This version of the form is not currently in use and is provided for reference only. Download this version of

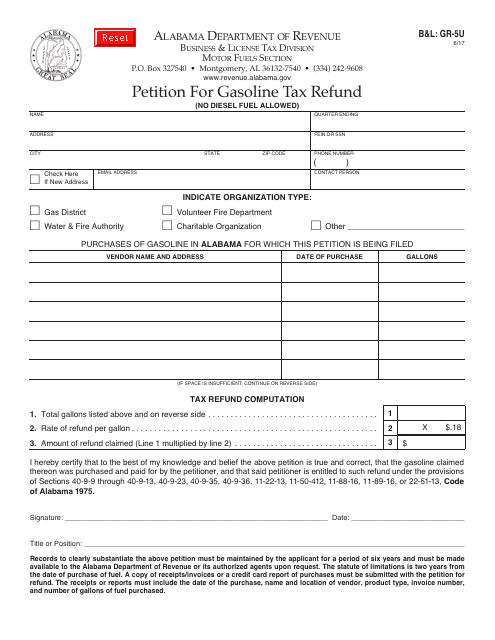

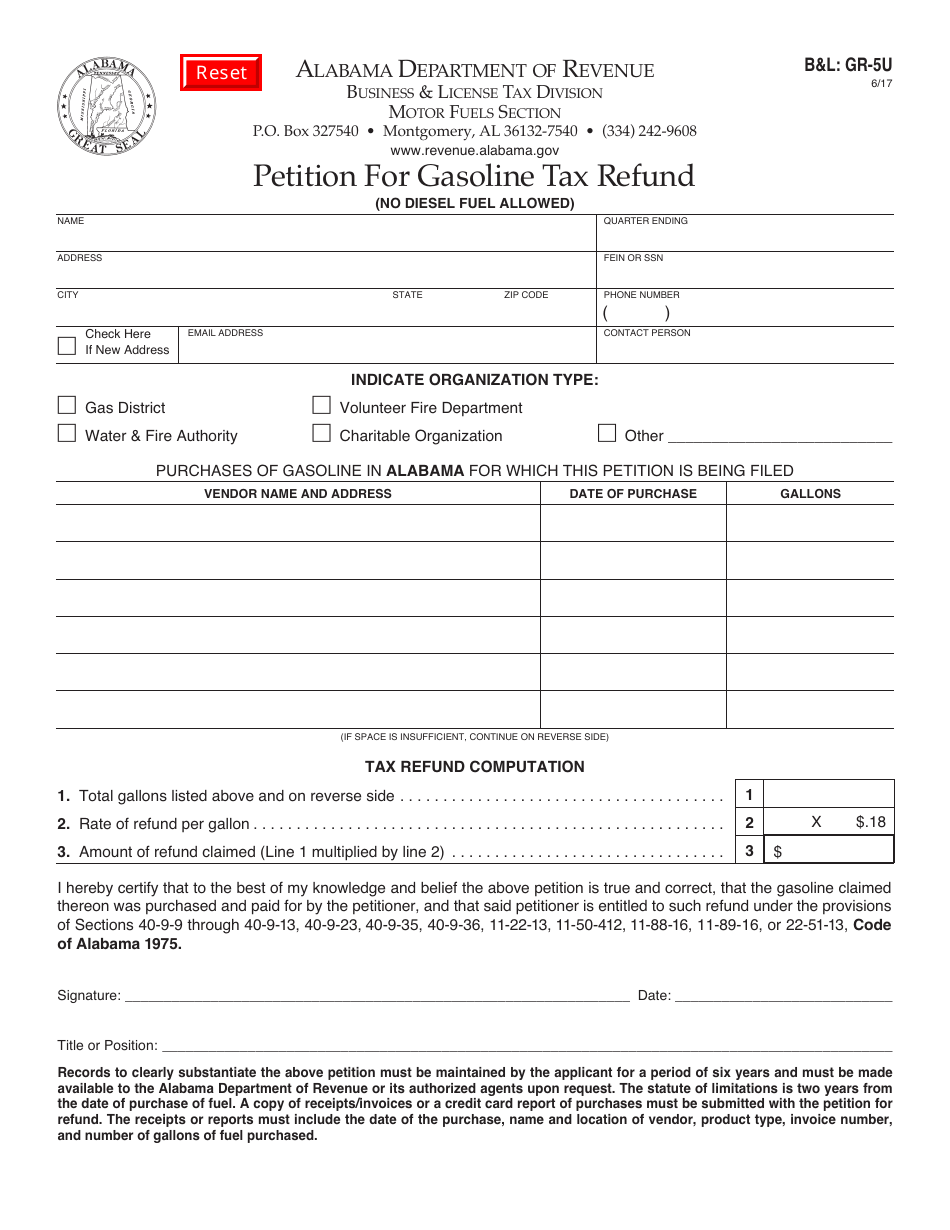

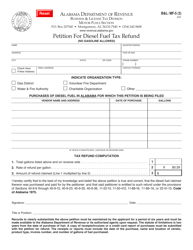

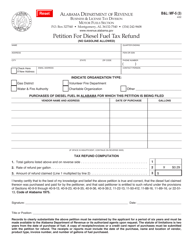

Form B&L: GR-5U

for the current year.

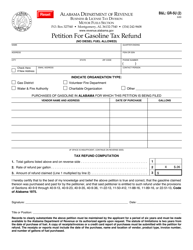

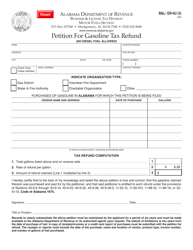

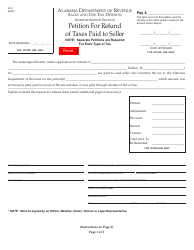

Form B&L: GR-5U Petition for Gasoline Tax Refund - Alabama

What Is Form B&L: GR-5U?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B&L: GR-5U?

A: Form B&L: GR-5U is a petition form for gasoline tax refund in the state of Alabama.

Q: What is a gasoline tax refund?

A: A gasoline tax refund is a reimbursement of taxes paid on gasoline purchases.

Q: Who can use Form B&L: GR-5U?

A: Any individual or business in Alabama that is eligible for a gasoline tax refund can use Form B&L: GR-5U.

Q: How can I be eligible for a gasoline tax refund in Alabama?

A: To be eligible for a gasoline tax refund in Alabama, you must use gasoline for a nontaxable purpose, such as off-road use or agricultural activities.

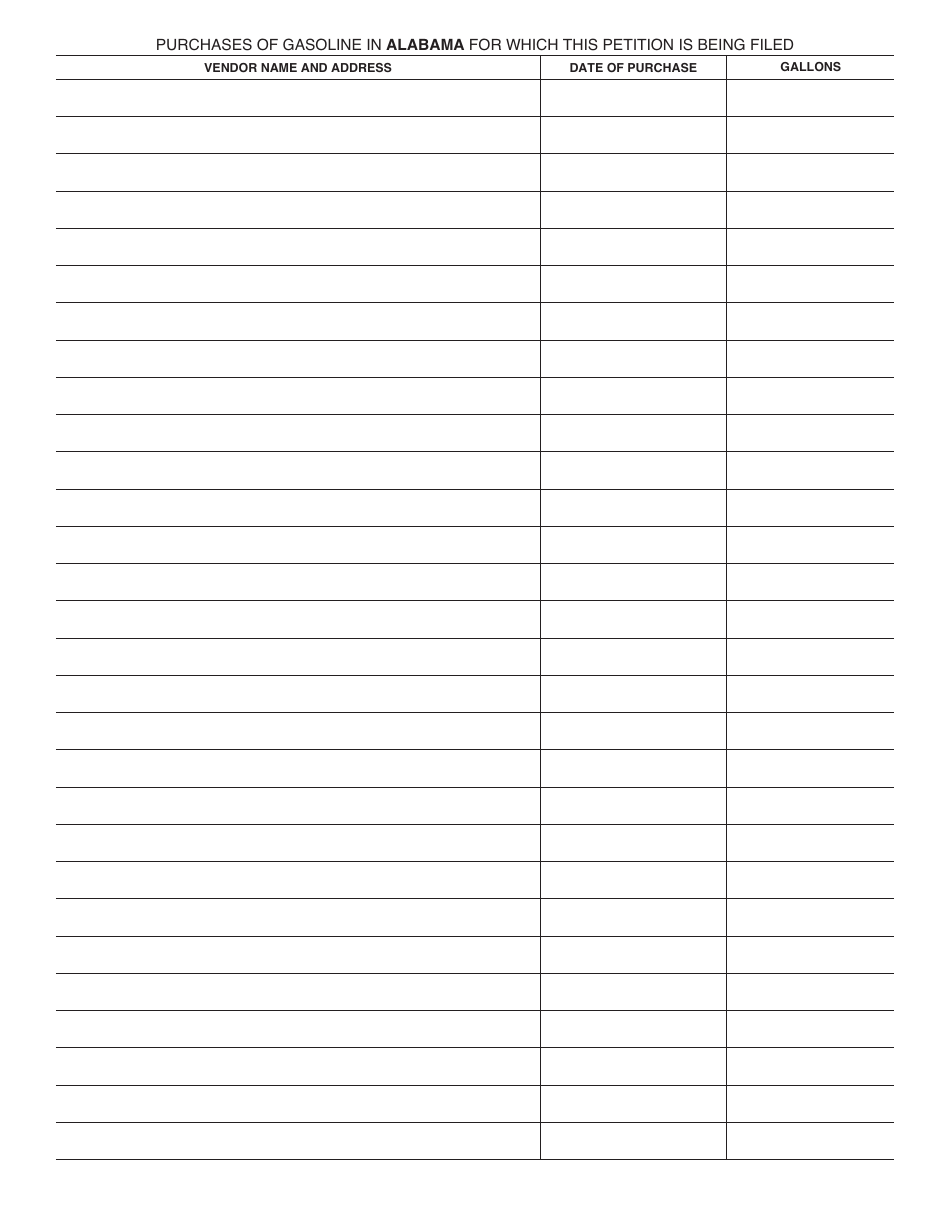

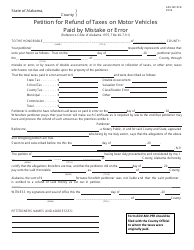

Q: What information is required on Form B&L: GR-5U?

A: Form B&L: GR-5U requires information such as the claimant's name, address, gasoline purchase details, and the purpose for which gasoline was used.

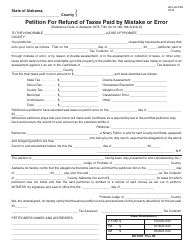

Q: Is there a deadline to submit Form B&L: GR-5U?

A: Yes, Form B&L: GR-5U should be submitted within three years from the date of the gasoline purchase for which a refund is sought.

Q: When will I receive my gasoline tax refund?

A: The processing time for gasoline tax refunds in Alabama varies, but you can expect to receive your refund within a few weeks to a few months.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Alabama Department of Revenue;

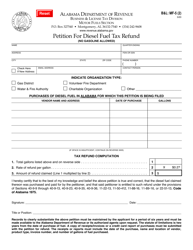

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: GR-5U by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.