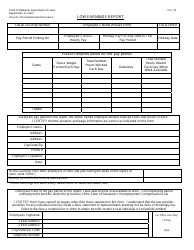

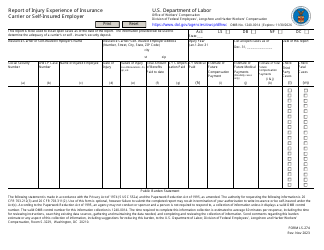

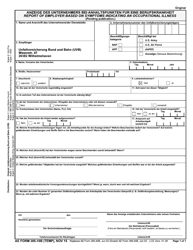

Form UC-8 Employer's Quarterly Report Forms - Delaware

What Is Form UC-8?

This is a legal form that was released by the Delaware Department of Labor - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is UC-8 Employer's Quarterly Report Form?

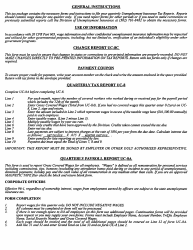

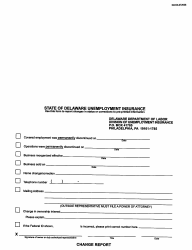

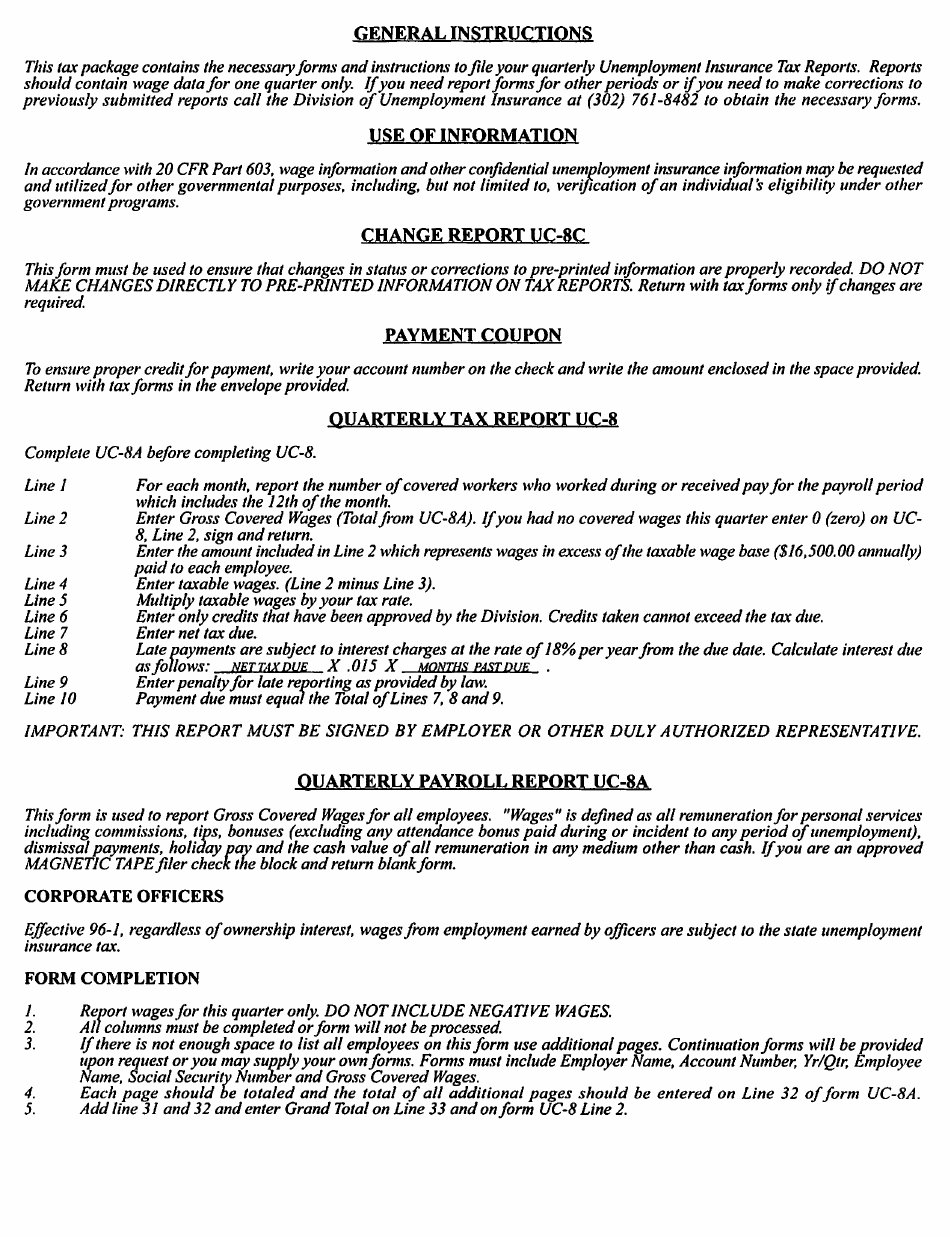

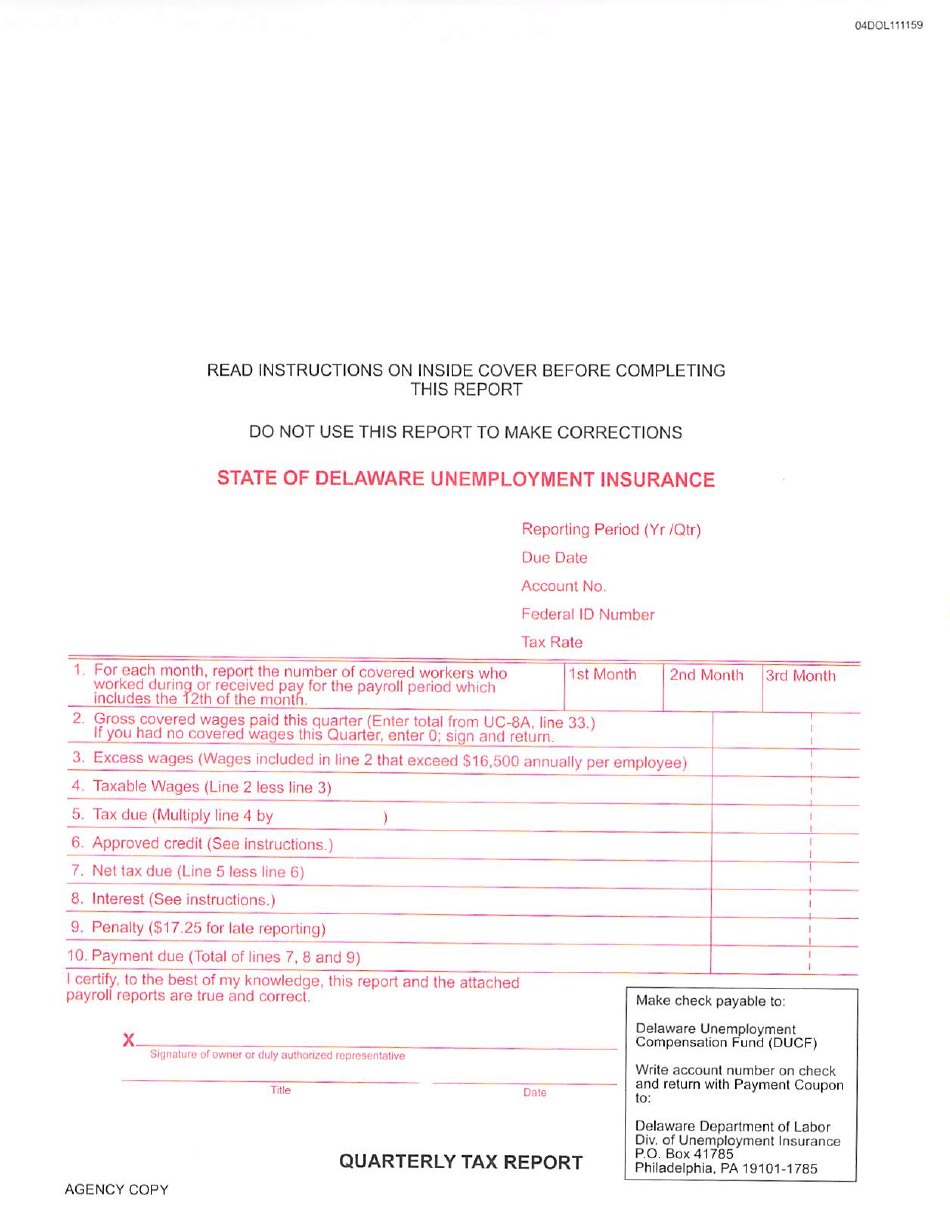

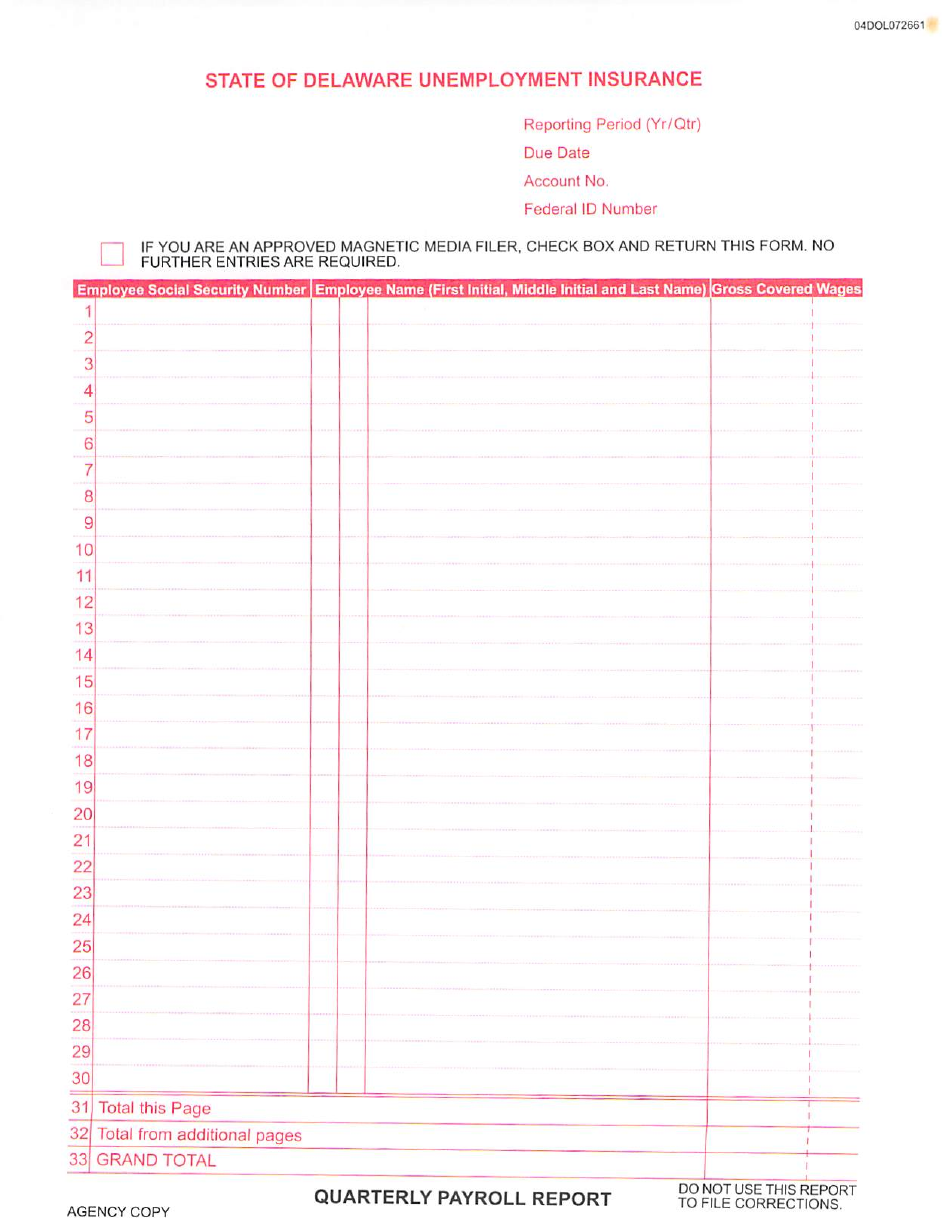

A: UC-8 Employer's Quarterly Report Form is a form used by employers in Delaware to report their quarterly wages and pay the required unemployment insurance tax.

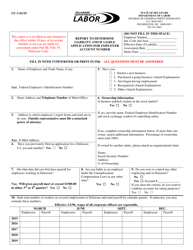

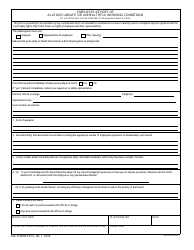

Q: Who needs to file UC-8 Employer's Quarterly Report Form?

A: All employers in Delaware who have paid wages in the previous quarter must file the UC-8 Employer's Quarterly Report Form.

Q: When is the deadline for filing UC-8 Employer's Quarterly Report Form?

A: The UC-8 Employer's Quarterly Report Form must be filed by the last day of the month following the end of the quarter. For example, the form for the first quarter (January-March) must be filed by April 30th.

Q: What information is required on UC-8 Employer's Quarterly Report Form?

A: The form requires information such as the employer's name, address, federal employer identification number (FEIN), total wages paid in the quarter, and the amount of unemployment insurance tax due.

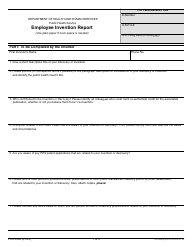

Q: What happens if I don't file UC-8 Employer's Quarterly Report Form?

A: Failure to file the UC-8 Employer's Quarterly Report Form or pay the required unemployment insurance tax may result in penalties and interest charges.

Q: Are there any exemptions from filing UC-8 Employer's Quarterly Report Form?

A: Some employers, such as certain nonprofit organizations and government entities, may be exempt from filing UC-8 Employer's Quarterly Report Form. It is recommended to check with the Delaware Department of Labor for specific exemption criteria.

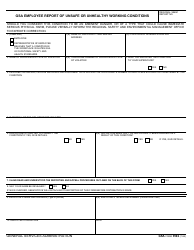

Form Details:

- The latest edition provided by the Delaware Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

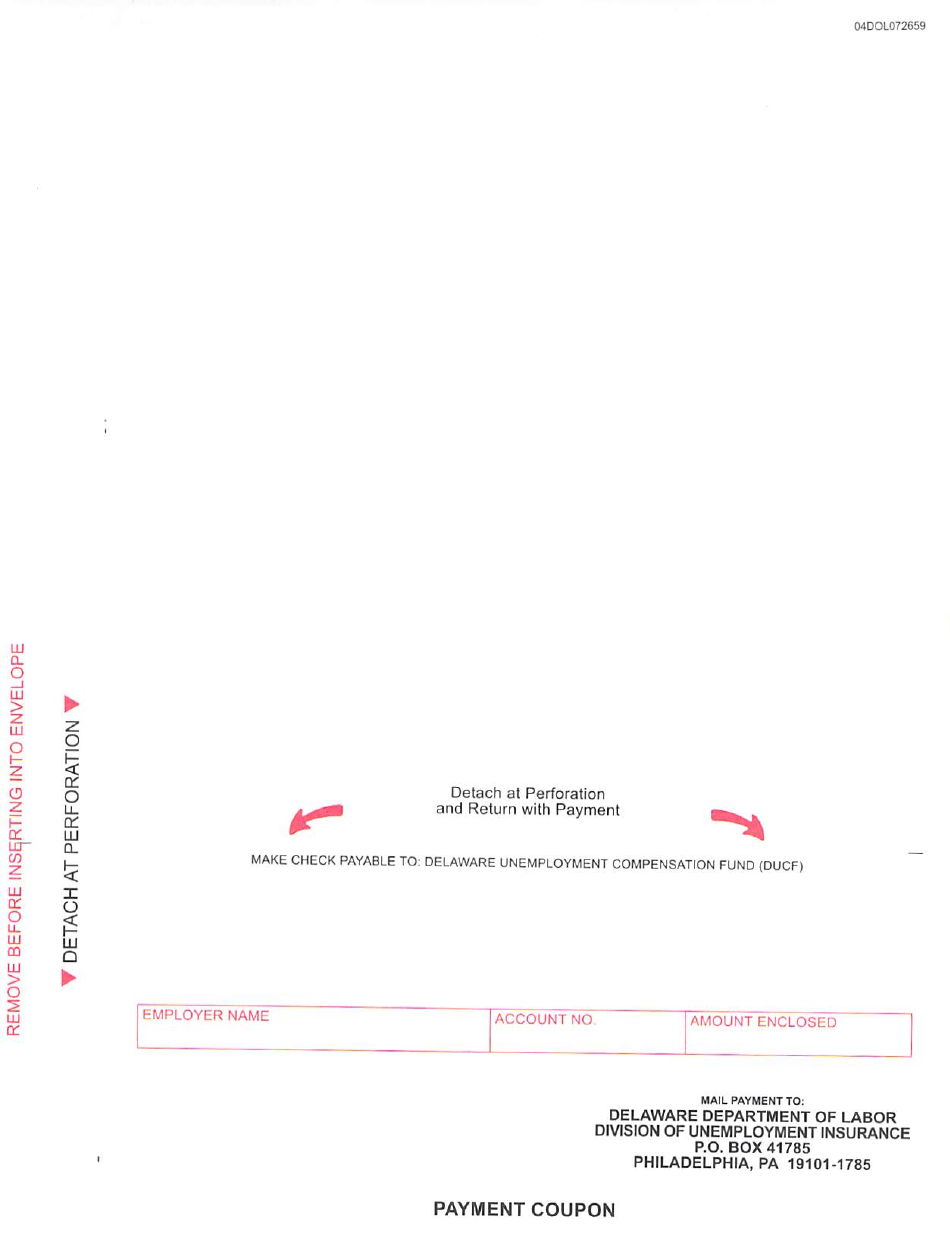

Download a printable version of Form UC-8 by clicking the link below or browse more documents and templates provided by the Delaware Department of Labor.