This version of the form is not currently in use and is provided for reference only. Download this version of

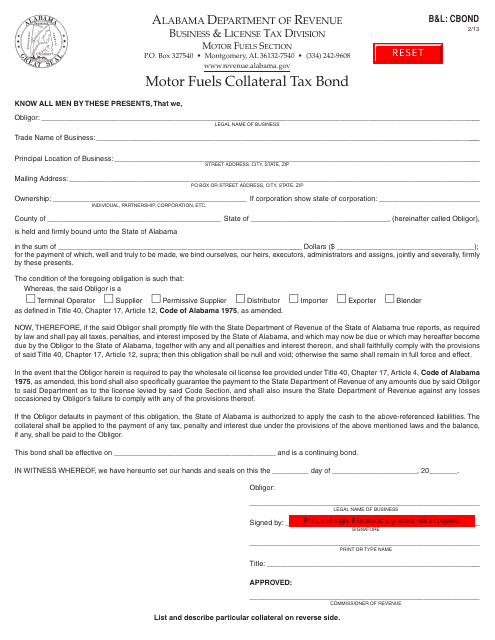

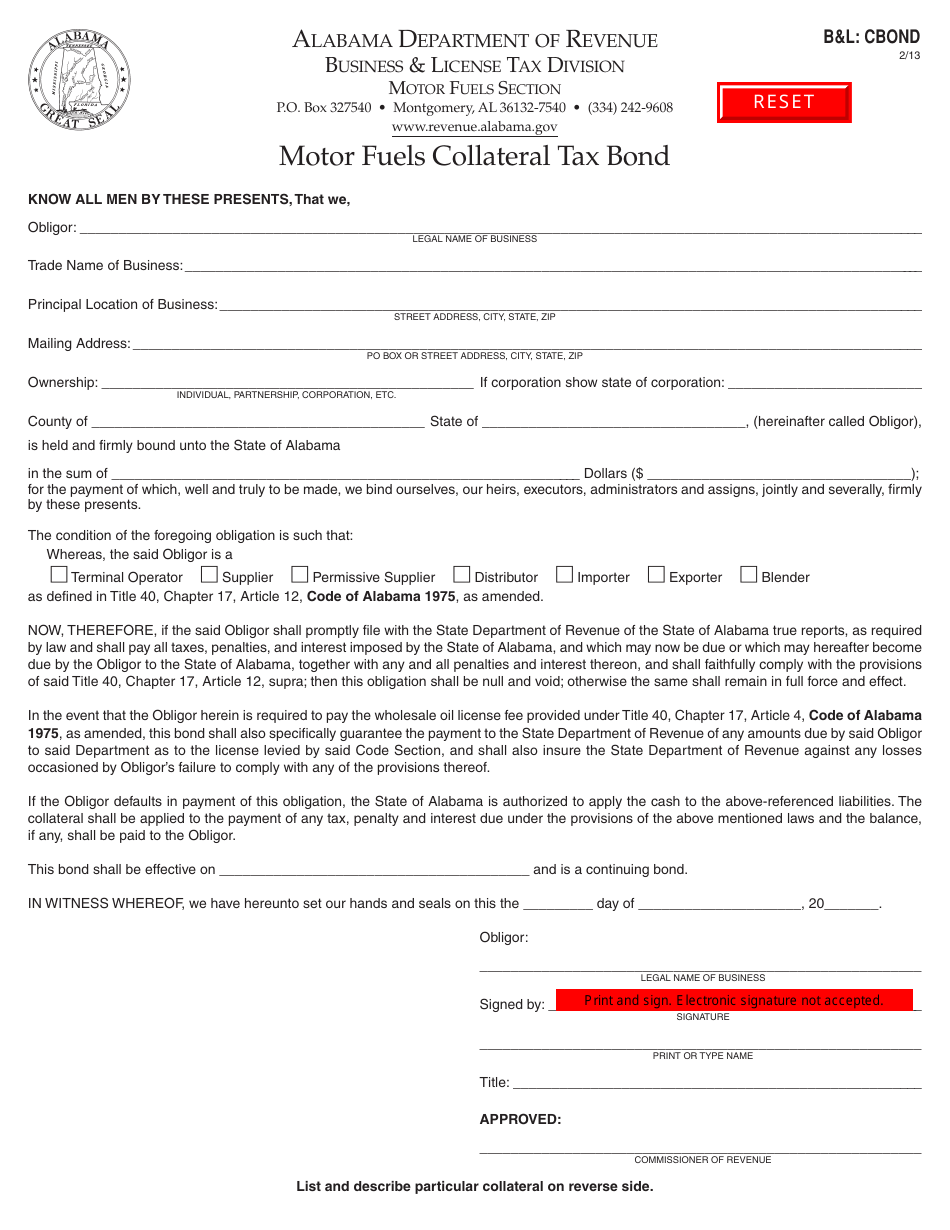

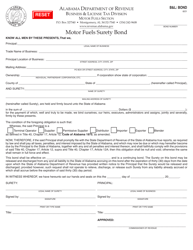

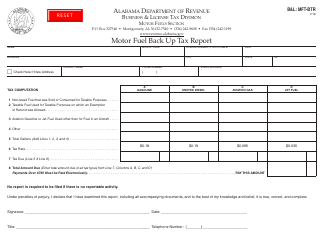

Form B&L: CBOND

for the current year.

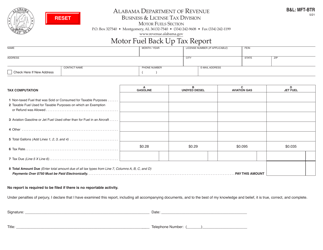

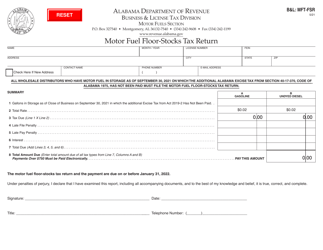

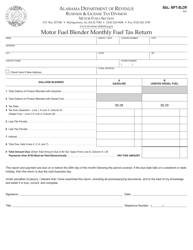

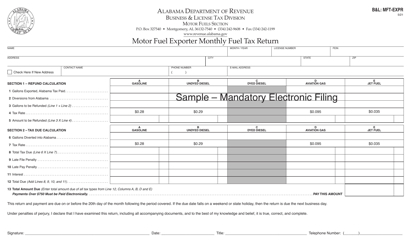

Form B&L: CBOND Motor Fuels Collateral Tax Bond - Alabama

What Is Form B&L: CBOND?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CBOND Motor Fuels Collateral Tax Bond?

A: A CBOND Motor Fuels Collateral Tax Bond is a type of surety bond that is required by the State of Alabama for motor fuel distributors and suppliers to ensure payment of motor fuel taxes.

Q: Who needs a CBOND Motor Fuels Collateral Tax Bond?

A: Motor fuel distributors and suppliers in Alabama need a CBOND Motor Fuels Collateral Tax Bond.

Q: Why is a CBOND Motor Fuels Collateral Tax Bond required?

A: The CBOND Motor Fuels Collateral Tax Bond is required to protect the state's interest and ensure that motor fuel taxes are paid in a timely manner.

Q: How much does a CBOND Motor Fuels Collateral Tax Bond cost?

A: The cost of a CBOND Motor Fuels Collateral Tax Bond can vary depending on factors such as the bond amount and the applicant's creditworthiness.

Q: How long does a CBOND Motor Fuels Collateral Tax Bond stay in effect?

A: The CBOND Motor Fuels Collateral Tax Bond remains in effect as long as the motor fuel distributor or supplier remains in compliance with the bond requirements.

Q: What happens if a motor fuel distributor or supplier fails to pay their motor fuel taxes?

A: If a motor fuel distributor or supplier fails to pay their motor fuel taxes, the CBOND Motor Fuels Collateral Tax Bond can be used to compensate the state for the unpaid taxes.

Q: Can the CBOND Motor Fuels Collateral Tax Bond be canceled?

A: The CBOND Motor Fuels Collateral Tax Bond can be canceled by the surety bond company or by the motor fuel distributor or supplier with proper notice to the state.

Q: Is collateral required for a CBOND Motor Fuels Collateral Tax Bond?

A: Yes, collateral is required for a CBOND Motor Fuels Collateral Tax Bond. The collateral amount is determined by the state and can vary depending on factors such as the bond amount and the applicant's creditworthiness.

Q: What other requirements are there for motor fuel distributors and suppliers in Alabama?

A: Motor fuel distributors and suppliers in Alabama are also required to obtain a license and maintain records of their motor fuel transactions.

Form Details:

- Released on February 1, 2013;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: CBOND by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.