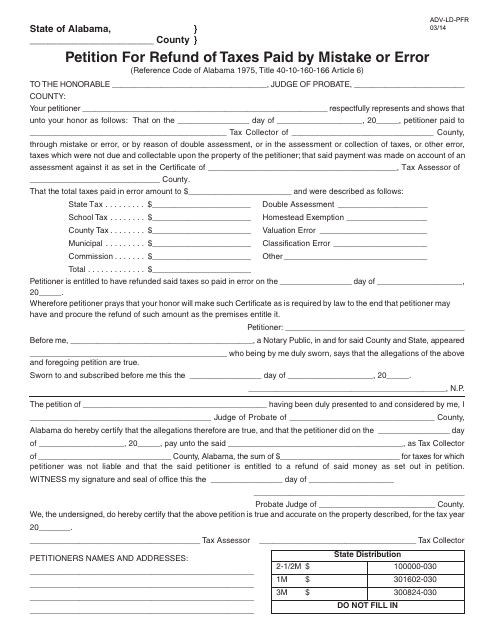

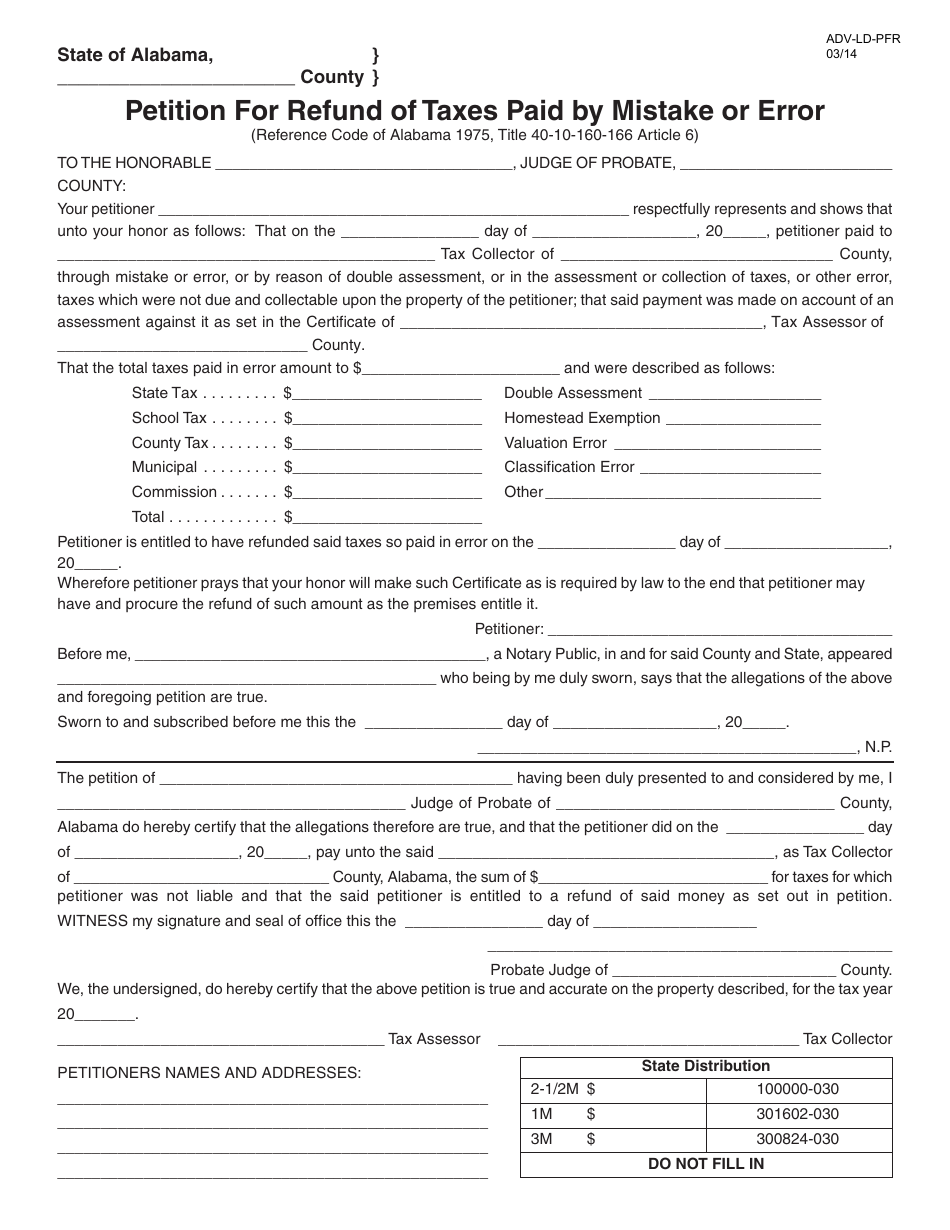

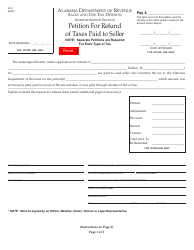

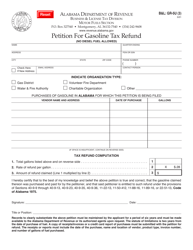

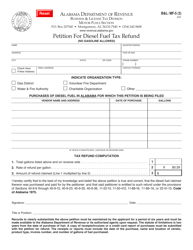

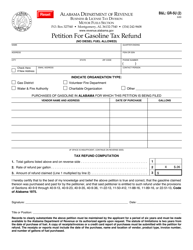

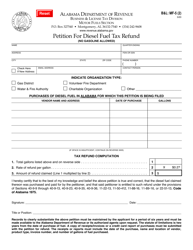

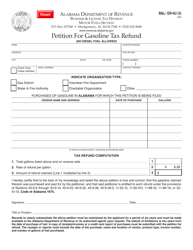

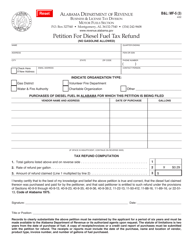

Form ADV-LD-PFR Petition for Refund of Taxes Paid by Mistake or Error - Alabama

What Is Form ADV-LD-PFR?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADV-LD-PFR?

A: Form ADV-LD-PFR is a petition for refund of taxes paid by mistake or error in Alabama.

Q: Who can use Form ADV-LD-PFR?

A: Individuals or businesses that have paid taxes to Alabama by mistake or error can use this form to request a refund.

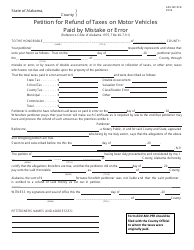

Q: What types of taxes can be refunded with Form ADV-LD-PFR?

A: Form ADV-LD-PFR can be used to request a refund of various types of taxes, including income tax, sales tax, and use tax.

Q: How do I fill out Form ADV-LD-PFR?

A: You need to provide your personal or business information, details about the tax paid in error, and a description of the mistake or error. The form also requires supporting documentation.

Q: What is the deadline to file Form ADV-LD-PFR?

A: Form ADV-LD-PFR must be filed within three years from the original payment date or two years from the date the tax was assessed, whichever is later.

Q: How long does it take to receive a refund?

A: The processing time for refunds can vary, but typically it takes several weeks to receive a refund after submitting Form ADV-LD-PFR.

Q: What should I do if my refund request is denied?

A: If your refund request is denied, you can appeal the decision and provide additional evidence to support your claim.

Q: Can I electronically file Form ADV-LD-PFR?

A: No, Form ADV-LD-PFR must be submitted by mail with the necessary attachments.

Q: Are there any fees associated with filing Form ADV-LD-PFR?

A: No, there are no fees for filing Form ADV-LD-PFR.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADV-LD-PFR by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.