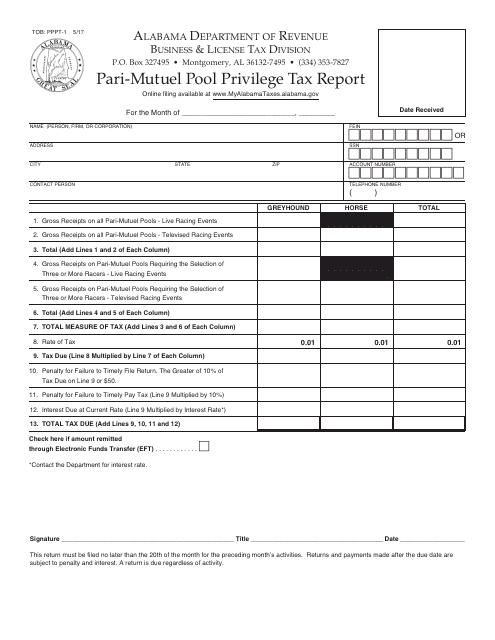

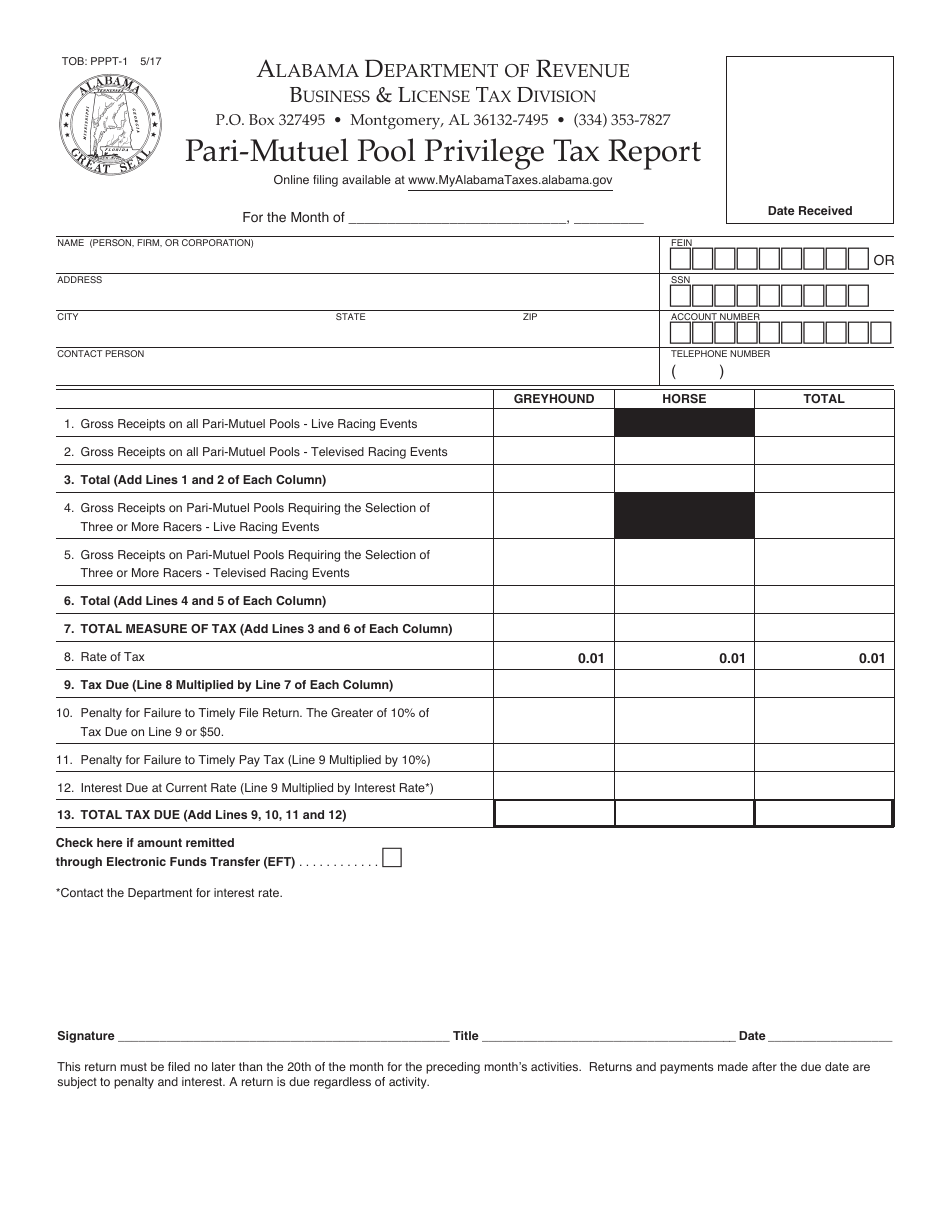

Form TOB: PPPT-1 Pari-Mutuel Pool Privilege Tax Report - Alabama

What Is Form TOB: PPPT-1?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PPPT-1 Pari-Mutuel Pool Privilege Tax Report?

A: The PPPT-1 Pari-Mutuel Pool Privilege Tax Report is a tax report required in Alabama for reporting and remitting taxes on pari-mutuel pool wagers.

Q: Who is required to file the PPPT-1 Pari-Mutuel Pool Privilege Tax Report?

A: Any person or organization operating a pari-mutuel pool in Alabama is required to file the PPPT-1 Pari-Mutuel Pool Privilege Tax Report.

Q: What is a pari-mutuel pool?

A: A pari-mutuel pool is a type of betting system where all bets are placed in a pool and the payoff odds are determined by the total amount wagered on each horse or contestant.

Q: What is the purpose of the PPPT-1 Pari-Mutuel Pool Privilege Tax?

A: The purpose of the PPPT-1 Pari-Mutuel Pool Privilege Tax is to generate revenue for the state of Alabama by taxing the operation of pari-mutuel pools.

Q: When is the PPPT-1 Pari-Mutuel Pool Privilege Tax Report due?

A: The PPPT-1 Pari-Mutuel Pool Privilege Tax Report is due on or before the 15th day of the month following the month in which the pool operated.

Q: Are there any penalties for late or non-filing of the PPPT-1 Pari-Mutuel Pool Privilege Tax Report?

A: Yes, there are penalties for late or non-filing of the PPPT-1 Pari-Mutuel Pool Privilege Tax Report, including fines and potential loss of license to operate a pari-mutuel pool.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TOB: PPPT-1 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.