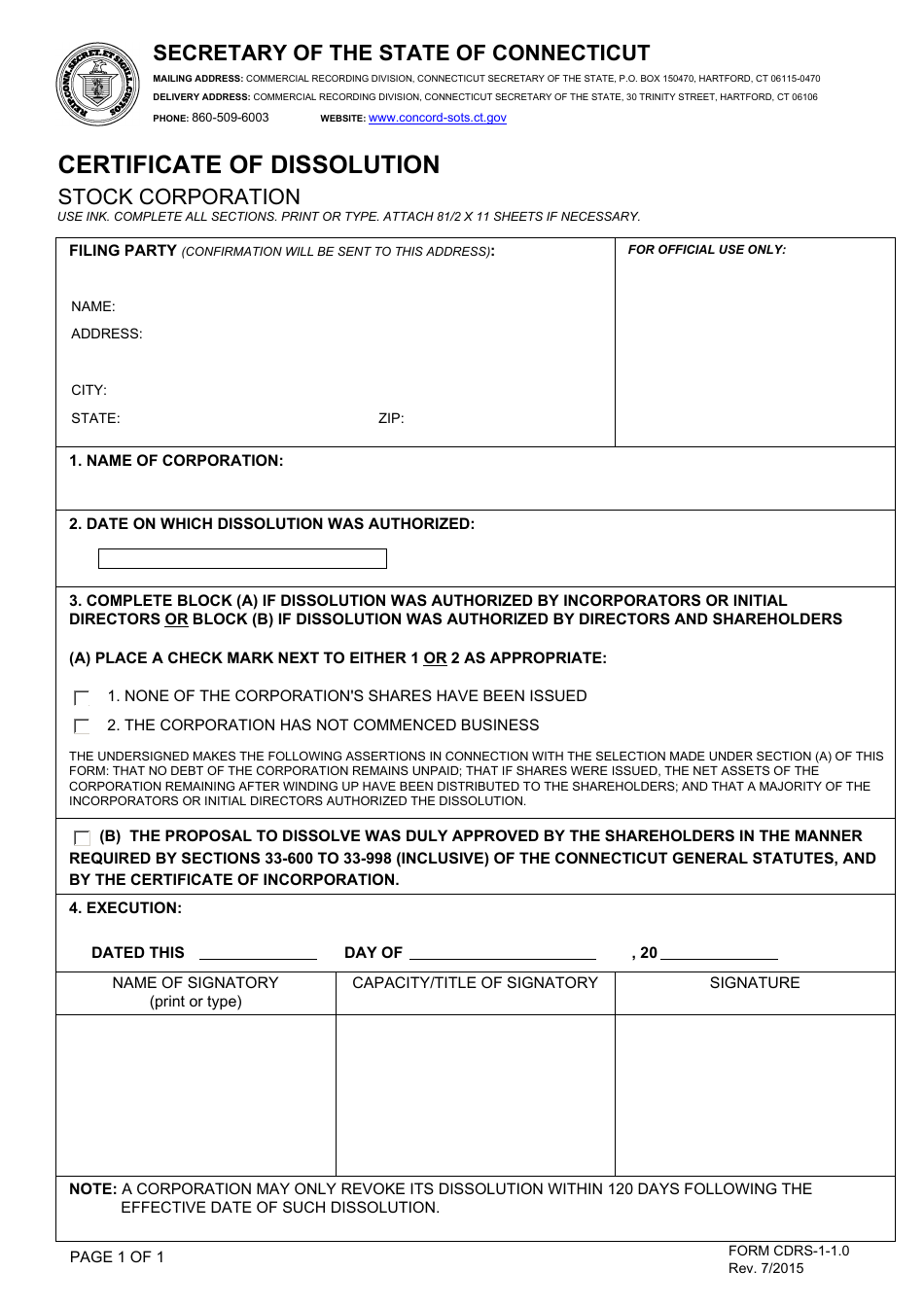

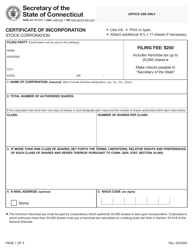

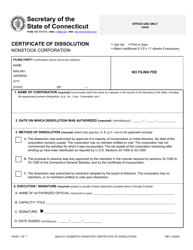

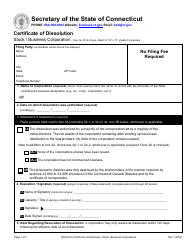

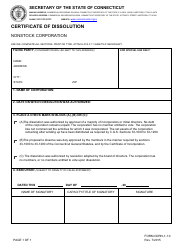

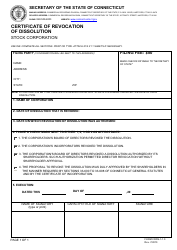

Form CDRS-1-1.0 Certificate of Dissolution - Stock Corporation - Connecticut

What Is Form CDRS-1-1.0?

This is a legal form that was released by the Connecticut Secretary of the State - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDRS-1-1.0?

A: Form CDRS-1-1.0 is the Certificate of Dissolution for a Stock Corporation in Connecticut.

Q: What is a Stock Corporation?

A: A stock corporation is a type of corporation where ownership is represented by shares of stock.

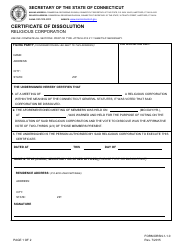

Q: What is a Certificate of Dissolution?

A: A Certificate of Dissolution is a legal document that officially terminates the existence of a corporation.

Q: Who needs to file Form CDRS-1-1.0?

A: Stock corporations in Connecticut that wish to dissolve their business need to file this form.

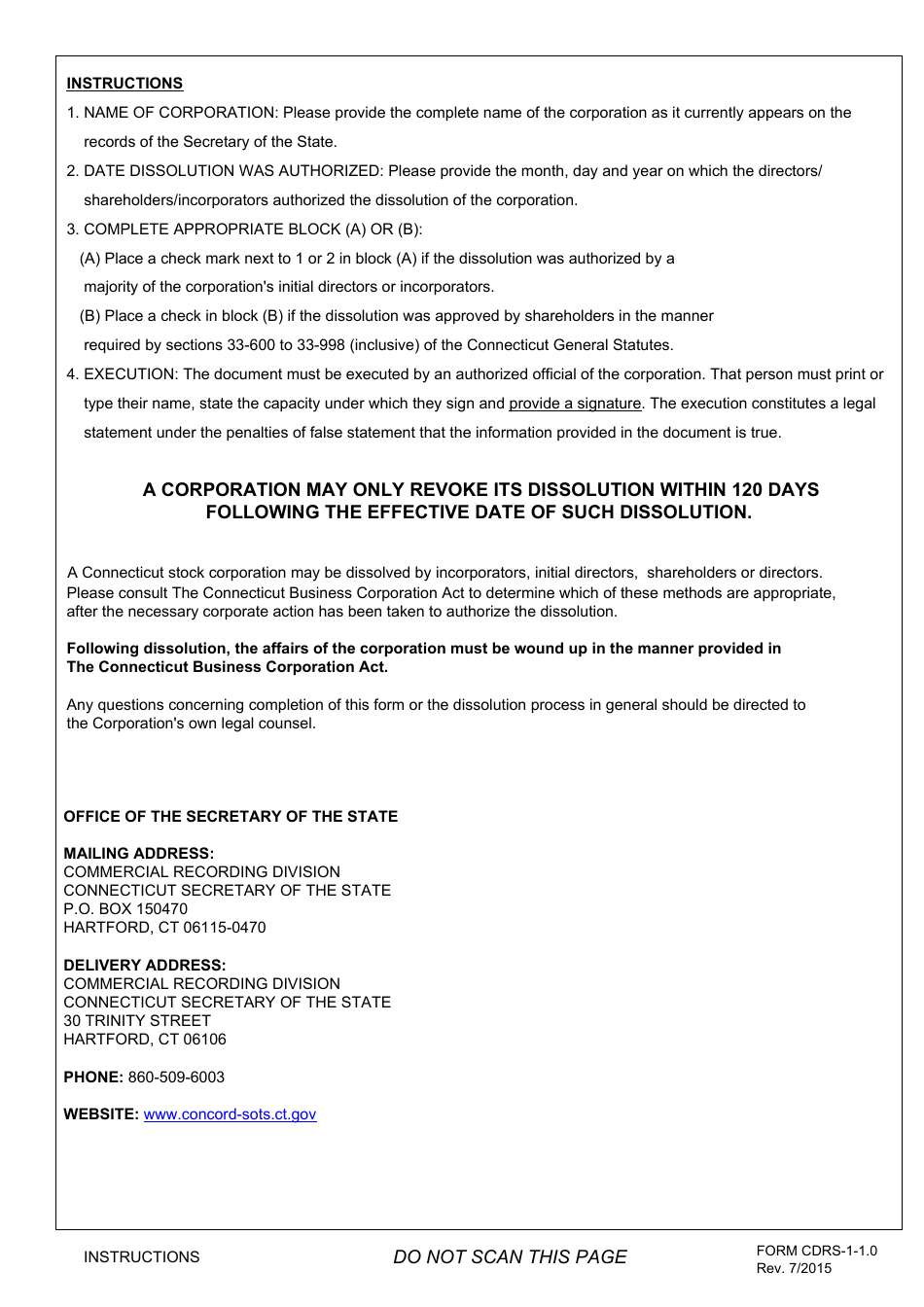

Q: What information is required on Form CDRS-1-1.0?

A: Form CDRS-1-1.0 requires information such as the corporation name, date of dissolution, and the signature of an authorized officer.

Q: Are there any fees associated with filing Form CDRS-1-1.0?

A: Yes, there is a filing fee for submitting Form CDRS-1-1.0, which is payable to the Connecticut Secretary of the State.

Q: What happens after filing Form CDRS-1-1.0?

A: After filing Form CDRS-1-1.0 and paying the applicable fee, the corporation's dissolution will be processed and officially recorded by the state.

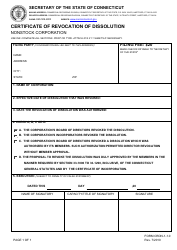

Q: Is it necessary to file Form CDRS-1-1.0 to dissolve a stock corporation?

A: Yes, filing Form CDRS-1-1.0 is necessary in Connecticut to officially dissolve a stock corporation.

Q: Can I dissolve my stock corporation without filing Form CDRS-1-1.0?

A: No, Form CDRS-1-1.0 must be filed to legally dissolve a stock corporation in Connecticut.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Connecticut Secretary of the State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDRS-1-1.0 by clicking the link below or browse more documents and templates provided by the Connecticut Secretary of the State.