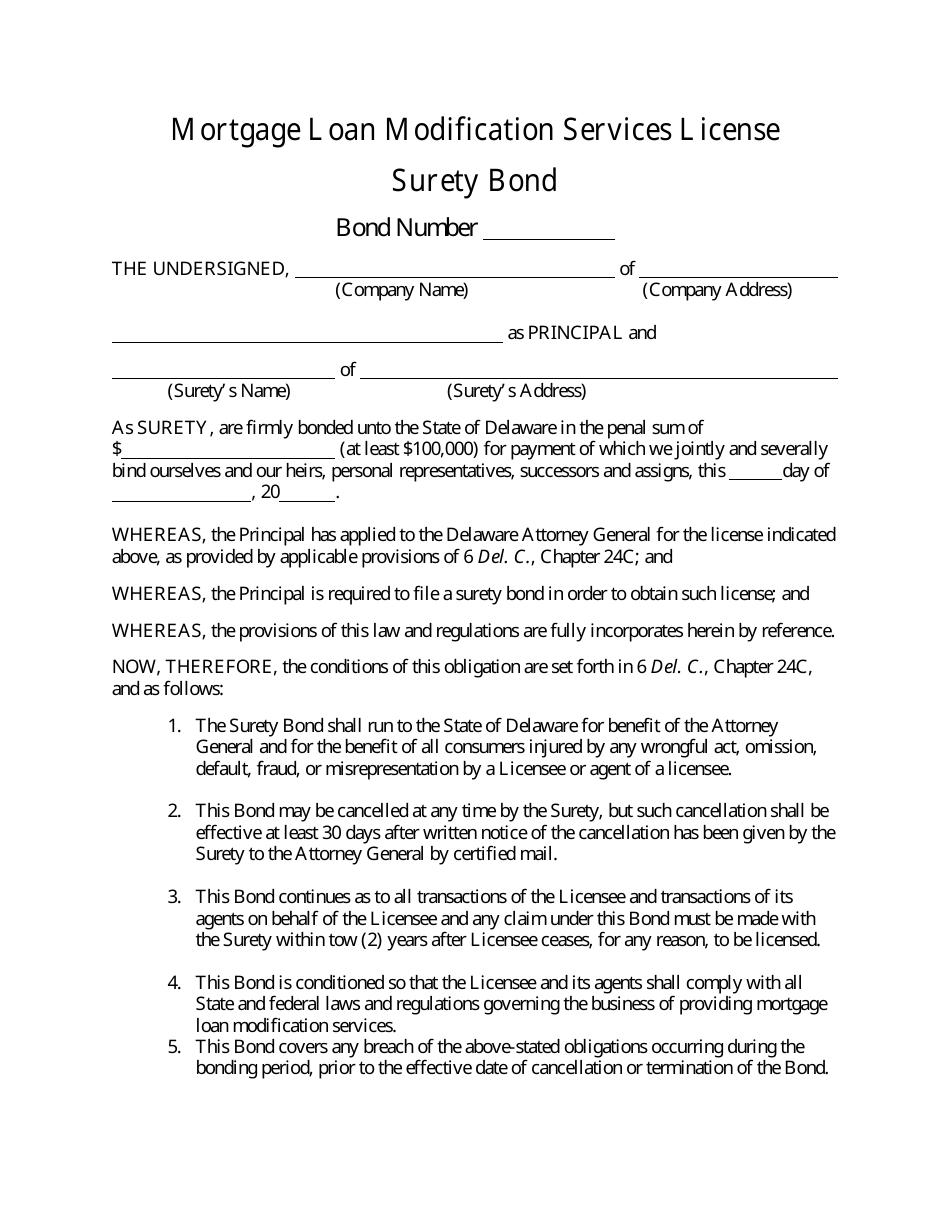

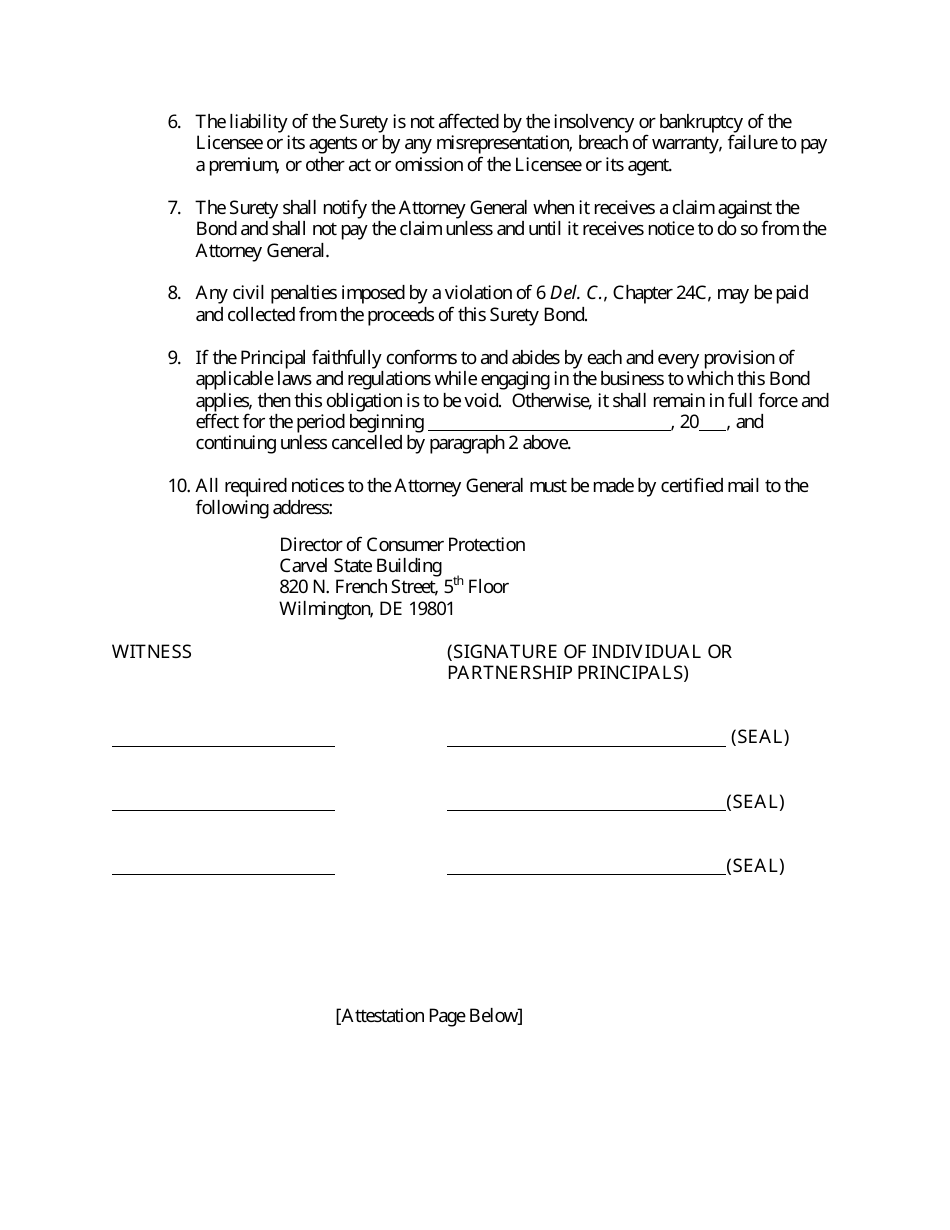

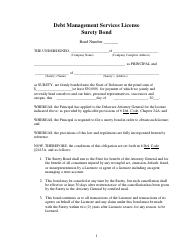

Mortgage Loan Modification Services License Surety Bond - Delaware

Mortgage Loan Modification Services License Surety Bond is a legal document that was released by the Delaware Department of Justice - a government authority operating within Delaware.

FAQ

Q: What is a Mortgage Loan Modification Services License Surety Bond?

A: A Mortgage Loan Modification Services License Surety Bond is a type of insurance that ensures that mortgage loan modification service providers in Delaware adhere to the regulations and protect the interest of consumers.

Q: Why is a Mortgage Loan Modification Services License Surety Bond required?

A: The bond is required to protect consumers from potential financial harm resulting from unethical or fraudulent practices by mortgage loan modification service providers.

Q: Who needs a Mortgage Loan Modification Services License Surety Bond?

A: Any company or individual offering mortgage loan modification services in Delaware needs to obtain this bond as a requirement for licensure.

Q: What does the Mortgage Loan Modification Services License Surety Bond cover?

A: The bond covers potential damages caused by unethical or fraudulent practices of mortgage loan modification service providers, up to the bond amount.

Q: How much does a Mortgage Loan Modification Services License Surety Bond cost?

A: The cost of the bond may vary depending on various factors, such as the desired bond amount, the financial history of the bond applicant, and the bonding company's underwriting criteria.

Form Details:

- The latest edition currently provided by the Delaware Department of Justice;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of Justice.