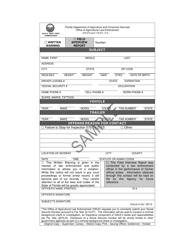

This version of the form is not currently in use and is provided for reference only. Download this version of

Form FDACS-03524

for the current year.

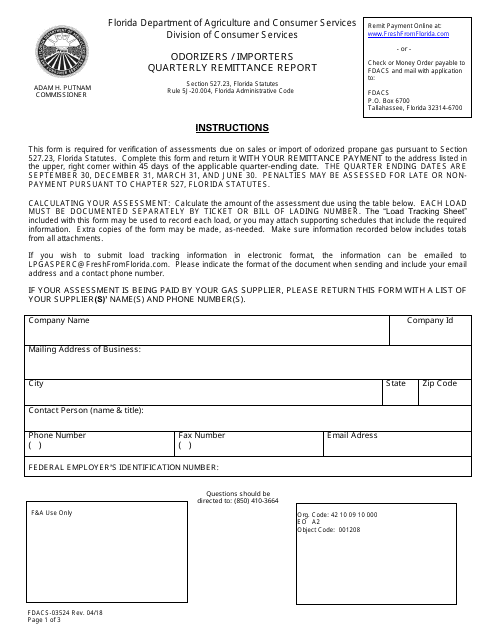

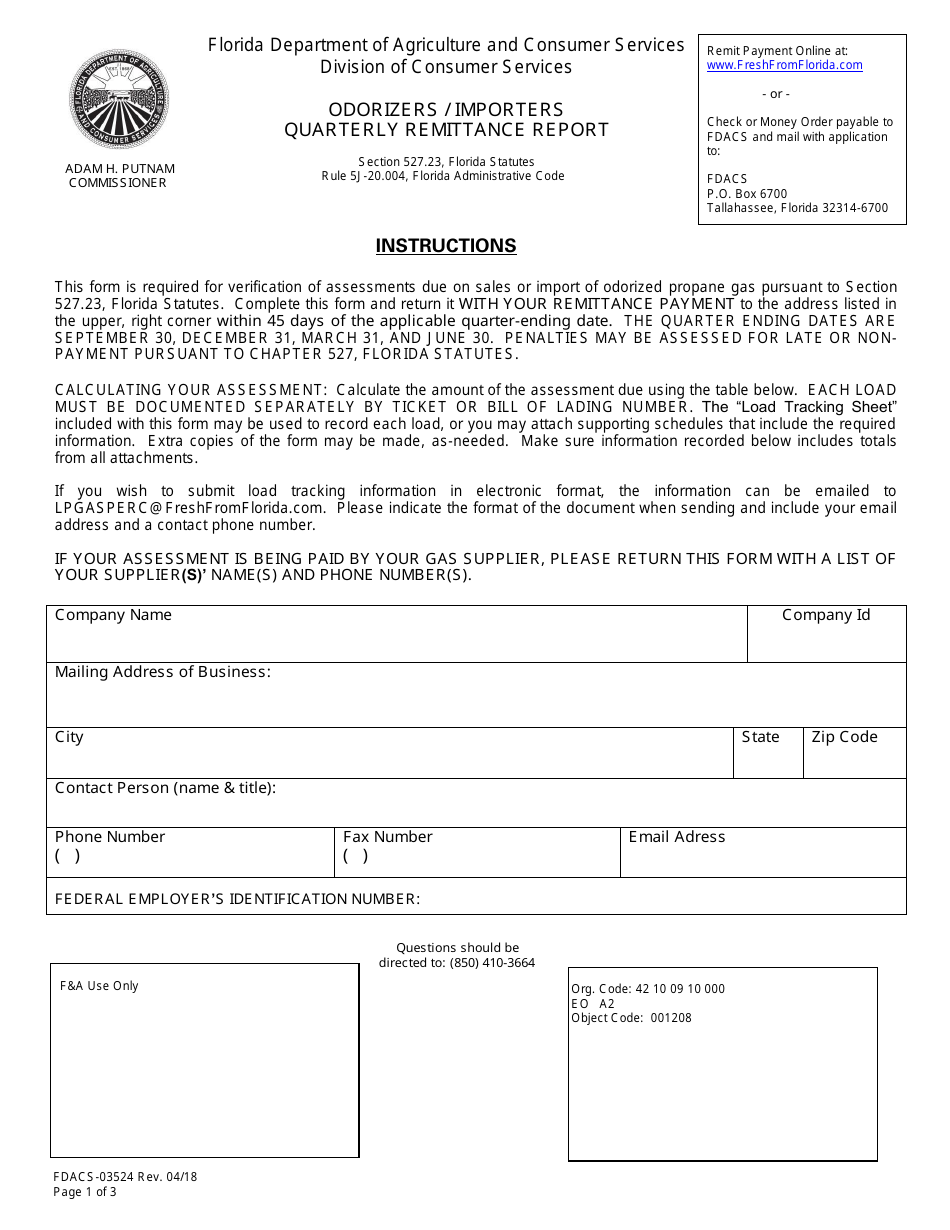

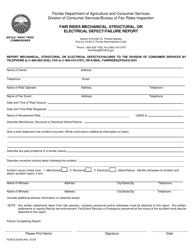

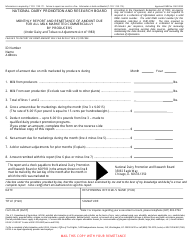

Form FDACS-03524 Odorizers / Importers Quarterly Remittance Report - Florida

What Is Form FDACS-03524?

This is a legal form that was released by the Florida Department of Agriculture and Consumer Services - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FDACS-03524?

A: Form FDACS-03524 is the Odorizers / Importers Quarterly Remittance Report for the state of Florida.

Q: Who needs to file Form FDACS-03524?

A: Odorizers and importers operating in Florida are required to file Form FDACS-03524.

Q: What is the purpose of Form FDACS-03524?

A: The purpose of Form FDACS-03524 is to report and remit taxes on odorizers and imported products in Florida.

Q: How often should Form FDACS-03524 be filed?

A: Form FDACS-03524 should be filed on a quarterly basis.

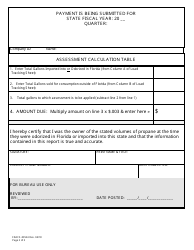

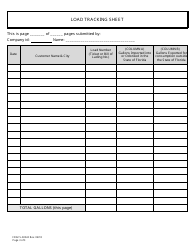

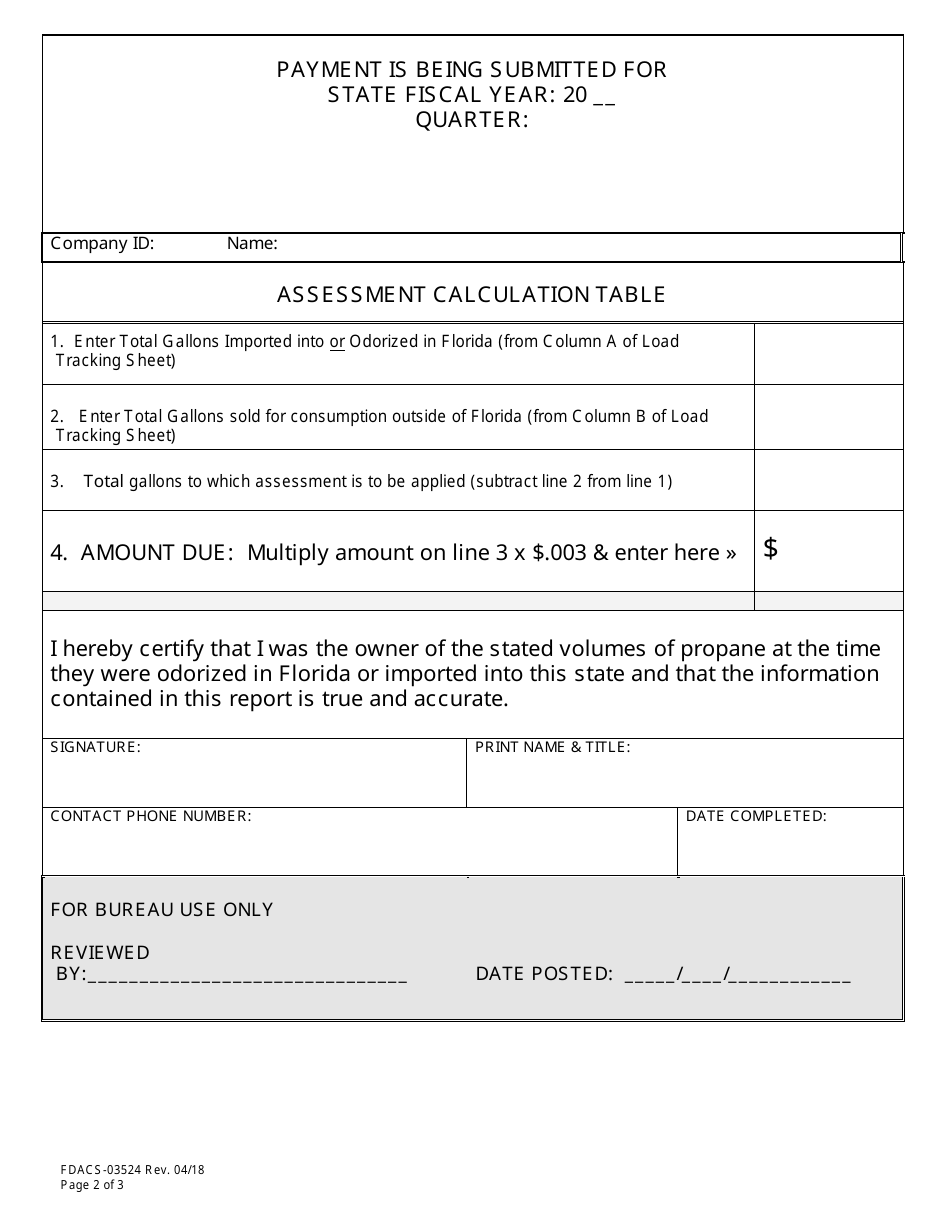

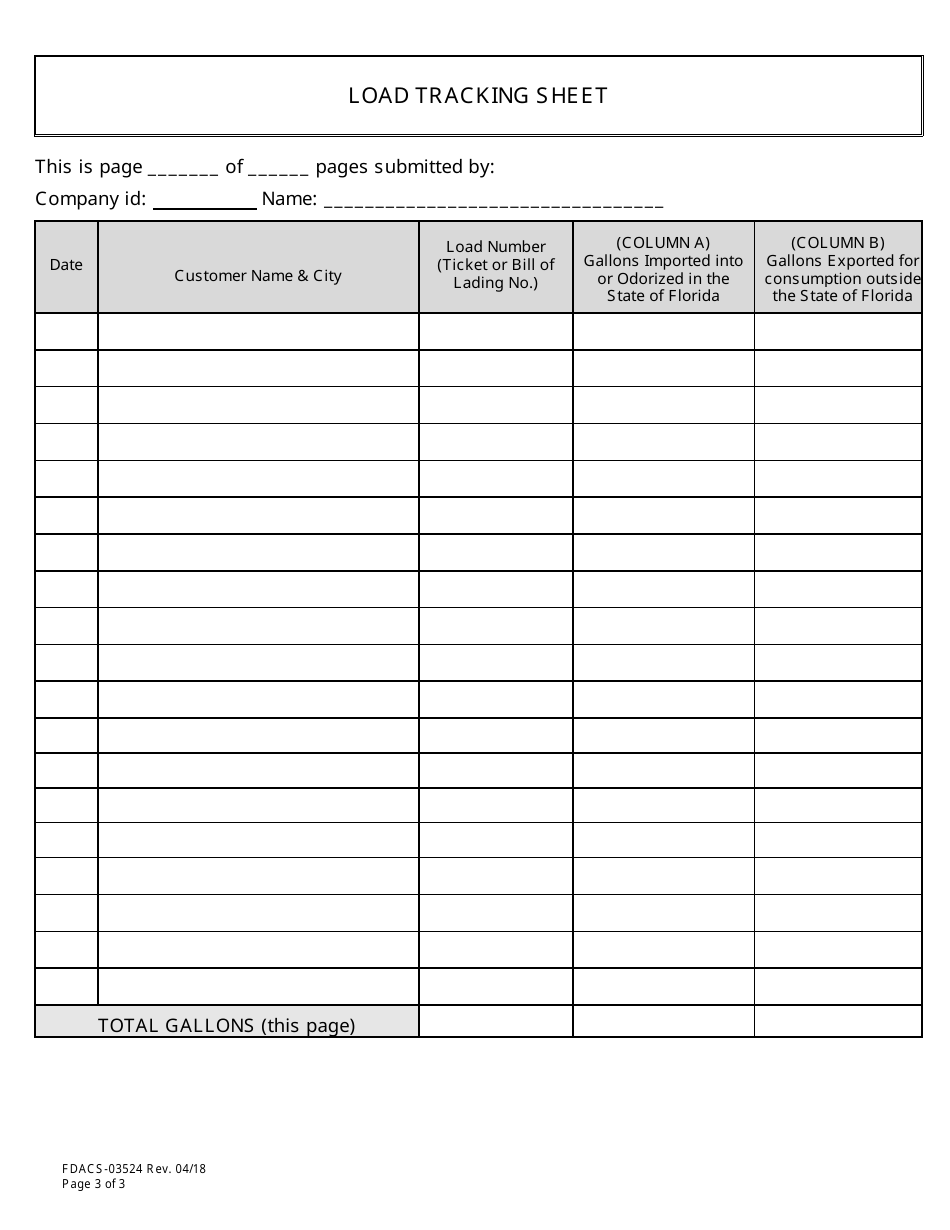

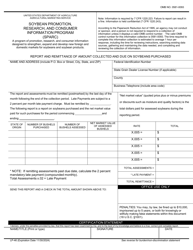

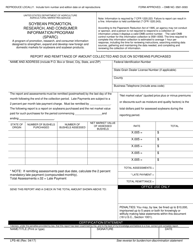

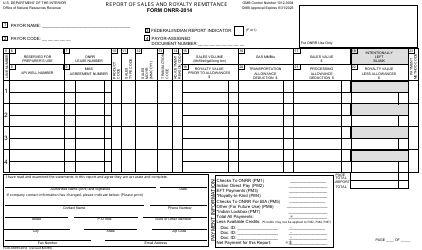

Q: What information is required on Form FDACS-03524?

A: Form FDACS-03524 requires information such as sales and volume data, tax calculations, and remittance details.

Q: Are there any penalties for not filing Form FDACS-03524?

A: Yes, there may be penalties for failing to file or late filing of Form FDACS-03524. It is important to submit the form accurately and within the specified timeframe.

Q: Is Form FDACS-03524 specific to odorizers and importers only?

A: Yes, Form FDACS-03524 is specifically for odorizers and importers in Florida. Other businesses may have different tax filing requirements.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Florida Department of Agriculture and Consumer Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FDACS-03524 by clicking the link below or browse more documents and templates provided by the Florida Department of Agriculture and Consumer Services.