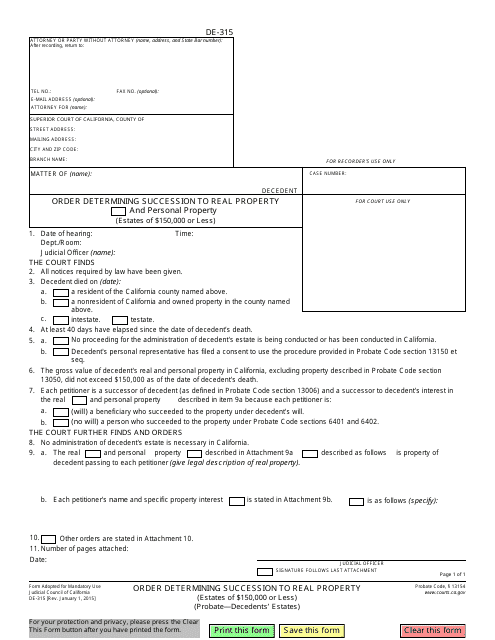

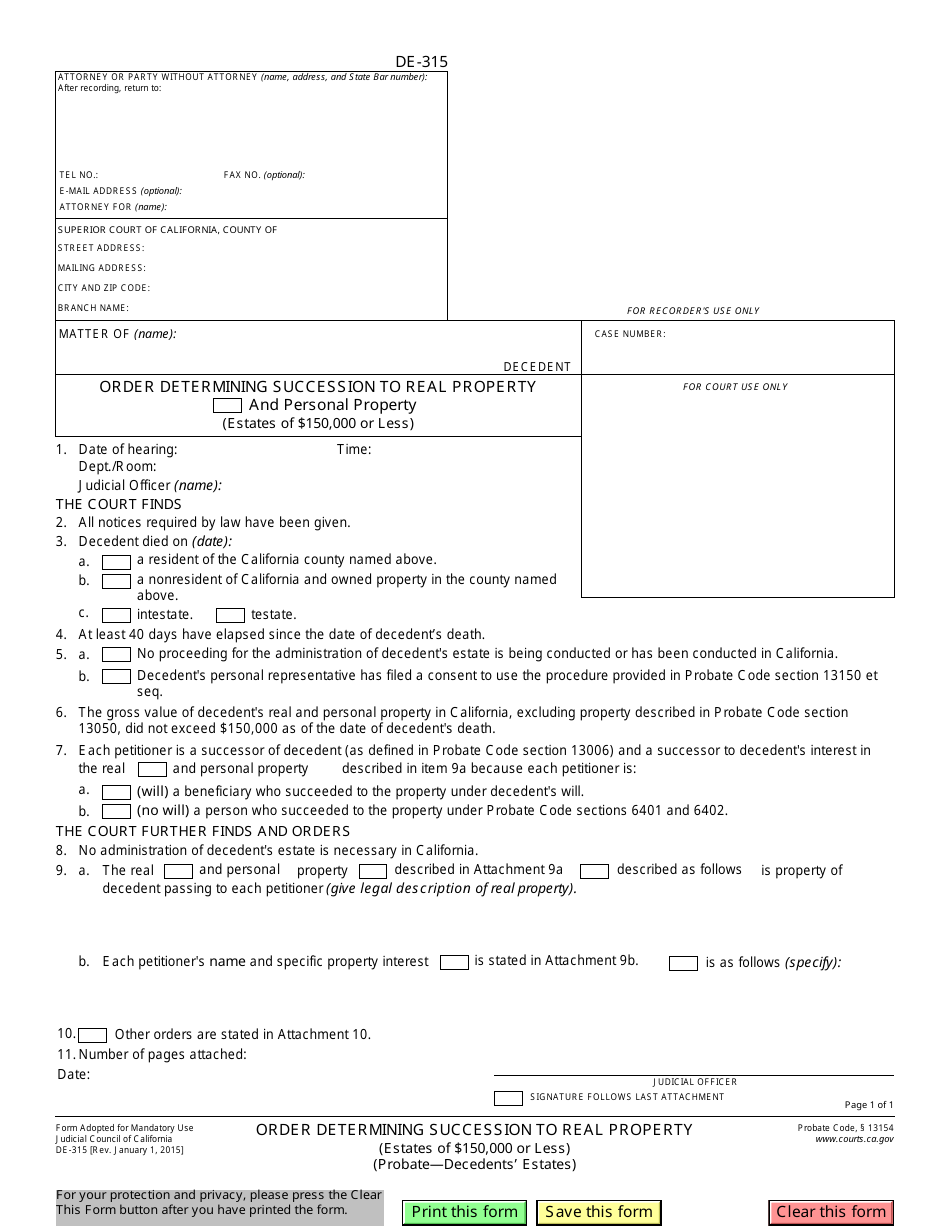

This version of the form is not currently in use and is provided for reference only. Download this version of

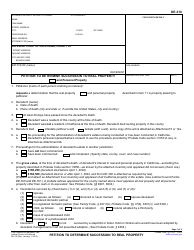

Form DE-315

for the current year.

Form DE-315 Order Determining Succession to Real Property (Estates of $150,000 or Less) - California

What Is Form DE-315?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DE-315?

A: Form DE-315 is an Order Determining Succession to Real Property (Estates of $150,000 or Less) in California.

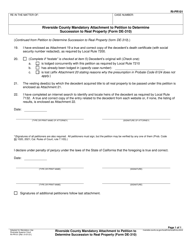

Q: What does Form DE-315 determine?

A: Form DE-315 determines the succession to real property in cases where the total value of the estate is $150,000 or less.

Q: What is the purpose of Form DE-315?

A: The purpose of Form DE-315 is to establish who will inherit the real property when the total value of the estate is $150,000 or less.

Q: Who can use Form DE-315?

A: Form DE-315 can be used by individuals who need to determine the succession to real property in California when the estate value is $150,000 or less.

Q: Is Form DE-315 specific to California?

A: Yes, Form DE-315 is specific to California and should be used in cases of succession to real property in the state.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DE-315 by clicking the link below or browse more documents and templates provided by the California Superior Court.