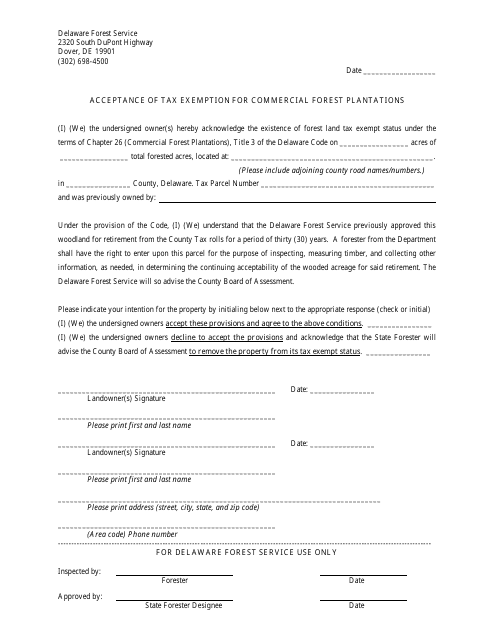

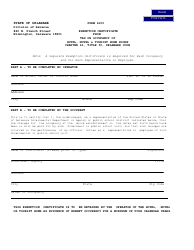

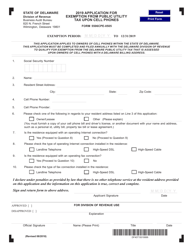

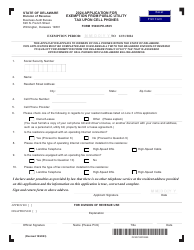

Acceptance of Tax Exemption for Commercial Forest Plantations - Delaware

Acceptance of Tax Exemption for Commercial Forest Plantations is a legal document that was released by the Delaware Department of Agriculture - a government authority operating within Delaware.

FAQ

Q: What is tax exemption for commercial forest plantations?

A: Tax exemption for commercial forest plantations is a policy that grants certain tax benefits to landowners who engage in forestry activities.

Q: What is the purpose of tax exemption for commercial forest plantations?

A: The purpose of tax exemption for commercial forest plantations is to incentivize the establishment and management of productive forests.

Q: How do landowners benefit from tax exemption for commercial forest plantations?

A: Landowners who meet the eligibility criteria for tax exemption can enjoy reduced property taxes and other financial incentives.

Q: Who is eligible for tax exemption for commercial forest plantations in Delaware?

A: In Delaware, landowners who have at least 10 acres of forestland and meet other requirements can apply for tax exemption.

Q: What are the requirements for tax exemption for commercial forest plantations in Delaware?

A: The requirements for tax exemption in Delaware include having a written forest management plan and actively engaging in forest management practices.

Q: Why does Delaware offer tax exemption for commercial forest plantations?

A: Delaware offers tax exemption for commercial forest plantations to promote sustainable forestry, wildlife habitat conservation, and soil and water quality improvement.

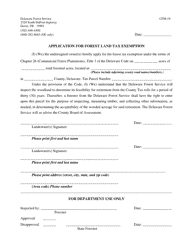

Q: How can landowners apply for tax exemption for commercial forest plantations in Delaware?

A: Landowners can apply for tax exemption by contacting the Delaware Forest Service and submitting the necessary documentation.

Q: Are there any restrictions or limitations for tax exemption for commercial forest plantations in Delaware?

A: Yes, there are certain restrictions and limitations, such as maintaining a minimum tree density, following best management practices, and refraining from non-forest uses of the land.

Q: What is the duration of the tax exemption for commercial forest plantations in Delaware?

A: The tax exemption for commercial forest plantations in Delaware is granted for a period of 10 years, with the possibility of renewal.

Form Details:

- The latest edition currently provided by the Delaware Department of Agriculture;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of Agriculture.