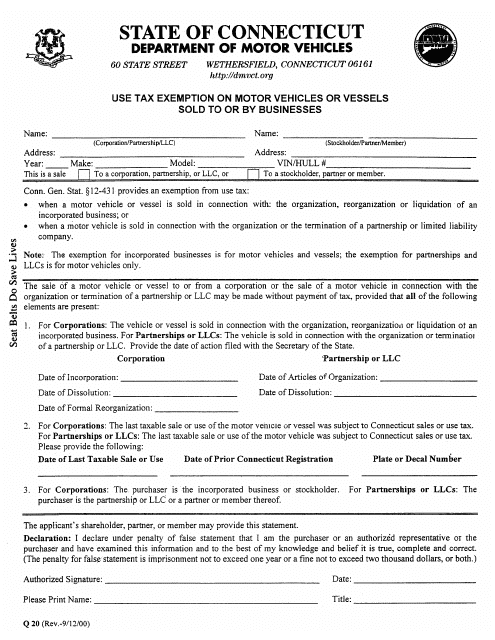

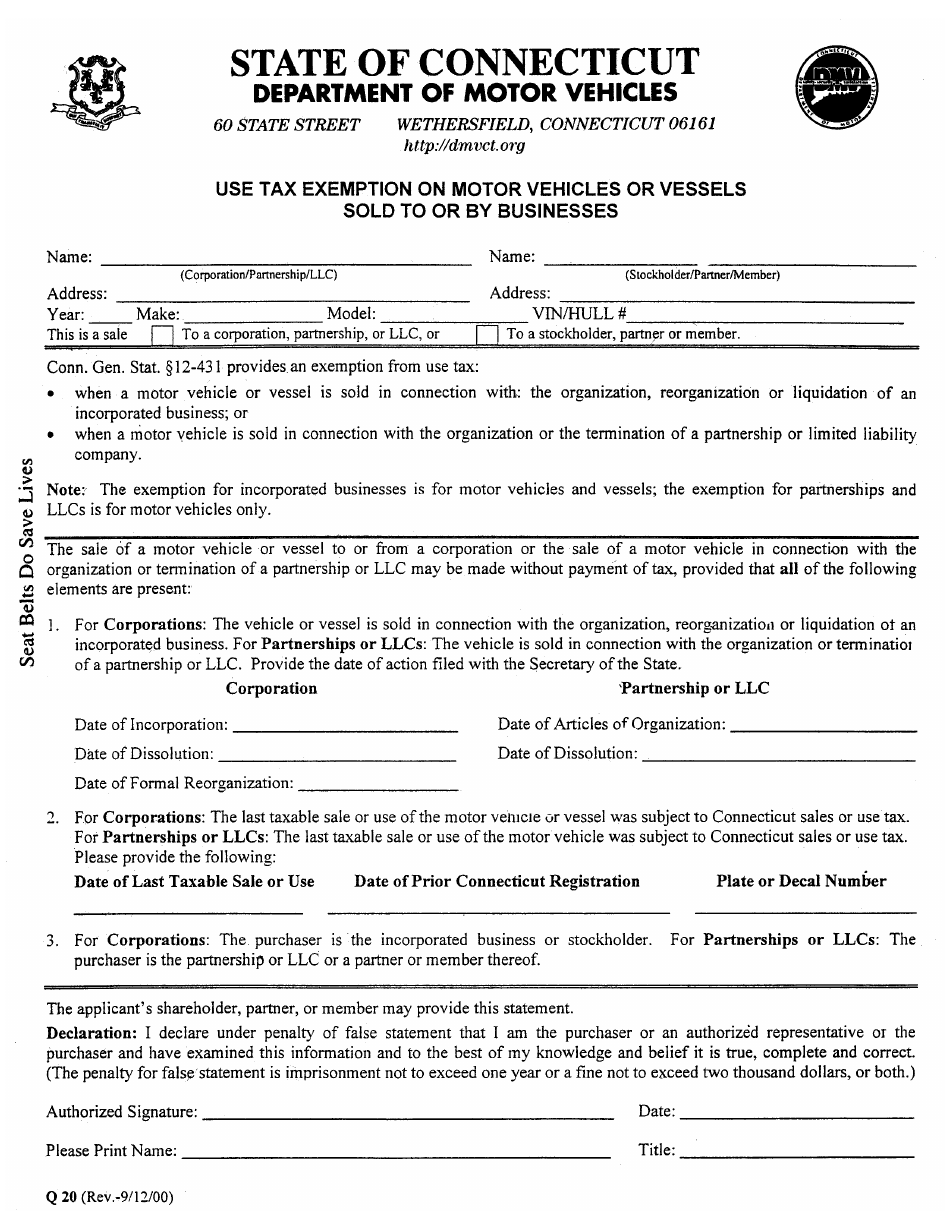

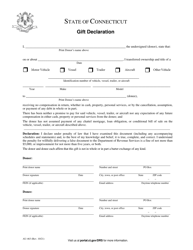

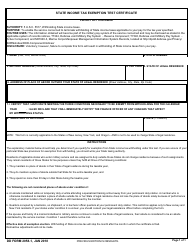

Form Q-20 Use Tax Exemption on Motor Vehicles or Vessels Sold to or by Businesses - Connecticut

What Is Form Q-20?

This is a legal form that was released by the Connecticut Department of Motor Vehicles - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form Q-20?

A: Form Q-20 is a form used in Connecticut to claim use tax exemption on motor vehicles or vessels sold to or by businesses.

Q: Who can use Form Q-20?

A: Businesses in Connecticut can use Form Q-20 to claim use tax exemption on motor vehicles or vessels.

Q: What is use tax?

A: Use tax is a tax on the use, consumption, or storage of tangible personal property in Connecticut.

Q: When should Form Q-20 be filed?

A: Form Q-20 should be filed within 30 days of the date of purchase or acquisition of the motor vehicle or vessel.

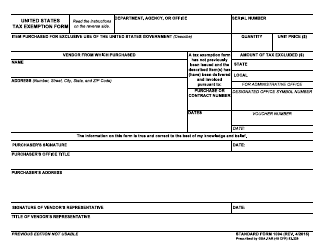

Q: What information is required on Form Q-20?

A: Form Q-20 requires information such as the name and address of the purchaser, seller, and vehicle or vessel details.

Form Details:

- Released on September 12, 2000;

- The latest edition provided by the Connecticut Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form Q-20 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Motor Vehicles.