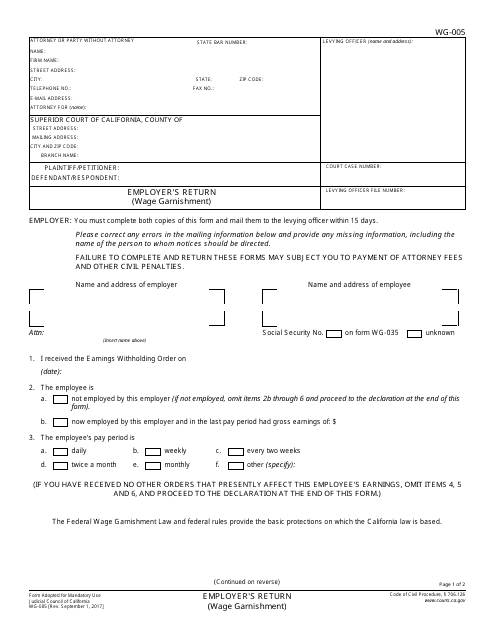

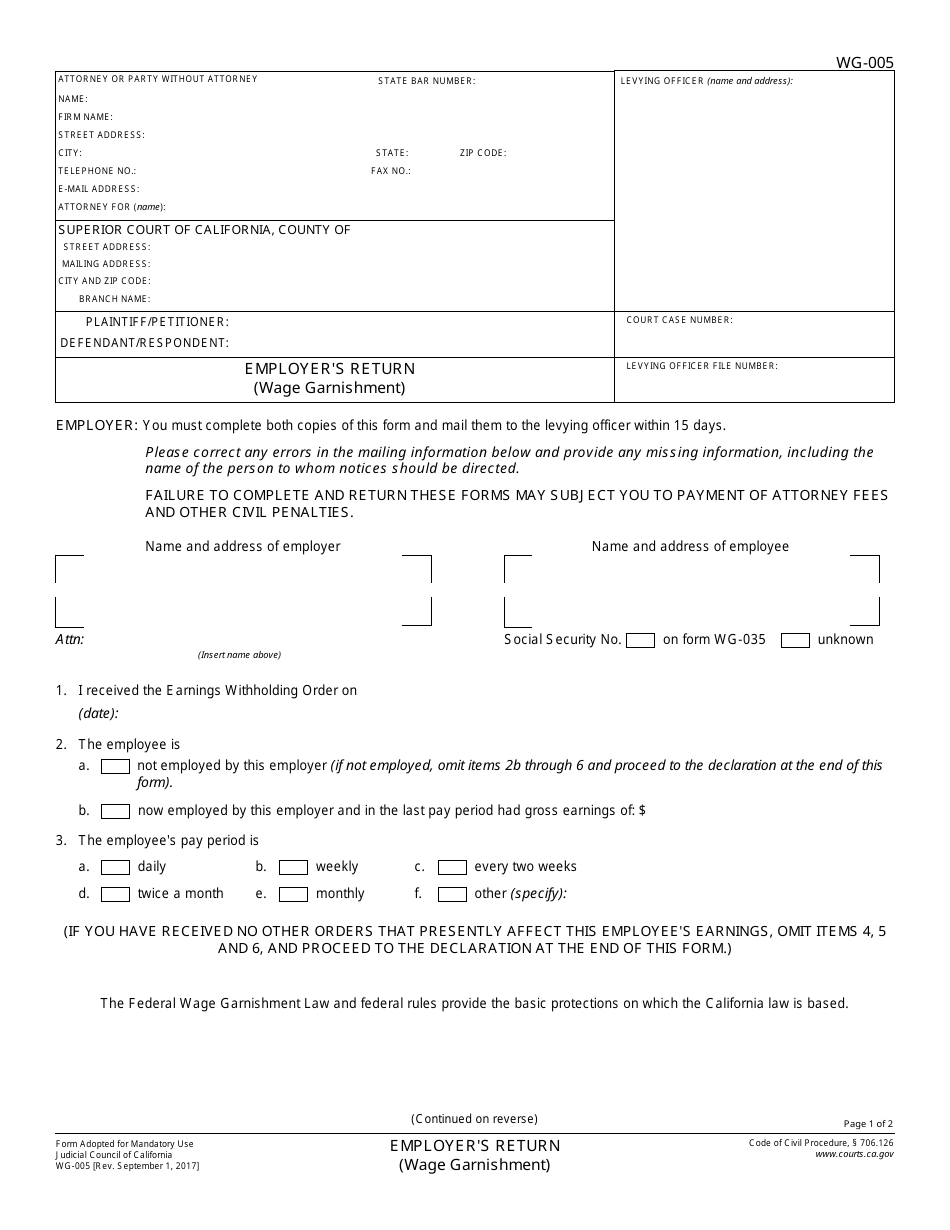

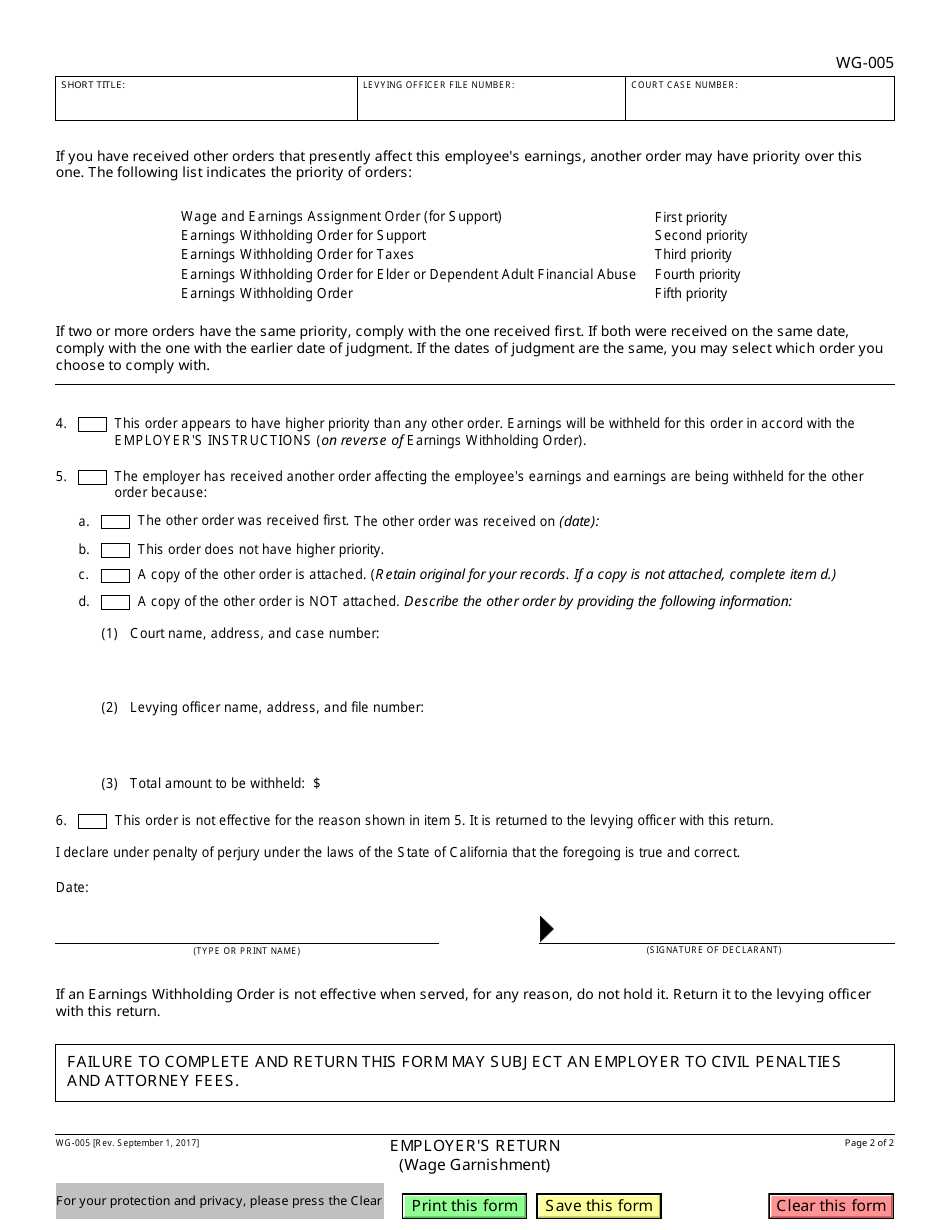

Form WG-005 Employer's Return (Wage Garnishment) - California

What Is Form WG-005?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WG-005?

A: Form WG-005 is the Employer's Return (Wage Garnishment) form in California.

Q: Who should use Form WG-005?

A: Employers in California should use Form WG-005 when they need to report wages withheld for a wage garnishment.

Q: What is a wage garnishment?

A: A wage garnishment is a legal process where a portion of an employee's earnings are withheld by their employer to pay off a debt.

Q: When should Form WG-005 be filled out?

A: Form WG-005 should be filled out and submitted within 15 days of the payday for which the wages were withheld.

Q: What information is required on Form WG-005?

A: Form WG-005 requires information such as the employer's name, address, and EIN, as well as details about the employee and the wage garnishment order.

Q: Are there any penalties for not submitting Form WG-005?

A: Yes, failure to timely submit Form WG-005 may result in penalties imposed by the EDD.

Q: Can Form WG-005 be submitted electronically?

A: Yes, Form WG-005 can be submitted electronically through the EDD's e-Services for Business.

Q: Is there a fee for submitting Form WG-005?

A: No, there is no fee for submitting Form WG-005.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WG-005 by clicking the link below or browse more documents and templates provided by the California Superior Court.