This version of the form is not currently in use and is provided for reference only. Download this version of

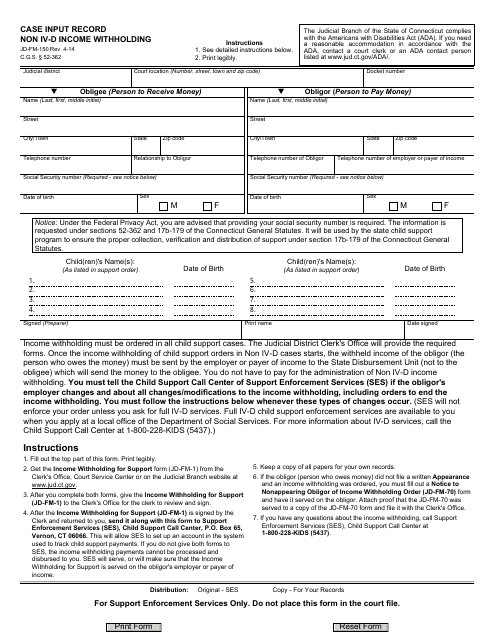

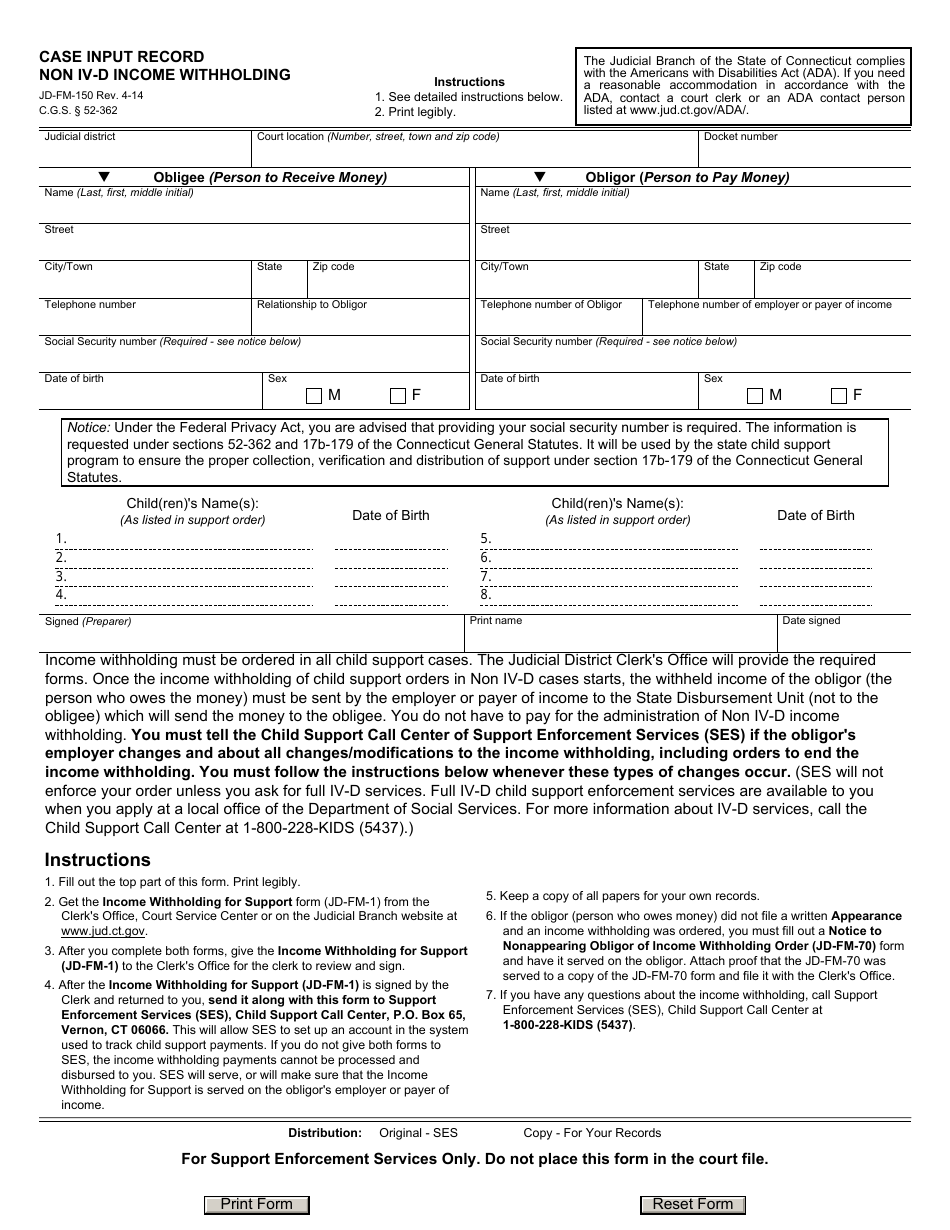

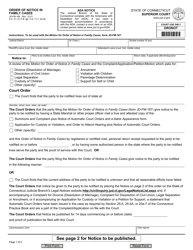

Form JD-FM-150

for the current year.

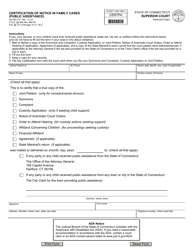

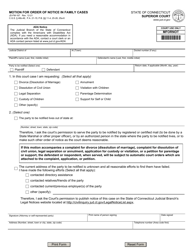

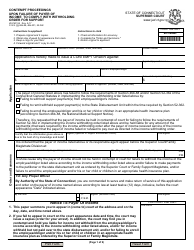

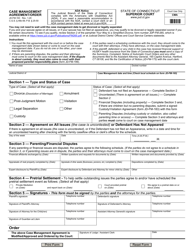

Form JD-FM-150 Case Input Record Non IV-D Income Withholding - Connecticut

What Is Form JD-FM-150?

This is a legal form that was released by the Connecticut Judicial Branch - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is JD-FM-150?

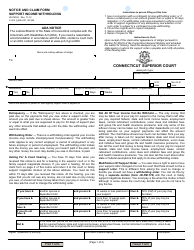

A: JD-FM-150 is a form used in Connecticut for recording non-IV-D income withholding in a child support case.

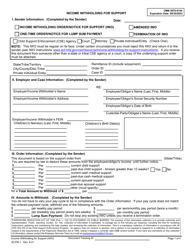

Q: What is non-IV-D income withholding?

A: Non-IV-D income withholding refers to the process by which income is withheld to fulfill child support obligations, outside of the IV-D program.

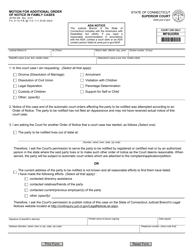

Q: Who uses JD-FM-150?

A: JD-FM-150 is used by individuals in Connecticut who are involved in a child support case and need to report non-IV-D income withholding.

Q: What information does JD-FM-150 require?

A: JD-FM-150 requires information about the payor's income, details of child support obligations, and information about the payor's employer.

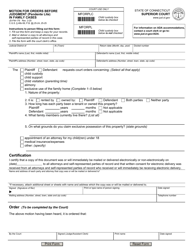

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Connecticut Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form JD-FM-150 by clicking the link below or browse more documents and templates provided by the Connecticut Judicial Branch.