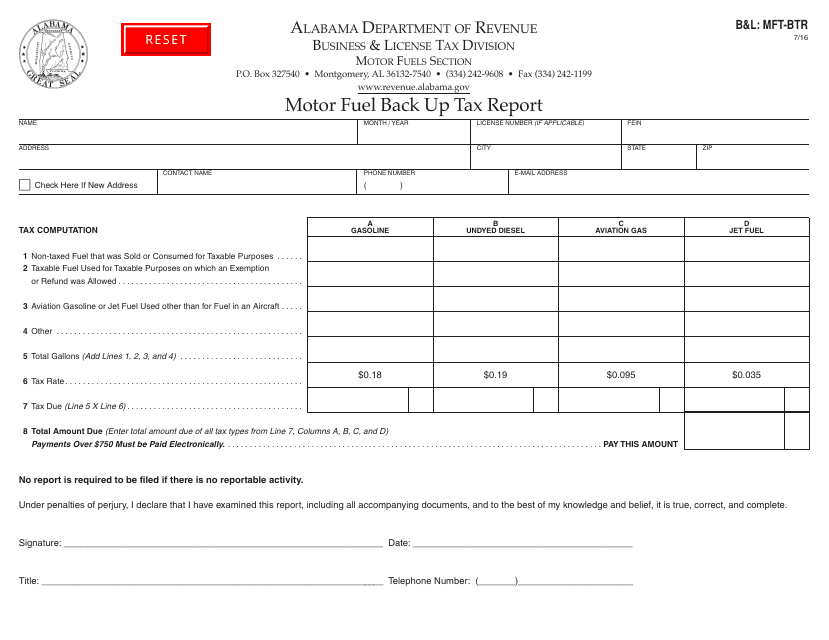

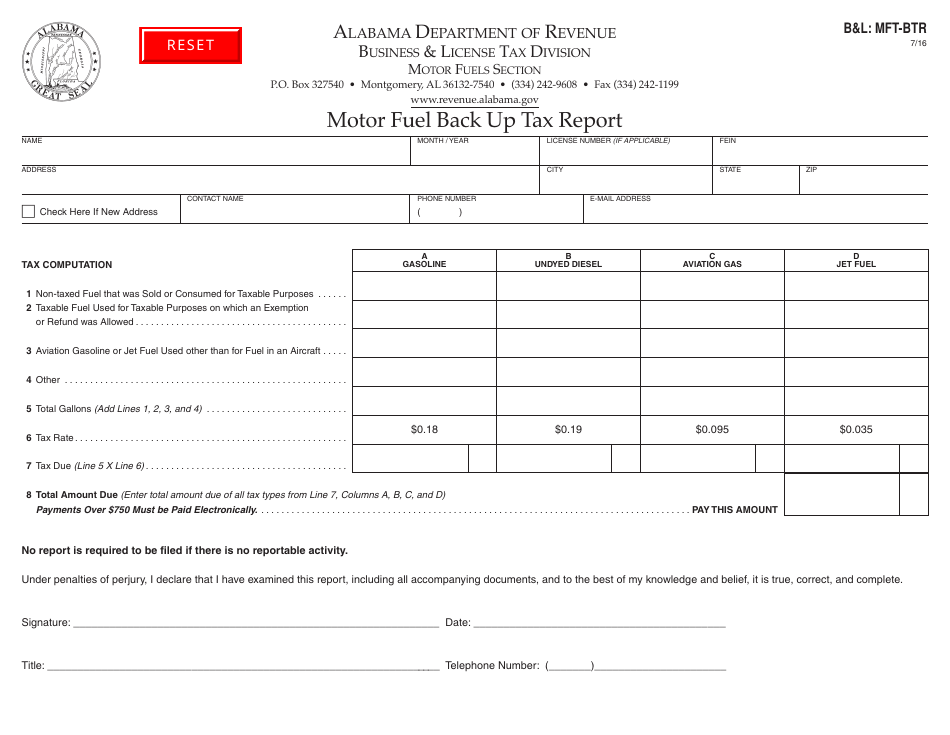

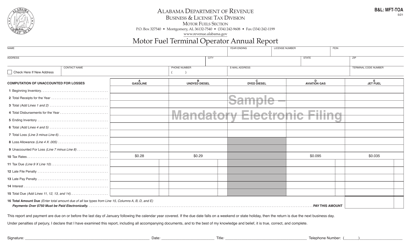

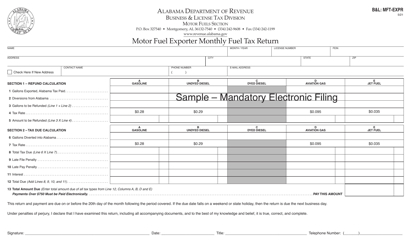

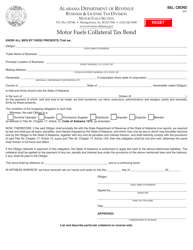

Form B&L: MFT-BT Motor Fuel Back up Tax Report - Alabama

What Is Form B&L: MFT-BT?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form MFT-BT?

A: Form MFT-BT is the Motor Fuel Back up Tax Report.

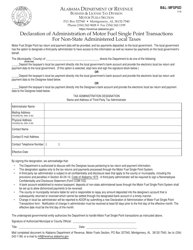

Q: What is the purpose of Form MFT-BT?

A: The purpose of Form MFT-BT is to report and pay motor fuel back up taxes in Alabama.

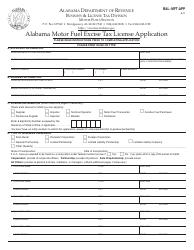

Q: Who needs to file Form MFT-BT?

A: Any person who sells or uses motor fuel in Alabama and is not already licensed as a supplier or distributor of motor fuel needs to file Form MFT-BT.

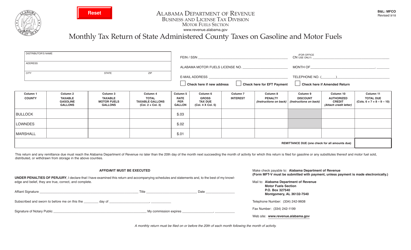

Q: How often do I need to file and pay the motor fuel back up tax?

A: Form MFT-BT must be filed and the tax paid on a monthly basis.

Q: What are the due dates for Form MFT-BT?

A: The due date for filing and paying the motor fuel back up tax is on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing or payment?

A: Yes, failure to file or pay the motor fuel back up tax by the due date may result in penalties and interest.

Q: What should I do if I have questions or need assistance with Form MFT-BT?

A: If you have questions or need assistance with Form MFT-BT, you can contact the Alabama Department of Revenue for further guidance.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: MFT-BT by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.