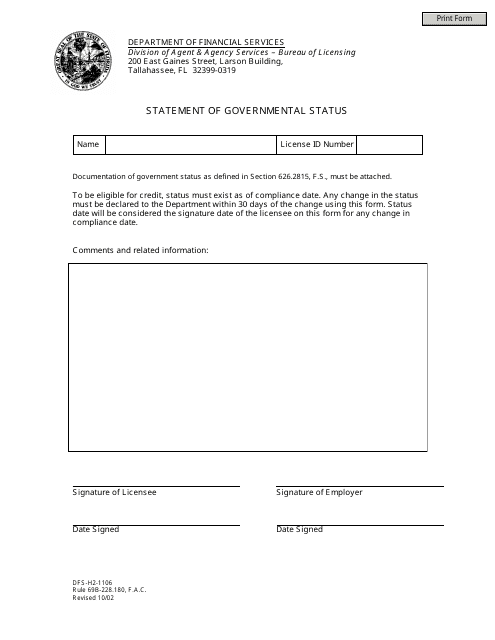

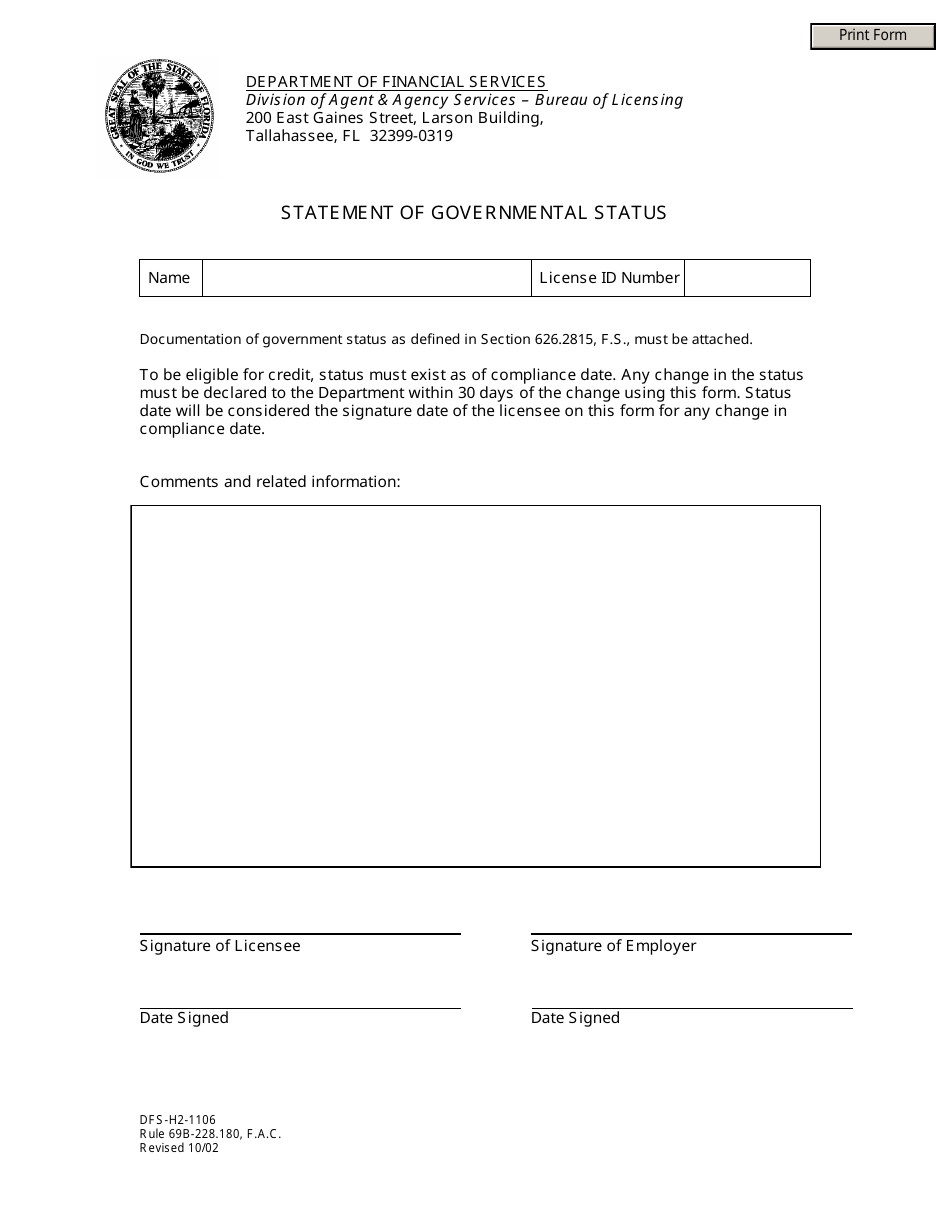

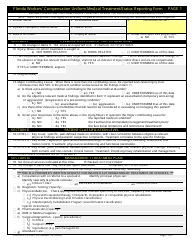

Form DFS-H2-1106 Statement of Governmental Status - Florida

What Is Form DFS-H2-1106?

This is a legal form that was released by the Florida Department of Financial Services - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DFS-H2-1106 Statement of Governmental Status?

A: The DFS-H2-1106 is a form used in Florida to demonstrate the governmental status of an organization.

Q: Why is the DFS-H2-1106 Statement of Governmental Status necessary?

A: This form is necessary to establish the tax-exempt status of an organization and determine if it qualifies for certain government benefits and exemptions.

Q: Who needs to file the DFS-H2-1106 Statement of Governmental Status?

A: Non-profit organizations and government agencies in Florida need to file this form to prove their governmental status.

Q: What information is required on the DFS-H2-1106 Statement of Governmental Status form?

A: The form asks for basic information about the organization, its purpose, governing documents, and financial activities.

Q: Are there any fees associated with filing the DFS-H2-1106 Statement of Governmental Status?

A: There is no fee required for filing this form.

Q: What are the consequences of not filing the DFS-H2-1106 Statement of Governmental Status?

A: Failure to file this form may result in the loss of tax-exempt status and the inability to claim government benefits and exemptions.

Q: Is the DFS-H2-1106 Statement of Governmental Status specific to Florida?

A: Yes, this form is specific to organizations operating in the state of Florida.

Q: How often do I need to file the DFS-H2-1106 Statement of Governmental Status?

A: The form needs to be filed every year to maintain the organization's governmental status.

Form Details:

- Released on October 1, 2002;

- The latest edition provided by the Florida Department of Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DFS-H2-1106 by clicking the link below or browse more documents and templates provided by the Florida Department of Financial Services.