This version of the form is not currently in use and is provided for reference only. Download this version of

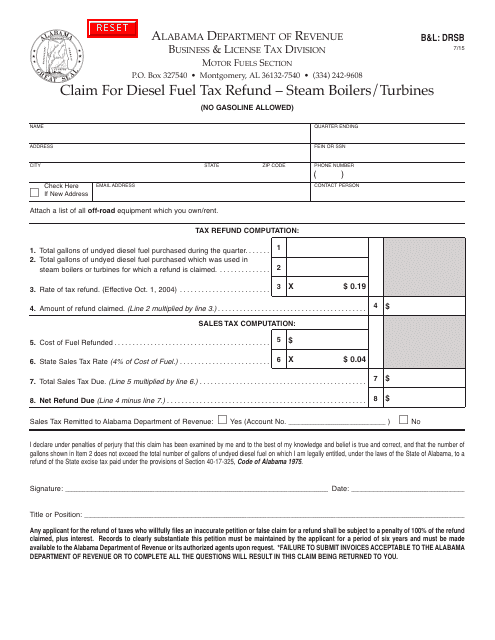

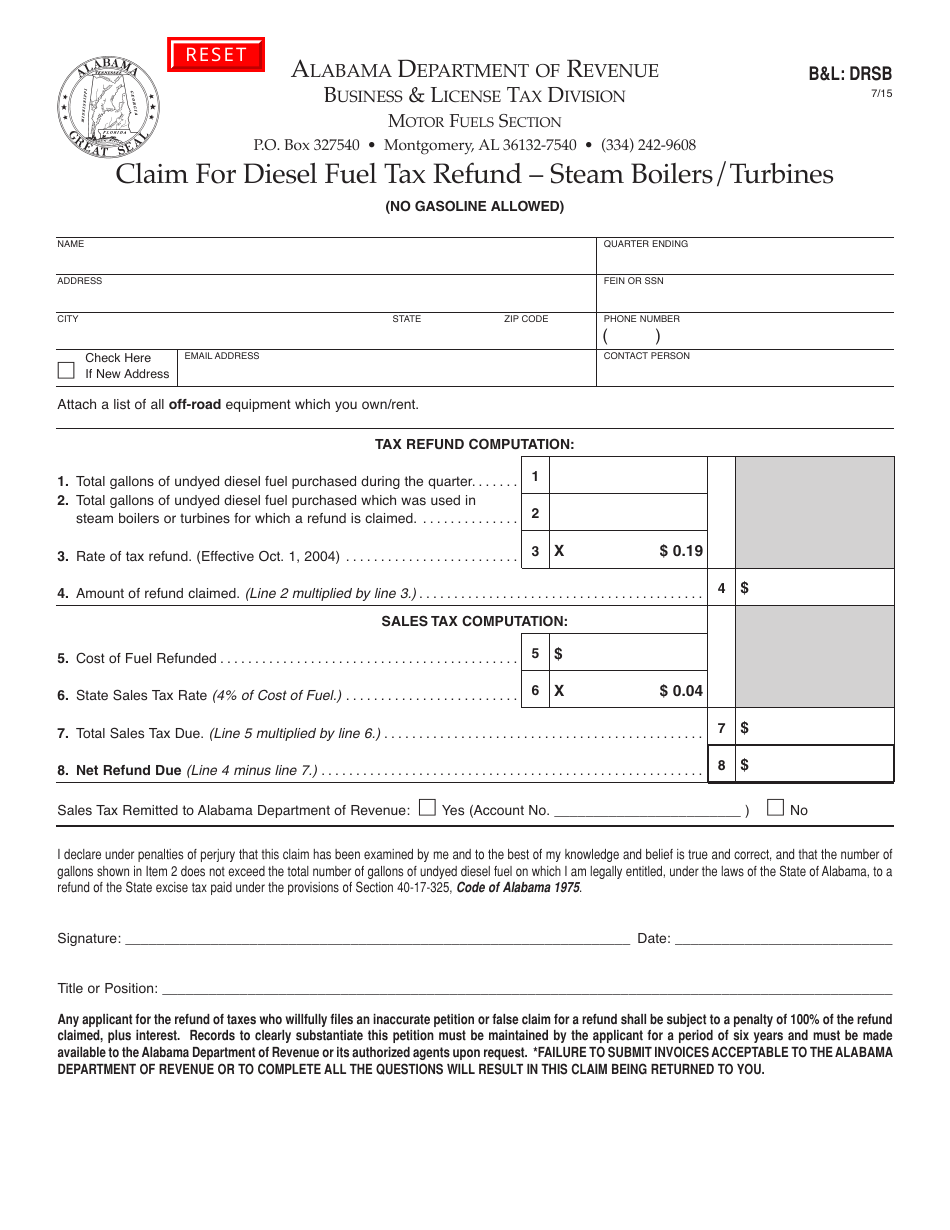

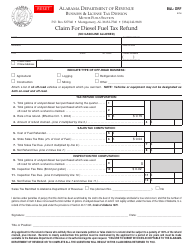

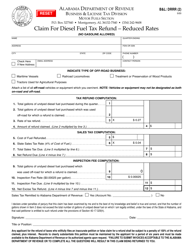

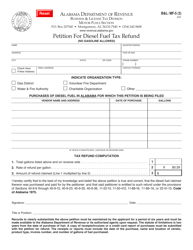

Form B&L: DRSB

for the current year.

Form B&L: DRSB Claim for Diesel Fuel Tax Refund - Steam Boilers / Turbines - Alabama

What Is Form B&L: DRSB?

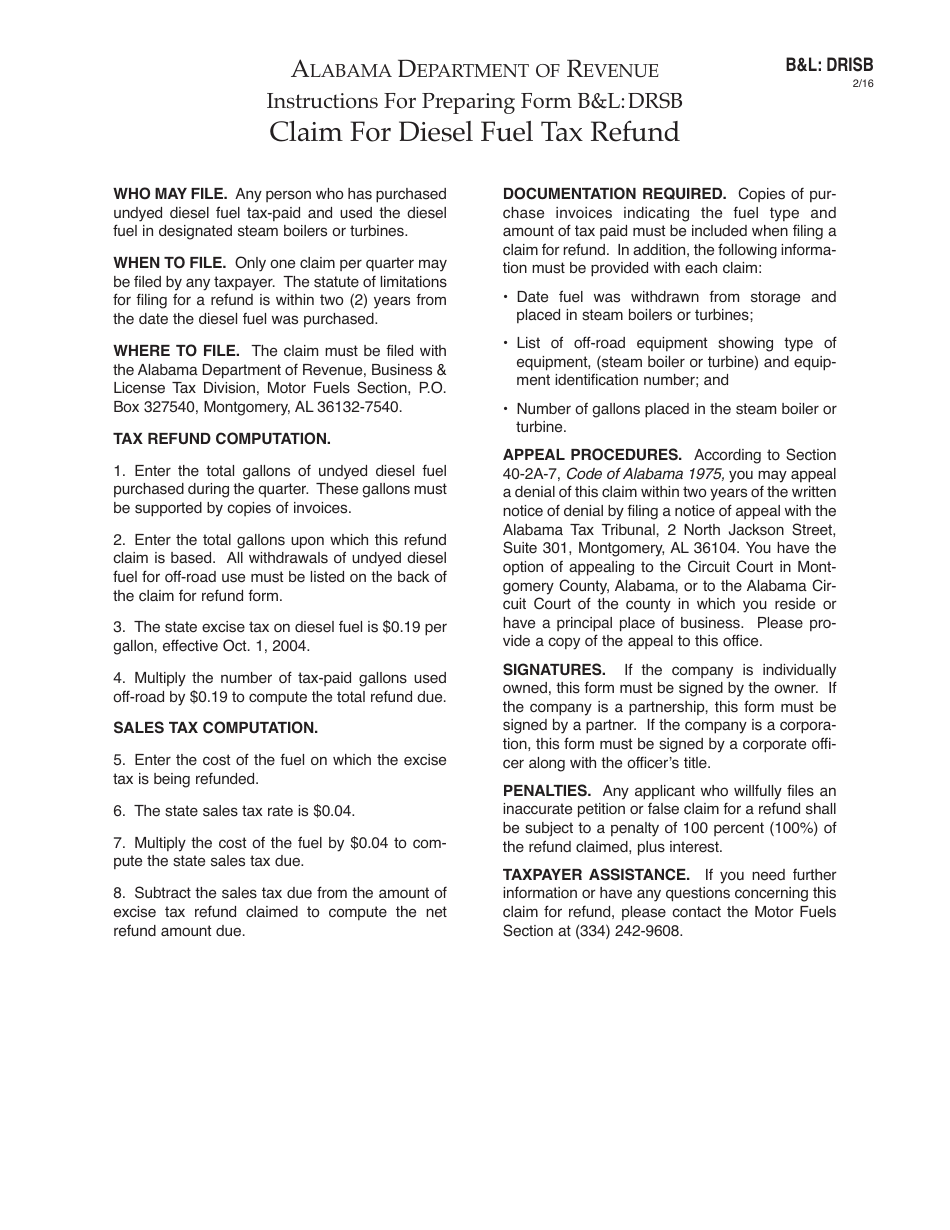

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. Check the official instructions before completing and submitting the form.

FAQ

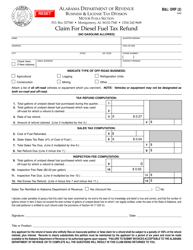

Q: What is Form B&L?

A: Form B&L is the DRSB Claim for Diesel Fuel Tax Refund form.

Q: Who can use Form B&L?

A: Form B&L can be used by businesses in Alabama that operate steam boilers or turbines.

Q: What is the purpose of Form B&L?

A: The purpose of Form B&L is to claim a refund of the state diesel fuel tax paid on diesel fuel when used in steam boilers or turbines.

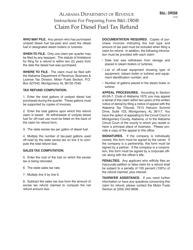

Q: How do I complete Form B&L?

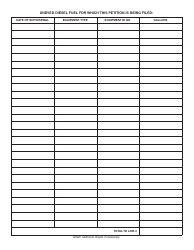

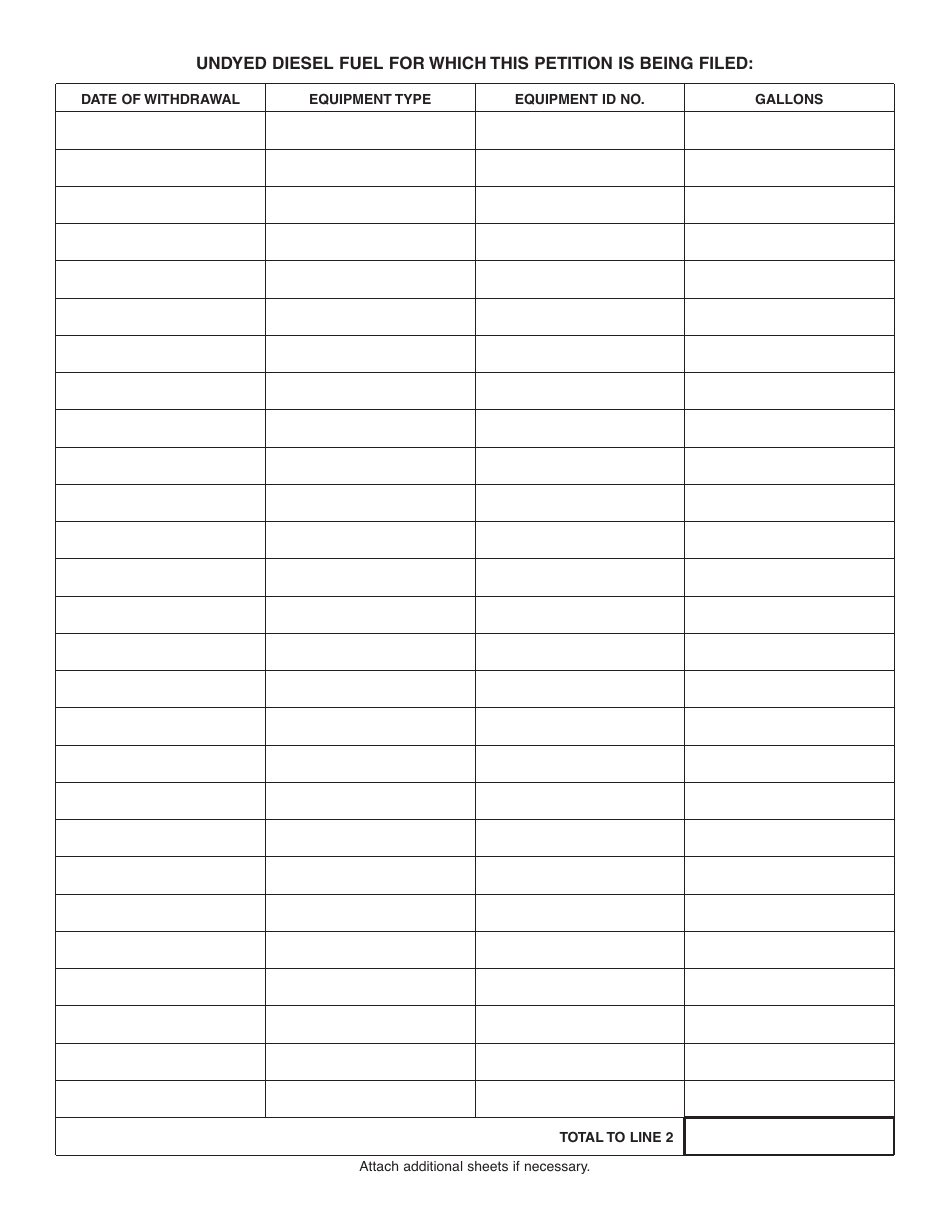

A: You must provide your contact information, details about your business, purchase and consumption information, and attach supporting documentation.

Q: When is the deadline for filing Form B&L?

A: Form B&L must be filed by the 20th day of the month following the end of the calendar quarter.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: DRSB by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.