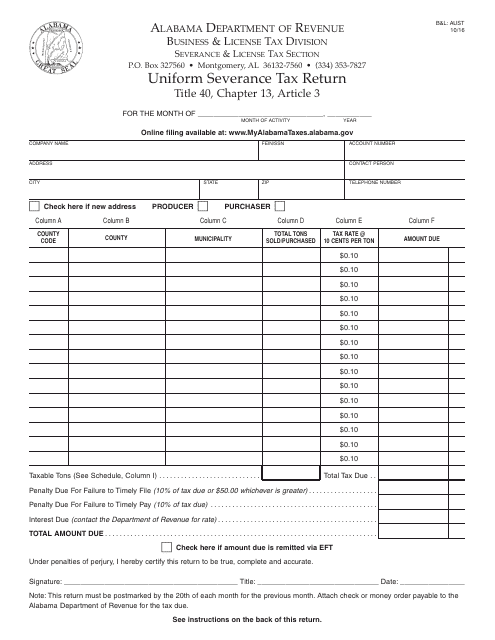

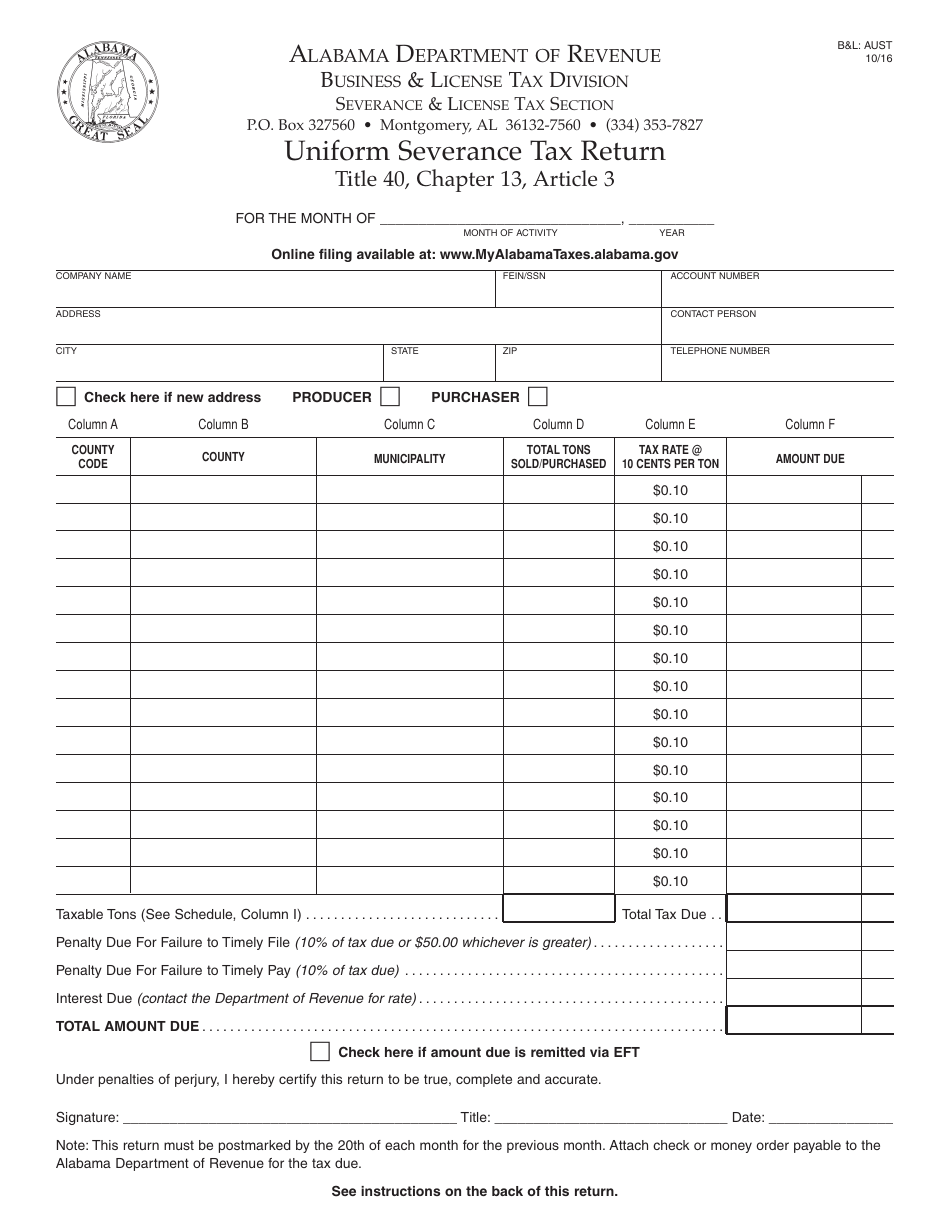

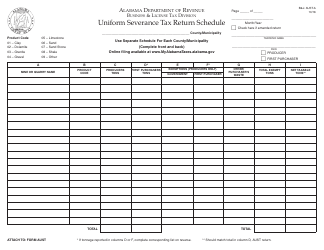

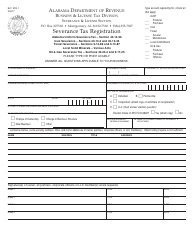

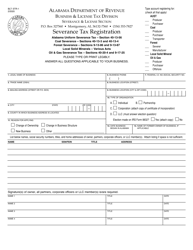

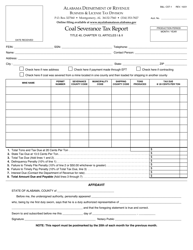

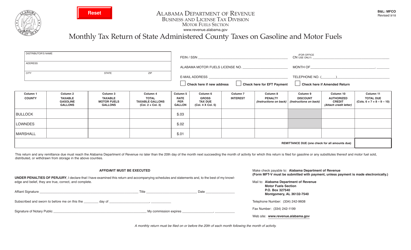

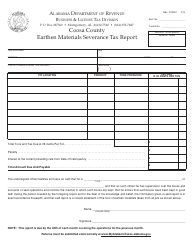

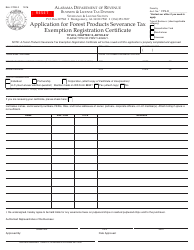

Form B&L: AUST Uniform Severance Tax Return - Alabama

What Is Form B&L: AUST?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

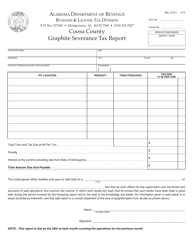

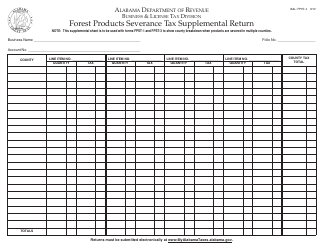

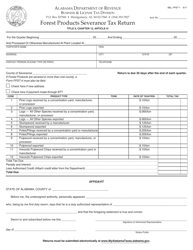

Q: What is the Form B&L: AUST Uniform Severance Tax Return?

A: The Form B&L: AUST Uniform Severance Tax Return is a tax return form used in Alabama for reporting and paying severance taxes on natural resources.

Q: Who is required to file the Form B&L: AUST Uniform Severance Tax Return?

A: Any person or entity engaged in the severance of natural resources in Alabama is required to file the Form B&L: AUST Uniform Severance Tax Return.

Q: What are severance taxes?

A: Severance taxes are taxes imposed on the extraction or severance of natural resources, such as oil, gas, coal, or minerals.

Q: How often is the Form B&L: AUST Uniform Severance Tax Return filed?

A: The Form B&L: AUST Uniform Severance Tax Return is filed on a monthly basis.

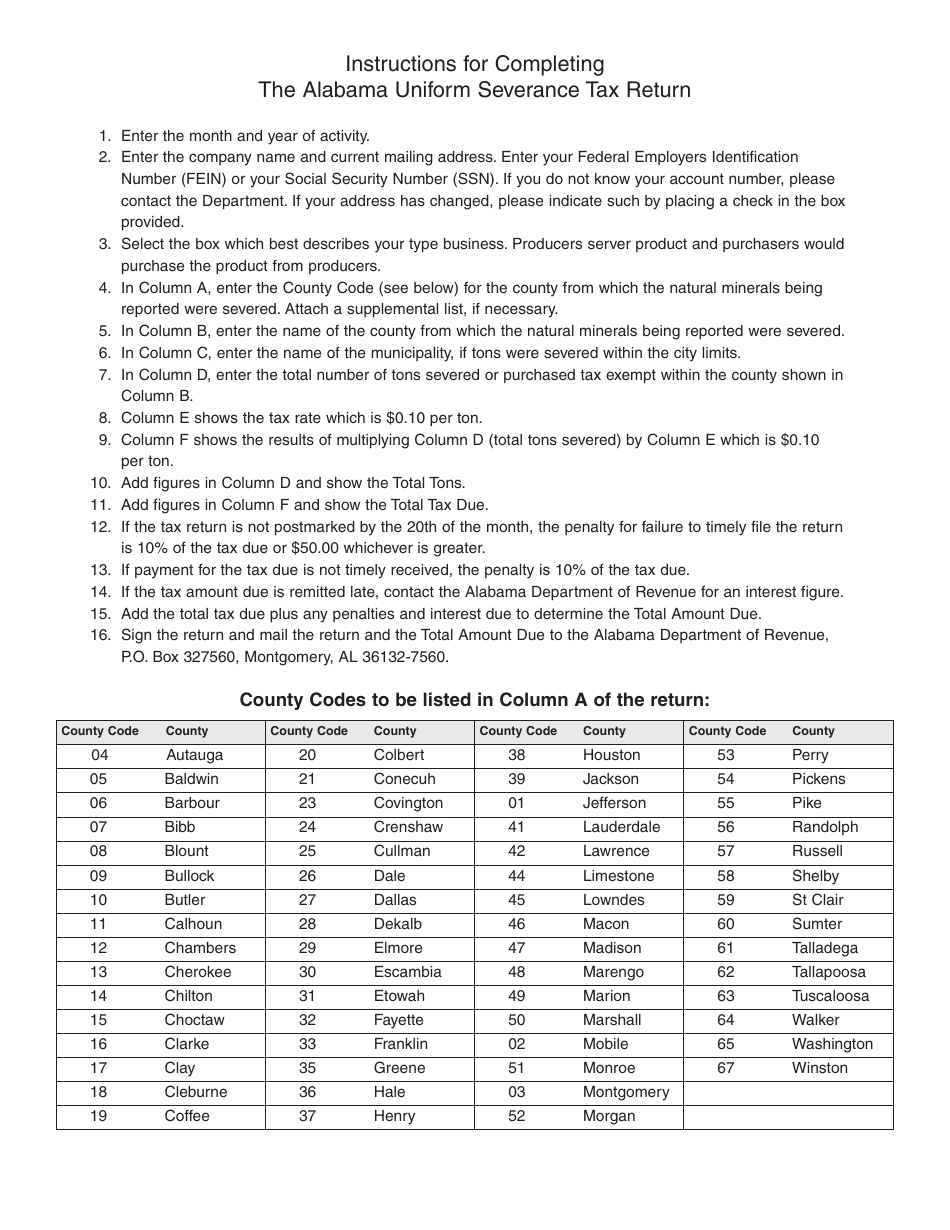

Q: What information is required to complete the Form B&L: AUST Uniform Severance Tax Return?

A: The Form B&L: AUST Uniform Severance Tax Return requires information such as the quantity and value of the natural resources severed, the tax rate, and any applicable exemptions.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B&L: AUST by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.