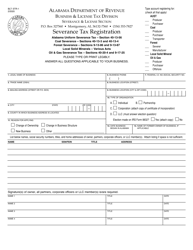

This version of the form is not currently in use and is provided for reference only. Download this version of

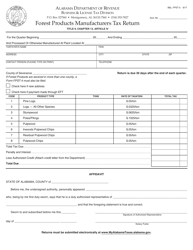

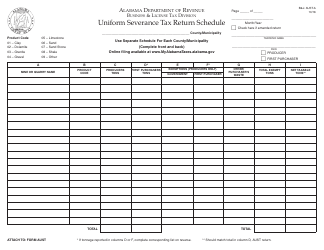

Form B&L: FPST-1

for the current year.

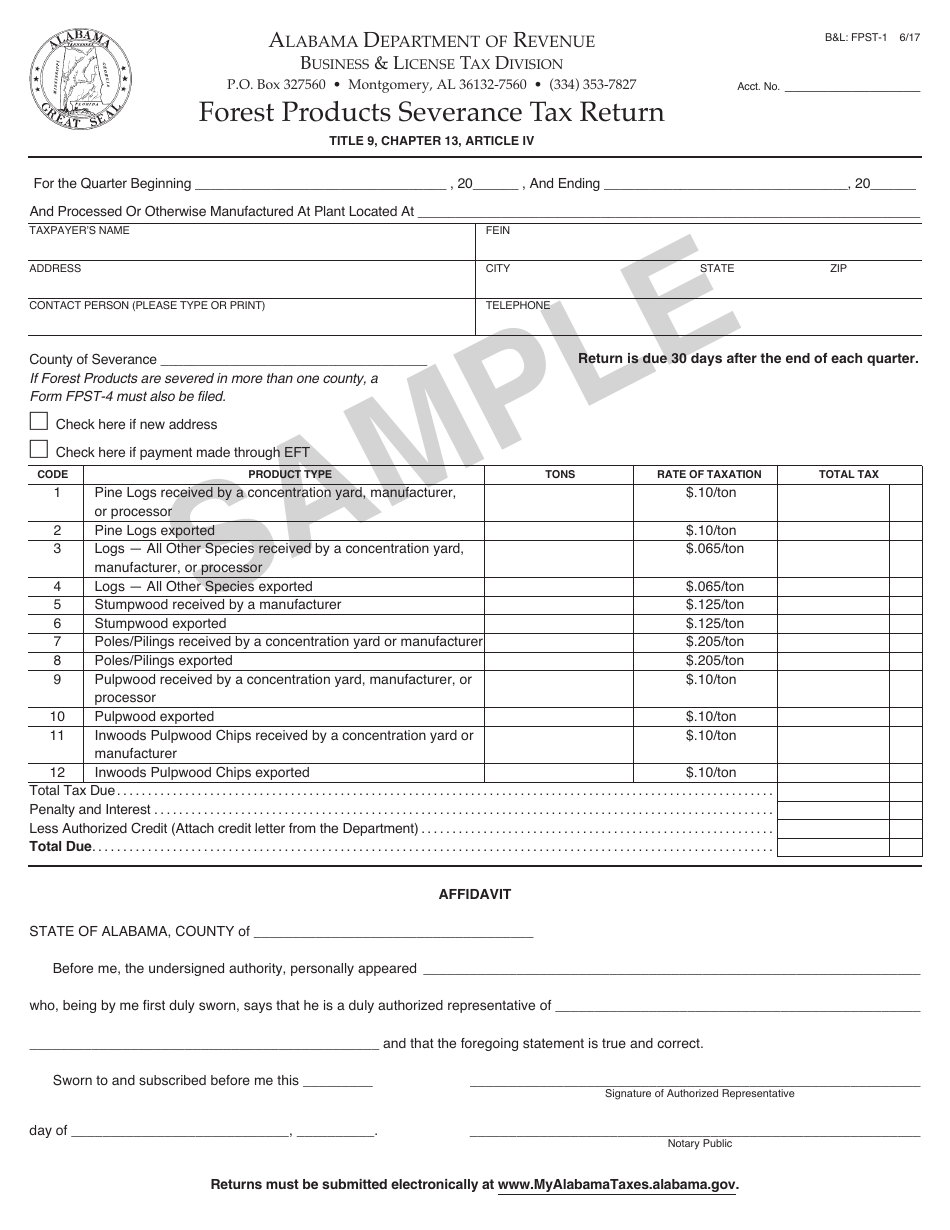

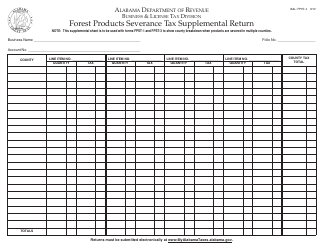

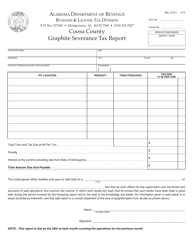

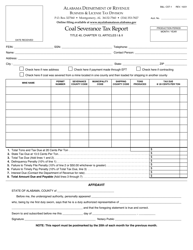

Form B&L: FPST-1 Forest Products Severance Tax Return - Sample - Alabama

What Is Form B&L: FPST-1?

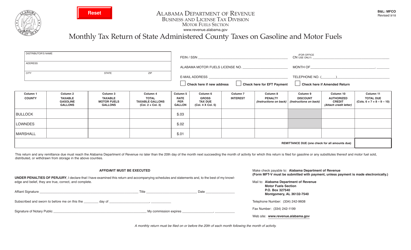

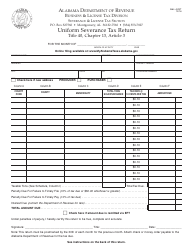

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B&L: FPST-1?

A: Form B&L: FPST-1 is the Forest ProductsSeverance Tax Return.

Q: What is the purpose of Form B&L: FPST-1?

A: The purpose of Form B&L: FPST-1 is to report and remit severance taxes on forest products in Alabama.

Q: Who needs to file Form B&L: FPST-1?

A: Any person or business engaged in the severance of forest products in Alabama needs to file Form B&L: FPST-1.

Q: What are considered forest products?

A: Forest products include timber, logs, pulpwood, and other similar products obtained from forests.

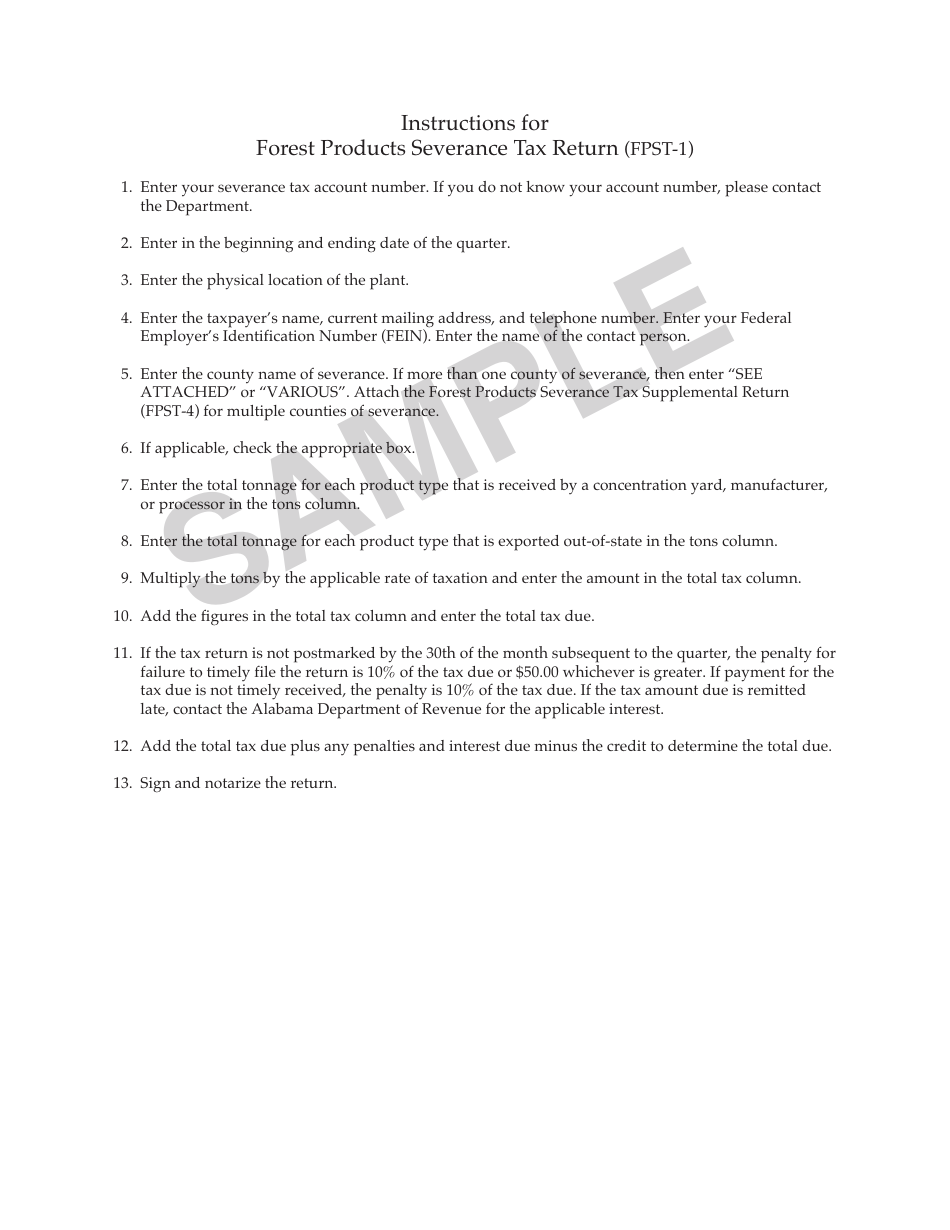

Q: When is Form B&L: FPST-1 due?

A: Form B&L: FPST-1 is due on or before the 20th day of the month following the end of the calendar quarter in which the severance occurred.

Q: Are there any penalties for late or incorrect filing of Form B&L: FPST-1?

A: Yes, there are penalties for late or incorrect filing of Form B&L: FPST-1, including interest on unpaid taxes and potential additional penalties.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B&L: FPST-1 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.