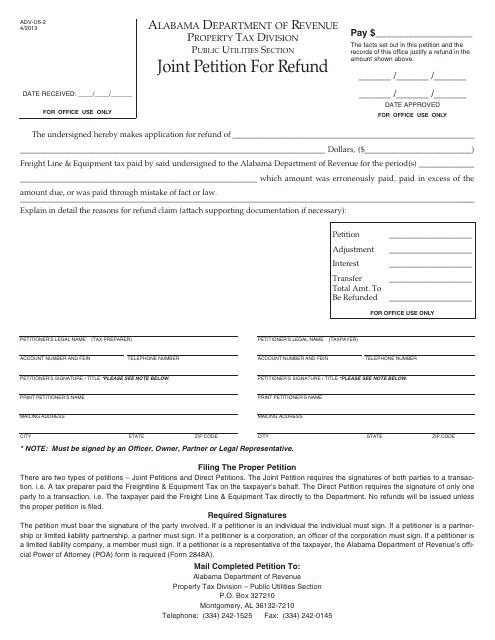

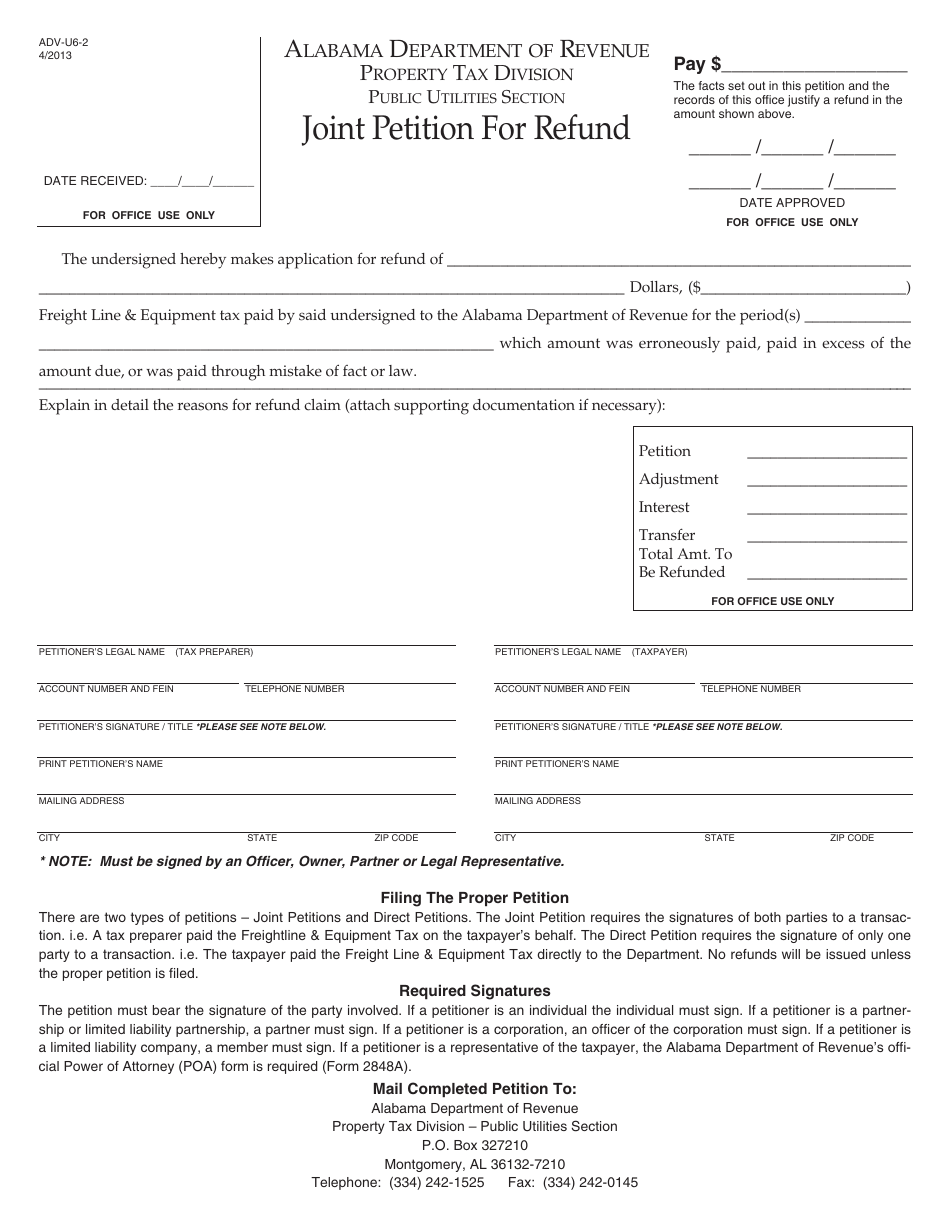

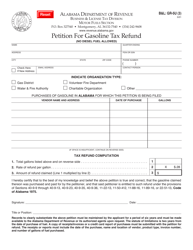

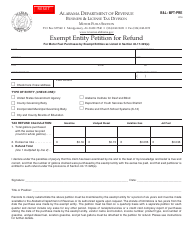

Form ADV-U6-2 Joint Petition for Refund - Alabama

What Is Form ADV-U6-2?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADV-U6-2?

A: Form ADV-U6-2 is a Joint Petition for Refund specifically for Alabama.

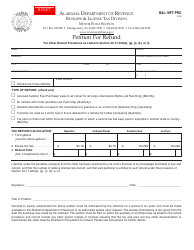

Q: What is this form used for?

A: This form is used to request a refund for overpaid fees or penalties in the state of Alabama.

Q: Who can file Form ADV-U6-2?

A: This form can be filed jointly by the taxpayer and their spouse. Both parties must sign the petition.

Q: What information is required on Form ADV-U6-2?

A: You need to provide personal information, details of the overpayment, and reasons for the refund request.

Q: Are there any fees associated with filing Form ADV-U6-2?

A: No, there are no fees required for filing this form.

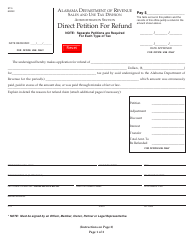

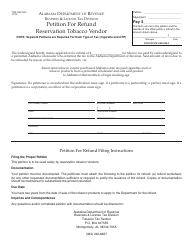

Q: What should I do after completing Form ADV-U6-2?

A: Once you have completed the form, you need to submit it to the Alabama Department of Revenue for processing.

Q: How long does it take to receive a refund after filing Form ADV-U6-2?

A: The processing time for refunds can vary, but typically it takes several weeks to receive a refund.

Q: What should I do if I disagree with the decision on my refund request?

A: If you disagree with the decision on your refund request, you can file an appeal with the Alabama Department of Revenue.

Form Details:

- Released on April 1, 2013;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ADV-U6-2 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.