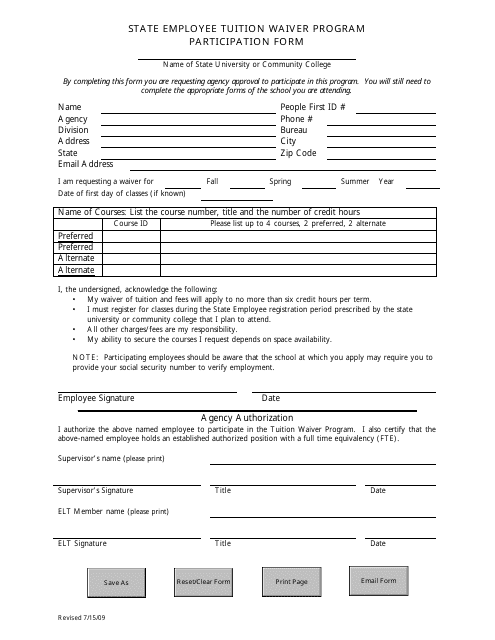

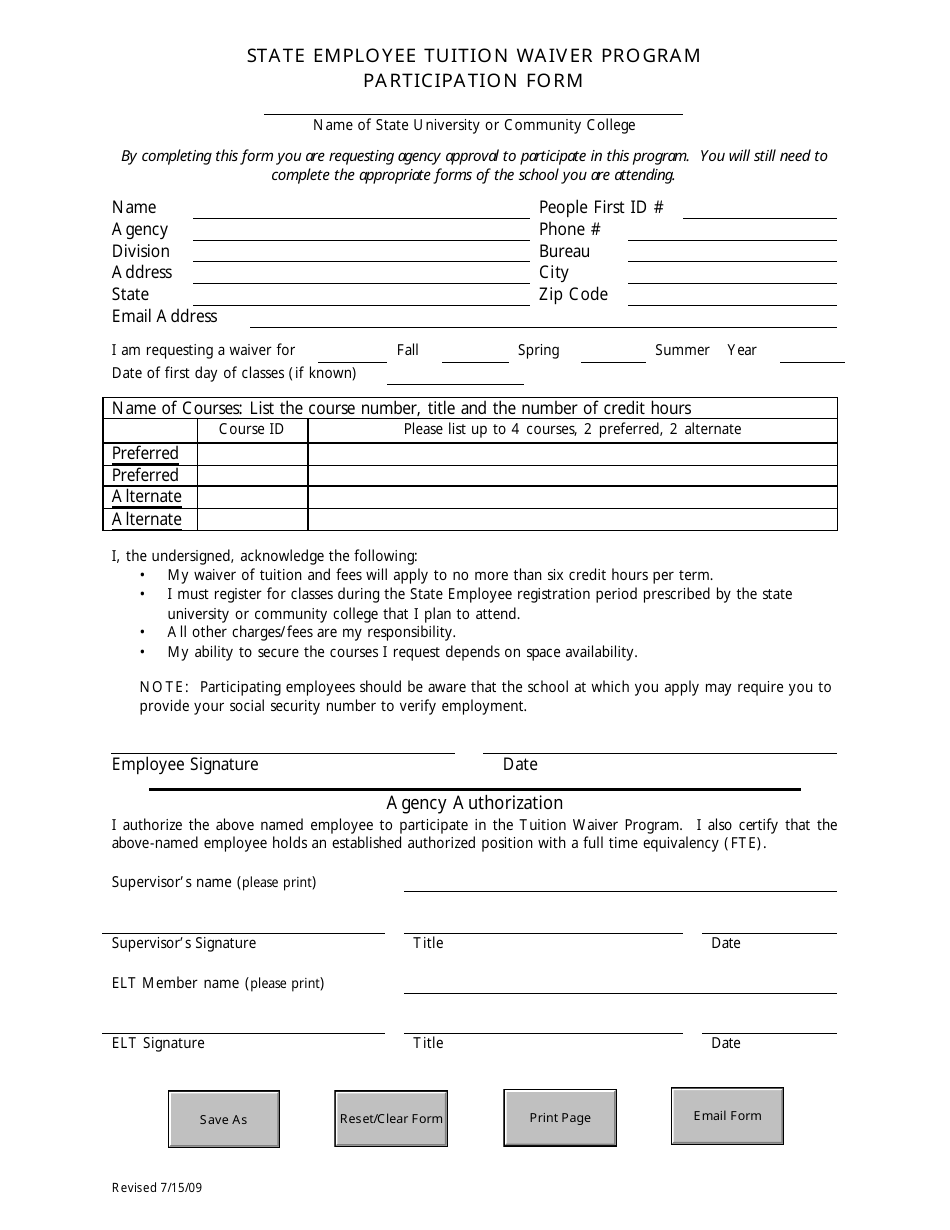

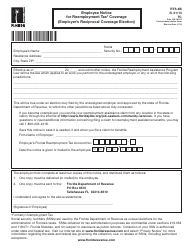

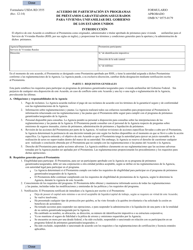

State Employee Tuition Waiver Program Participation Form - Florida

State Employee Program Participation Form is a legal document that was released by the Florida Department of Management Services - a government authority operating within Florida.

FAQ

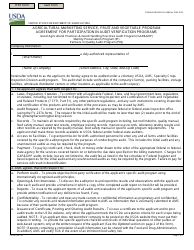

Q: What is the State Employee Tuition Waiver Program?

A: The State Employee Tuition Waiver Program is a program in Florida that allows eligible state employees to waive tuition fees for certain courses at participating public colleges or universities.

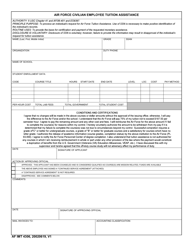

Q: Who is eligible for the State Employee Tuition Waiver Program?

A: Eligibility for the State Employee Tuition Waiver Program depends on the specific policies of each participating institution, but generally, full-time and part-time state employees are eligible.

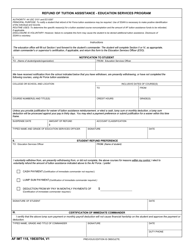

Q: What does the State Employee Tuition Waiver Program cover?

A: The State Employee Tuition Waiver Program usually covers tuition fees for up to six credit hours per term or semester. However, the specific details may vary depending on the institution.

Q: How can I apply for the State Employee Tuition Waiver Program?

A: To apply for the State Employee Tuition Waiver Program, you typically need to complete a participation form. Contact your institution's human resources department or relevant office for more information and instructions.

Q: Can I use the State Employee Tuition Waiver for graduate courses?

A: In most cases, the State Employee Tuition Waiver Program can be used for undergraduate and graduate courses, but this may vary depending on the institution's policies.

Q: Are there any restrictions or limitations to the program?

A: Each participating institution may have its own specific restrictions and limitations regarding the State Employee Tuition Waiver Program. It's best to contact the institution directly for detailed information.

Q: Can the State Employee Tuition Waiver be used for professional development courses?

A: The State Employee Tuition Waiver Program is generally intended for job-related coursework, so it may be applicable to certain professional development courses. However, it's important to review the policies of the participating institution.

Q: Is the State Employee Tuition Waiver taxable income?

A: According to the Internal Revenue Service (IRS), the State Employee Tuition Waiver Program is considered taxable income if the total amount waived exceeds $5,250 in a calendar year. You may need to consult with a tax advisor for more specific information.

Form Details:

- Released on July 15, 2009;

- The latest edition currently provided by the Florida Department of Management Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Florida Department of Management Services.