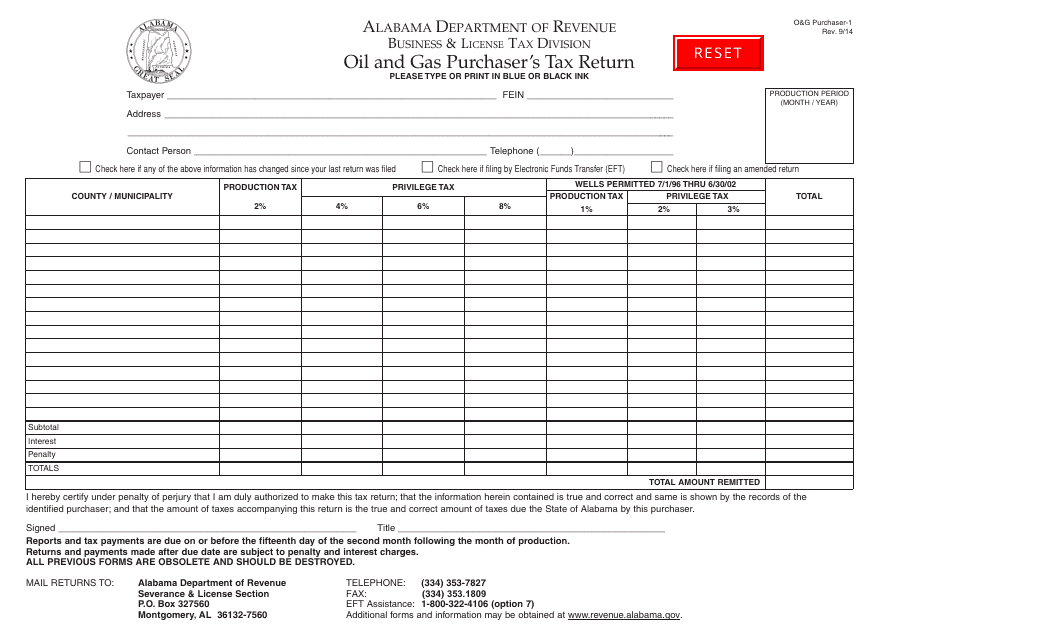

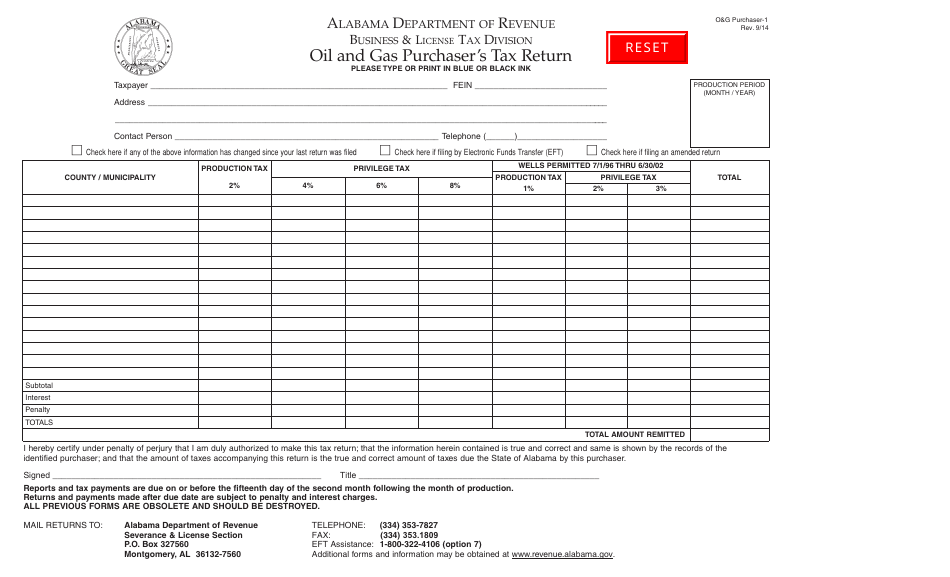

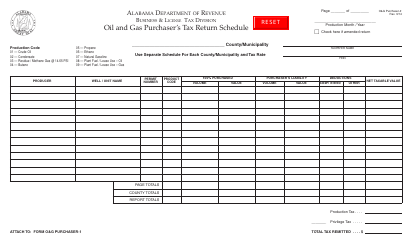

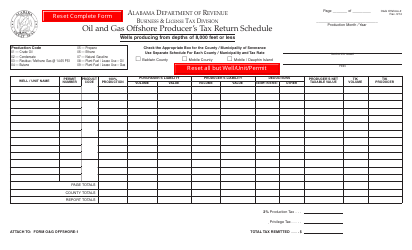

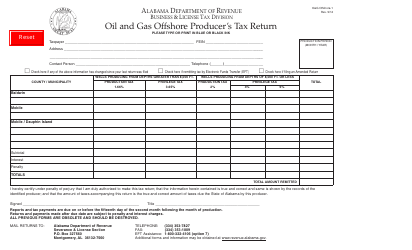

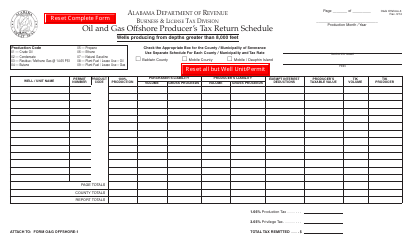

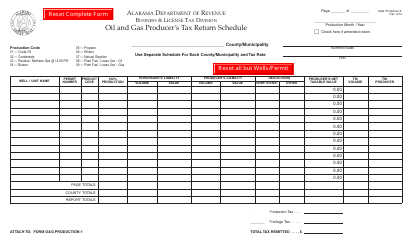

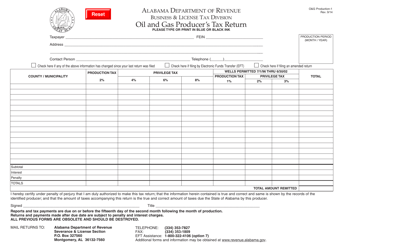

Form O&G Purchaser-1 Oil and Gas Purchaser's Tax Return - Alabama

What Is Form O&G Purchaser-1?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form O&G Purchaser-1?

A: Form O&G Purchaser-1 is a tax return form specifically for oil and gas purchasers in Alabama.

Q: Who needs to file Form O&G Purchaser-1?

A: Oil and gas purchasers in Alabama need to file Form O&G Purchaser-1.

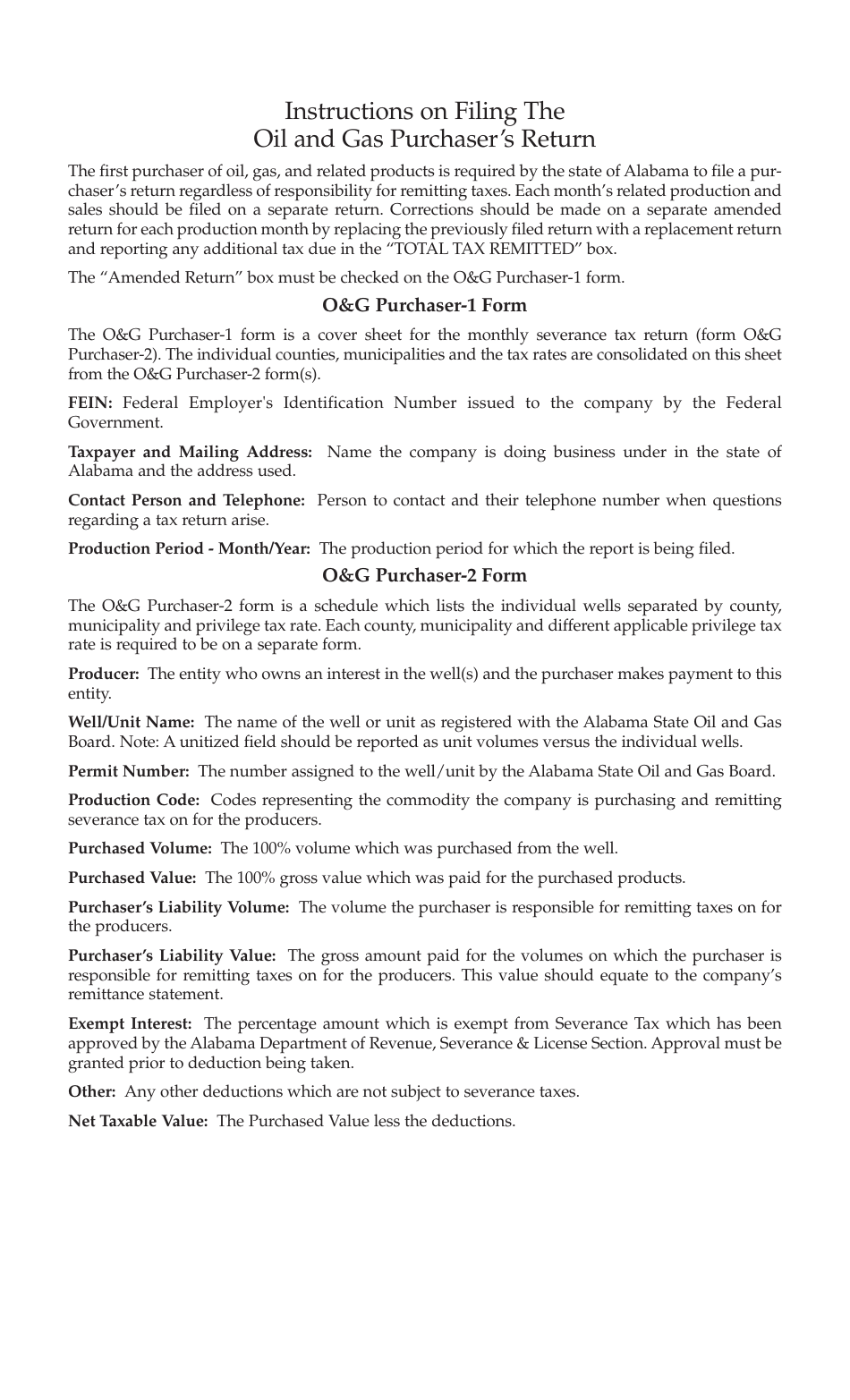

Q: What information is required on Form O&G Purchaser-1?

A: Form O&G Purchaser-1 requires information such as the taxpayer's name, contact details, and details of purchased oil and gas products.

Q: When is the deadline to file Form O&G Purchaser-1?

A: The deadline to file Form O&G Purchaser-1 is based on the taxpayer's reporting period, which is usually the last day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form O&G Purchaser-1?

A: Yes, there are penalties for late filing of Form O&G Purchaser-1, including potential interest and penalties for underpayment of tax.

Q: What should I do if I made an error on my filed Form O&G Purchaser-1?

A: If you made an error on your filed Form O&G Purchaser-1, you should file an amended return to correct the error.

Form Details:

- Released on September 1, 2014;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form O&G Purchaser-1 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.