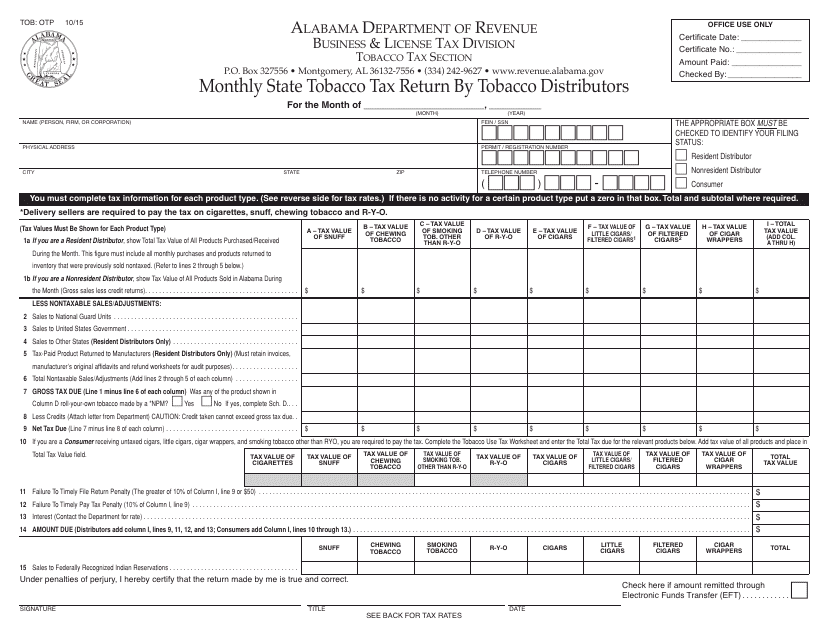

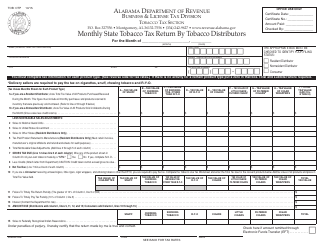

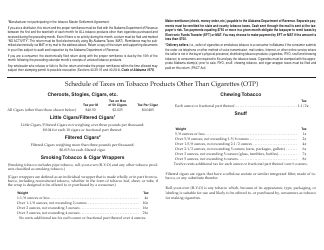

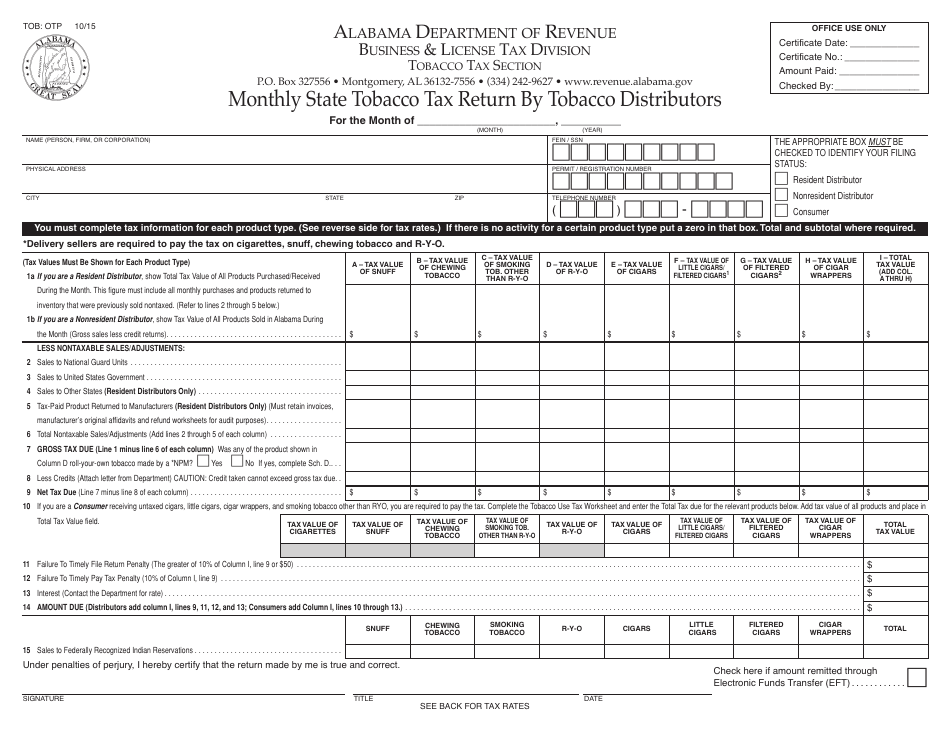

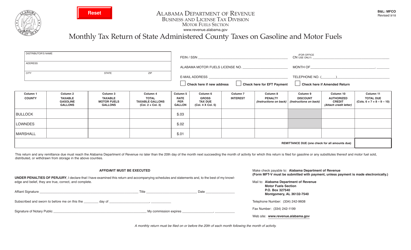

Form TOB: OTP Monthly State Tobacco Tax Return by Tobacco Distributors - Alabama

What Is Form TOB: OTP?

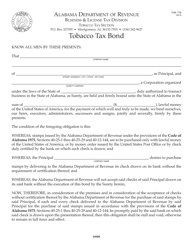

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form TOB?

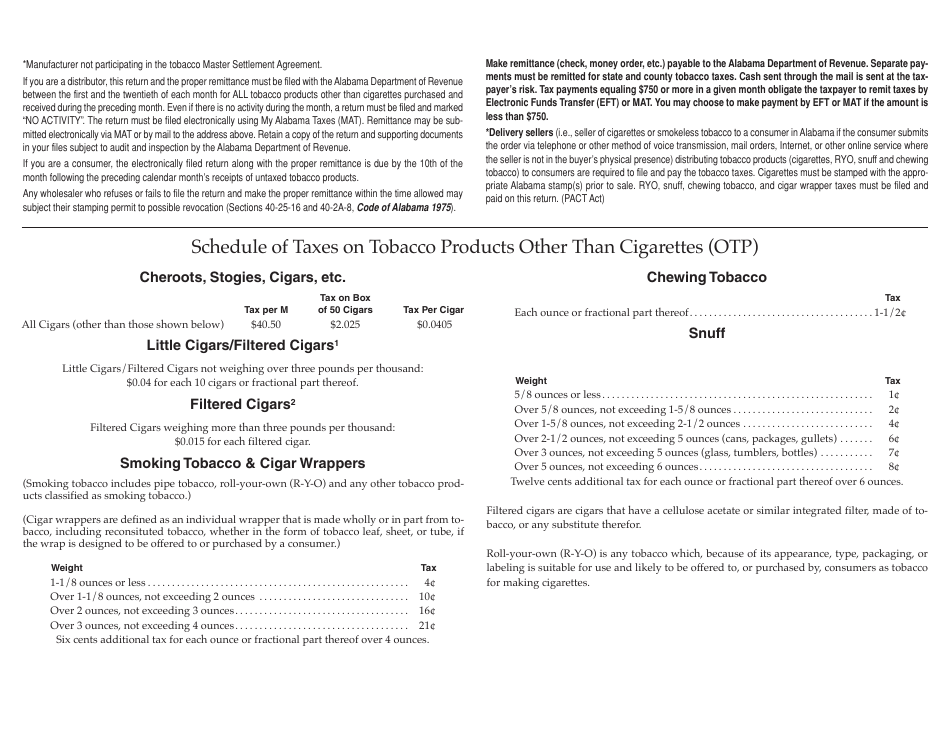

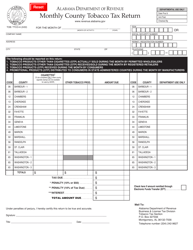

A: Form TOB is the OTP Monthly State Tobacco Tax Return by Tobacco Distributors in Alabama.

Q: Who should file the Form TOB?

A: Tobacco distributors in Alabama should file the Form TOB.

Q: What is the purpose of the Form TOB?

A: The Form TOB is used to report and pay the monthly state tobacco tax for tobacco distributors in Alabama.

Q: When is the Form TOB due?

A: The Form TOB is due on the 20th day of the month following the reporting period.

Q: What information is required on the Form TOB?

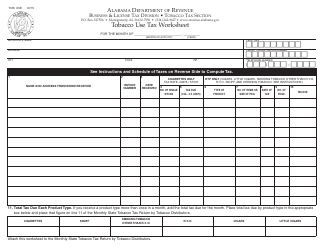

A: The Form TOB requires information such as the distributor's name, address, federal tax ID number, quantity and cost of tobacco products sold, and calculated tax liability.

Q: Are there any penalties for late or non-filing of the Form TOB?

A: Yes, penalties may be imposed for late or non-filing of the Form TOB, including interest charges and possible revocation of the distributor's license.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TOB: OTP by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.