This version of the form is not currently in use and is provided for reference only. Download this version of

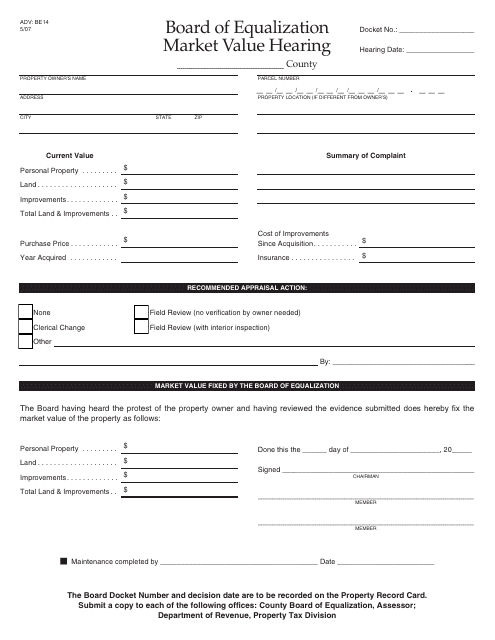

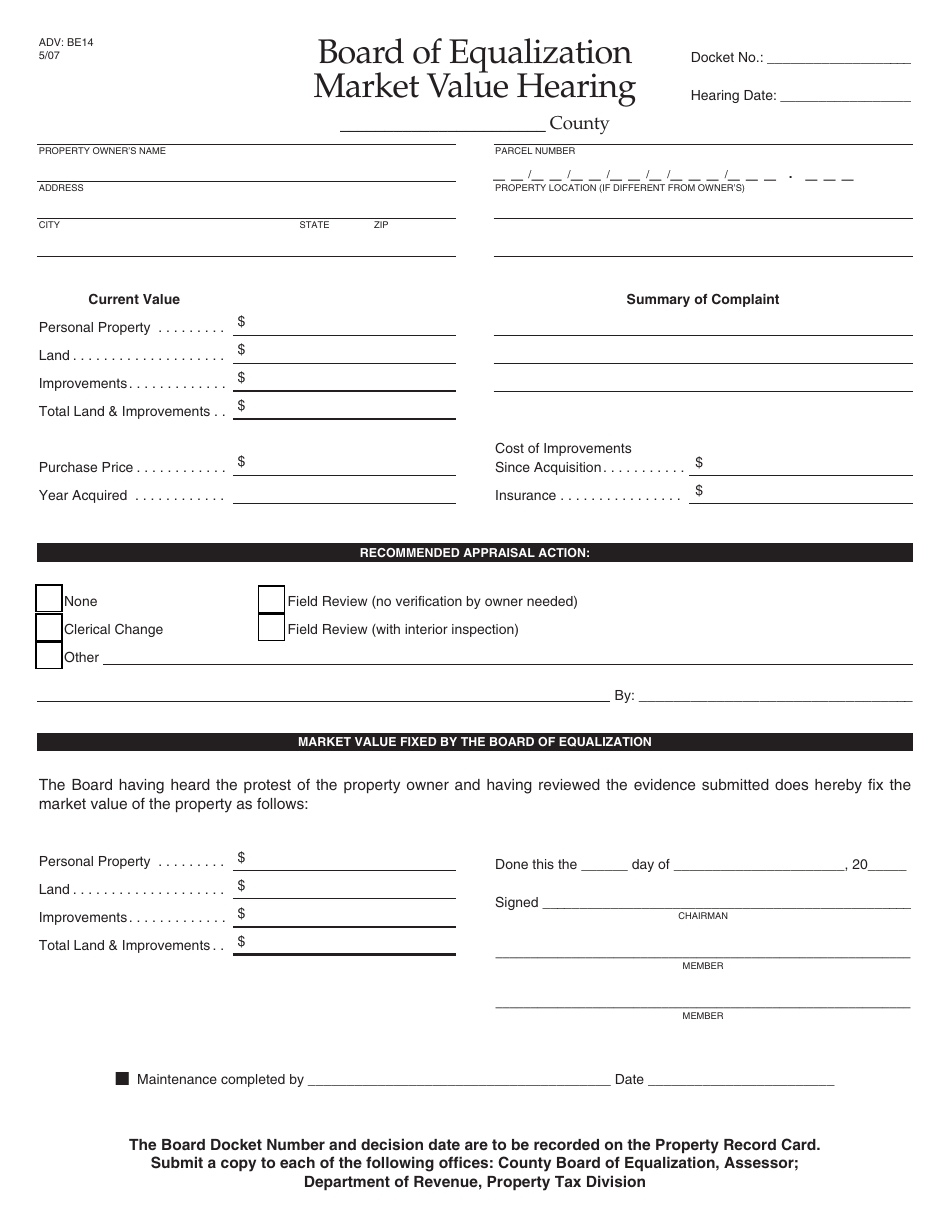

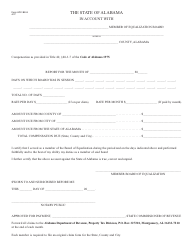

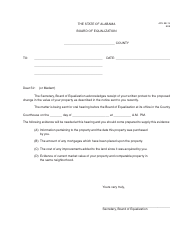

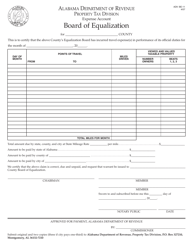

Form ADV: BE14

for the current year.

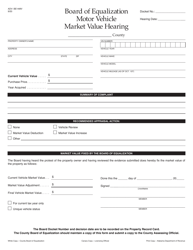

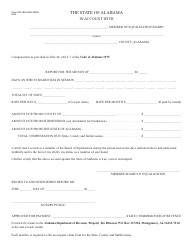

Form ADV: BE14 Board of Equalization Market Value Hearing - Alabama

What Is Form ADV: BE14?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADV BE14?

A: Form ADV BE14 is a form used by the Board of Equalization in Alabama for market value hearings.

Q: What is the Board of Equalization?

A: The Board of Equalization is a government body in Alabama responsible for reviewing and setting property values for tax purposes.

Q: What is a market value hearing?

A: A market value hearing is a process where property owners can appeal the assessed value of their property to the Board of Equalization.

Q: Who can request a market value hearing?

A: Property owners in Alabama can request a market value hearing if they believe their property's assessed value is incorrect.

Q: What is the purpose of a market value hearing?

A: The purpose of a market value hearing is to ensure that property values are assessed accurately for taxation purposes.

Q: How can I request a market value hearing?

A: To request a market value hearing, you need to complete and submit Form ADV BE14 to the Board of Equalization.

Q: What information is required on Form ADV BE14?

A: Form ADV BE14 requires you to provide details about your property, such as its location, description, and the reasons for disputing the assessed value.

Q: What happens after submitting Form ADV BE14?

A: After submitting Form ADV BE14, the Board of Equalization will review your request and schedule a market value hearing if necessary.

Q: Can I have representation at the market value hearing?

A: Yes, property owners can choose to have representation, such as an attorney or a property appraiser, at the market value hearing.

Q: What is the outcome of a market value hearing?

A: After the market value hearing, the Board of Equalization will make a decision to either adjust the assessed value of the property or uphold the original assessment.

Form Details:

- Released on May 1, 2007;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADV: BE14 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.