET-1, Financial Institution Excise Tax Return. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form ET-1 Schedule EC?

A: Form ET-1 Schedule EC is a schedule that is attached to Form ET-1, which is the Alabama Excise Tax Return. It is used to report excise tax credits.

Q: What are excise tax credits?

A: Excise tax credits are deductions or reductions in the amount of excise tax owed. They are typically granted for specific activities or industries.

Q: Who needs to file Form ET-1 Schedule EC?

A: Anyone who is required to file Form ET-1 and is eligible for any excise tax credits in Alabama needs to file Schedule EC.

Q: How do I complete Form ET-1 Schedule EC?

A: You will need to enter information about the excise tax credits you qualify for, including the type of credit, amount, and any supporting documentation required.

Q: Are there any deadlines for filing Form ET-1 Schedule EC?

A: Yes, the deadlines for filing Form ET-1 and Schedule EC are the same as the deadlines for filing the Alabama Excise Tax Return.

Q: What happens if I don't file Form ET-1 Schedule EC?

A: If you are eligible for excise tax credits and do not file Schedule EC, you may not receive the credits you are entitled to.

Q: Can I claim multiple excise tax credits on Form ET-1 Schedule EC?

A: Yes, you can claim multiple excise tax credits on Schedule EC as long as you meet the requirements for each credit.

Q: Can I amend Form ET-1 Schedule EC after filing?

A: If you need to make changes to Schedule EC after filing, you will need to file an amended Form ET-1 Schedule EC.

Q: Can I file Form ET-1 Schedule EC electronically?

A: Yes, Alabama allows electronic filing of Form ET-1 and Schedule EC.

Q: Is there a fee for filing Form ET-1 Schedule EC?

A: There is no fee for filing Form ET-1 or Schedule EC.

Q: Can I get help with completing Form ET-1 Schedule EC?

A: Yes, the Alabama Department of Revenue provides assistance and resources to help taxpayers complete Form ET-1 and Schedule EC.

Q: What should I do if I have additional questions about Form ET-1 Schedule EC?

A: If you have additional questions or need further clarification, you should contact the Alabama Department of Revenue directly.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET-1 Schedule EC by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.