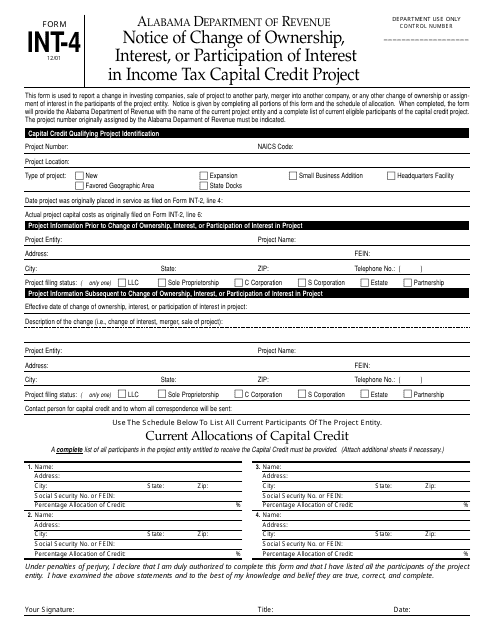

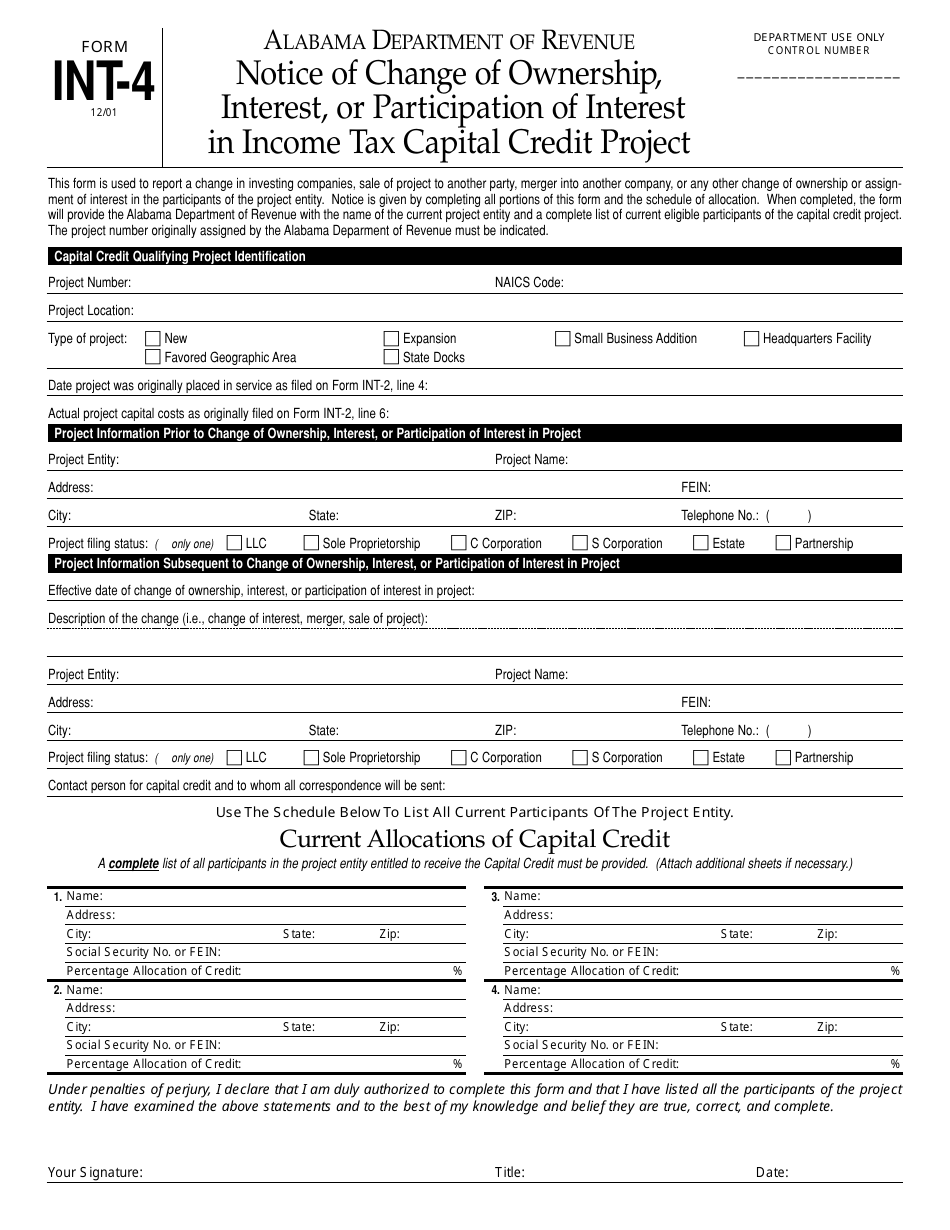

Form INT-4 Notice of Change of Ownership, Interest, or Participation of Interest in Income Tax Capital Credit Project - Alabama

What Is Form INT-4?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form INT-4?

A: Form INT-4 is the Notice of Change of Ownership, Interest, or Participation of Interest in Income Tax Capital Credit Project.

Q: Who is required to file Form INT-4?

A: Individuals or entities that have a change of ownership, interest, or participation in an income tax capital credit project in Alabama are required to file Form INT-4.

Q: What is the purpose of Form INT-4?

A: The purpose of Form INT-4 is to notify the Alabama Department of Revenue about any changes in ownership, interest, or participation in an income tax capital credit project.

Q: When should Form INT-4 be filed?

A: Form INT-4 should be filed within 30 days of the change in ownership, interest, or participation.

Q: Is there a fee for filing Form INT-4?

A: No, there is no fee for filing Form INT-4.

Q: Are there any penalties for not filing Form INT-4?

A: Yes, there may be penalties for not filing Form INT-4, including the loss of income tax capital credits.

Q: Are there any additional requirements after filing Form INT-4?

A: Yes, the Alabama Department of Revenue may request additional information or documentation related to the change of ownership, interest, or participation.

Q: Can I make changes to a filed Form INT-4?

A: Yes, you can file an amended Form INT-4 if there are any changes or corrections to the previously filed form.

Form Details:

- Released on December 1, 2001;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form INT-4 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.