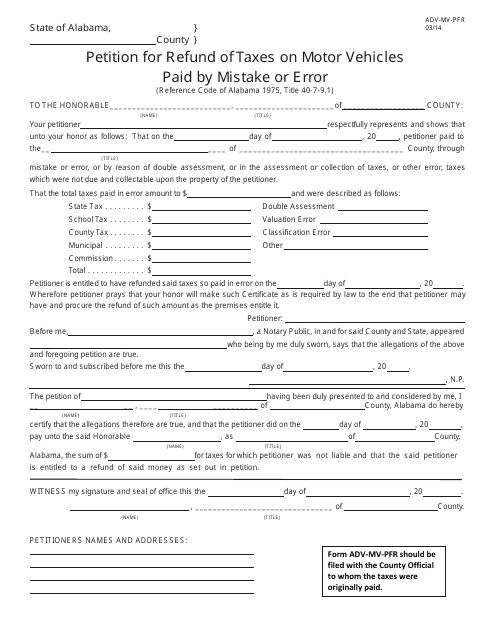

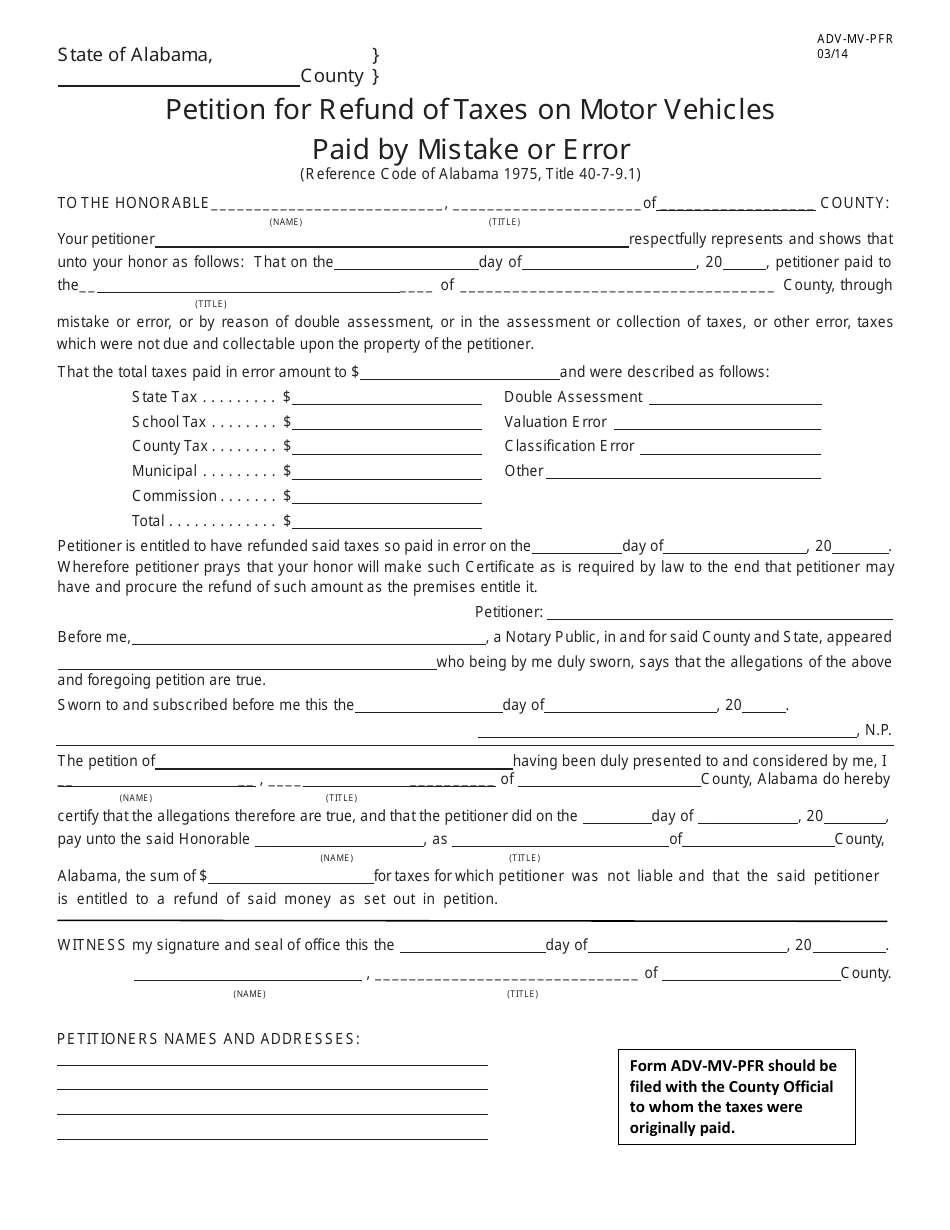

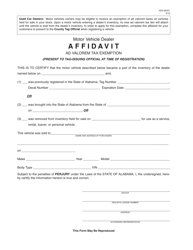

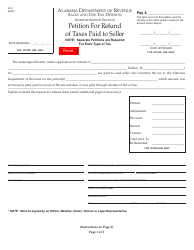

Form ADV-MV-PFR Petition for Refund of Taxes on Motor Vehicles Paid by Mistake or Error - Alabama

What Is Form ADV-MV-PFR?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADV-MV-PFR?

A: Form ADV-MV-PFR is a petition for refund of taxes on motor vehicles paid by mistake or error in Alabama.

Q: Who can use Form ADV-MV-PFR?

A: Any individual who has mistakenly or erroneously paid taxes on a motor vehicle in Alabama can use Form ADV-MV-PFR.

Q: What is the purpose of Form ADV-MV-PFR?

A: The purpose of Form ADV-MV-PFR is to request a refund of taxes paid on a motor vehicle in Alabama due to a mistake or error.

Q: What information is required on Form ADV-MV-PFR?

A: Form ADV-MV-PFR requires information such as the taxpayer's name, contact information, vehicle description, and details of the tax payment error.

Q: Is there a deadline for submitting Form ADV-MV-PFR?

A: Yes, Form ADV-MV-PFR must be submitted within three years from the date of the tax payment error.

Q: What supporting documents should be included with Form ADV-MV-PFR?

A: Supporting documents such as copies of vehicle titles, registration receipts, and proof of tax payment should be included with Form ADV-MV-PFR.

Q: How long does it take to process a Form ADV-MV-PFR?

A: The processing time for Form ADV-MV-PFR varies, but it typically takes several weeks to a few months.

Q: Will I receive a refund if my Form ADV-MV-PFR is approved?

A: Yes, if your Form ADV-MV-PFR is approved, you will receive a refund of the taxes paid on the motor vehicle.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ADV-MV-PFR by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.