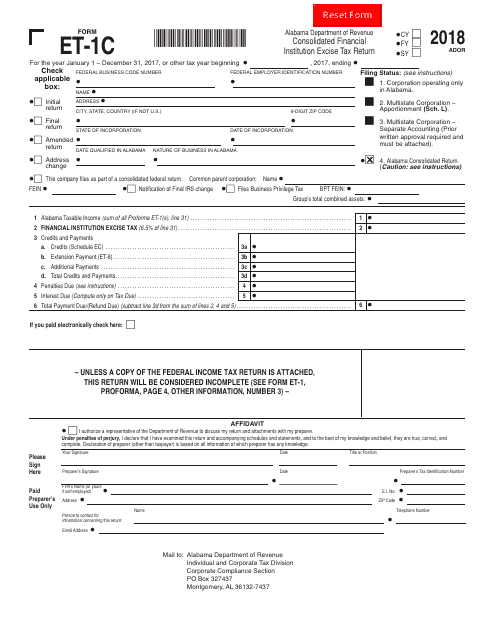

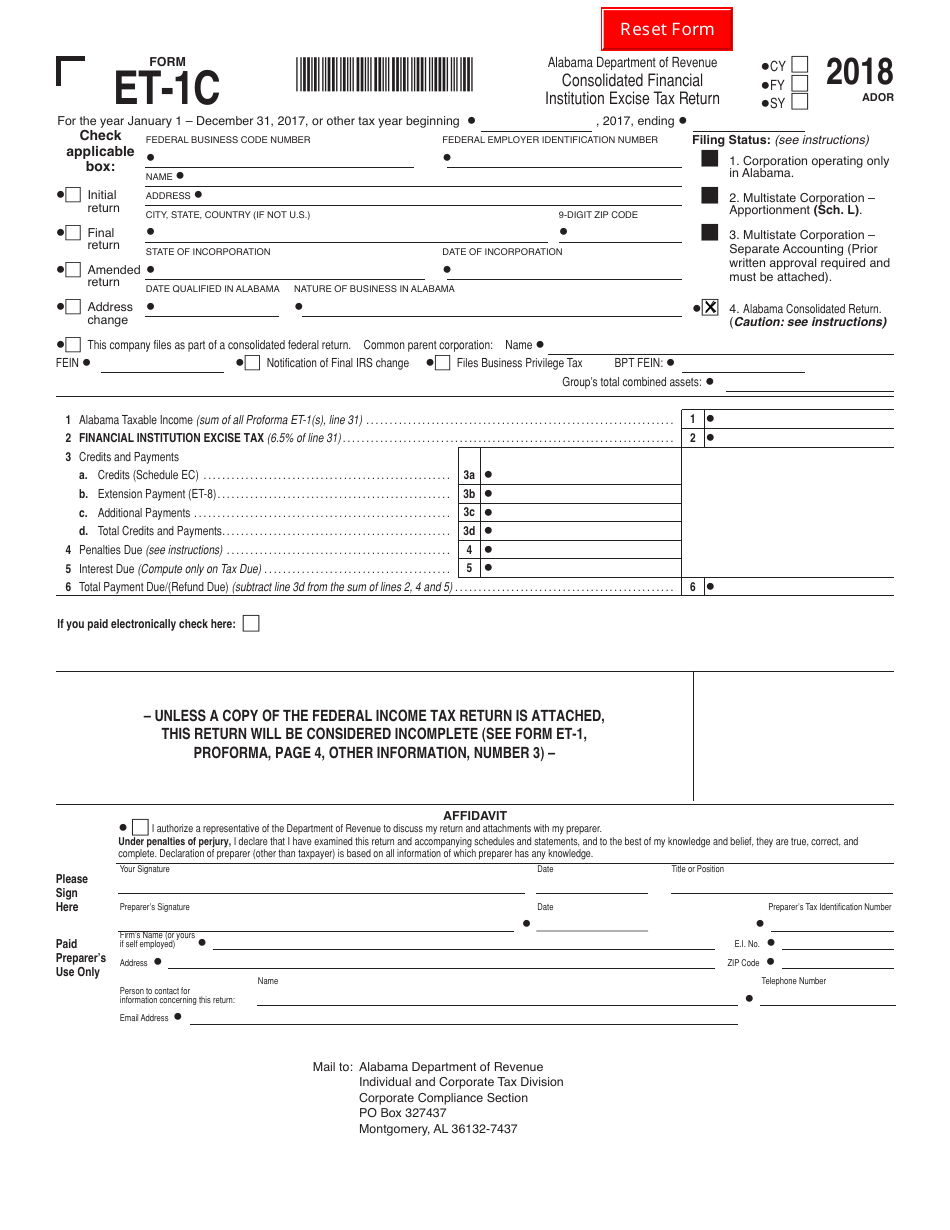

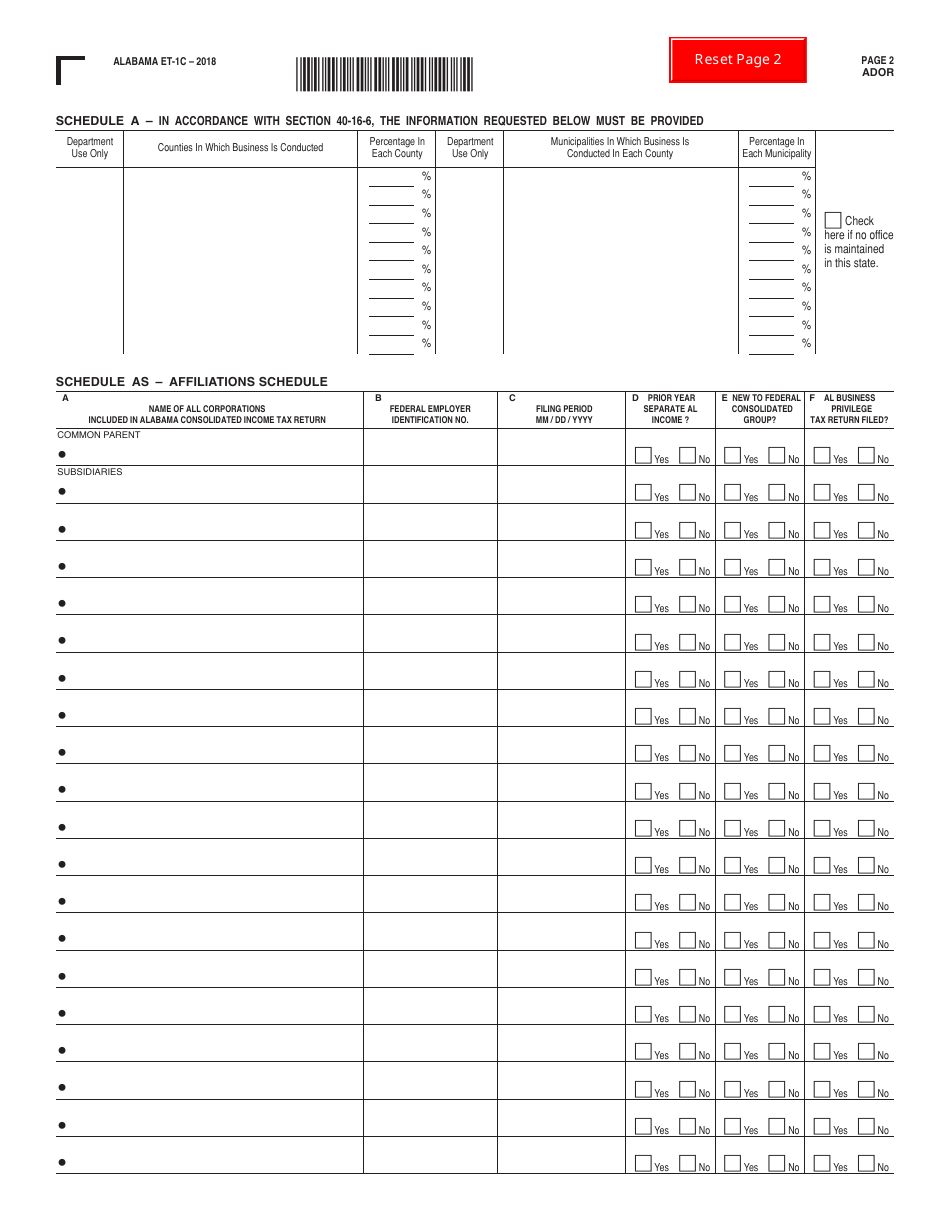

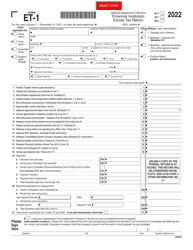

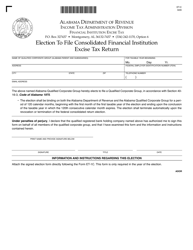

Form ET-1C Consolidated Financial Institution Excise Tax Return - Alabama

What Is Form ET-1C?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET-1C?

A: Form ET-1C is the Consolidated Financial Institution Excise Tax Return in Alabama.

Q: Who needs to file Form ET-1C?

A: Financial institutions in Alabama need to file Form ET-1C.

Q: What is the purpose of Form ET-1C?

A: The purpose of Form ET-1C is to report and pay the excise tax on the income of financial institutions in Alabama.

Q: When is Form ET-1C due?

A: Form ET-1C is due on or before the 15th day of the 4th month following the close of the tax year.

Q: Are there any penalties for late filing of Form ET-1C?

A: Yes, there are penalties for late filing of Form ET-1C. It is recommended to file the return and pay the tax on time to avoid penalties and interest.

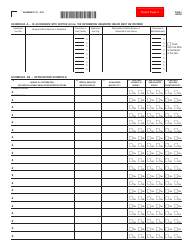

Q: What information is required to complete Form ET-1C?

A: To complete Form ET-1C, you will need to provide information about your financial institution's income, deductions, and tax liability.

Q: What should I do if I have questions about Form ET-1C?

A: If you have questions about Form ET-1C, you can contact the Alabama Department of Revenue's Taxpayer Service Center for assistance.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET-1C by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.