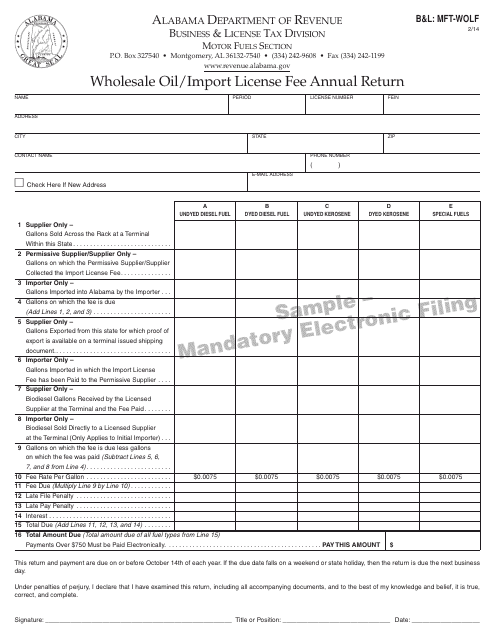

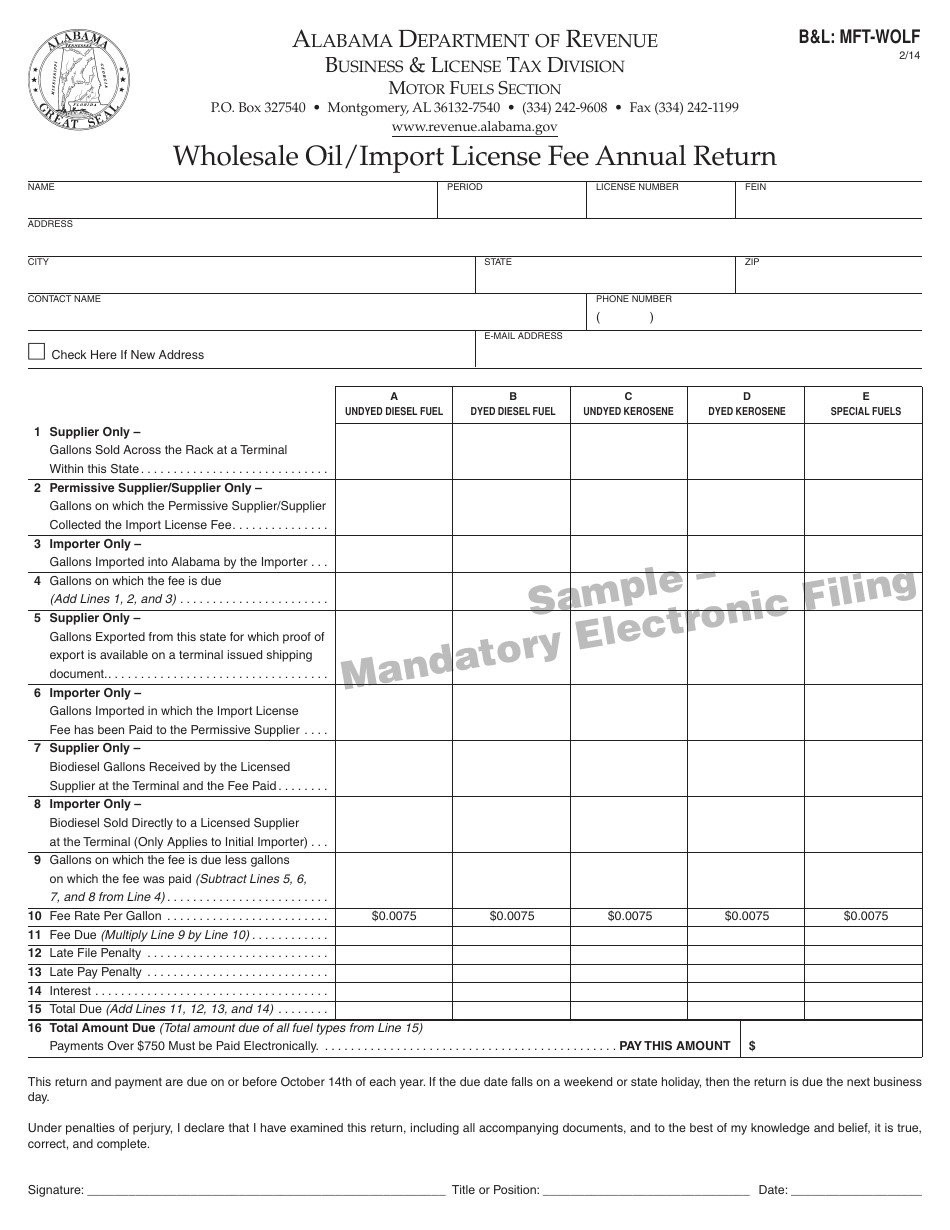

Form B&L: MFT-WOLF Wholesale Oil / Import License Fee Annual Return - Alabama

What Is Form B&L: MFT-WOLF?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form B&L: MFT-WOLF?

A: The Form B&L: MFT-WOLF is a document used to report the Wholesale Oil/Import License Fee Annual Return in Alabama.

Q: What is the purpose of the Wholesale Oil/Import License Fee Annual Return?

A: The Wholesale Oil/Import License Fee Annual Return is used to report and pay the required license fee for wholesale oil and import businesses in Alabama.

Q: Who is required to file the Wholesale Oil/Import License Fee Annual Return?

A: Wholesale oil and import businesses operating in Alabama are required to file the Wholesale Oil/Import License Fee Annual Return.

Q: How often is the Wholesale Oil/Import License Fee Annual Return filed?

A: The Wholesale Oil/Import License Fee Annual Return is filed annually.

Q: What information is required in the Wholesale Oil/Import License Fee Annual Return?

A: The Wholesale Oil/Import License Fee Annual Return requires businesses to provide information such as sales amounts, gallons sold, and other related details.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B&L: MFT-WOLF by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.