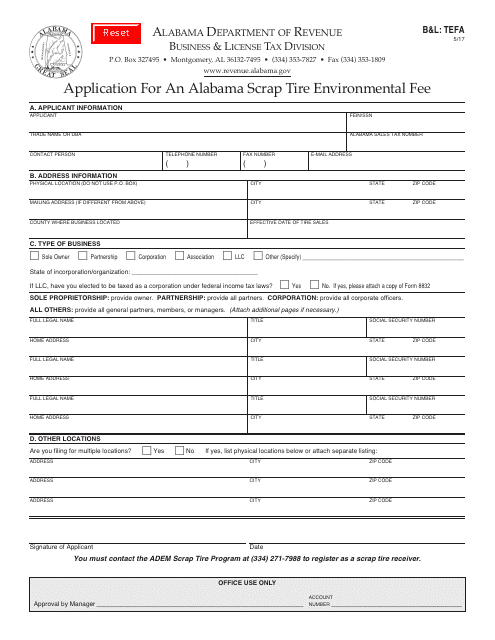

Form B&L:TEFA Application for an Alabama Scrap Tire Environmental Fee - Alabama

What Is Form B&L:TEFA?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the B&L:TEFA Application?

A: The B&L:TEFA Application is a form used to apply for the Alabama Scrap Tire Environmental Fee.

Q: What is the Alabama Scrap Tire Environmental Fee?

A: The Alabama Scrap Tire Environmental Fee is a fee imposed on the sale of new tires in Alabama to support the proper management and disposal of scrap tires.

Q: Who is required to file the B&L:TEFA Application?

A: Any person or entity engaged in the sale of new tires in Alabama is required to file the B&L:TEFA Application.

Q: What information is required in the B&L:TEFA Application?

A: The B&L:TEFA Application requires information such as the name and address of the tire facility, the number of tires sold, and the amount of fees collected.

Q: How often should the B&L:TEFA Application be filed?

A: The B&L:TEFA Application should be filed on a quarterly basis, covering the preceding calendar quarter.

Q: Are there any penalties for not filing the B&L:TEFA Application?

A: Yes, failure to file the B&L:TEFA Application or paying the required fees can result in penalties and enforcement actions.

Q: Is there a deadline for filing the B&L:TEFA Application?

A: Yes, the B&L:TEFA Application must be filed within 30 days after the end of each calendar quarter.

Q: What is the purpose of the Alabama Scrap Tire Environmental Fee?

A: The Alabama Scrap Tire Environmental Fee is used to fund programs and initiatives aimed at properly managing and disposing of scrap tires, preventing environmental hazards.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L:TEFA by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.