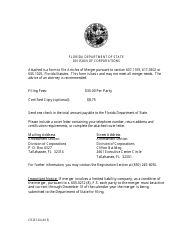

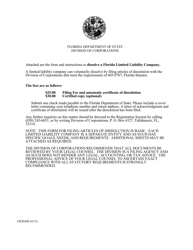

Form CR2E080 Articles of Merger for Florida Limited Liability Company - Florida

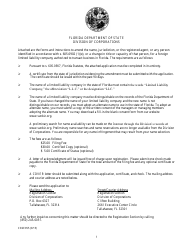

What Is Form CR2E080?

This is a legal form that was released by the Florida Department of State (Secretary of State) - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Articles of Merger?

A: Articles of Merger is a legal document used to combine two or more companies into one.

Q: What is a Limited Liability Company (LLC)?

A: An LLC is a type of business structure that offers limited liability protection to its owners and combines the flexibility of a partnership with the liability protection of a corporation.

Q: What does the term 'merger' mean?

A: A merger refers to the consolidation of two or more companies into a single entity.

Q: What is the purpose of filing Articles of Merger?

A: The purpose of filing Articles of Merger is to make the merger between two companies legally valid.

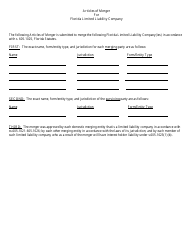

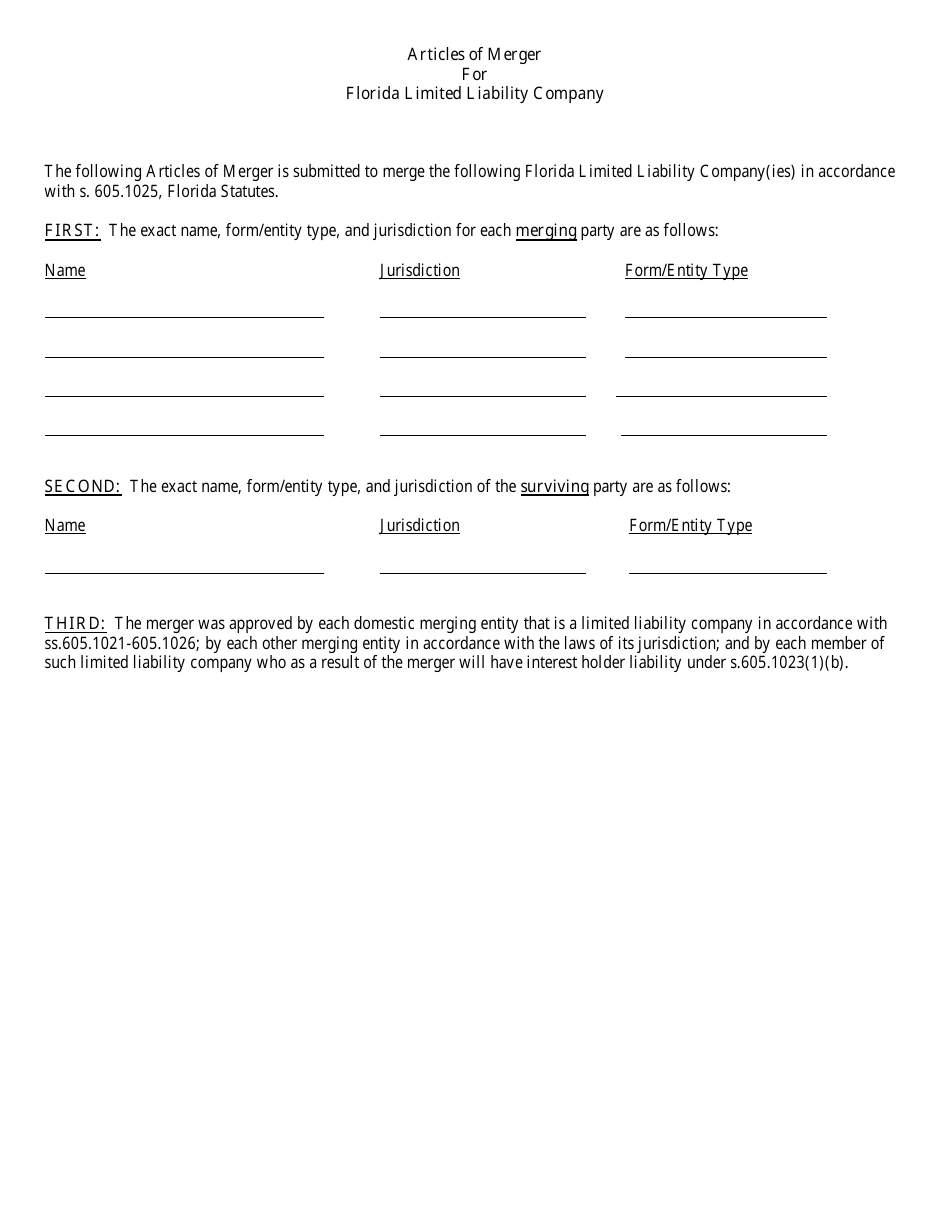

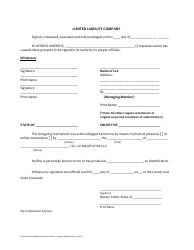

Q: What information is required in Articles of Merger?

A: The required information typically includes the names and addresses of the merging companies, the effective date of the merger, and any changes to the company's name or structure.

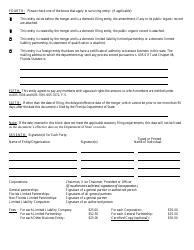

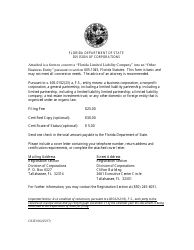

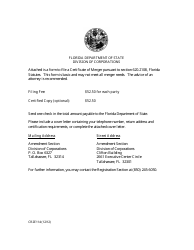

Q: Are there any fees associated with filing Articles of Merger?

A: Yes, there are usually filing fees associated with the submission of Articles of Merger. The specific fee amount can vary depending on the state and the type of business entity.

Q: Is it necessary to hire a lawyer to file Articles of Merger?

A: While not mandatory, it is recommended to seek legal counsel or assistance when filing Articles of Merger to ensure compliance with all applicable laws and regulations.

Q: Can an LLC merge with another type of business entity?

A: Yes, an LLC can merge with another type of business entity, such as a corporation or a partnership.

Q: Are there any tax implications of a merger?

A: Yes, there may be tax implications associated with a merger. It is advisable to consult with a tax professional or accountant to fully understand the tax consequences of a merger.

Q: Can I cancel a filed Articles of Merger?

A: In most cases, it is not possible to cancel a filed Articles of Merger. Once the merger has been completed, it is considered legally binding.

Q: Is there a time limit for filing Articles of Merger?

A: While there may not be a specific time limit, it is generally advisable to file Articles of Merger within a reasonable timeframe after the merger has been approved by all parties involved.

Q: Do I need to notify creditors and other stakeholders about the merger?

A: Yes, it is important to provide notice of the merger to creditors, shareholders, and other stakeholders to ensure transparency and compliance with legal requirements.

Q: Can I complete the merger process without filing Articles of Merger?

A: No, in order for the merger to be legally recognized, the required documents, such as Articles of Merger, must be filed with the appropriate government authorities.

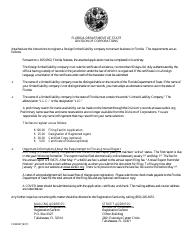

Q: What happens after I file Articles of Merger?

A: Once the Articles of Merger are filed and approved, the merger becomes official and the companies involved are considered to be a single legal entity.

Q: Can the name of the merged company be changed during the merger process?

A: Yes, the name of the merged company can be changed during the merger process, but this change must be reflected in the Articles of Merger.

Q: Is a resolution or approval from the shareholders required for the merger?

A: Yes, typically a resolution or approval from the shareholders of each merging company is required for the merger to proceed.

Q: Can an LLC merger result in the creation of a new company?

A: Yes, an LLC merger can result in the creation of a new company with a new name and structure.

Q: What happens to the assets and liabilities of the merging companies after the merger?

A: The assets and liabilities of the merging companies are combined and transferred to the new or surviving company as part of the merger process.

Form Details:

- Released on April 1, 2015;

- The latest edition provided by the Florida Department of State (Secretary of State);

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR2E080 by clicking the link below or browse more documents and templates provided by the Florida Department of State (Secretary of State).